The last batch of Mizoram Bru refugees permanently settled in Tripura (The Hindu)

- 16 Jan 2024

Why is it in the News?

The Tripura government has allocated land for the rehabilitation of the last batch of Mizoram Bru refugees, who were granted permanent settlement in Tripura through a Home Ministry-initiated quadripartite agreement signed on January 16, 2020.

Who are Bru refugees?

- Brus, also referred to as Reangs, are a tribal community indigenous to northeast India and have historically resided in parts of Mizoram, Tripura, and Assam.

- In the state of Tripura, the Brus are a designated Particularly Vulnerable Tribal Group (PVTG).

- Most Brus residing in Tripura today have suffered more than two decades of internal displacement, fleeing ethnic persecution primarily from the neighbouring state of Mizoram.

Bru-Reang Refugee Crisis:

- It all started in 1995 when the Young Mizo Association and the Mizo Students' Association demanded that Brus be eliminated from Mizoram’s electoral rolls as they were not indigenous inhabitants.

- Being ethnically distinct from the majority of Mizos, the Brus are often referred to as “Vai” in the state, meaning outsiders or non-Mizos.

- Tensions escalated after the Brus retaliated against the Mizos’ attempts to disenfranchise them, and organized themselves into an armed group, the Bru National Liberation Front, and a political entity, the Bru National Union.

- They also demanded the creation of a separate Bru Autonomous District Council (ADC) in western Mizoram as per the provisions of the sixth schedule of the Indian Constitution.

- However, their attempts at seeking greater autonomy were foiled and resultant ethnic clashes forced many Reangs in Mamit, Kolasib and Lunglei districts of Mizoram to migrate to neighbouring Tripura in 1997.

- Today, roughly 35,000 Reangs continue to reside in north Tripura’s Kanchanpur camp as refugees, as per Home Ministry estimates.

Have there been any attempts to resettle the Brus?

- The state governments, along with the union government have made multiple attempts to send Brus back to their homeland in Mizoram.

- But until 2014, following eight rounds of resettlement, only an estimated 5,000 individuals, or 1622 Bru-Reang families returned to Mizoram in various batches.

- In July 2018, the governments of Tripura, Mizoram, and the central government concluded a quadripartite pact with Bru community representatives to resettle refugees in Mizoram.

- This was however opposed by not only native Mizo groups but also by the Reangs who feared threats to life and further ethnic repression in their home state.

- Efforts were still made to pursue the terms of this pact. The supply of free ration to relief camps was halted on instructions of the Home Ministry in a bid to hastily complete the repatriation of refugees, which resulted in at least six starvation deaths.

- Sensing a failure of the 2018 pact, the four groups once again came together in January 2020 to sign another quadripartite pact to resettle the Brus, this time in the state of Tripura.

- The central government earmarked a Rs 600 crore package to aid the rehabilitation efforts, and the Bru families were promised a residential plot, a fixed deposit of Rs 4 lakh, a Rs 1.5 lakh grant to construct their houses, as well as free ration and a monthly stipend of Rs 5,000 for a period of two years.

- Additionally, the renewed 2020 pact also promised to include the displaced Reangs in the electoral rolls in Tripura.

Darjeeling zoo’s success with snow leopards: Why wild cats are fussy breeders (Indian Express)

- 16 Jan 2024

Why is it in the News?

The Padmaja Naidu Himalayan Zoological Park (PNHZP) in Darjeeling has made headlines for successfully breeding 77 snow leopards since the 1980s, placing it next only to New York’s Bronx Zoo, which has produced 80 snow leopard cubs since it started breeding experiments with the species in the 1960s.

About Snow Leopard:

- The snow leopard, also known as the ounce, is a large Asian cat belonging to the family Felidae, classified as Panthera uncia.

- It preys on various animals, including marmots, wild sheep, ibex, and domestic livestock. As the apex predator in the mountain ecosystem, snow leopards serve as vital indicators of ecosystem health.

- Habitat: Native to the mountain ranges of Central and South Asia, snow leopards are found in India, specifically in the western Himalayas covering Jammu and Kashmir, Ladakh, Himachal Pradesh, Uttarakhand, Sikkim, and Arunachal Pradesh in the eastern Himalayas.

- Threats to Survival: With an estimated 4,000 to 6,500 snow leopards remaining in the wild, around 500 of them are in India.

- Human settlement expansion, particularly livestock grazing, has escalated conflicts.

- Climate change, causing a rise in average temperatures across their habitat, poses an additional threat.

- Poaching, driven by illegal trades in pelts and body parts used in traditional Chinese medicine, further endangers their lives.

- Protection Status:

- IUCN Red List: Vulnerable

- CITES: Appendix I

- Wildlife (Protection) Act, 1972: Schedule I

- Conservation Efforts: The Government of India initiated Project Snow Leopard in 2009 to safeguard and conserve the snow leopard population and their habitats through participatory policies.

- Under the UNDP's SECURE Himalaya project in 2020, India's first Snow Leopard Conservation Centre was launched in Uttarkashi, Uttarakhand, promoting conservation efforts in the region.

About Padmaja Naidu Himalayan Zoological Park (PNHZP):

- Formerly known as the Himalayan Zoological Park, the PNHZP was established in August 1958 in Darjeeling, West Bengal.

- Dedicated to the preservation of ecological balance in the Eastern Himalayas, the park pursues the following objectives:

- Ex-situ Conservation and Captive Breeding: The park focuses on the ex-situ conservation and captive breeding of endangered Himalayan animal species.

- Awareness and Education: Aiming to educate and motivate both local residents and visitors, the park conducts awareness campaigns highlighting the significance of Himalayan ecosystem conservation.

- Applied Research: The PNHZP initiates applied research in animal biology, behaviour, and healthcare, contributing to a better understanding of these aspects.

- Conservation Pioneering: Recognized as a conservation pioneer, the zoo initiated the first ex-situ conservation breeding program in 1986, commencing with the Snow Leopard conservation breeding project.

- The Red Panda project followed suit in 1990.

- High-Altitude Zoo: The PNHZP holds the distinction of being the largest high-altitude zoo in the country, making significant strides in the conservation of endangered Eastern Himalayan species in India.

How do flights land safely despite fog and low visibility? The wizardry tech that makes it possible! (Financial Express)

- 16 Jan 2024

Why is it in the News?

In the past few days, the Delhi airport has experienced chaos, resulting in over 100 flight delays, 10 flights being diverted, and some even cancelled due to low visibility caused by dense fog conditions affecting flying operations.

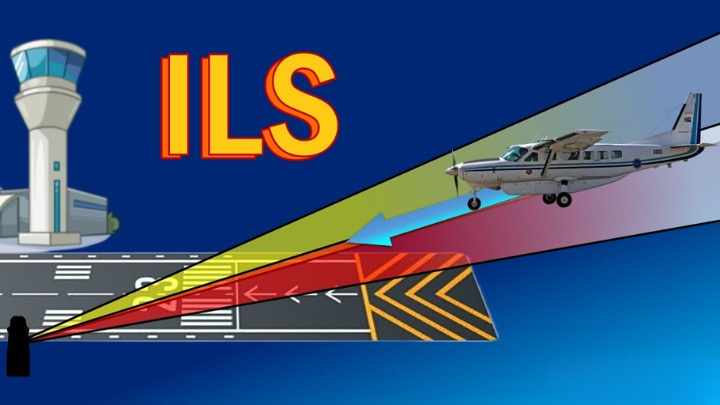

What is an Instrument Landing System?

- Fog, which is the suspension of water droplets near the ground, poses a considerable obstacle to aircraft operations during instances of reduced visibility.

- This atmospheric condition results in thick mist which hampers flight operations, necessitating the reliance on instruments like the “Instrument Landing System” (ILS) to navigate through the obscured surroundings.

- ILS is a standard International Civil Aviation Organisation (ICAO) precision landing aid that is used to provide accurate azimuth (angular measurement in a spherical coordinate system) and descent guidance signals for guidance to flight for landing on the runway under adverse weather conditions.

- To put things in perspective, ILS operates in tandem with ground-based equipment and avionic components on the aircraft, providing precise guidance to pilots during the critical phases of approach and landing.

- The ILS guiding system helps planes land in low visibility with the help of radio signals and also sometimes high-intensity lighting arrays.

- Among the various categories of ILS, Category 3 (CAT III) is the most significant due to its capability to support landing operations in low visibility conditions, thereby enhancing flight safety and operational efficiency.

- At present, airports like Delhi, Amritsar, Jaipur, Lucknow, and Kolkata among others use CAT IIIB technology in India.

- However, the absence of pilots or the ILS technology can lead to massive delays and cancellations.

- Moreover, a lot of financial and logistics are required to operate the technology which is still a distant dream at many airports around the country.

How does this system work?

- Consisting of two main components—the localizer and the glide slope—the CAT safe system functions by transmitting radio signals that help pilots align their aircraft with the correct runway and maintain the appropriate descent path.

- The localizer ensures lateral alignment, guiding the aircraft along the correct azimuth toward the runway centerline.

- Simultaneously, the glide slope provides vertical guidance, aiding pilots in maintaining the proper descent angle for a safe landing.

- Together, these components create a reliable and accurate navigational reference, allowing pilots to execute precision landings even when external visibility is severely compromised.

- Notably, ILS-equipped runways are equipped with ground-based transmitters positioned at the end of the runway, emitting signals that are received by the aircraft’s onboard ILS receiver.

- As the aircraft approaches the runway, the pilot uses the visual and audible cues provided by the ILS to make real-time adjustments, ensuring that the aircraft remains aligned with the desired glide path.

- In essence, the technology significantly enhances aviation safety and operational reliability by enabling pilots to conduct precise landings even in conditions that would otherwise pose a considerable risk.

NHAI cracks down on multiple FASTags for a single vehicle, launches ‘One Vehicle, One FASTag’ program (Financial Express)

- 16 Jan 2024

Why is it in the News?

The National Highways Authority of India (NHAI) announced on Monday (January 15) that FASTags with valid balances but incomplete KYC will be deactivated by banks after January 31, 2024.

What is the ‘One Vehicle, One FASTag’ Program?

- In a bid to enhance the efficiency of the electronic toll collection system and facilitate seamless movement at toll plazas, NHAI has initiated the ‘One Vehicle, One FASTag’ program, discouraging the use of a single FASTag for multiple vehicles or linking multiple FASTags to a particular vehicle.

- NHAI encourages FASTag users to complete the ‘Know Your Customer’ (KYC) process for their latest FASTag, aligning with RBI guidelines.

- To prevent inconvenience, users must ensure KYC completion for their latest FASTag and discard all previously issued FASTags through their respective banks.

- The initiative aims to deactivate or blacklist previous tags after January 31, 2024.

- Ensuring seamless and comfortable journeys: The ‘One Vehicle, One FASTag’ initiative, coupled with the high penetration rate of FASTag at around 98% and over 8 crore users, is poised to streamline toll operations, ensuring efficient and comfortable journeys on national highways.

About FASTags:

- FASTag serves as an electronic toll collection system in India, administered by the NHAI.

- Utilising Radio Frequency Identification (RFID) technology, it facilitates toll payments directly from the linked prepaid or savings account or directly from the toll owner.

- FASTag utilizes Radio Frequency Identification (RFID) technology, allowing seamless toll payments while the vehicle is in motion.

- Windscreen Affixation: FASTag is affixed on the vehicle's windscreen, providing a hassle-free experience for customers to drive through toll plazas without the need to stop for payments.

- Automatic Deduction: Toll fares are automatically deducted from the linked account of the customer, ensuring a swift and cashless transaction.

- Vehicle Specific: Once affixed to a vehicle, FASTag becomes vehicle-specific, preventing transferability to another vehicle.

- Purchase from NETC Member Banks: FASTag can be conveniently purchased from any of the National Electronic Toll Collection (NETC) Member Banks.

- Prepaid Account Recharge: In the case of linking FASTag to a prepaid account, customers need to recharge or top-up the tag based on their usage.

Govt cuts windfall tax on petroleum crude to Rs 1,700 per tonne (The Hindu)

- 16 Jan 2024

Why is it in the News?

The government has cut the windfall tax on domestically-produced crude oil to ?1,700 per tonne from ?2,300 per tonne with effect from January 16.

What is Windfall Tax?

- A Windfall Tax is imposed by governments on specific industries that experience exceptionally high profits due to economic conditions surpassing the norm.

- The term "windfall" denotes an unforeseen surge in profits, leading to the imposition of the windfall tax on the excess gains.

- Imposition Criteria: Governments impose the Windfall Tax when there is a sudden and substantial increase in an industry's revenue.

- Notably, this increase must be unrelated to the company's intentional actions, such as business strategies or expansions, but instead linked to external events beyond its control.

- A Windfall Tax is typically triggered by external occurrences, such as the unexpected surge in profits observed in the oil and gas industries amid the Russia-Ukraine conflict.

- Tax Rates: Governments tax these windfall gains at rates higher than the standard tax rates applicable to regular profits.

- Target Industries: Commonly, industries such as oil, gas, and mining become targets for windfall gains tax.

Objectives:

- Redistribution of Gains: To redistribute unexpected profits, especially when high prices benefit producers at the expense of consumers.

- Funding Social Welfare Schemes: Utilizing the windfall tax revenue to support social welfare initiatives.

- Supplementary Revenue Source: Acting as an additional revenue stream for the government.

- Addressing Trade Deficit: Providing a means for the government to mitigate the widening trade deficit in the country.

When Did India Introduce Windfall Tax?

- To address the shortage of energy products on the domestic market, the Indian government added a special additional excise duty on the export of gasoline and diesel, known as the Windfall Tax, on July 1st, 2022.

Why are Countries Levying Windfall Taxes Now?

- Since the past few years, gasoline prices, crude oil, gas, and coal have significantly increased.

- COVID-19 and the conflict between Ukraine and Russia made this increase even more pronounced.

- Because of this, energy companies profited handsomely at the expense of consumers, who now pay much higher prices for their energy use.

- The UN Secretary-General, therefore, encouraged nations to impose windfall taxes on those companies that have greatly benefited from the rise in the price of fossil fuels.

- As a result, many countries, including the UK, Germany, and others, besides India, are considering imposing Windfall Taxes.

Conclusion

In conclusion, a windfall tax is a tax that a government may impose or an additional tax that may be imposed on a business when it generates a sizable unanticipated profit, particularly if the company has benefited from favourable economic conditions.

Companies in specific economic sectors, such as the oil and gas industry, that profit from circumstances like commodity shortages that significantly drive up the cost of their goods at the expense of consumers may be subject to windfall taxes.