Trade Watch Quarterly

- 05 Dec 2024

In News:

NITI Aayog released its first quarterly report, Trade Watch Quarterly (TWQ), on December 4, 2024, focusing on India's trade developments during Q1 FY2024 (April-June).

Overview:

- Purpose: The publication aims to provide a comprehensive analysis of India’s trade performance, highlighting key trends, challenges, and opportunities.

- Target: To leverage insights for evidence-based policy interventions and foster informed decision-making, contributing to sustainable growth in India’s trade.

Trade Performance Highlights (Q1 FY24):

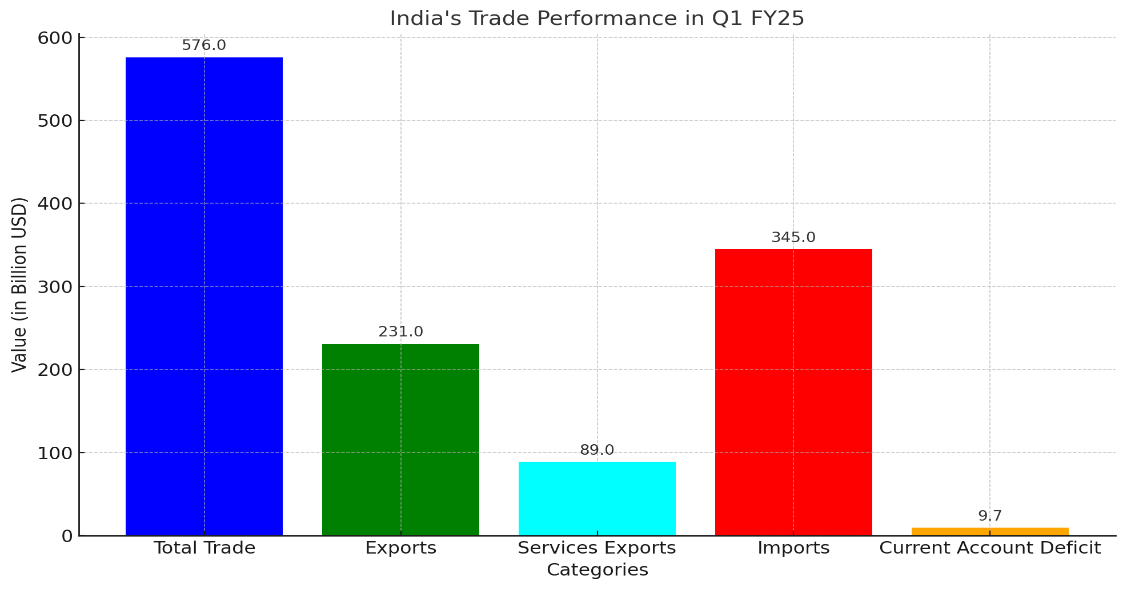

- Total Trade: $576 billion (5.45% YoY growth).

- Merchandise Exports: Growth was restrained due to declines in iron & steel, and pearls.

- Imports: Driven by high-value goods, including aircraft, spacecraft, mineral fuels, and vegetable oils.

- Services Exports: Displayed a surplus, particularly in IT services.

- Growth in Services Exports: A positive trend, rising by 10.09% YoY, particularly in IT services and business solutions.

Key Challenges for India’s Trade:

- Limited Success in China-Plus-One Strategy:Countries like Vietnam, Thailand, Malaysia have gained more from this strategy, benefitting from cheaper labor, simplified tax laws, and lower tariffs.

- CBAM (Carbon Border Adjustment Mechanism):Starting in 2026, CBAM will impose carbon taxes on imports like cement, steel, and fertilizers. India’s iron and steel industry could face significant risks due to this.

- Declining Share in Labor-Intensive Sectors:India’s global market share in labor-intensive sectors (e.g., textiles, leather) has declined despite a strong workforce.

- Geopolitical Instability (West Asia):

- Oil price hikes could increase India’s Current Account Deficit (CAD) and fuel inflation.

- Declining agricultural exports to markets like Iran further add to the challenges.

Strategic Recommendations for Overcoming Challenges:

- Infrastructure Modernization:

- Expansion of digital platforms like Trade Connect e-Platform to streamline processes and support exporters.

- Strengthening logistics via the National Logistics Policy.

- Export Incentives:Continuation of schemes like RoDTEP (Remission of Duties and Taxes on Exported Products) to maintain export competitiveness.

- Technological Integration:Leveraging digital trade to tap into high-growth sectors and foster innovation in trade.

- Strengthening FTAs (Free Trade Agreements):Focus on negotiating strategic FTAs with global partners (e.g., the UK and the EU) to reduce trade barriers and enhance global market access.

Geopolitical and Environmental Risks:

- U.S.-China Trade Tensions:Offers opportunities for India to diversify its supply chains, but also poses challenges in terms of overdependence on certain countries.

- Impact of CBAM:Risk to carbon-intensive Indian exports like steel and aluminium, which will face tariffs starting in 2026.

Sectoral Performance:

- Growing Sectors:

- IT Services: India’s market share of IT services reached 10.2%, continuing to be a strong contributor.

- Pharmaceuticals, Electrical Machinery, and Mineral Fuels: Significant contributors to export growth.

- Declining Sectors:Labor-Intensive Goods: Declines in global market share for textiles, pearls, and leather.

Pathway to $2 Trillion Exports by 2030:

- India's Export Aspirations:To achieve the target of $2 trillion in exports by 2030, India must address structural inefficiencies, diversify exports, and reduce trade barriers.

- Vision 2047:Aligning with India’s broader vision to become a developed nation, the report stresses the importance of strengthening trade, technology, and infrastructure to realize these ambitions.

- Trade's Role in Economic Growth:

- Trade is vital to India’s economic trajectory, contributing significantly to GDP growth.

- Through evidence-based policymaking, infrastructure modernization, and strategic global partnerships, India can achieve sustained growth in trade, leading to the realization of a Viksit Bharat (Developed India) by 2047.

Heat Shock Protein 70

- 05 Dec 2024

In News:

JNU scientists make big discovery that could change malaria, Covid-19 treatment.

Overview of the Discovery:

- Institution: Jawaharlal Nehru University (JNU), Special Centre for Molecular Medicine.

- Key Discovery: Identification of human protein Hsp70 as a critical factor in the spread of malaria and COVID-19.

- Research Collaboration: Involvement of Indian and Russian researchers.

- Outcome: Development of a small molecule inhibitor of Hsp70 that could act as a broad-spectrum treatment for multiple infections.

About Heat Shock Protein 70 (Hsp70):

- Definition: Hsp70 is a type of molecular chaperone protein.

- Function:

- Helps other proteins fold into their proper shapes.

- Prevents protein misfolding.

- Regulates protein synthesis and protects proteins from stress.

- Elevates during cellular stress to shield cells from damage.

- Role in Cellular Processes:

- Prevents protein aggregation and assists in protein transport across membranes.

- Plays a critical role in protein homeostasis and cell survival during stress conditions.

Hsp70's Role in Disease Spread:

- SARS-CoV-2 (COVID-19) Interaction:

- Hsp70 interacts with the spike protein of SARS-CoV-2 and human ACE2 receptors.

- Facilitates viral entry into human cells by stabilizing this interaction during fever (when Hsp70 levels rise).

- Malaria:Pathogens like malaria parasites rely on the host's machinery for survival, including Hsp70.

Research Findings and Implications:

- Published in: International Journal for Biological Macromolecules.

- Inhibition of Hsp70:

- Targeting Hsp70 can disrupt viral replication.

- In lab tests, Hsp70 inhibitor (PES-Cl) blocked SARS-CoV-2 replication at low doses.

- Potential for Broad-Spectrum Treatment:

- Hsp70 could be a target for treating multiple infections, not limited to COVID-19 or malaria.

- Prevention of Drug Resistance:

- Host-targeting antivirals are less prone to resistance as the virus cannot mutate the host protein (Hsp70).

- This approach could be especially beneficial for combating rapidly evolving viruses like SARS-CoV-2 and its variants (e.g., Omicron).

Host-Targeting Approach vs. Traditional Drugs:

- Host-Targeting: Targets the host cell machinery (e.g., Hsp70) rather than the virus itself.

- Reduces the likelihood of viral mutation-induced resistance.

- Traditional Drugs: Target the virus directly, which can lead to resistance, especially with rapidly mutating viruses.

Global Health and Pandemic Preparedness:

- Universal Tool for Infectious Diseases: The discovery could serve as a universal tool for managing infections during health emergencies.

- Collaboration and Importance: Highlights the significance of international collaboration in addressing global health challenges (e.g., Dr. Pramod Garg of AIIMS, Ph.D. scholar Prerna Joshi).

- Future Implications:Preparation for future pandemics, as the world must remain vigilant even post-COVID-19.

Donald Trump's Threat on BRICS and US Dollar

- 05 Dec 2024

In News:

- US President-elect Donald Trump threatens BRICS countries (Brazil, Russia, India, China, South Africa) with 100% import tariffs if they create a new currency or support an alternative to the US dollar as the global reserve currency.

- Trump emphasizes that attempts to undermine the US dollar’s dominance will face economic retaliation, asserting the US economy won’t tolerate such moves.

Background

- Weaponization of the Dollar: The US has increasingly used its financial influence to impose sanctions (e.g., Russia, Iran) and cut off countries from systems like SWIFT (Society for Worldwide Interbank Financial Telecommunication).

- Concerns: Countries are concerned about their vulnerability to US monetary policies, which can have global impacts (e.g., rising US interest rates causing economic instability in other countries).

Efforts to Reduce Dependence on the US Dollar

- BRICS Countries’ Initiatives:

- Russian President Putin criticizes the weaponization of the dollar.

- Brazil's President Lula advocates for a new BRICS currency to increase payment options and reduce vulnerabilities.

- India's Steps:

- The Reserve Bank of India (RBI) allows invoicing and payments in Indian rupees for international trade (since 2022), particularly with Russia.

- Prime Minister Modi supports increasing financial integration and cross-border trade in local currencies within BRICS.

- External Affairs Minister Jaishankar emphasizes the importance of mutual trade settlements in national currencies.

- China-Russia Trade: Over 90% of trade between Russia and China is settled in rubles and yuan due to their more balanced trade relations.

Internationalization of the Indian Rupee

- RBI's Role:

- In July 2022, RBI allowed export/import settlements in rupees, starting with Russia in December 2022.

- More than 19 countries, including the UK and UAE, have agreed to settle trade in rupees.

- Challenges:

- The Indian rupee currently accounts for only 1.6% of global forex turnover.

- India’s trade imbalance with Russia limits the effective use of rupee reserves.

- Indian banks are cautious due to the risk of US sanctions.

Global Trends in Currency Diversification

- Multipolarity in Finance: Emerging economies like China, India, and Brazil are advocating for a more decentralized financial system, moving away from US dominance.

- Declining Dollar Share: The US dollar’s share of global reserves is gradually decreasing, with non-traditional currencies like the Chinese yuan gaining ground.

Risks of Moving Away from the US Dollar

- Chinese Dominance: Concerns about increasing Chinese economic influence, especially within BRICS, as China pushes for more use of the yuan in trade.

- Liquidity and Volatility Issues: Alternatives to the dollar may face challenges like lower liquidity and increased exchange rate volatility.

- Implementation Challenges: Countries, especially those with trade imbalances, find it difficult to adopt local currencies for international trade.

Potential Impact of 100% US Tariff on BRICS Imports

- Global Trade Dynamics: A blanket tariff would likely encourage deeper intra-BRICS trade and accelerate the move towards de-dollarization.

- Impact on the US: Higher import costs for American consumers and potential trade diversification to third countries could hurt the US economy without revitalizing domestic manufacturing.

- Retaliation: BRICS countries might retaliate with tariffs on US goods, escalating trade tensions.

India’s Strategic Approach

- Diplomatic Engagement: India should clarify to the US that diversifying trade mechanisms is not anti-American but seeks financial stability and multipolarity.

- Leadership Role in BRICS: India should support financial reforms within BRICS that align with its interests while maintaining strong ties with the US.

- Promotion of Digital Currency: India should accelerate its Central Bank Digital Currency (CBDC) and strengthen international platforms like UPI to enhance its global financial presence.

International Debt Report 2024

- 05 Dec 2024

In News:

Recently released, World Bank’s "International Debt Report 2024" highlights a worsening debt crisis for developing nations, with 2023 marking the highest debt servicing levels in two decades, driven by rising interest rates and economic challenges.

Key Highlights:

Rising Debt Levels:

- Total external debt of low- and middle-income countries (LMICs) reached $8.8 trillion by the end of 2023, an 8% increase since 2020.

- For IDA-eligible countries (those receiving concessional loans from the World Bank), external debt rose by 18%, reaching $1.1 trillion.

Debt Servicing Costs:

- Developing nations paid a record $1.4 trillion in debt servicing costs (principal and interest) in 2023.

- Interest payments surged by 33%, totaling $406 billion, putting immense pressure on national budgets, especially in critical sectors like health, education, and environmental sustainability.

Interest Rate Increases:

- Interest rates on loans from official creditors doubled to 4% in 2023.

- Rates from private creditors rose to 6%, the highest in 15 years, exacerbating the financial burden on developing countries.

Impact on IDA-Eligible Countries:

- IDA countries faced severe financial strain, paying $96.2 billion in debt servicing, including $34.6 billion in record-high interest costs (four times higher than a decade ago).

- On average, 6% of their export earnings were allocated to debt payments, with some countries dedicating up to 38%.

Role of Creditors:

- Private creditors reduced lending, leading to more debt-servicing payments than new loans.

- In contrast, multilateral lenders like the World Bank provided additional support, with the World Bank contributing $28.1 billion.

- Multilateral institutions have emerged as crucial support systems, becoming "lenders of last resort" for poor economies.

Debt Data Transparency:

- Efforts to improve debt transparency led to nearly 70% of IDA-eligible economies publishing accessible public-debt data in 2023, a 20-point increase since 2020.

- Accurate debt data can reduce corruption and promote sustainable investment.

Global Financial Reforms:

- There is a growing call for global financial reforms to address the systemic challenges of developing nations facing rising debt burdens.

- Proposed measures include increased concessional financing, improved restructuring mechanisms, and the establishment of a Global Debt Authority for better debt management.

Impact on Climate and Development Goals:

- Debt servicing has become a larger financial burden than climate initiatives in many countries, with developing nations spending more on debt servicing than climate goals (2.4% of GDP vs. 2.1% for climate investments).

- To meet climate commitments under the Paris Agreement, climate investments would need to rise to 6.9% of GDP by 2030.

Debt Relief Initiatives:

- Programs like the Heavily Indebted Poor Countries (HIPC) Initiative and the Multilateral Debt Relief Initiative (MDRI) provide debt relief to the world’s poorest nations, helping them meet Sustainable Development Goals (SDGs).

- For instance, Somalia saved $4.5 billion in debt service after completing the HIPC program in December 2023.

Global Sovereign Debt Roundtable (GSDR):

- The GSDR brings together debtor nations and creditors (both official and private) to improve debt sustainability and address restructuring challenges.

- Co-chaired by the IMF, World Bank, and G20, the forum aims to find coordinated solutions for sovereign debt issues.

Overview of Global Plastic Treaty Negotiations

- 05 Dec 2024

In News:

The recent negotiations for a global treaty aimed at curbing plastic pollution, held in Busan, South Korea, concluded without reaching a legally binding agreement. This marked the fifth round of discussions since the United Nations Environment Assembly (UNEA) initiated the process in March 2022, with the goal of finalizing a treaty by the end of 2024. The failure to adopt a treaty was primarily due to disagreements over production cap goals and the elimination of specific plastic chemicals and products.

Key Points of Dispute

- Production Cap Goals: A coalition of over 100 countries, including many from Africa, Latin America, and the European Union, pushed for clear production cap goals in the treaty. They argued that such measures are essential for effective regulation of plastic pollution.

- Opposition from Oil-Producing Nations: Conversely, a group of “like-minded countries” such as Saudi Arabia, Kuwait, Russia, and Iran opposed these provisions. They contended that regulating production cuts exceeded the original mandate set by UNEA and could lead to trade restrictions disguised as environmental measures. India and China aligned with this coalition, emphasizing their concerns regarding economic impacts.

Draft Treaty Highlights

Despite the failure to finalize an agreement, discussions produced a draft text that included both consensus points and contentious issues:

- Consensus Points:

- Proposals for banning open dumping and burning of plastics.

- Definitions for various plastic types were suggested but lacked clarity on contentious terms like microplastics.

- Contentious Issues:

-

- The draft did not adequately address definitions for microplastics or recycling standards.

- References to single-use plastics were included but faced pushback from certain nations.

India’s Position

India articulated its stance focusing on several key areas:

- Development Rights: Emphasized the need for recognizing varying responsibilities among countries in managing plastic pollution while considering their developmental rights.

- Technical and Financial Support: Advocated for provisions ensuring technical assistance and financial support for developing nations to manage plastic waste effectively.

- Opposition to Production Caps: India opposed any articles that would impose caps on polymer production, arguing that such measures were not directly linked to reducing plastic pollution.

Future Steps

The negotiations will continue with plans to reconvene in 2025. In the meantime, global plastic production is projected to rise significantly, potentially tripling by 2050 if no urgent action is taken. The ongoing dialogue will need to address both environmental concerns and developmental needs to create a balanced approach toward managing plastic pollution globally.

Global Context and Initiatives

The need for a global treaty is underscored by alarming statistics:

- Over 462 million tons of plastic are produced annually, with a significant portion contributing to pollution.

- Microplastics have infiltrated ecosystems worldwide, affecting biodiversity and human health.

Countries like Rwanda and Austria have implemented successful measures to reduce plastic waste, serving as models for global efforts. Initiatives such as the UNDP Plastic Waste Management Program in India aim to enhance waste management practices while addressing environmental impacts.