Chanakya Defence Dialogue 2024

- 26 Oct 2024

In News:

- Recently, the Chanakya Defence Dialogue (CDD) 2024, second edition, was held at the Manekshaw Centre, New Delhi.

- Theme: "Drivers in Nation Building: Fueling Growth Through Comprehensive Security."

- Focus: Discussions on integrating national security into India's development trajectory and global strategy for a Viksit Bharat by 2047.

Key Objectives:

- The dialogue aimed to explore India’s strategic directions and development priorities by fostering discussions between policymakers, strategic thinkers, defence experts, and academia.

- Highlighted the link between national security and economic growth, stressing how security frameworks are vital for national progress.

Key Sessions and Discussions:

- Session 1: Social Cohesion and Inclusive Growth: Pillars of a Secure Nation:

- Focused on internal security, social unity, and inclusive development.

- Panelists discussed the role of community engagement, countering terrorism, and law enforcement reforms.

- Emphasized the need for integrating social progress and addressing challenges like separatism and terrorist narratives.

- Panelists called for evidence-based policies for equitable growth and stronger security frameworks to protect the country from internal threats.

- Session 2: Blurring Frontiers: The Convergence of Technology & Security:

- Addressed the intersection of technology and national security.

- Topics included AI, quantum computing, IoT, and blockchain for improving cyber resilience and data protection.

- Panelists emphasized the need to balance technological innovation with strong security measures, particularly in cybersecurity and critical infrastructure protection.

- Session 3: Ground-breakers: Shaping Land Warfare, Reflections for the Indian Army:

- Explored the integration of emerging technologies like AI, unmanned systems, and cyber warfare tools in enhancing military readiness.

- Focused on indigenous defense technologies under the Atmanirbhar Bharat initiative, promoting self-reliance and reducing dependency on foreign technologies.

- Emphasized multi-domain operations and the challenges of adapting to evolving security threats, especially from advanced cyber and space warfare.

Strategic Insights:

- Economic Growth & Security: The dialogue highlighted that national security and economic growth are interlinked, with a strong military infrastructure crucial for sustaining development.

- Role of Technology: Technological advancements like AI, space technology, and cybersecurity are pivotal for enhancing India's defense capabilities and strategic posture in a rapidly evolving global security landscape.

- Inclusive Security: Emphasized social cohesion and inclusive growth as key components of national security, acknowledging that a unified society contributes significantly to national resilience.

- Global Diplomacy: India’s global leadership in multilateral forums, its stance on peacekeeping, and its role in promoting sustainable development were discussed as part of the country’s soft power strategy.

National Mission for Manuscripts (NMM)

- 26 Oct 2024

In News:

- The Union Ministry of Culture plans to revive and relaunch the National Mission for Manuscripts (NMM) to enhance the preservation and accessibility of India’s ancient texts.

- The mission’s objective is to document, conserve, digitize, and disseminate India’s rich manuscript heritage, ensuring their protection and public access.

Formation of a New Autonomous Body:

- The National Mission for Manuscripts (NMM) is likely to be restructured into an autonomous body called the National Manuscripts Authority, which will be under the Ministry of Tourism and Culture.

- The new body will address the challenges and gaps in manuscript preservation and management, offering more focused and flexible governance.

Background and Achievements:

- Established in 2003, the NMM has been part of the Indira Gandhi National Centre for Arts (IGNCA).

- Key achievements:

- 52 lakh manuscripts have had metadata prepared.

- Over 3 lakh manuscripts have been digitized, though only one-third have been uploaded for public access.

- Preventive and curative conservation of over 9 crore folios of manuscripts has been undertaken over the last 21 years.

- The NMM has set up 100 Manuscripts Resource Centres and Manuscripts Conservation Centres across India.

Current Challenges and Gaps:

- Data Uploading and Access:

- Of the 130,000 digitized manuscripts, only 70,000 are accessible online due to the absence of a comprehensive access policy.

- A significant portion (around 80%) of manuscripts areprivately owned, restricting public access and usage.

- Digitization Mismatch:

- There have been concerns about discrepancies between the digitized data and the original manuscripts, which requires correction to ensure authenticity and accuracy.

- Lack of Comprehensive Access Policy:

- Limited public access to manuscripts due to policy restrictions hinders further research and public engagement with this rich heritage.

Scope and Future of NMM:

- India's Manuscript Heritage: India is believed to have around 10 million manuscripts, spread across various regions, languages, scripts, and topics.

- Digitization and Accessibility: Moving forward, the key challenge will be ensuring that a larger proportion of the manuscripts are digitized, uploaded, and made publicly available, particularly from private collections.

- The establishment of the National Manuscripts Authority is expected to streamline efforts and enhance coordination between government bodies, private institutions, and scholars.

Precision Medicine, Biobanks, and Regulatory Challenges in India

- 26 Oct 2024

In News:

Precision medicine is bringing in a new era of personalised healthcare. The field began to take concrete shape when scientists were wrapping up the Human Genome Project.

Introduction to Precision Medicine:

- Precision Medicine is a novel approach to healthcare that tailors treatments and preventive strategies based on an individual’s genetics, environment, and lifestyle, instead of using a one-size-fits-all approach.

- It leverages technologies like genomics, gene editing (CRISPR), and mRNA therapeutics to address various diseases such as cancer, chronic diseases, and genetic disorders.

- Recent breakthroughs include gene therapy for restoring vision and stem cell transplants for reversing diabetes, demonstrating the transformative potential of precision medicine.

Role of Biobanks in Precision Medicine:

- Biobanks are repositories storing biological samples (blood, DNA, tissues) along with associated health data. These samples are crucial for research and development of personalized treatments.

- Large and diverse biobanks are essential for ensuring that precision medicine benefits a wide demographic, as data from homogenous groups could limit the applicability of findings.

- Recent studies using biobank data have led to breakthroughs, such as identifying rare genetic disorders and developing organoid models for high-throughput drug screening.

Precision Medicine and Biobanks in India:

- Market Growth: India’s precision medicine market is growing at a CAGR of 16%, expected to surpass USD 5 billion by 2030, contributing 36% to the national bioeconomy.

- Policy Framework: The government’s BioE3 policy aims to promote biomanufacturing, with a focus on precision therapeutics and related technologies like gene editing and cancer immunotherapy.

- Biobank Initiatives:

- Genome India Programme: Completed sequencing of 10,000 genomes from 99 ethnic groups, aimed at identifying treatments for rare genetic diseases.

- Phenome India Project: Focused on collecting 10,000 samples for improving prediction models for cardio-metabolic diseases.

- Paediatric Rare Genetic Disorders (PRaGeD) Mission: Aiming to identify genes that could help develop targeted therapies for genetic diseases in children.

Regulatory and Ethical Challenges in Biobanking:

- India’s biobanking regulations are inconsistent, hindering the full potential of precision medicine. Unlike countries like the U.K., U.S., and Japan, which have comprehensive laws addressing issues like informed consent, data protection, and privacy, India lacks a cohesive regulatory framework.

- Informed Consent Issues: In India, participants provide samples without full knowledge of how their data will be used, who will have access to it, and for how long it will be stored. This lack of transparency undermines public trust in biobank research.

- Ethical Concerns: Without a clear regulatory framework, there is a risk of misuse of biological samples, such as non-consensual data sharing and sample mishandling.

- International Implications: The absence of robust laws allows foreign pharmaceutical companies to access Indian biobank data and samples without ensuring that the Indian population benefits from the resulting research or profits.

Global Comparison of Biobank Regulations:

- International Standards: Countries like the U.K., U.S., and Japan have established comprehensive biobank regulations, addressing:

- Informed consent for sample collection and data usage.

- Privacy protection and secure storage of genetic information.

- Withdrawal rights for participants at any stage of research.

- India’s biobank regulations lack clear provisions for data protection and participant rights, limiting the effectiveness of research and undermining public confidence in biobanks.

Microfinance Institutions (MFIs)

- 26 Oct 2024

In News:

Recently, the Financial Services Secretary stated that Microfinance institutions (MFIs) have played a crucial role in fostering financial inclusion but they should refrain from any reckless lending.

Microfinance Institutions (MFIs) and Financial Inclusion:

- MFIs provide small loans and financial services to low-income and marginalized groups, particularly those without access to formal banking services.

- Goal: To promote financial inclusion and empower marginalized communities, especially women, by enabling them to become self-sufficient and improve their socio-economic status.

- In India, over 168 MFIs serve around 3 crore clients across 29 states and 563 districts.

- The sector has grown significantly and is crucial for empowering Self-Help Groups (SHGs) and Joint Liability Groups (JLGs) to access credit and other financial services.

Concerns over Reckless Lending:

- The Financial Services Secretary, emphasized that MFIs should avoid reckless lending practices that could harm both borrowers and the sector.

- Poor underwriting and irresponsible lending could lead to unsustainable debt, especially for Self-Help Groups (SHGs) and Joint Liability Groups (JLGs) with limited financial literacy.

- Key Advice: Lending practices must be responsible, careful, and should aim to empower borrowers, not exploit their limited understanding.

Government Programs Supporting MFIs:

- SHG-Bank Linkage Programme: Over 77 lakh SHGs with a total loan outstanding of ?2.6 lakh crore, benefiting around 10 crore households.

- Lakhpati Didi Yojana: Aimed at empowering women, this scheme helps transform SHG members into women entrepreneurs.

Challenges Facing Microfinance Institutions:

- Regulatory Scrutiny: Many MFIs face scrutiny for high interest rates and non-compliance with borrower assessments. The RBI has urged MFIs to reassess lending practices.

- Over-Indebtedness: Many borrowers take loans from multiple MFIs, leading to unsustainable debt. As of March 2024, over 12% of borrowers had multiple loans, risking defaults.

- Low Financial Literacy: A significant challenge is low financial literacy among borrowers, which increases the risk of defaults and harms the reputation of MFIs.

RBI Guidelines on Microfinance (2022):

- Collateral-Free Loans: For households with income up to ?3 lakh, loans should be collateral-free.

- Repayment Cap: Monthly loan repayments should not exceed 50% of the borrower’s monthly income.

- Flexibility in Repayment: MFIs must offer flexible repayment options and ensure proper income assessment.

- Interest Rate Cap: The RBI has implemented guidelines to limit excessive interest rates charged by MFIs.

Government Schemes for Microfinance:

- Pradhan Mantri Mudra Yojana (PMMY): Provides financial assistance to non-corporate, non-farm small/micro enterprises.

- National Rural Livelihoods Mission (NRLM): Promotes rural livelihoods through the formation and capacity building of Self-Help Groups (SHGs).

- Deen Dayal Upadhyaya Antyodaya Yojana: Focuses on the empowerment of rural poor through skill development and income generation.

- Credit Guarantee Fund for Micro and Small Enterprises (CGTMSE): Provides guarantee cover to micro and small enterprises.

Way Forward for Microfinance Sector:

- Responsible Lending: MFIs must prioritize affordable lending practices, ensuring borrower’s repayment capacity is carefully assessed to avoid over-indebtedness.

- Enhancing Financial Literacy: MFIs should focus on financial education for borrowers, enabling them to make informed choices.

- Adherence to Regulatory Guidelines: MFIs should comply strictly with RBI regulations, including interest rate caps and borrower income assessments, to enhance sector transparency and trust.

- Malegam Committee Recommendations: Implementing suggestions like capping interest rates, tracking multiple loans, and improving transparency to prevent over-indebtedness.

- Diversifying Funding Sources: To reduce vulnerability to economic downturns, MFIs should work on diversifying their funding sources, reducing dependence on external capital.

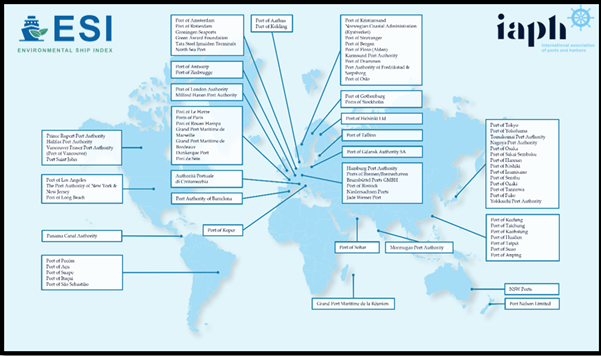

Environmental Ship Index (ESI)

- 26 Oct 2024

In News:

- Mormugao Port Authority (MPA) has been globally recognized as an incentive provider on the Environmental Ship Index (ESI) platform, acknowledged by the International Association of Ports and Harbours (IAPH).

- Mormugao is India's first port to implement Green Ship Incentives through the ESI, contributing to global efforts to reduce maritime air emissions.

‘Harit Shrey’ Scheme:

- Launched in October 2023, the ‘Harit Shrey’ scheme provides discounts on port fees based on the Environmental Ship Index (ESI) scores of commercial vessels.

- Ships with higher ESI scores (indicating better environmental performance) are rewarded with incentives to encourage eco-friendly practices in shipping.

ESI and Global Efforts for Emission Reduction:

- The Environmental Ship Index (ESI) is a global system to evaluate and reward ships based on their environmental performance, particularly their emissions of nitrogen oxides (NOx) and sulphur oxides (SOx).

- The 2023 IMO greenhouse gas strategy aims to reduce the carbon intensity of international shipping by at least 40% by 2030.

Incentives and Benefits:

- The Harit Shrey scheme has already benefitted several vessels, promoting greenhouse gas emission reductions and contributing to sustainable maritime operations.

- The scheme aligns with global sustainability goals, particularly in reducing the carbon footprint of shipping operations.

Sustainability Recognition:

- The Mormugao Port Authority has submitted the Harit Shrey scheme for consideration in the IAPH Sustainability Awards under the World Port Sustainability Programme (WPSP), reflecting its commitment to environmental sustainability.

The Environmental Ship Index (ESI):

- ESI is a system that evaluates and rewards ships for better environmental performance than the standards set by the International Maritime Organization (IMO).

- Ships are assessed based on their emissions of NOx and SOx, with greenhouse gas reporting also included in the evaluation.

Main Features of ESI:

- Port-Centric: Developed as a port-to-port system, where ports can offer incentives based on the ESI score.

- Voluntary Participation: Shipowners participate voluntarily to demonstrate their vessels' environmental performance.

- Automated Calculation: The ESI score is automatically calculated and updated.

- Incentives: Ships with higher ESI scores may receive benefits such as reduced port fees and priority berthing.