SUGAM REC Mobile App for 54EC Bonds Investors (PIB)

- 07 Oct 2023

Why in the News?

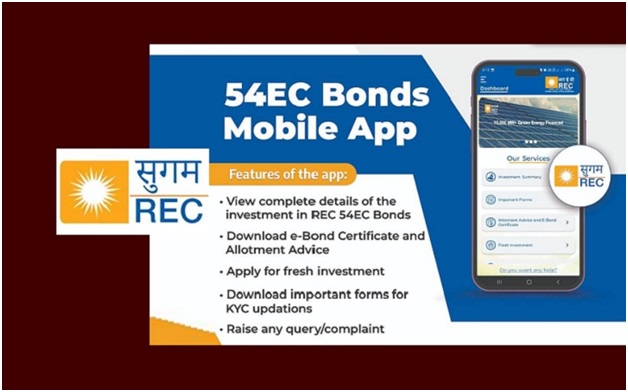

Recently, REC Limited, the Maharatna Central Public Sector Enterprise launched a SUGAM REC mobile application.

What is the SUGAM REC App?

- The SUGAM REC App caters exclusively to current and prospective investors in REC's 54EC Capital Gain Tax Exemption Bonds.

- Users can conveniently download e-bond certificates, apply for new investments, access essential forms for KYC updates, and connect with REC's Investor Cell through call, email, or WhatsApp.

What are 54EC Bonds?

- Also known as Capital Gain Bonds, these fixed-income instruments offer capital gains tax exemption under section 54EC.

- Investors can save on income tax for long-term capital gains by investing in these bonds within six months of the gain.

- With a fixed lock-in period of 5 years, the bonds can be held in either Physical or Demat form.

- Issued by government-managed institutions, they fund specific capital projects and derive their name from the relevant section of the Income Tax Act, 1961.

Key Facts about REC Limited:

- A 'Maharatna' company under the Ministry of Power, Government of India.

- Registered with RBI as a non-banking finance company (NBFC), Public Financial Institution (PFI), and Infrastructure Financing Company (IFC).

- Established in 1969 to address severe drought and famine, focusing on energizing agricultural pump sets for irrigation and reducing reliance on monsoons.

- Provides long-term loans and financing products to State, Centre, and Private Companies for infrastructure asset creation.

- It is the nodal agency for initiatives like Pradhan Mantri Sahaj Bijli Har Ghar Yojana (SAUBHAGAYA), Deen Dayal Upadhaya Gram Jyoti Yojana (DDUGJY), and National Electricity Fund (NEF) Scheme.