Development Initiatives for North East Region (NER)

- 07 Dec 2024

In News:

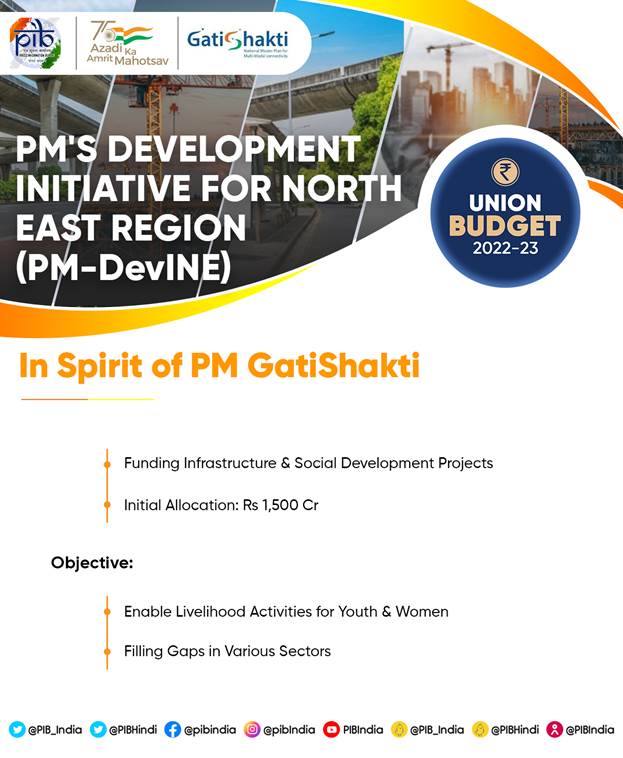

Prime Minister’s Development Initiative for North East Region (PM-DevINE) was announced as a new Central Sector scheme, with 100% Central funding in the Union Budget 2022-23 with initial outlay of Rs.1500 crore.

PM-DevINE Scheme:

- Launched in 2022 as a Central Sector scheme, with 100% Central funding.

- Initial outlay: Rs. 1500 crore in the Union Budget 2022-23.

- Total outlay: Rs. 6600 crore for the period from FY 2022-23 to FY 2025-2026, approved by the Union Cabinet on 12 October 2022.

- Objectives:

- Fund infrastructure projects in the spirit of PM Gati Shakti.

- Support social development projects tailored to the felt needs of the NER.

- Enable livelihood opportunities for youth and women.

- Address development gaps in various sectors.

- 35 projects worth Rs. 4857.11 crore have been sanctioned under the scheme up to 30 November 2024, including 7 projects from the Union Budget 2022-23.

Industrialization Initiatives:

- North East Industrial Development Scheme (NEIDS):

- Launched on 1 April 2017, ended on 31 March 2022.

- Aimed at promoting industrialization in the NER.

- UNNATI Scheme:

- Launched on 9 March 2024 for enhancing regional infrastructure and promoting industrial growth.

- Provides specific incentives to industries, including:

- Capital Investment Incentive.

- Capital Interest Subvention.

- Manufacturing & Services Linked Incentive.

Budgetary Allocation for NER Development:

- Non-exempt Union Ministries/Departments are mandated to allocate at least 10% of their annual Gross Budgetary Allocation towards NER development.

- Between 2019-20 and 2023-24, these Ministries/Departments have incurred Rs. 3,53,412 crore towards the development of NER.

Role of State Governments and Central Support:The Government of India supplements state efforts with various schemes to promote industrialization and infrastructure development in the NER.

The PM-DevINE scheme, along with initiatives like UNNATI and the allocation of substantial funds by the central government, aims to accelerate the holistic development of NER. These efforts focus on infrastructure, social development, and industrialization, with specific emphasis on youth and women empowerment, ensuring long-term growth and prosperity for the region.

China Plus OneStrategy

- 07 Dec 2024

In News:

India had ‘limited success’ in capturing ‘China Plus One’ opportunity.

Limited Success in ‘China Plus One’ Strategy:

- India has had limited success in attracting multinational companies looking to diversify their supply chains under the ‘China Plus One’ strategy, aimed at reducing dependence on China.

- Vietnam, Thailand, Cambodia, and Malaysia have been more successful in benefiting from this shift due to factors like lower labor costs, simplified tax laws, and proactive Free Trade Agreements (FTAs).

Geopolitical Context - US-China Trade Conflict:

- The fresh US-China trade conflict involves tit-for-tat restrictions, with the US imposing export controls on Chinese high-tech goods and China retaliating by banning key materials.

- India's Position: As a "connecting economy" not directly aligned with the US or China, India stands to benefit from trade diversions arising from this conflict.

Opportunities for India Amid Trade Diversion:

- NITI Aayog CEO BVR Subrahmanyam highlighted opportunities arising from trade diversion, particularly due to US trade policies under President-elect Donald Trump, which could potentially create an economic boom for India.

- India has opportunities to capture a larger share of the global trade, especially in sectors where it currently holds a small market share (less than 1% of world trade in many areas).

Trade Policy Challenges:

- Steel Import Duty Proposal: NITI Aayog Vice Chairperson cautioned against imposing high duties on steel imports, arguing that it could reduce India’s competitiveness and lead to negative consequences for domestic industries reliant on steel.

- The global steel market has been affected by oversupply from China, with India’s iron and steel exports experiencing a sharp decline in Q1 FY25 due to weak domestic demand.

Impact of US Tariffs:

- A general 10% tariff on all imports by the US would not have a major negative impact on India.

- However, a 60% tariff on China could open significant opportunities for India, especially in sectors where it competes directly with China. There might be short-term shocks but long-term benefits.

Ongoing Trade Fragmentation:

- The report noted that trade fragmentation is driven by strict export controls on Chinese goods, implemented by the US to curb China’s growth, particularly in high-tech sectors.

Sectoral Competitiveness:

- While China remains India's key competitor across most export sectors, countries like Brazil, Indonesia, and South Africa generally lag behind India.

- Malaysia and Thailand outperform India in select sectors such as electrical machinery.

Challenges in the EU Market - Carbon Border Adjustment Mechanism (CBAM):

- Iron and steel industry facehigh exposure under the CBAM for EU exports, with tariffs potentially rising by 20-35% due to carbon emissions-related regulations.

- Indian firms could experience higher compliance costs due to the requirement for detailed emissions reporting, impacting competitiveness in the European market.

‘Anna Chakra’ and SCAN Portal

- 07 Dec 2024

In News:

The Union Minister of Consumer Affairs, Food and Public Distribution and New & Renewable Energy, launched ‘Anna Chakra’, the Public Distribution System (PDS) Supply chain optimisation tool and SCAN (Subsidy Claim Application for NFSA) portal a significant step towards modernizing the Public Distribution System and subsidy claim mechanisms of the States.

Anna Chakra: PDS Supply Chain Optimization Tool

- Purpose: A tool developed to enhance the efficiency of PDS logistics across India, optimizing food grain transportation.

- Collaboration: Developed by the Department of Food and Public Distribution, in collaboration with the World Food Programme (WFP) and IIT-Delhi’s Foundation for Innovation and Technology Transfer (FITT).

- Functionality: Uses advanced algorithms to identify optimal transportation routes for food grains.

- Key Features:

- Efficiency and Cost Savings: Achieves annual savings of Rs 250 crores by reducing fuel consumption, time, and logistics costs.

- Environmental Impact: Reduces transportation-related emissions by cutting transportation distance by 15-50%, contributing to a smaller carbon footprint.

- Wide Coverage: Impacts 30 states, 4.37 lakh Fair Price Shops (FPS), and 6,700 warehouses in the PDS supply chain.

- Technology Integration: Linked with the Freight Operations Information System (FOIS) of Railways and PM Gati Shakti platform, enabling geo-location mapping of FPS and warehouses.

SCAN Portal: Subsidy Claim Application for NFSA

- Objective: To streamline the subsidy claim process under the National Food Security Act (NFSA) 2013, ensuring better utilization of funds.

- Functionality: Provides a unified platform for states to submit food subsidy claims, reducing administrative complexity and delays.

- Key Features:

- Single Window Submission: Simplifies subsidy claim submission for states, enhancing coordination.

- Automated Workflow: End-to-end automation ensures efficiency, transparency, and faster settlements.

- Rule-Based Processing: Claims are scrutinized and approved through a rule-based system, speeding up the approval process.

Public Distribution System (PDS) Overview

- Purpose: Ensures food security by providing subsidized food grains to vulnerable populations under the NFSA, benefitting nearly 80 crore people.

- Management: A joint effort between the Central and State/UT Governments. The Food Corporation of India (FCI) handles procurement and transportation, while state governments manage local distribution.

- Commodities: Primarily wheat, rice, sugar, and kerosene, with some states also distributing pulses and edible oils.

Initiatives to Reform PDS in India

- One Nation One Ration Card (ONORC):

- Goal: To allow portability of ration cards, benefiting migrant workers and seasonal laborers.

- Features: Biometric authentication, digital payments, and enhanced inclusivity.

- SMART-PDS Scheme (2023-2026):

- Objective: To upgrade technology in PDS, including computerized FPS, point-of-sale (POS) machines, and GPS tracking for transparency and fraud reduction.

- Aadhaar and Direct Benefit Transfer (DBT):

- Purpose: Ensures proper beneficiary identification and cash transfers, allowing beneficiaries to purchase grains from the open market.

- Technology and Transparency Enhancements:

- GPS and SMS Monitoring: Ensures the proper delivery of food grains to FPS and provides citizens with updates via SMS.

PMeVIDYA DTH 24x7 Channel No. 31

- 07 Dec 2024

In News:

Union Minister for Education, launched the PMeVIDYA DTH 24x7 Channel No. 31 dedicated to Indian Sign Language (ISL) on December 6, 2024, in New Delhi.

Channel Purpose and Vision:

- Objective: To bridge the communication gap between the hearing-impaired and hearing populations by promoting ISL.

- Significance: Channel 31 aims to unlock talent and ensure equal opportunities for all, making society more inclusive and progressive.

- ISL's Role: Pradhan emphasized the importance of alternative communication methods like ISL, which ensures that individuals with hearing impairments have equal access to education, employment, and societal participation.

Government's Focus on Inclusivity:

- Legal Framework: Pradhan highlighted the expansion of recognized disabilities from 7 to 21, making the legal framework more comprehensive.

- National Education Policy (NEP) 2020: The policy focuses on inclusive education, with particular attention to Children with Special Needs (CwSN). The NEP promotes the standardization of ISL and its inclusion in educational curricula.

- Employment and Cultural Expression: ISL is not only essential for communication but also contributes to cultural expressions like dance and drama. Pradhan emphasized that learning ISL would open employment opportunities and allow individuals to express themselves fully.

Importance of Channel 31:

- The launch of Channel 31 aligns with India’s commitment to ensuring equal rights and access to education, as enshrined in the Constitution.

- Pradhan urged for widespread adoption of ISL, ensuring that more people learn the language to better support the hearing-impaired community.

PM e-Vidya Initiative:

- Launch Date: PM e-Vidya was launched as part of the Atmanirbhar Bharat Abhiyaan on May 17, 2020, to bridge the digital divide and ensure inclusive education.

- Key Components:

- DIKSHA: A national platform providing e-content for all grades.

- DTH TV Channels: Initially started with 12 channels, now expanded to 200, offering supplementary education in multiple languages.

- SWAYAM: A platform for online courses and MOOCs for both school and higher education.

- Community Radio & Podcasts: These platforms are used for wider educational outreach, especially in rural and remote areas.

- e-Content for Teachers: Interactive videos and resources aimed at enhancing teacher education.

Channel Content:

- Channel 31 will provide 24x7 educational content for children with hearing impairments, teachers, and other stakeholders.

- The content will include school curricula, career guidance, skill training, mental health support, and promotion of ISL as a subject.

- The content will be available on YouTube, increasing its reach and accessibility.

RBI Cuts CRR, Keeps Repo Rate Unchanged

- 07 Dec 2024

In News:

The Reserve Bank of India (RBI) has recently made significant monetary policy decisions that could have a broad impact on the economy.

Key Highlights:

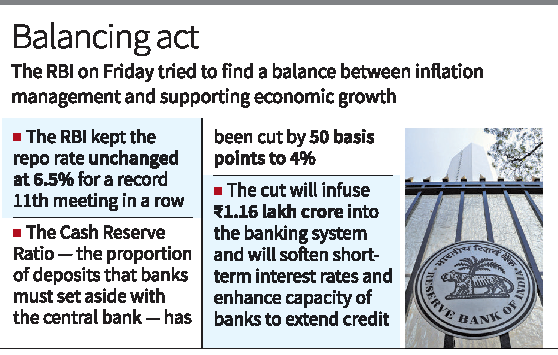

Cut in Cash Reserve Ratio (CRR)

- CRR Reduction: The RBI has reduced the CRR by 50 basis points (bps), from 4.5% to 4%.

- Impact on Banks: This move will free up ?1.16 lakh crore in liquidity, which banks can use to lend, boosting the credit flow in the economy.

- Objective: The CRR cut is aimed at easing the liquidity stress in the financial system, which has been tightening due to RBI's foreign exchange interventions.

- Bank Benefits: Banks will benefit as they don’t earn interest on the CRR, and the extra liquidity may help them reduce deposit rates. Additionally, it may encourage banks to pass on benefits to borrowers, particularly in terms of lending rates.

Repo Rate Kept Unchanged at 6.5%

- Decision: The MPC decided to keep the key policy rate, the Repo rate, unchanged at 6.5%, continuing its stance for the 11th consecutive meeting.

- Reasons for Keeping Repo Rate Steady:

- Persistent inflation, particularly food prices, is a key concern. Despite strong growth in sectors like rural consumption, inflation remains high and continues to affect disposable income.

- RBI Governor emphasized that durable price stability is essential for strong, sustained economic growth.

Impact on Borrowers

- Borrowing Costs: With the Repo rate unchanged, external benchmark lending rates (EBLR) linked to the Repo rate will not rise, providing relief to borrowers by keeping Equated Monthly Installments (EMIs) stable.

- Deposit Rates: However, the CRR cut may lead to a marginal reduction in deposit rates due to increased liquidity in the system.

Economic Growth Forecast Adjusted

- Reduced GDP Growth Estimate: The RBI has downgraded the GDP growth forecast for FY25 to 6.6%, down from the earlier estimate of 7.2%. This revision comes after the economy showed signs of slowdown in the second quarter of FY25.

- Growth Outlook: Despite the downgrade, the RBI remains cautiously optimistic about recovery driven by festive demand and rural consumption. Governor Das indicated that the slowdown had likely bottomed out and the economy is set to recover in the coming quarters.

Inflation Forecast Raised

- Inflation Outlook: The inflation estimate for FY25 has been revised upward to 4.8%, compared to the earlier forecast of 4.5%. This is largely due to rising food prices, which surged to a 14-month high of 6.21% in October.

- Inflationary Pressures: The MPC noted that inflation has remained above the RBI’s target of 4%, primarily driven by food inflation. As inflation impacts consumption, the RBI aims to balance growth support with inflation management.

Monetary Policy Stance

- Neutral Stance Retained: The RBI has maintained a ‘neutral’ stance, meaning it is neither tightening nor easing monetary policy drastically, focusing instead on bringing inflation closer to its target of 4%.

- Inflation Control: While the RBI is aware of the economic slowdown, it continues to prioritize inflation control to ensure price stability and support sustainable growth.

Global and Domestic Economic Context

- Global Factors: The RBI has also been cautious about global developments, including capital outflows and the impact of U.S. monetary policy on the Indian economy. A rate cut could have further weakened the rupee by narrowing the interest rate differential with the U.S.

- Domestic Concerns: Domestically, the economy faces challenges such as weak manufacturing growth and high inflation. The GDP growth in Q2 FY25 dropped to 5.4%, a seven-quarter low, highlighting concerns over demand and inflationary pressures.