Warming up to climate change: How does climate change impact extreme weather events?

- 19 Feb 2024

Why is it in the News?

Extreme weather is becoming more frequent and more intense in many places around the world because of climate change.

How Does Climate Change Impact Extreme Weather Events?

- The Earth's average temperature has gone up by at least 1.1 degrees Celsius since 1850, mostly because of human activities like burning fossil fuels and deforestation.

- This temperature rise has led to more frequent and stronger extreme weather events worldwide, such as heatwaves, droughts, floods, hurricanes, and wildfires.

- It's hard to directly blame one single weather event on climate change because there are many factors involved.

- However, studies can tell us if climate change made a particular event worse or more likely to happen.

- For example, after a deadly heatwave in Western Europe in 2019, a study found that climate change made that heatwave five times more likely to occur.

- In India, heatwaves have become longer because of global warming, and they're expected to get even worse in the future.

- Climate models predict that by the 2040s, heatwaves might become 12 times more common.

- Higher temperatures also make droughts worse.

- In East Africa, for instance, a severe drought happened between 2020 and 2022, leading to famine and displacing millions of people.

- A report found that climate change made droughts like this at least 100 times more likely in that region.

- Warmer temperatures also contribute to wildfires by drying out land and making it easier for fires to start and spread.

- In Canada, for example, a study showed that climate change doubled the chances of extreme fire conditions.

- This was particularly concerning because Canada recently faced its worst wildfire season ever.

- As temperatures rise, the air can hold more moisture, leading to heavier rainfall and more flooding during storms.

- Warm air can also dry out the soil, making droughts worse. But when warm, moist air meets cooler air, it can lead to more intense storms and flooding.

- There's also evidence that climate change is making hurricanes stronger and more frequent.

- Warmer oceans provide more energy for hurricanes to form and intensify.

- The oceans have absorbed a lot of the extra heat from greenhouse gases, making them warmer.

- This, in turn, leads to stronger storms and more damage when they hit land.

- So, while climate change doesn't directly cause any single weather event, it's making extreme weather events more common and more severe, putting people and ecosystems at risk.

Bird flu outbreak in Andhra: Could H5N1 spark the next pandemic?

- 19 Feb 2024

Why is it in the News?

A bird flu outbreak in poultry in Andhra Pradesh’s Nellore district was reported recently. Laboratory tests by the National Institute of High-Security Animal Diseases in Bhopal confirmed that it was caused by the type A strain of the H5N1 variant of the avian influenza virus.

What is Bird Flu/Avian Influenza?

- Bird flu, also known as avian influenza, is a viral respiratory illness primarily affecting birds.

- It's caused by specific strains of the Influenza A virus.

- Bird flu spreads between both wild and domesticated birds.

- It has also been passed from birds to humans who are in close contact with poultry or other birds.

- There is no clear evidence that the virus can be transmitted from human to human.

- However, this may have happened in rare cases, where a person has become ill after caring for a sick family member.

- While most types don't infect humans, certain strains like H5N1, H7N9, and H5N6 have caused concern due to their ability to transmit to humans in rare cases.

- Transmission:

- Birds: Spreads easily between birds through bodily fluids (saliva, faeces, nasal discharge) and contaminated environments.

- Humans: Primarily occurs through direct contact with infected birds or surfaces, inhaling infected droplets, or consuming undercooked poultry meat from infected birds.

- Symptoms:

- The symptoms of bird flu in humans are similar to those of regular influenza and include:

- Can range from mild (fever, cough, sore throat, muscle aches) to severe (pneumonia, respiratory failure, multi-organ failure, death).

- Symptoms usually appear within 3-7 days of exposure.

- Treatment: Antiviral medications like Tamiflu have proven effective in managing human infections caused by avian influenza viruses, reducing both the severity of symptoms and the likelihood of fatalities.

Avian Influenza in India:

- Initial Incidence: The first instance of Highly Pathogenic Avian Influenza (HPAI) H5N1 in India occurred in 2006 in Navapur, Maharashtra, marking the onset of recurrent annual outbreaks.

- The emergence of H5N8 was documented in India in November 2016, primarily affecting wild birds in five states, with Kerala reporting the highest number of cases.

- This disease has been identified in 24 states and union territories, prompting the culling of over 9 million birds to curb its spread.

- Corresponding Strategy: India's strategy for managing Highly Pathogenic Avian Influenza (HPAI) revolves around a "detect and cull" approach, as delineated in the National Action Plan for Prevention, Control, and Containment of Avian Influenza (revised - 2021).

Banks to conduct periodic performance reviews of empanelled advocates to fast-track cases in DRTs

- 19 Feb 2024

Why is it in the News?

Banks will conduct periodical reviews of the performance of empanelled advocates at debt recovery tribunals (DRTs) and rationalise the cases assigned to them based on performance.

What is the Debt Recovery Tribunal?

- Debt Recovery Tribunal is a quasi-judicial body formed under the Recovery of Debts Due to Banks and Financial Institutions (RDDBFI) Act, 1993 to facilitate recovery of loans by banks and financial institutions to the customers.

- It was introduced as a response to the growing issue of Non-performing Assets (NPAs) and the need for a dedicated mechanism to resolve disputes related to debt recovery.

- These tribunals were instituted to offer a swifter and more effective alternative to traditional civil courts for the resolution of matters concerning debt recovery by banks and financial institutions.

- Its Appellate Tribunal is the Debt Recovery Appellate Tribunal (DRAT).

- Under Section 22 of the RDDBFI Act, 1993, both DRT and DRAT are mandated to adhere to the principles of natural justice, and proceedings before them are deemed to be judicial.

Jurisdiction of Debt Recovery Tribunal:

- They are empowered to adjudicate cases brought forth by banks, financial institutions, and related entities seeking the recovery of outstanding amounts.

- DRTs preside over matters surpassing a designated monetary threshold, and their rulings carry the weight of civil court decrees.

- The scope of DRT jurisdiction encompasses a broad spectrum of financial claims, encompassing loans, advances, and financial aid extended by banks and financial institutions.

Powers of DRT:

- Under Section 22(2) of the RDDBFI Act, 1993, the DRT possesses the following powers:

- Summoning individuals and compelling them to testify under oath.

- Demanding the disclosure and presentation of documents.

- Accepting evidence through affidavits.

- Issuing commissions to examine witnesses or documents.

- Revisiting its rulings.

- Rejecting applications due to default or adjudicating them in absentia.

- Revoking any order of dismissal stemming from default or any order passed in absentia.

- Addressing any other matters stipulated by regulations.

- The organisational framework of the Debt Recovery Tribunal:

- DRTs fall under the purview of the Ministry of Finance and operate akin to judicial courts.

- Each DRT is helmed by a Presiding Officer, who must hold qualifications equivalent to that of a District Judge.

- The Presiding Officer is appointed for a tenure of five years or until reaching the age of 62, whichever comes first.

- Appointment of the Presiding Officer is vested in the Central Government.

- At present, 39 DRTs and 5 DRATs are functioning across the country.

- Each DRT and DRAT are headed by a Presiding Officer and a Chairperson respectively.

Key aspect in poll bond case still alive: Money Bill route

- 19 Feb 2024

Why is it in the News?

Even as a five-judge bench of the Supreme Court struck down the electoral bonds scheme as unconstitutional recently, it saved one aspect of the challenge for another day and a larger bench – the issue of the government using the money Bill route to bring in the laws that introduced the electoral bonds.

News Summary:

- A recent ruling by a five-judge bench of the Supreme Court invalidated the electoral bonds scheme, citing it as unconstitutional.

- However, the court reserved one aspect of the challenge for further review by a larger bench – specifically, the government's use of the money Bill route to enact the laws introducing the electoral bonds.

The Supreme Court highlighted that:

- The examination of introducing these amendments through a money Bill under Article 110 of the Constitution was not addressed.

- The interpretation of Article 110 of the Constitution has been referred to a seven-judge Bench and remains pending judicial review.

What are Money Bills?

- According to Article 110, a money Bill encompasses provisions related to taxes, government borrowing, and expenditure from the Consolidated Fund of India, among other financial matters.

- Article 109 outlines the process for the passage of such Bills, granting predominant authority to the Lok Sabha in their enactment.

- The Speaker is responsible for certifying a Bill as a Money Bill, with the Speaker's decision being final.

- In the past seven years, the government has utilised the money Bill route to introduce various legislations, notably including the Aadhaar Act, 2016, and the Finance Act, 2017.

Other Instances of Government Utilising Money Bill Route:

- Several significant legislations have been enacted by the government through the money Bill route, including:

- The Finance Acts of 2016 and 2018, introduced amendments to the Foreign Contribution Regulation Act, of 2010.

- The Tribunals Reforms Act was passed as a money Bill in 2017.

- The rigorous amendments to the Prevention of Money Laundering Act (PMLA) in 2022, alongside the enactment of the Aadhaar Act in 2018.

- The Supreme Court has upheld the validity of the PMLA amendments and the legality of the Aadhaar Act.

- Notably, Chief Justice of India Chandrachud dissented in the five-judge bench decision that upheld the Aadhaar Act, criticising the government's use of the money Bill route as a subversion of the Constitution.

- However, these laws may still face scrutiny and potential invalidation if the court determines that they were enacted through improper procedure, namely, utilising the money Bill route.

Difference Between Money Bills and Financial Bills:

- While every Money Bill is categorised as a Financial Bill, not every Financial Bill qualifies as a Money Bill.

- For instance, a Finance Bill solely dedicated to tax proposals is deemed a Money Bill.

- Conversely, a Financial Bill may include provisions on taxation or expenditure alongside other subjects.

- The Compensatory Afforestation Fund Bill, 2015, which establishes funds under the Public Account of India and states, serves as an example of a Financial Bill.

The process for passing these two types of bills varies considerably.

-

- The Rajya Sabha lacks the authority to reject or amend a Money Bill.

- Following passage by the Lok Sabha, Money Bills are referred to the Rajya Sabha for recommendations.

- Within 14 days, the Rajya Sabha must return the Bill to the Lok Sabha with its suggestions, which are not binding.

- Should the Lok Sabha reject the recommendations, the Bill is considered passed by both Houses in its original form from the Lok Sabha.

- If the Rajya Sabha fails to provide recommendations within 14 days, the same outcome applies.

- However, both Houses of Parliament must approve a Financial Bill.

- While an ordinary Bill can originate in either House, a Money Bill can only be introduced in the Lok Sabha, per Article 117(1).

- Moreover, only on the President's recommendation can anyone introduce or propose Money Bills in the Lok Sabha.

- Amendments related to reducing or abolishing any tax are exempt from requiring the President's recommendation.

- The essential conditions for a Financial Bill to attain Money Bill status are that it must solely originate in the Lok Sabha, not the Rajya Sabha, and must be introduced upon the President's recommendation.

INCOIS, ISRO to study rip currents for safer beaches

- 19 Feb 2024

Why is it in the News?

Indian National Centre for Ocean Information Services (INCOIS) and Indian Space Research Organisation (ISRO) have embarked on a project to continuously monitor and issue operational forecast alerts of rip currents.

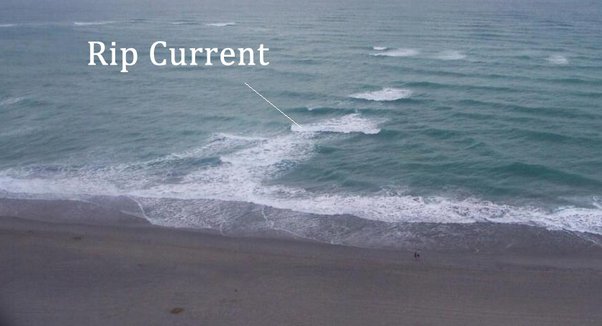

What is a Rip Current?

- Rip currents are channelled currents of water flowing away from shore at surf beaches.

- They typically extend from near the shoreline, through the surf zone and past the line of breaking waves. (The surf zone is the area between the high tide level on the beach to the seaward side of breaking waves.)

Formation of Rip Currents:

- Rip currents form when waves break near the shoreline, piling up water between the breaking waves and the beach.

- One of the ways this water returns to sea is to form a rip current, a narrow stream of water moving swiftly away from shore, often perpendicular to the shoreline.

Size of the Rip Currents:

- Rip currents can be as narrow as 10 or 20 feet in width though they may be up to ten times wider.

- The length of the rip current also varies.

- Rip currents begin to slow down as they move offshore, beyond the breaking waves, but sometimes extend for hundreds of feet beyond the surf zone.

Speed of the Rip Current:

- Rip current speeds can vary. Sometimes they are too slow to be considered dangerous.

- However, under certain wave, tide, and beach-shape conditions the speeds can quickly become dangerous.

Are All Rip Currents Dangerous?

- Rip currents are present on many beaches every day of the year, but they are usually too slow to be dangerous to beachgoers.

- However, under certain wave, tide, and beach-shape conditions they can increase to dangerous speeds.

- The strength and speed of a rip current will likely increase as wave height and wave period increase.

How Do Rip Currents Result in the Drowning of Swimmers?

- Drowning deaths occur when people pulled offshore are unable to keep themselves afloat and swim to shore.

- This may be due to any combination of fear, panic, exhaustion, or lack of swimming skills.

- Rip currents are the greatest surf zone hazard to all beachgoers. They can sweep even the strongest swimmer out to sea.

- Rip currents are particularly dangerous for weak and non-swimmers.