Rashtriya Poshan Maah 2024

- 06 Sep 2024

In News:

Union Minister of State for Women and Child Development, launched the Rashtriya Poshan Maah 2024 in Dhar district of Madhya Pradesh on 1st September,2024.

Key Highlights:

- As part of the 7th Rashtriya POSHAN Maah, awareness programs are being organized at various levels.

- Under the ICDS (Integrated Child Development Services) Project, complementary feeding activities were conducted at Anganwadi Centres (AWC) Paduck Bagicha, South Andaman.

- Also, at AWC, Champin Nancowrie, Nicobar district (Andaman & Nicobar) under the ICDS Tribal initiative, local food items and nutrition sources were displayed.

- These efforts aim to further the Prime Minister's vision of a ‘Suposhit Bharat’ by conducting diverse large-scale activities, harnessing the potential of Gram Panchayats and Urban Local Bodies.

Rashtriya Poshan Maah:

- The programme is annually celebrated in the month of September, with a different theme each year, primarily focusing on addressing malnutrition by ensuring convergence of various nutrition-related schemes and programmes.

- The objective of the Poshan Maah is to ensure community mobilisation and bolster people’s participation for addressing malnutrition amongst young children, and women and to ensure health and nutrition for everyone.

Poshan Abhiyaan:

- POSHAN Abhiyan (Prime Minister's Overarching Scheme For Holistic Nourishment) focuses on advancing nutritional outcomes for children under six years, adolescent girls, pregnant women, and lactating mothers.

- To cultivate widespread awareness about nutrition at each stage of life, it is celebrated annually as Poshan Maah (1st—30th September) and Poshan Pakhwada (fortnight of March).

- POSHAN Abhiyan (National Nutrition Month) aims to strengthen efforts to end hunger and malnutrition.

- It focuses to improving the nutritional outcomes among children, adolescent girls, pregnant women, and lactating mothers by focusing on prenatal care, diet, and optimal breastfeeding.

- The Ministry of Women and Child Development plans month-long activities under Poshan Maah, focusing on issues such as the hygiene and sanitation, anaemia prevention, maternal and infant health, among others.

- There are outreach programmes, identification drives, camps, and fairs with a special focus on pregnant and lactating women, children below six years, and adolescent girls in order to realise the vision of ‘Swasth Bharat’.

SAMRIDH Scheme

- 06 Sep 2024

In News:

- Ministry of Electronics and Information Technology (MeitY) launches 2nd Cohort of Startup Accelerators of MeitY for Product Innovation, Development and Growth (SAMRIDH).

About SAMRIDH Scheme:

- SAMRIDH is a flagship programme of MeitY for startups acceleration under National Policy on Software Products – 2019.

- The SAMRIDH programme, launched in August 2021 aims to support 300 software product startups with outlay of ?99 crore over a period of 4 years.

- SAMRIDH is being implemented through potential and established accelerators across India which provide services like making products market fit, business plan, investor connect and international expansion to startups plus matching funding upto ?40 lakh by MeitY.

- The scheme is being implemented by MeitY Start-up Hub (MSH), Digital India Corporation (DIC).

- In the first round of cohort, 22 Accelerators spread across 12 states are supporting 175 startups, selected through a multilevel screening process.

- Major Objective:

- The SAMRIDH scheme aims to support existing and upcoming Accelerators to select and accelerate potential IT-based startups to scale.

- Among others, the program focuses on accelerating the startups by providing customer connect, investors connect and connect to international markets

- Eligibility of Accelerator:

- Should be a registered Section-8/Society, [Not-for-Profit Company (eligible to hold equity)] having operations in India.

- The Accelerator and the team are recommended to have more than 3 years of startup experience and should have supported more than 50 start-ups of which at least 10 startups should have received investment from external Investors

- The Accelerator should have an experience of running startup program cohorts with activities listed as desirable under SAMRIDH program.

23rd Law Commission of India

- 06 Sep 2024

Constitution and Tenure:

- Notification and Term:

- The 23rd Law Commission of India was notified by the Union government on September 2, with effect from September 1.

- The commission will have a three-year term, concluding on August 31, 2027.

- The tenure of the previous Law Commission, chaired by former Karnataka High Court Chief Justice Ritu Raj Awasthi, ended on August 31.

Role and Importance of the Law Commission:

- Purpose:

- The Law Commission is a non-statutory body formed by the Union Ministry of Law and Justice through a gazette notification.

- Its role includes reviewing the functioning of laws, recommending the repeal of obsolete legislation, and providing recommendations on issues referred by the government.

- Composition:

- Typically chaired by a retired Supreme Court or High Court judge.

- Includes legal scholars and can also have serving judges.

- Impact:

- Over the years, 22 Law Commissions have submitted 289 reports.

- Their recommendations have influenced significant legislation, such as the Code of Criminal Procedure, 1973 (CrPC), and the Right of Children to Free and Compulsory Education Act, 2009 (RTE Act).

Constitution of the 23rd Law Commission:

- Structure:

- The commission will consist of:

- A full-time chairperson.

- Four full-time members, including a member-secretary.

- Up to five part-time members.

- Ex officio members including the secretaries of the Legal Affairs and Legislative departments.

- The commission will consist of:

- Appointment and Remuneration:

- Chairperson and full-time members can be serving Supreme Court or High Court judges or other experts chosen by the government.

- The chairperson will receive a monthly salary of ?2.50 lakh, while members will receive ?2.25 lakh.

- The member-secretary must be an officer of the Indian Legal Service of the rank of Secretary.

- Serving judges appointed to the commission will serve until retirement or the end of the commission’s term, without additional remuneration.

Terms of Reference:

- Primary Tasks:

- Identify and recommend the repeal of obsolete or irrelevant laws.

- Create a Standard Operating Procedure (SOP) for periodic review and simplification of existing laws.

- Identify laws that are misaligned with current economic needs and suggest amendments.

- Directive Principles and Reforms:

- Examine laws in light of Directive Principles of State Policy and suggest improvements and new legislation to achieve constitutional objectives.

- Address laws affecting the poor, conduct post-enactment audits of socio-economic legislation, and review judicial administration for responsiveness.

Previous Commission's Contributions:

- Reports and Recommendations:

- The 22nd Law Commission produced 11 reports, including:

- A report in April 2023 recommending retention of Section 124A of the Indian Penal Code (sedition law), with suggested amendments for clarity.

- A report recommending a new law to protect trade secrets.

- A report on simultaneous elections, though it was not submitted to the government before the commission’s chairperson assumed office as a Lokpal member.

- The 22nd Law Commission produced 11 reports, including:

Upcoming Focus:

- The 23rd Law Commission is expected to continue examining key issues, including the implementation of a uniform civil code, which was also considered by the 22nd Commission but whose recommendations remain unpublished.

Addressing Vertical Fiscal Imbalance: The Role of the 16th Finance Commission

- 06 Sep 2024

In India, the financial relationship between the Union government and the States is characterized by vertical fiscal imbalance (VFI), where the Union government holds most of the revenue while States shoulder significant expenditure responsibilities. The 16th Finance Commission has a pivotal role in addressing this imbalance. Here's how it should approach the issue:

Understanding Vertical Fiscal Imbalance (VFI)

- Current Situation:

- States incur 61% of revenue expenditure but collect only 38% of revenue receipts.

- States rely heavily on transfers from the Union government, leading to a pronounced VFI.

- VFI Definition:

- VFI arises when the expenditure responsibilities of States exceed their revenue-raising capabilities, necessitating transfers from the Union.

Reasons to Address VFI

- Constitutional Allocation:

- Revenue duties and expenditure responsibilities are constitutionally divided.

- Union government collects Personal Income Tax, Corporation Tax, and part of indirect taxes for efficiency.

- States are better positioned to deliver publicly provided goods and services effectively.

- Historical Context:

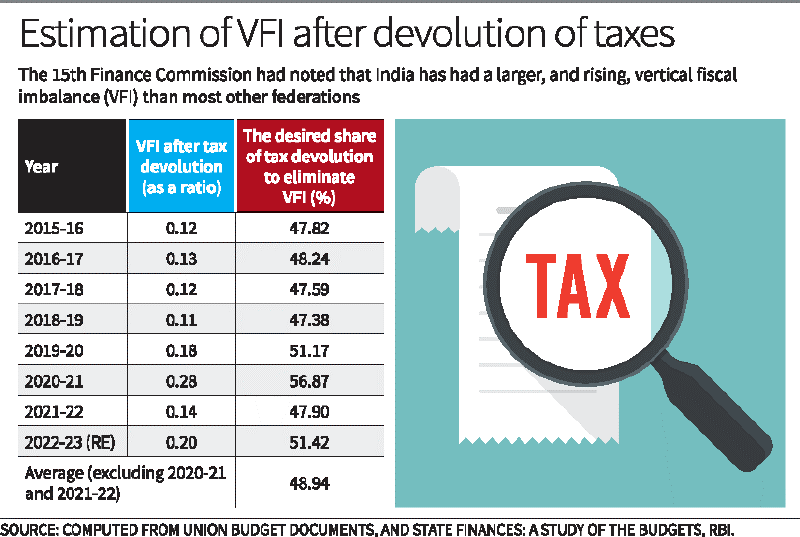

- The 15th Finance Commission highlighted that India has experienced a rising VFI, exacerbated by crises like the COVID-19 pandemic.

- Finance Commission's Role:

- The Commission addresses VFI by determining how to allocate taxes collected by the Union to the States and how to distribute these among States.

Finance Commission Recommendations

- Tax Devolution:

- The Commission recommends devolving a portion of Union taxes to States.

- The 14th and 15th Finance Commissions recommended devolving 42% and 41% of net proceeds, respectively.

- To eliminate VFI, devolution should be around 48.94%.

- Grants and Transfers:

- The Commission also suggests grants under Article 275 for specific purposes.

- Transfers under Article 282, such as centrally sponsored and central sector schemes, are tied and include conditionalities, which are not untied resources.

Calculation and Recommendations for VFI

- Estimating VFI:

- Ratio = (Own Revenue Receipts + Tax Devolution) / Own Revenue Expenditure.

- A ratio less than 1 indicates insufficient revenue to meet expenditure, showing the VFI deficit.

- Empirical Findings:

- To address VFI, the share of net proceeds devolved to States should be around 49%.

- This increase would ensure that States have more untied resources, enhancing their ability to meet local needs and priorities.

Implications of Increased Tax Devolution

- Enhanced State Capacity:

- A higher share of tax devolution would empower States with more resources for untied expenditures.

- It would improve the alignment of State expenditures with local needs and priorities.

- Improved Efficiency:

- Enhanced devolution would lead to better efficiency in expenditure by allowing States to respond more effectively to jurisdictional requirements.

- Strengthened Fiscal Federalism:

- Addressing VFI through increased tax devolution contributes to a more balanced and cooperative fiscal federalism.

Conclusion: The 16th Finance Commission should focus on increasing the share of tax devolution to around 50% to address the vertical fiscal imbalance. This adjustment will provide States with the necessary resources to manage their expenditure responsibilities more effectively and ensure a more equitable distribution of fiscal resources in India’s federal structure.

Can Kerala access funds from the Loss and Damage Fund?

- 06 Sep 2024

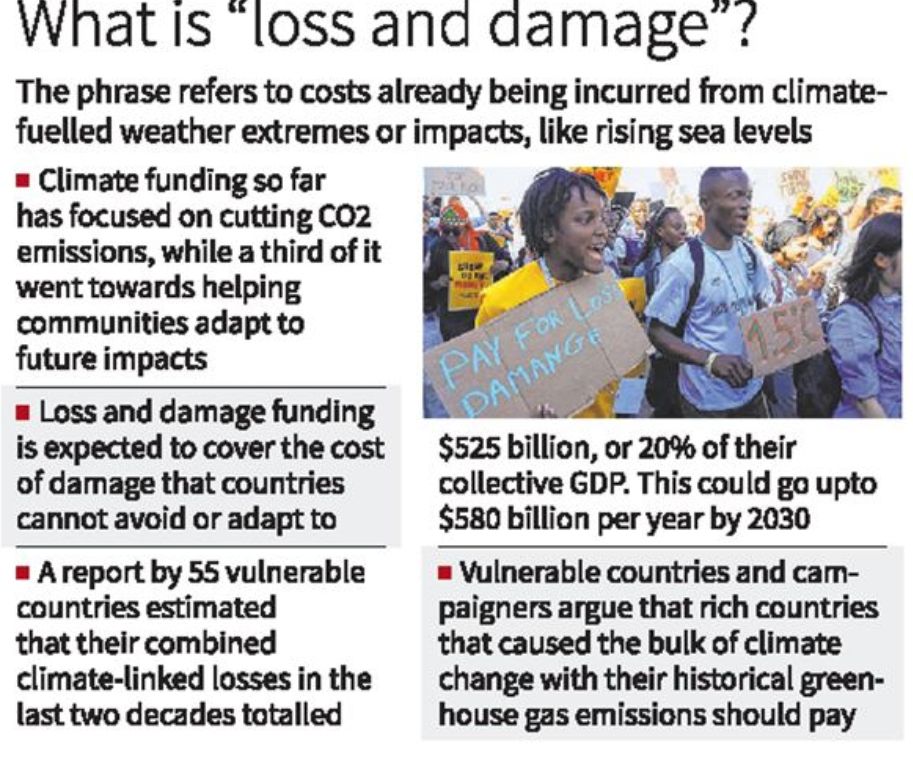

In light of the recent landslides in Kerala’s Wayanad district, the question arises whether subnational entities like Kerala can access the United Nations Framework Convention on Climate Change (UNFCCC)’s Loss and Damage Fund (LDF). While the need for compensation is clear, the process of accessing climate funds is complex.

What is the Loss and Damage Fund (LDF)?

- Established at COP27 in Egypt, the LDF aims to support regions experiencing economic and non-economic losses from climate change.

- Includes extreme weather events and slow-onset processes like rising sea levels.

- Managed by a Governing Board, with the World Bank as the interim trustee.

- The Board is developing mechanisms for resource access, such as direct access, small grants, and rapid disbursement options.

- Concerns exist about the speed and accessibility of climate funds, which may affect their effectiveness in immediate disaster recovery.

What has been India’s Role?

- India faced over $56 billion in weather-related damages from 2019 to 2023. Despite this, its National Climate Action Policy prioritizes mitigation over adaptation, leading to limited engagement in Loss and Damage dialogues at COP meetings.

- High vulnerability in certain regions could benefit from active participation in these dialogues.

- India needs a clear legal and policy framework for climate finance, focusing on locally led adaptation, which is vital for vulnerable communities.

- The Union Budget 2024’s introduction of a climate finance taxonomy raises hopes for increased international climate finance.

- Without clear guidelines for accessing loss and damage funds, frontline communities remain at risk.

- India should advocate for decentralized fund disbursement methods from the LDF, contrasting with the centralized systems used for other climate funds.

What have been State Interventions?

- State governments, such as Kerala, often bear the financial burden of disaster recovery.

- Example: The Rebuild Kerala Development Programme post-August 2018 floods, funded by World Bank and KfW Development Bank loans.

- Focused on infrastructure reconstruction, including roads and bridges.

- Lack of a standardized method for comprehensive disaster damage assessments, especially for slow-onset events, may mean significant loss and damage needs go unassessed.

- This could hinder India’s ability to access the LDF.

- The Wayanad situation highlights broader challenges in accessing and managing climate finance for loss and damage.

- A clearer domestic policy framework focusing on locally led adaptation and defined guidelines for accessing loss and damage funds is needed for better climate change protection.