Lighthouse Tourism in India

- 27 Dec 2024

In News:

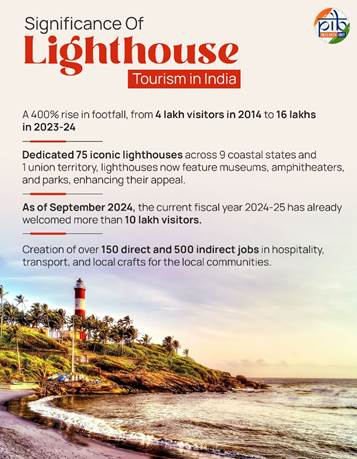

Lighthouse tourism in India is rapidly emerging as an exciting and profitable segment of the country's travel and tourism industry. India's coastline, stretching over 7,500 kilometers, is home to 204 lighthouses, many of which are being transformed into vibrant tourist destinations, celebrating both India's rich maritime history and its natural beauty.

Key Highlights:

- Historical and Scenic Appeal: Lighthouses in India are often located in breathtaking coastal or island locations, offering panoramic sea views and access to surrounding natural beauty. Some of these structures are centuries old and are situated near significant cultural landmarks or UNESCO World Heritage Sites, adding cultural depth to the visitor experience.

- Economic Growth: As part of the broader Maritime India Vision (MIV) 2030 and Amrit Kaal Vision 2047, the Government of India is keen to transform these historic lighthouses into hubs of economic activity. By developing infrastructure, creating new tourism-related jobs, and fostering local entrepreneurship, lighthouse tourism aims to benefit coastal communities and boost India's tourism economy. As of 2023-24, 75 lighthouses across 10 states have been equipped with modern amenities, attracting 16 lakh visitors—a 400% increase from previous years.

- Government Initiatives:

- Lighthouse Festivals: The annual Indian Lighthouse Festival, inaugurated in 2023, serves as a key event to promote lighthouse tourism and cultural heritage.

- The 1st Indian Lighthouse Festival, “Bharatiya Prakash Stambh Utsav”, was inaugurated on 23rd September, 2023 by the Union Minister of Ports, Shipping & Waterways, Shri Sarbananda Sonowal and Goa Chief Minister, Shri Pramod Sawant at the historic Fort Aguada in Goa.

- The 2nd Indian Lighthouse Festival was held in Odisha. Union Minister of Ports, Shipping & Waterways, Shri Sarbananda Sonowal, was also joined by Odisha Chief Minister, Mohan Charan Majhi. Shri Sonowal dedicated two new lighthouses at Chaumuck (Balasore) and Dhamra (Bhadrak) and emphasized empowering coastal communities to preserve and promote lighthouses as part of India’s rich maritime heritage.

- Sagarmala Programme: This government initiative integrates infrastructure development with sustainable practices, ensuring that the growth of lighthouse tourism benefits local communities while preserving the environment.

- Tourism Infrastructure: The government has invested ?60 crore in enhancing these sites, providing facilities like museums, parks, amphitheaters, and more to enrich the visitor experience.

- Lighthouse Festivals: The annual Indian Lighthouse Festival, inaugurated in 2023, serves as a key event to promote lighthouse tourism and cultural heritage.

- Sustainable Development: The Indian government places a strong emphasis on eco-friendly tourism. This includes integrating lighthouses into broader coastal circuits and launching digital awareness campaigns to attract domestic and international tourists.

- Community Empowerment and Employment: Lighthouse tourism has already created direct and indirect employment, from hospitality to transportation, local handicrafts, and artisan work, with more than 500 jobs being generated. Local communities are being trained to offer skills in hospitality and tourism services.

Future Plans:

- Skill Development: Programs are being introduced to equip local people with the necessary skills to cater to the tourism industry.

- Sustainable Practices: Eco-friendly practices will continue to be emphasized to protect coastal ecosystems.

- Integration with Coastal Circuits: Lighthouses will become key points of interest in broader coastal tourism itineraries, further enhancing their appeal to tourists.

Household Consumption Expenditure Survey: 2023-24

- 27 Dec 2024

In News:

The latest Household Consumption Expenditure Survey (HCES) for 2023-24 reveals notable trends in consumption patterns in rural and urban India, reflecting economic shifts post-pandemic.

Key Highlights:

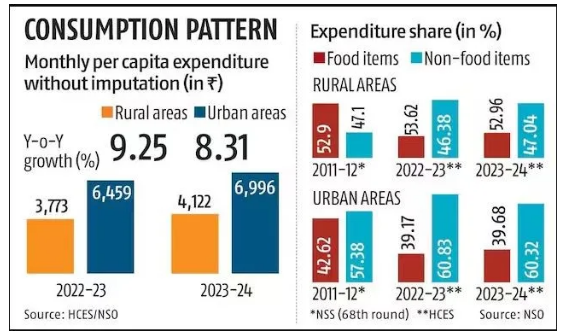

- Food Spending Increase: The share of food expenditure in household budgets has increased both in rural and urban areas, likely due to rising food prices.

- Rural households allocated 47.04% of their expenditure to food in 2023-24, up from 46.38% in 2022-23.

- Urban households spent 39.68% of their budgets on food, slightly up from 39.17% last year.

- Narrowing Urban-Rural Gap: The gap in Monthly Per Capita Consumption Expenditure (MPCE) between rural and urban households has steadily reduced over the past decade.

- In 2023-24, rural consumption spending was 69.7% of urban consumption, an improvement from 71.2% in 2022-23 and 83.9% in 2011-12.

- Increased Rural Spending: Rural India has seen significant increases in spending. The average monthly spending per person in rural areas rose by 9.3% to Rs 4,122 in 2023-24, surpassing the 8.3% rise to Rs 6,996 in urban areas.

- This suggests a growing momentum in rural consumption, which has outpaced urban consumption growth in the last year.

- Spending Trends Across Income Groups: While the top 5% of both rural and urban populations saw a decrease in their consumption spending, every other income group, including the bottom 5%, registered an increase in spending.

- The bottom 20% in both rural and urban areas saw the highest growth in expenditure, signaling rising economic activity among lower-income groups.

- Non-Food Expenditure Dominates: Non-food items make up a larger share of household spending, particularly in urban areas, where they account for 60.32% of total expenditure compared to 52.96% in rural areas.

- In rural India, major non-food expenses include medical, conveyance, and clothing, while urban households allocate more to entertainment, education, and miscellaneous goods.

- Regional Consumption Patterns: Consumption expenditure varied significantly across states, with western and northern states like Maharashtra, Punjab, and Tamil Nadu spending more than the national average.

- In contrast, eastern and central states, including West Bengal, Bihar, and Odisha, spent less. Sikkim reported the highest per capita expenditure in both rural (Rs 9,377) and urban (Rs 13,927) areas, while Chhattisgarh recorded the lowest.

- Declining Consumption Inequality: The Gini coefficient, which measures consumption inequality, has declined in both rural and urban areas.

- This reflects reduced disparity in spending, indicating a trend toward more equitable economic growth across regions.

- Food Expenditure Trends: Food categories like beverages, processed foods, and cereals continued to see rising shares in total expenditure. The rise in spending on food items was particularly notable in rural areas for eggs, fish, and meat.

Operation Green Scheme

- 27 Dec 2024

In News:

The government’s flagship Operation Greens scheme, designed to stabilise crop prices and benefit farmers, has spent just 34 per cent of its allocated budget for 2024-25, according to a parliamentary report, even as onion farmers in Maharashtra reel from massive losses and potato shortages grip eastern states.

Key Highlights:

Overview:

- Launched: November 2018 under the Pradhan Mantri Kisan SAMPADA Yojana.

- Objective: Stabilize prices and improve farmers' income by enhancing the production and marketing of perishable crops, initially focusing on Tomato, Onion, and Potato (TOP).

- Expanded Scope (2021): Includes 22 perishable crops like mango, banana, ginger, apple, and shrimp.

- Implemented by: Ministry of Food Processing Industries (MoFPI).

- Funding: Managed by the National Agricultural Cooperative Marketing Federation of India (NAFED).

Key Aims:

- Reduce price volatility in agricultural markets.

- Minimize post-harvest losses.

- Strengthen farm-to-market linkages.

- Enhance farmers’ earnings by stabilizing market prices.

- Promote value addition and food processing.

Scheme Components:

- Short-term Interventions:

- Subsidies on transportation (50%) and storage (50%) to protect farmers from distress sales.

- Price stabilization during periods of surplus or shortage.

- Long-term Interventions:

- Development of farm-gate infrastructure like cold storage and processing facilities.

- Strengthening production clusters and Farmer Producer Organizations (FPOs).

- Building efficient agri-logistics systems.

- Promoting food processing and value addition capacities.

Key Features:

- 50% subsidy on transportation and storage costs for eligible crops.

- Projects eligible for 50% subsidy (up to ?50 crore per project), and for FPOs, a 70% subsidy.

- Demand-driven funding based on applications, with no fixed crop or state-wise allocation.

Key Findings from Parliamentary Standing Committee (PSC) Report (2024):

- Underutilisation of Budget: Only 34% (?59.44 crore) of the allocated ?173.40 crore for 2024-25 spent by October 2024, leaving 65.73% unspent.

- Slow Implementation: Out of 10 targeted projects, only 3 were completed by October 2024.

- Limited Impact on Price Stabilization:

- Onion prices fell by nearly 50% in Maharashtra, despite the scheme's intent to stabilize prices.

- Potato shortages in states like Odisha and Jharkhand due to weather-induced production dips in West Bengal.

- Inconsistent Policies: Export bans and fluctuating export duties caused frustration among onion farmers, undermining the scheme’s effectiveness in ensuring fair prices.

Impact on Farmers:

- Price Stabilization: Despite the scheme’s aims, price fluctuations continue to affect farmers, especially in Maharashtra with the onion price crash.

- Post-Harvest Losses: The scheme aims to reduce wastage by building infrastructure like cold storage, but challenges remain in implementation.

- Market Linkages: Attempts to connect farmers and FPOs with retail markets have not yet yielded significant results.

Operational Challenges:

- The scheme faces challenges in fulfilling its dual mandate of ensuring fair prices for farmers while keeping consumer prices affordable.

- The slow utilization of funds and incomplete infrastructure projects raise concerns about the effectiveness of the program.

- Inconsistent policy decisions, like the export ban and imposition of export duties, have contributed to farmer discontent.

Dr. Pushpak Bhattacharyya Committee

- 27 Dec 2024

In News:

- The Reserve Bank of India (RBI) has set up an eight-member committee to create a framework for the responsible and ethical use of Artificial Intelligence (AI) in the financial sector.

- The committee is chaired by Dr. Pushpak Bhattacharyya, Professor in the Department of Computer Science and Engineering at IIT Bombay.

Key Highlights:

Committee's Objective:

- The primary goal is to develop a Framework for Responsible and Ethical Enablement of AI (FREE-AI) in the financial sector.

- It will guide the ethical adoption of AI in financial services to enhance operational efficiency, decision-making, and risk management.

Scope of the Committee's Work:

- Assess the current global and domestic adoption of AI in financial services.

- Identify potential risks and challenges associated with the integration of AI in the sector.

- Recommend a framework for evaluating, mitigating, and monitoring AI-related risks.

- Propose compliance requirements for various financial entities (e.g., banks, NBFCs, fintech firms).

- Suggest a governance framework for ethical AI usage.

Key Benefits of AI in Financial Services:

- Operational Efficiency: AI can automate repetitive tasks, process large datasets, and enhance accuracy (e.g., loan application processing).

- Enhanced Decision-Making: Predictive analytics in AI help forecast market trends, aiding in better financial decision-making (e.g., algorithmic trading).

- Customer Relationship Management: AI-powered chatbots and virtual assistants enhance customer interaction, offering 24/7 support.

- Improved Risk Management: AI enables proactive fraud detection, improving security and preventing financial losses.

Concerns Associated with AI in Finance:

- Embedded Bias: AI models can replicate biases present in training data, leading to discriminatory outcomes and financial exclusion.

- Data Privacy and Security: The use of AI poses risks to personal data security, with potential violations of privacy regulations.

- Operational Challenges: AI systems may exhibit inconsistent responses, leading to challenges in trust and effectiveness.

- Cybersecurity Risks: Increased use of AI can heighten vulnerability to cyber-attacks and exploitation.

RBI's Role & Governance:

- The RBI aims to ensure that AI adoption in the financial sector is ethical, transparent, and aligned with global best practices.

- The committee's recommendations will influence policies to prevent misuse and safeguard consumer interests.

Rupee and Real Effective Exchange Rate (REER)

- 27 Dec 2024

In News:

The real effective exchange rate (REER) index of the rupee touched a record 108.14 in November, strengthening by 4.5 per cent during this calendar year, according to the latest Reserve Bank of India (RBI) data.

Key Highlights:

- Record REER Index:

- The Real Effective Exchange Rate (REER) of the rupee reached an all-time high of 108.14 in November 2024.

- This marks a 4.5% appreciation in REER during the calendar year 2024, according to RBI data.

- What is REER?

- REER is a weighted average of a country’s currency value against the currencies of its major trading partners, adjusted for inflation differentials.

- It considers 40 currencies accounting for about 88% of India's trade.

- REER Calculation:

- Nominal Exchange Rates: The exchange rate between the rupee and each partner's currency.

- Inflation Differentials: Adjusts for inflation differences between India and its trading partners.

- Trade Weights: Based on the trade share with each partner.

- Recent Trends in REER:

- In 2023, REER dropped from 105.32 in January to 99.03 in April.

- It has since been on an appreciating trend, reaching 107.20 in October and 108.14 in November 2024.

- Dollar Strengthening Impact:

- Despite the rupee weakening against the US dollar (from 83.67 to 85.19 between September and December 2024), it has appreciated against the euro, British pound, and Japanese yen.

- The dollar's strengthening was fueled by global economic factors, including inflation expectations in the US and high bond yields, which led to capital outflows from other countries, including India.

- Impact on Exports and Imports:

- Overvaluation: A REER above 100 signals overvaluation, which can harm export competitiveness (exports become costlier) while making imports cheaper.

- Undervaluation: A REER below 100 indicates a currency is undervalued, boosting exports but increasing the cost of imports.

- India's Inflation and REER:

- India's higher inflation relative to trading partners is a key factor behind the rupee’s rising REER, despite its depreciation against major currencies.

- This suggests the rupee is overvalued, which could explain why the RBI may allow the rupee to depreciate further against the dollar.

- Global Context:

- The strengthening of the US dollar, influenced by factors such as tariff policies under the Trump administration and tighter US monetary policies, plays a significant role in the depreciation of the rupee against the dollar.

- This dynamic affects India's trade balance, with potential consequences for export growth.

- Implications for India’s Economy:

- Overvalued currency (as indicated by REER above 100) can lead to a trade deficit, as imports become cheaper and exports less competitive.

- A weaker rupee, particularly against the dollar, could boost Indian exports but raise the cost of imports.