ISRO’s NVS-02 Satellite Launch

- 25 Jan 2025

In News:

ISRO successfully launched the NVS-02 satellite aboard GSLV-F15, placing it into a Geosynchronous Transfer Orbit (GTO). This marks ISRO’s 100th mission, reinforcing India’s space and navigation capabilities under the NavIC (Navigation with Indian Constellation) program.

What is NavIC?

- NavIC is India’s indigenous regional satellite navigation system, developed for both civilian and strategic use.

- Offers accurate positioning over India and up to 1,500 km beyond its borders.

- Comparable to GPS (USA), GLONASS (Russia), Galileo (EU), and BeiDou (China).

About NVS-02 Satellite:

Feature Description

Series Second satellite in the next-gen NVS series (after NVS-01 in 2023)

Mission Role Replaces aging IRNSS-1E satellite

Mass 2,250 kg

Power Capacity ~3 kW

Orbit Final orbital slot at 111.75°E in geosynchronous orbit (~36,000 km)

Life Span 12 years

Developed by URSC (U R Rao Satellite Centre), Bengaluru

Technological Advancements:

- Equipped with navigation payloads across L1, L5, and S-bands for enhanced accuracy and broader coverage.

- Features the Rubidium Atomic Frequency Standard (RAFS) – an indigenously developed atomic clock for precision timekeeping.

- Includes C-band ranging payload, similar to NVS-01.

Significance of NVS-02:

- Enhances NavIC’s positioning accuracy for civilian, commercial, and strategic applications:

- Disaster management

- Fleet tracking

- Precision agriculture

- Emergency response

- Mobile navigation

- L1 signal inclusion makes NavIC-compatible with international GNSS systems, improving global device integration.

- Demonstrates India’s technological self-reliance, particularly in atomic clock development.

ISRO’s Launch Vehicles

Vehicle First Flight Notable Use

SLV 1980 Launched Rohini satellite

ASLV 1987 Five-stage solid rocket, retired in 1990s

PSLV 1994 Reliable, used for Mars Orbiter, LEO missions

GSLV 2001 Used for heavier payloads, INSAT/GSAT

GSLV 2014 Heavy-lift, Chandrayaan-2/3, Gaganyaan crew module

Mk III (LVM3)

SSLV 2022 Affordable launches for nano/micro satellites

PKC-ERCP: Rajasthan’s River-Linking Project

- 25 Jan 2025

In News:

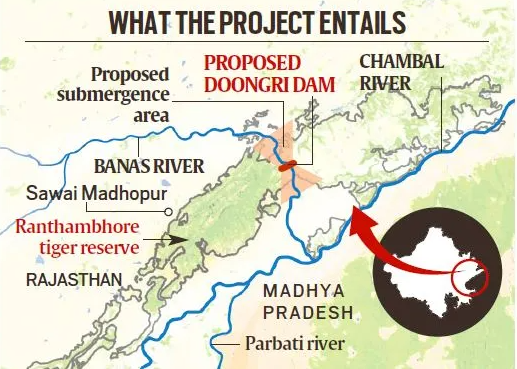

The Parbati-Kalisindh-Chambal-Eastern Rajasthan Canal Project (PKC-ERCP), part of the National Interlinking of Rivers (ILR) programme, aims to address water scarcity in 23 districts of Rajasthan, potentially benefiting 3.45 crore people. However, it has raised serious concerns over its ecological impact, particularly on the Ranthambore Tiger Reserve.

About the PKC-ERCP Project:

Aspect Details

Objective To channel surplus water from the Chambal basin for irrigation, drinking, and industrial use in Rajasthan and Madhya Pradesh

Estimated Cost ?72,000 crore (90% funded by the Central Government)

Water Allocation 4,100 MCM to Rajasthan and 3,000 MCM to Madhya Pradesh

Rivers Involved Chambal, Parbati, Kalisindh, Banas, and tributaries

Major Structure 39 m high, 1.6 km long dam across the Banas River, a Chambal tributary, near Doongri village, ~30 km from Sawai Madhopur

Submergence and Environmental Concerns:

- Total Submergence: ~408.86 sq km in Rajasthan.

- Reservoir Impact: 227 sq km to be submerged under the proposed dam across Banas River.

- Impact on Tiger Reserve:

- 37.03 sq km of the Ranthambore Tiger Reserve (total area: 1,133 sq km) to be submerged.

- This includes parts of Ranthambore National Park (392 sq km) and Keladevi Wildlife Sanctuary (674 sq km).

- May fragment the reserve, disrupting wildlife corridors and tiger movement.

- Ranthambore’s Significance:

- Home to ~57 tigers, it is one of India’s most prominent conservation areas.

- Situated at the Aravalli-Vindhya junction, with rich biodiversity, including leopards, hyenas, sloth bears, and iconic flora like Dhok trees.

- Encompasses the UNESCO-listed Ranthambore Fort and the Great Boundary Fault.

Arguments For the Project:

- Addresses chronic water scarcity in eastern Rajasthan.

- Promotes agricultural productivity, drinking water security, and industrial development.

- Aims to optimize water use by diverting surplus flows.

Arguments Against the Project:

- Biodiversity loss due to habitat submergence and reserve fragmentation.

- Risks to tiger conservation efforts.

- Potential violation of environmental safeguards under the Wildlife Protection Act and Forest Conservation norms.

Long-term ecological costs may outweigh short-term developmental gains.

SEBI’s Sachetisation of Mutual Funds

- 25 Jan 2025

In News:

In January 2025, the Securities and Exchange Board of India (SEBI) proposed the “sachetisation” of mutual fund investments to promote financial inclusion, especially among low-income and first-time investors.

What is Sachetisation?

- Originating from the FMCG sector (e.g., shampoo sachets), sachetisation refers to offering financial products in small, affordable units, enhancing accessibility and affordability.

- In capital markets, it implies micro-level investment options, particularly through low-ticket SIPs (Systematic Investment Plans).

Objectives:

- Promote financial inclusion and empower economically underserved sections.

- Expand mutual fund penetration to semi-urban and rural areas.

- Encourage long-term savings and wealth creation among new investors.

- Reduce dependency on large institutional or foreign investors by broadening the domestic retail base.

Key Features of SEBI’s Sachet SIP Proposal:

Feature Details

Minimum SIP Amount ?250 per month

Eligibility Only for new mutual fund investors

Investment Limit Up to 3 sachet SIPs across different AMCs

Excluded Schemes Debt funds, sectoral/thematic, small-cap, mid-cap equity funds (due to higher risk)

Commitment Period Encouraged to commit for 5 years (60 SIPs), but premature withdrawal allowed

Payment Modes Only via auto-pay mechanisms such as UPI Autopay and NACH

Cost Incentives AMCs to receive subsidies from SEBI’s Investor Education and Awareness Fund

Distributor Incentive ?500 per investor after completion of 24 monthly SIPs

Significance:

- Democratizes investment access by lowering the entry barrier for mutual funds.

- Encourages behavioral shift towards long-term financial planning and discipline.

- Stabilizes domestic markets by broadening and diversifying the retail investor base.

Supports SEBI’s vision of making capital markets inclusive, tech-enabled, and accessible.

Fiscal Health Index (FHI) 2025

- 25 Jan 2025

In News:

NITI Aayog launched the inaugural Fiscal Health Index (FHI) 2025 on 24 January 2025 in the presence of the 16th Finance Commission Chairman, Dr. Arvind Panagariya. The index evaluates the fiscal performance of 18 major Indian states using FY 2022–23 as the base year.

Key Highlights:

- Objective: To assess, monitor, and improve the fiscal health of Indian states and foster balanced regional development, economic resilience, and fiscal transparency. It aims to support the national goal of Viksit Bharat @2047.

- Developed by:

- NITI Aayog, with data sourced from the Comptroller and Auditor General (CAG).

- Designed as an annual publication to promote informed and targeted state-level policy reforms.

- Evaluation Parameters:

The index comprises five sub-indices that collectively offer a holistic picture of fiscal health:

- Quality of Expenditure – Efficiency in developmental and social sector spending (e.g., health, education).

- Revenue Mobilization – Tax and non-tax revenue generation capacity.

- Fiscal Prudence – Adherence to fiscal deficit targets and sound financial management.

- Debt Index – Absolute level of public debt.

- Debt Sustainability – Debt-to-GSDP ratio and interest burden on revenues.

Key Highlights from FHI 2025:

Top Performing States (Achievers):

Rank State FHI Score Strengths

1. Odisha 67.8 Low fiscal deficit, strong debt management, effective capital expenditure

2. Chhattisgarh 55.2 Revenue growth from mining, fiscal prudence

3. Goa 53.6 High tax efficiency and non-tax revenue

Aspirational States (Facing Challenges):

- Punjab, West Bengal, Kerala, Andhra Pradesh

- Issues: High debt-to-GSDP ratios, revenue deficits, poor revenue mobilization

Sub-Index Insights:

- Revenue Mobilization: Odisha, Goa, and Chhattisgarh excelled; Bihar and West Bengal lagged due to low own-tax revenues.

- Quality of Expenditure: Madhya Pradesh and Chhattisgarh prioritized social sectors; Punjab and Rajasthan underperformed in capital investment.

- Debt Management: Maharashtra and Gujarat maintained robust practices; Punjab and Haryana faced rising interest burdens.

- Debt Sustainability: Odisha and Chhattisgarh displayed strong sustainability; West Bengal and Punjab showed fiscal stress.

- Fiscal Prudence: Odisha and Jharkhand maintained low deficits, enabling better public investment.

Significance for Policy & Governance:

- Encourages healthy interstate competition and promotes cooperative federalism.

- Provides data-driven insights for targeted fiscal reforms.

- Reinforces the need for decentralized and transparent financial governance.

- Offers a benchmark for fiscal performance aligned with national transformation goals.

Recommendations:

- Enhance revenue base via tax reforms and tapping into non-tax sources.

- Boost capital expenditure in infrastructure, health, and education.

- Strengthen debt sustainability frameworks and reporting mechanisms.

- Institutionalize fiscal responsibility through better compliance and accountability.

Sanjay Battlefield Surveillance System

- 25 Jan 2025

In News:

Defence Minister Rajnath Singh recently flagged off Sanjay, an indigenously developed Battlefield Surveillance System (BSS), to be inducted into the Indian Army in phased manner from March to October 2025, designated as the ‘Year of Reforms’ by the Ministry of Defence.

Overview:

- Nature: Automated surveillance system

- Purpose: To integrate real-time data from ground and aerial sensors, enabling swift, informed decision-making in conventional and sub-conventional warfare scenarios.

Key Features:

- Common Surveillance Picture (CSP): Fuses verified sensor data to generate a real-time surveillance image of the battlefield.

- Real-time Integration & Analytics: Processes inputs using advanced analytics to eliminate duplication and enhance situational awareness.

- Secure Networks: Operates over the Indian Army’s Data Network and Satellite Communication Network, ensuring reliable and secure data flow.

- Centralized Web Application: Provides integrated inputs to Command Headquarters and Army HQ through a unified platform, supporting the Indian Army's Decision Support System.

- Indigenous Development: Jointly developed by the Indian Army and Bharat Electronics Limited (BEL) under the Buy (Indian) category, promoting Aatmanirbharta in defense.

Operational Significance:

- Enhances battlefield transparency, situational awareness, and surveillance capabilities along vast and sensitive land borders.

- Functions as a force multiplier in Intelligence, Surveillance & Reconnaissance (ISR) operations.

- Enables network-centric warfare, marking a shift towards data-driven military operations.

Deployment:

- To be inducted into all Brigades, Divisions, and Corps of the Army in three phases (March–October 2025).