Paryatan Mitra and Paryatan Didi

- 29 Sep 2024

In News:

- The Ministry of Tourism, Government of India, launched the national responsible tourism initiative ‘Paryatan Mitra & Paryatan Didi’ on September 27, 2024, coinciding with World Tourism Day.

- Vision: Aligned with the Prime Minister's vision to use tourism as a tool for social inclusion, employment, and economic development.

Pilot Locations

- Destinations: The initiative is piloted in six tourist destinations:

- Orchha (Madhya Pradesh)

- Gandikota (Andhra Pradesh)

- Bodh Gaya (Bihar)

- Aizawl (Mizoram)

- Jodhpur (Rajasthan)

- Sri Vijaya Puram (Andaman & Nicobar Islands)

Objectives and Training

- Enhancing Tourist Experience: The program aims to connect tourists with ‘tourist-friendly’ individuals who serve as local ambassadors and storytellers.

- Training Focus: Individuals interacting with tourists—such as cab drivers, hotel staff, street vendors, and students—receive training on:

- Importance of tourism and hospitality

- Cleanliness and safety

- Sustainability practices

- Local stories and attractions

Empowering Women and Youth

- Target Groups: Emphasis on training women and youth to develop tourism products such as:

- Heritage walks

- Food and craft tours

- Nature treks and homestays

- Employment Opportunities: Aims to enable locals to secure jobs as homestay owners, cultural guides, and adventure guides.

Digital Literacy

- Training in Digital Tools: Participants are also educated in digital literacy to enhance visibility of their offerings to tourists.

Impact and Recognition

- Training Success: Since the program's pilot in August 2024, approximately 3,000 individuals have been trained.

- Local Enthusiasm: Increased local interest in participating in tourism training programs and contributing to the tourism ecosystem.

- Future Recognition: The Ministry plans to award dedicated badges to Paryatan Mitra and Didi participants, ensuring tourists can identify those committed to providing exceptional experiences.

ETURNAGARAM WILDLIFE SANCTUARY

- 29 Sep 2024

In News:

A rare collision of two cyclones has led to significant environmental impact, including the flattening of thousands of trees within the sanctuary.

Key Details:

- Location: Situated in the Mulugu district of Telangana, near the borders of Maharashtra and Chhattisgarh. Approximately 100 km from Warangal and 250 km from Hyderabad.

- Establishment: Declared a wildlife sanctuary in 1952 by the Nizam government of Hyderabad.

- Area: Covers around 806 square kilometers.

Geographic Features

Rivers:

- Dayyam Vagu: A significant water source that divides the sanctuary into two parts.

- Godavari River: Flows through the sanctuary, contributing to its rich biodiversity.

Flora

- Vegetation: Dense tropical dry deciduous forest.

- Key Species: Includes teak, bamboo, madhuca, and terminalia trees, creating a lush habitat.

Fauna

- Wildlife: Home to diverse species such as:

- Mammals: Tiger, leopard, panther, wolf, wild dogs, jackals, sloth bear, chousingha, blackbuck, nilgai, sambar, spotted deer, and four-horned antelope.

- Reptiles: Notable for its population of mugger crocodiles and snakes, including cobras, pythons, and kraits.

Cultural Significance

- Temple: The famous Sammakka-Saralamma Temple is located within the sanctuary.

INDIA TO SUPPORT TRINIDAD AND TOBAGO IN DEVELOPING UPI-LIKE PAYMENT SYSTEM

- 29 Sep 2024

In News:

- NPCI International Payments Limited (NIPL) has partnered with Trinidad and Tobago's Ministry of Digital Transformation to create a payment platform for person-to-person and person-to-merchant transactions.

- Modeling on UPI: The new digital payments system will be based on India’s Unified Payments Interface (UPI), which is widely recognized as a leading digital payment solution.

- Role of NPCI: NIPL, a quasi-government body under the Reserve Bank of India, manages India’s retail payment systems, including UPI.

Previous Initiatives

- Global Expansion: Earlier in 2024, NIPL also committed to establishing digital payment systems in Peru and Namibia, leveraging the UPI model.

- Ongoing Talks: NIPL is exploring opportunities with additional countries in Africa and South America to assist in building their payment infrastructures.

Significance:

- UPI has emerged as a transformative force in India's financial landscape, registering nearly 15 billion transactions in August 2024, with an estimated value of USD 245 billion.

- This strategic partnership aims to empower Trinidad and Tobago to establish a reliable and efficient real-time payments platform for both person-to-person (P2P) and person-to-merchant (P2M) transactions, expanding digital payments in the country and fostering financial inclusion.

India’s Commitment to Social Determinants of Health at UNGA

- 29 Sep 2024

In News:

- Union Minister of State for Health and Family Welfare, represented India at the G20 Joint Finance-Health Task Force meeting during the 79th UN General Assembly.

- Focus: The session emphasized the importance of investing in health and addressing social determinants of health (SDH) through initiatives like debt-for-health swaps.

Key Highlights:

- Role of SDH: Underscored how social determinants such as housing, sanitation, water access, and income security are crucial for health investment priorities.

- Flagship Programs: India’s notable initiatives include:

- Ayushman Bharat: The world’s largest health insurance scheme.

- Swachh Bharat Mission: Aiming for a cleaner India.

- Jal Jeevan Mission: Ensuring water access for all.

- Pradhan Mantri Awas Yojana: Promoting housing for all.

- Impact of PM-JAY: Highlighted improvements in access to healthcare and outcomes, especially for non-communicable diseases.

Data and Policymaking

- Importance of Data: Stressed the need for enhanced data availability and standardization on SDH indicators to support effective policymaking.

- Unified Approach: Called for G20 nations to collaborate on data collection and analysis for better health systems globally.

Exploring Debt-for-Health Swaps

- Potential Mechanism: Discussed debt-for-health swaps as a means to relieve financial pressure while promoting health equity.

- Next Steps: Emphasized the need for stakeholder engagement and pilot programs to ensure effective implementation.

Conclusion

- Global Leadership: India reaffirmed its commitment to health equity through evidence-based policies and partnerships.

- Shared Vision: Advocated for a unified effort towards achieving “Health for All,” highlighting the significance of investments in social determinants of health.

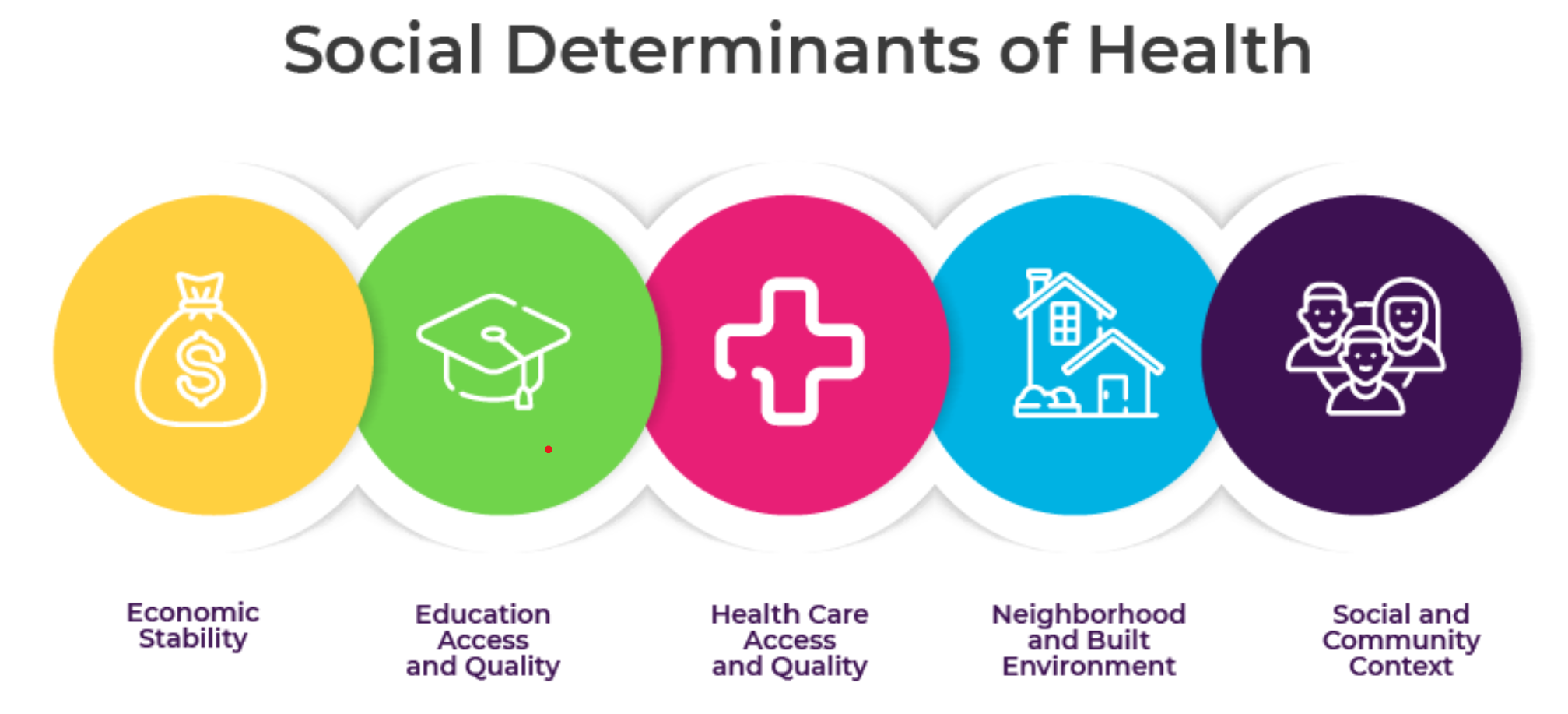

About Social determinants of health (SDOH)

- SDOH are non-medical factors that affect a person's health, well-being, and quality of life. They include the conditions in which people are born, grow, work, live, and age.

- SDOH also include the broader systems that shape everyday life, such as economic policies, social norms, and political systems.

- Some examples of SDOH include:

- Safe housing, transportation, and neighborhoods

- Racism, discrimination, and violence

- Education, job opportunities, and income

- Access to nutritious foods and physical activity opportunities

- Polluted air and water

- Language and literacy skills

GST COMPENSATION CESS

- 29 Sep 2024

In News:

- GST compensation cess likely to continue beyond January 2026, with potential rebranding and new end-use defined.

- Revenue Collection: Estimated Rs 20,000 crore expected from the cess by February 2026, with recent receipts of Rs 12,068 crore in August 2024.

- Cess Nature: The compensation cess, originally intended for revenue shortfall, cannot merge with the 28% GST slab due to regulatory limitations.

Financial Context

- RBI Study Insights: Weighted average GST rate decreased from 14.4% at launch to 11.6%, now even below 11%, raising concerns among states.

- State Concerns: Many states, including Punjab and Kerala, seek a 2-5 year extension for the compensation period to stabilize finances.

Regulatory Framework

- Cess Legislation: GST Compensation Cess is governed by the Goods and Services Tax (Compensation to States) Act, 2017, initially set for five years.

- Taxpayer Obligations: All suppliers of designated goods/services must collect the cess, except exporters and those under the composition scheme.

Distribution Mechanism

- Calculation of Compensation: Based on projected revenue growth (14%) against actual revenue, with payments distributed bi-monthly.

- Surplus Distribution: Any surplus in the compensation fund post-transition period will be shared between the Centre and states.

Future Considerations

- Ministerial Panel: A panel established by the GST Council will recommend the cess's future and revenue sharing post-compensation.

- Tax Expert Opinions: Some experts argue against pursuing the revenue-neutral rate, suggesting broader tax base expansion instead.

- Revenue Gap Solutions: Options for addressing compensation fund deficits include revising cess formulas, increasing rates, or market borrowing.