India’s Foreign Direct Investment (FDI) Journey Hits $1 Trillion Milestone

- 13 Dec 2024

In News:

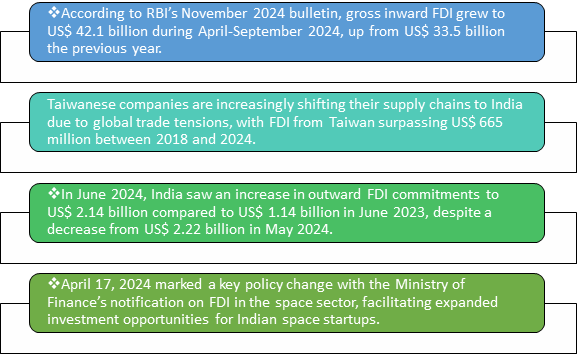

India has reached a historic milestone, surpassing $1 trillion in foreign direct investment (FDI) inflows since April 2000. This achievement highlights India’s growing status as a major global investment hub and is further validated by a 26% increase in FDI inflows, which reached $42.1 billion during the first half of FY 2024-25.

Key Highlights of India’s FDI Growth:

- $1 Trillion Milestone: India has attracted a total of $1 trillion in FDI from April 2000 to September 2024. This figure includes equity, reinvested earnings, and other capital inflows.

- 26% Growth in FDI: FDI inflows surged by 26% in the first half of FY 2024-25, totaling $42.1 billion.

- Top Investors: Major investors include Mauritius (25%), Singapore (24%), and the United States (10%). These countries benefit from favorable tax treaties with India, boosting investment.

- Dominant Sectors: FDI has flowed into sectors like services, manufacturing, technology, and telecommunications, with significant investments also in pharmaceuticals, automobile, and construction development.

Factors Behind India’s FDI Success:

- Policy Reforms: India’s liberalized FDI policies, such as allowing 100% FDI in most sectors under the automatic route, have attracted foreign capital. Key reforms like abolishing angel tax and reducing corporate tax rates in the Income Tax Act of 2024 have also enhanced investor confidence.

- Business Environment: India’s rise in global competitiveness is evident in its improvement in rankings. It moved from 43rd to 40th in the World Competitiveness Index 2024 and climbed to 40th in the Global Innovation Index 2023, up from 81st in 2015.

- Investor Confidence: The government’s efforts, including initiatives like "Make in India", Goods and Services Tax (GST), and sector-specific incentives, have fostered a conducive environment for investment.

- Global Investment Standing: India has been the third-largest recipient of greenfield projects globally and saw a 64% increase in international project finance deals.

Contribution of Mauritius and Singapore:

- Mauritius and Singapore lead as the primary sources of FDI into India. Their favorable tax treaties with India make them attractive gateways for foreign investments. Mauritius accounted for 25%, and Singapore for 24% of the total FDI inflows.

Key Sectors Attracting FDI:

- Services Sector: Significant growth in services, especially financial services, has attracted substantial foreign investments.

- Manufacturing and Technology: These sectors have benefited from policies like the Production-Linked Incentive (PLI) schemes, which encourage foreign investments in high-tech manufacturing.

- Telecommunications and Pharmaceuticals: India’s growing digital ecosystem and strong pharmaceutical industry continue to attract international investments.

Importance of FDI for India:

- Infrastructure Development: FDI plays a crucial role in financing infrastructure projects, helping meet the country’s significant infrastructure needs.

- Balance of Payments: FDI helps bridge India’s current account deficit, ensuring stable foreign exchange reserves.

- Technology Transfer and Employment: Foreign investments bring advanced technology and create jobs, boosting productivity across sectors.

- Currency Stability: FDI supports the Indian Rupee in global markets by injecting foreign capital.

Challenges:

Despite the positive trends, India faces challenges such as geopolitical tensions, regulatory issues, global economic uncertainty, and infrastructure bottlenecks that can affect investor sentiment and capital inflows.

Way Ahead:

- Focus on Infrastructure: Continued investment in infrastructure development, including public-private partnerships (PPPs), will be crucial for sustained economic growth.

- Workforce Skilling: Collaborative efforts to upskill the workforce will ensure that India can meet the evolving demands of industries.

- Research and Development: Strengthening R&D and innovation will enhance India’s productivity and global competitiveness.