Income-tax Bill, 2025

- 16 Feb 2025

In News:

The Income-tax Bill, 2025, tabled in Parliament on February 13, 2025, seeks to repeal and replace the Income-tax Act, 1961, marking a landmark step in tax law simplification.

It reflects the government's commitment to ease of doing business, legal clarity, and tax compliance, without altering the core tax policy or rate structure.

Guiding Principles

- Textual and structural simplification for better clarity.

- Policy continuity—no major tax policy changes.

- Preservation of existing tax rates for predictability.

Approach and Methodology

- Three-pronged strategy:

- Simplify language and eliminate legalese.

- Remove obsolete, redundant, and repetitive provisions.

- Reorganize the Act for logical and easier navigation.

- Consultative process:

- 20,976 online suggestions received.

- Stakeholder consultations with taxpayers, professionals, and industry bodies.

- International best practices reviewed, notably from Australia and the UK.

Quantitative Simplification

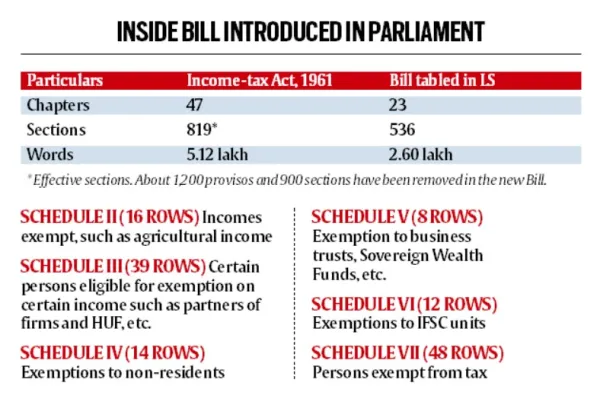

Parameter Income-tax Act, 1961 Income-tax Bill, 2025 Change

Words 5,12,535 2,59,676 ↓ 2,52,859

Chapters 47 23 ↓ 24

Sections 819 536 ↓ 283

Tables 18 57 ↑ 39

Formulae 6 46 ↑ 40

Key Features and Improvements

- Qualitative Enhancements:

- Use of simplified and accessible language.

- Consolidation of amendments to reduce fragmentation.

- Enhanced readability via structured use of tables and formulae.

- Elimination of outdated provisions.

- Introduction of "Tax Year":Defined as the 12-month period beginning April 1, providing better uniformity.

- Crypto as Capital Asset:Virtual Digital Assets (VDAs) such as cryptocurrencies included in the definition of "property", now taxable as capital assets.

- Dispute Resolution Clarity:Improved transparency in Dispute Resolution Panel (DRP) procedures by including points of determination and reasoning—addressing a key criticism of ambiguity in the earlier framework.

- Removal of Obsolete Exemptions:Section 54E, providing capital gain exemptions for transfers before April 1992, has been scrapped.

- Expected Timeline:Once enacted, the Income-tax Act, 2025 is proposed to come into effect from April 1, 2026.