Parliamentary Standing Committee on Rural Development & Panchayati Raj (PSC) and MGNREGA

- 20 Dec 2024

In News:

Recently, the Parliamentary Standing Committee (PSC) on Rural Development and Panchayati Raj highlighted several issues within the Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS). The committee recommended reforms to address these challenges, especially concerning wage rates, workdays, payment systems, and infrastructure.

Key Challenges in MGNREGS Implementation:

- Wages Not Aligned with Inflation:

- MGNREGA wage rates have failed to keep pace with inflation, diminishing the purchasing power of rural workers. This discourages workers from completing the full 100 workdays.

- The wage guarantee of 100 days per household often falls short, especially during times of natural calamities or post-pandemic recovery.

- Revision of Permissible Works:

- The list of allowable work under MGNREGA is outdated and doesn't cover all rural needs, such as flood protection or land erosion management. Delayed revisions limit its effectiveness in addressing region-specific challenges.

- Delayed Payment of Wages:

- Issues like Aadhaar-based payment system (ABPS) glitches, inactive Aadhaar details, or frozen bank accounts often lead to delayed wage payments.

- The delay in wages undermines the scheme's goal of providing livelihood support.

- Unemployment Allowance:

- Those who apply for work but are not provided employment within 15 days are entitled to a daily unemployment allowance. However, this allowance is rarely paid, and when it is, the amounts are insufficient.

- Weak Social Audits:

- Social audits are a vital mechanism to ensure transparency and accountability. However, in the 2020-21 fiscal year, only 29,611 Gram Panchayats out of a total were audited, pointing to the weak social audit system.

- Lack of Ombudsman:

- Despite the provision for 715 ombudsmen, only 263 have been appointed. This reduces the oversight and accountability of the scheme.

Recommendations for MGNREGS Reform by the PSC:

- Revision of Wage Rates:

- Link MGNREGA wages to an inflation index, ensuring wages reflect the rising cost of living in rural areas.

- The base year (2009-2010) should be updated to align with current inflation trends.

- Increase Days of Work:

- The PSC recommended increasing the guaranteed workdays from 100 to 150 days. This will provide better livelihood security, especially in times of economic distress.

- Improvement in Payment Mechanisms:

- The committee recommended maintaining alternative payment systems alongside ABPS to prevent wage delays.

- A streamlined process should be put in place to ensure timely wage disbursement, reducing bureaucratic hurdles.

- National Mobile Monitoring System (NMMS):

- The committee stressed the importance of training programs to help beneficiaries effectively use the NMMS.

- It also suggested retaining alternative attendance methods to avoid exclusion due to technological barriers. NMMS helps enhance transparency and accountability by tracking attendance and work progress.

- Sufficient Fund Allocation:

- The committee emphasized the need for adequate financial allocations for MGNREGS to make it more effective in providing livelihood security to rural households.

Additional Context and Statistics:

- In 2024-25, the average wage increase under MGNREGA was just Rs 28/day.

- The MGNREGA wage increase for 2023-24 ranged from 2%-10%.

- The Consumer Price Index for Agricultural Labour (CPI-AL) is used to determine wage rates, although Dr. Nagesh Singh Committee (2017) recommended using the CPI Rural instead.

About the Parliamentary Standing Committee on Rural Development & Panchayati Raj (PSC):

- Established: August 5, 2004.

- Jurisdiction: The committee oversees the Ministry of Rural Development and the Ministry of Panchayati Raj.

- Composition: 31 members – 21 from Lok Sabha and 10 from Rajya Sabha.

- Functions:

- Reviews Demands for Grants and reports.

- Examines Bills referred by the Speaker or Chairman.

- Reviews the annual reports of relevant ministries.

- Considers national policy documents.

About MGNREGA:

- Launched: 2005 by the Ministry of Rural Development.

- Objective: Provides 100 days of unskilled manual work at minimum wages for rural households annually.

- Key Features:

- Legal Guarantee: Work must be provided within 15 days of request.

- Unemployment Allowance: If work isn't provided within 15 days, beneficiaries are entitled to a daily allowance.

- Women-Focused: At least one-third of beneficiaries are women.

- Social Audits: Mandated by the Gram Sabha for all projects under the scheme.

INDIA'S BIOE3 POLICY AND SMART PROTEINS

- 26 Sep 2024

In News:

The Indian government recently approved the Biotechnology for Economy, Environment, and Employment (Bioe3) Policy, which prioritizes the production of "smart proteins". This initiative aligns with broader national goals of achieving a sustainable, circular bioeconomy and a Net Zero carbon economy.

What Are Smart Proteins?

Smart proteins are alternative proteins derived from unconventional sources such as:

- Algae

- Fungi

- Insects

- Fermentation processes

- Lab-grown cells

This category also includes plant-based proteins, designed to replicate the taste and nutritional value of animal products without the need for livestock farming.

Environmental Benefits

The production of smart proteins offers significant environmental advantages:

- Water Use: 72-99% less water compared to conventional meat.

- Land Use: 47-99% less land required.

- Water Pollution: 51-91% reduction in pollution.

- Greenhouse Gas Emissions: 30-90% fewer emissions.

Health and Safety

With rising incomes, India's protein consumption has increased, from 9.7% of calories in 1991 to 11% in 2021. Smart proteins:

- Enhance food safety by reducing the risk of zoonotic diseases.

- Foster ethical consumption and align with traditional Indian dietary preferences.

Objectives of the BioE3 Policy

The Bioe3 Policy aims to:

- Foster high-performance biomanufacturing.

- Promote sustainable growth and innovation in biotechnology.

- Support the transition towards a Net Zero carbon economy.

By emphasizing the development of smart proteins, the Bioe3 Policy represents a strategic move towards a more sustainable and resilient food system in India.

Reverse Flipping

- 20 Mar 2024

Why is it in the News?

Payments major Pine Labs and quick commerce firm Zepto are among the startups looking to relocate their headquarters from foreign shores to India, to capitalize on the country's burgeoning tech landscape.

What is Reverse Flipping?

- Reverse flipping is a growing trend where overseas startups relocate their domicile to India and list on Indian stock exchanges.

- The primary motivation behind this shift is the potential for a higher valuation and more certain exit opportunities in India's thriving economic landscape.

Several factors contribute to the rise of reverse flipping:

- Access to a large, expanding economy: India's significant market size and sustained economic growth offer foreign startups attractive prospects for business expansion and success.

- Abundant venture capital: India's substantial venture capital resources provide a strong financial foundation for startups, fueling innovation and growth.

- Favorable tax policies: The country's tax regulations encourage foreign startups to establish operations in India, helping them maximize profits and minimize costs.

- Enhanced intellectual property protection: India's robust IP protection framework fosters innovation and creativity, safeguarding the unique ideas and technologies of startups.

- Skilled, youthful workforce: The availability of a talented, young, and educated population provides startups with a valuable human resource pool to drive growth and success.

- Supportive government policies: The Indian government actively promotes entrepreneurship and innovation through various initiatives and policies, creating a conducive environment for startups.

- The Economic Survey 2022-23 acknowledged the importance of reverse flipping and suggested measures to expedite the process, including simplifying tax vacation procedures, ESOP taxation, capital movement, and reducing tax layers.

- These efforts aim to further enhance India's appeal as a destination for foreign startups and foster economic growth.

What is Flipping?

- Flipping refers to the process by which an Indian company becomes a 100% subsidiary of a foreign entity after moving its headquarters overseas, involving a transfer of intellectual property (IP) and other assets.

- This transforms an Indian startup into a fully-owned subsidiary of a foreign entity, with founders and investors maintaining their ownership through the new overseas structure by exchanging their shares.

The process of flipping poses several concerns for India:

- The brain drain of entrepreneurial talent: As Indian startups move their operations overseas, India experiences a loss of innovative and entrepreneurial talent, which could otherwise contribute to the country's economic growth and development.

- Value creation in foreign jurisdictions: Flipping redirects potential value creation to foreign countries, depriving India of the economic benefits that could result from successful startups and innovations.

- Loss of Intellectual Property: When companies relocate and transfer their intellectual property overseas, India loses valuable IP assets, undermining the country's competitive advantage and innovation potential.

- Reduced tax revenue: Flipping also contributes to decreased tax revenue for India as companies shift their operations and profits to other jurisdictions, which may have more favorable tax policies.

India to Make Climate Risk Disclosures Mandatory for Banks

- 02 Mar 2024

Why is it in the News?

While acknowledging the importance of the environment and its long-term impact on organizations and the economy as a whole, the Reserve Bank of India (RBI) has now released a draft framework for banks to follow.

What are Climate-led Financial Risks?

- “Climate-related financial risks” means the potential risks that may arise from climate change or from efforts to mitigate climate change, their related impacts, and economic and financial consequences according to RBI.

- These risks manifest through two primary channels: physical risks and transition risks.

- Physical Risks: These entail the economic and financial consequences arising from the escalating frequency and severity of extreme weather events linked to climate change. Such events can exert pressure on the financial sector in various ways:

- Renewable Energy Sector (REs) Vulnerability: The occurrence of local or regional weather events may strain the anticipated cash flows to REs, impacting their financial stability. Furthermore, chronic flooding or landslides pose risks to the collateral that REs have pledged as security for loans.

- Infrastructure and Property Damage: Severe weather phenomena can inflict damage on the physical assets and data centres owned or leased by REs, impairing their capacity to deliver financial services effectively.

- Transition Risks: These risks stem from the transition toward a low-carbon economy, influenced by factors such as evolving climate-related policies, technological advancements, and changing consumer behaviours. Key considerations include:

- Policy and Regulatory Shifts: Changes in climate-related regulations and policies, along with advancements in technologies, can significantly influence the transition process. Moreover, alterations in customer sentiments and behaviour patterns play a pivotal role in shaping this transition.

- Economic Impact: The transition toward reducing carbon emissions carries substantial implications for the economy at large. It entails a shift toward sustainable practices and investments, which can impact various sectors and industries differently.

- Recognizing and addressing these climate-related financial risks is imperative for ensuring the resilience and stability of the financial sector in the face of evolving environmental challenges.

About the Framework:

- Commencing from the financial year 2025-26, all major financial institutions across India, including top-tier NBFCs and renowned NBFCs, will be mandated to furnish details about governance, strategy, and risk management strategies.

- Additionally, they will be required to initiate disclosure of metrics and targets from the fiscal year 2027-28.

Key highlights of the framework include:

- Enhanced Disclosure Requirements: Banks will be obligated to unveil climate-related risks that could potentially impact their financial stability.

- This measure aims to facilitate a comprehensive understanding of climate-related financial risks and opportunities, fostering early assessment and proactive management.

- Scope of Coverage: The framework encompasses various financial entities, including scheduled commercial banks (excluding local area banks, payments banks, and regional rural banks), Tier-IV primary urban cooperative banks (UCBs), and top and upper layer non-banking financial companies (NBFCs).

- Disclosure Obligations for Renewable Energy Sector (REs): REs are mandated to disclose crucial information related to climate-related risks and opportunities across short-, medium-, and long-term horizons. Key areas of disclosure include:

- Identification of Climate-Related Risks and Opportunities: REs are required to identify and disclose climate-related risks and opportunities relevant to their operations and financial outlook.

- Assessment of Impact: REs must delineate the impact of climate-related risks and opportunities on their business strategies and financial planning, enabling stakeholders to comprehend the implications on their overall strategy.

- Resilience Evaluation: REs are tasked with evaluating the resilience of their strategies in light of diverse climate scenarios, thereby ensuring robustness in navigating potential challenges and capitalizing on emerging opportunities.

Significance:

- A pressing requirement exists for an improved and standardized disclosure framework for regulated entities to mitigate financial risks.

- Without such a framework, there is a risk of assets being mispriced and capital being misallocated, which could have adverse repercussions on financial stability. Consequently, the imperative for a standardized disclosure framework on climate-related financial risks became evident.

RBI Allows Lending And Borrowing Govt Securities

- 27 Feb 2024

Why is it in the News?

In a bid to deepen the bond market, the Reserve Bank of India on Wednesday issued guidelines for lending and borrowing in government securities.

What are Government Securities?

- Government securities, also known as G-Secs, refer to the debt instruments issued by the government to finance its fiscal requirements.

- These securities are backed by the government’s guarantee of repayment and are considered risk-free investments.

- They are an integral part of the fixed-income market and are traded on the government securities market.

- Government securities serve as a means for the government to raise funds from the public to meet its expenditure needs, bridge budget deficits, and fund developmental projects.

- Investors who purchase these securities lend money to the government in return for regular interest payments and the principal amount at maturity.

- These securities come in mainly two categories:

- Short-Term: Often known as “Treasury Bills,” these have initial maturities of less than a year.

- Long-Term: Typically referred to as Government Bonds or Dated Securities, these have an original maturity of one year or more.

- In India, the Central Government issues both treasury bills and bonds or dated securities while the State Governments issue only bonds or dated securities, which are called State Development Loans (SDLs).

Treasury Bills (Short-Term G-Secs)

- Treasury Bills, commonly known as T-Bills, are short-term government securities with a maturity period of less than one year.

- They are issued at a discount to their face value and are highly liquid instruments.

- T-Bills serve as a mechanism for the government to efficiently manage its short-term funding requirements.

Dated Securities (Long-Term G-Secs)

- Dated Securities are long-term government securities with a fixed maturity period, typically 5 to 40 years.

- They pay regular interest to investors, known as coupon payments, and return the principal amount at maturity.

- Dated Securities are vital for financing long-term projects and meeting government borrowing needs.

India overtakes Hong Kong as the world’s fourth-largest stock market by market capitalisation (Live Mint)

- 24 Jan 2024

Why is it in the News?

Recently, India’s stock market has overtaken Hong Kong’s to rank as the fourth-biggest equity market globally for the first time.

News Summary:

- As of January 22, 2024, data compiled by Bloomberg indicates that the combined value of shares listed on Indian exchanges has reached USD 4.33 trillion, surpassing Hong Kong's USD 4.29 trillion.

- The top three global stock markets are currently the United States, China, and Japan.

What is Stock Market?

- A stock market is a platform where individual and institutional investors trade various securities, including stocks, bonds, Exchange Traded Funds (ETFs), and derivatives.

- Stock markets are categorized into two types:

- Primary Market: Involves the initial offering of new shares, bonds, etc.

- Secondary Market: Encompasses the trading of existing securities like equities and bonds.

- Examples include stock exchanges such as the Bombay Stock Exchange.

Importance of Stock Market:

- For Businesses: Facilitates access to capital, risk diversification, and supports business expansion.

- For Investors: Offers better returns compared to traditional savings instruments, provides tax benefits, and contributes to capital growth.

- For Society: Drives social impact through instruments like Social Impact Bonds, encourages sustainable investment via Green bonds and promotes responsible financial practices.

- For Economy: Mobilizes idle savings, fosters entrepreneurship through venture capital funds, and plays a vital role in economic development.

Challenges in Indian Stock Markets:

- High Volatility: Market fluctuations can be significant, posing challenges for investors.

- Limited Issuer and Investor Base: Constraints on both issuers and investors can adversely impact liquidity.

- Sub-optimal Corporate Debt Market: Dominance of government bonds hampers the growth of the corporate debt market.

- Other Issues: Various factors, such as regulatory complexities and market inefficiencies, can affect the optimal functioning of Indian stock markets.

How is the Stock Market Regulated in India?

- The stock market in India is regulated by various bodies, with the primary regulatory authority being the Securities and Exchange Board of India (SEBI).

- SEBI is a statutory regulatory body established in 1992 to protect the interests of investors and promote the development of the securities market in India.

- It operates under the Securities and Exchange Board of India Act, 1992.

- Also, while SEBI is the primary regulatory authority for the Indian stock market, the Reserve Bank of India (RBI) supports its efforts by ensuring overall financial stability, implementing monetary policies, and regulating aspects related to banking and foreign investments.

- Additionally, these bodies contribute to the nation's economic progress by facilitating capital formation.

Telco body seeks USOF, tax reliefs in FY25 Union Budget (Live Mint)

- 19 Jan 2024

Why is it in the News?

Telecom services providers have urged the Ministry of Finance to suspend the Universal Service Obligation Fund (USOF) till the existing corpus is exhausted.

About Universal Service Obligation Fund (USOF):

- The USOF was established through a parliamentary amendment to the Indian Telegraph (Amendment) Act, 2003.

- Its primary goal is to ensure non-discriminatory access to affordable telecom services in rural and remote areas, thereby narrowing the digital gap between urban and rural regions.

- For financially unviable rural and remote areas, the USOF provides subsidy support in the form of Net Cost or Viability Gap Funding (VGF).

- This encourages telecom service providers to expand their services to these areas, enhancing telecommunications and broadband accessibility.

- Funding Mechanism: Telecom operators contribute to the USOF through a Universal Service Levy (USL), a percentage of their Adjusted Gross Revenue (AGR).

- Administration: The USOF is overseen by the Administrator, USO Fund, appointed by the Central Government.

- It operates as an attached office under the Department of Telecommunications (DoT), Ministry of Communications.

Telecom Technology Development Fund (TTDF):

- Launched by USOF on October 1st, 2022, the TTDF Scheme targets domestic companies and institutions engaged in designing, developing, and commercializing telecommunication products and solutions.

- The scheme aims to facilitate affordable broadband and mobile services in rural and remote areas.

- The initiative fosters connections between schools and diverse volunteers from the Indian Diaspora, including young professionals, retired teachers, retired government officials, NGOs, private sector companies, corporate institutions, and more.

- Under the scheme, USOF is committed to developing standards to meet nationwide requirements and establishing an ecosystem for research, design, prototyping, use cases, pilots, and proof-of-concept testing.

- The scheme provides grants to Indian entities, encouraging the integration of indigenous technologies tailored to domestic needs.

Cellular Operators Association of India (COAI)

- The Cellular Operators Association of India (COAI), was constituted in 1995 as a non-governmental society registered under the Societies Act, 1860.

- The Association is dedicated to the advancement of modern communications through the establishment of a world-class cellular infrastructure and to delivering the benefits of affordable mobile communication services to the people of India.

- Today it is regarded as an important interface between the main stakeholders of the Indian Telecom Ecosystem, i.e. Government, Operators, Consumers, Equipment Manufacturers, and Content Providers.

- COAI provides a forum for discussions and exchange of ideas between Service Providers, Policy Makers, Regulators, Technologists, etc., who share a common interest in the development of mobile telephony in the country.

Planning to invest in green deposits? RBI releases latest guidelines to explain key provisions (Live Mint)

- 01 Jan 2024

Why is it in the News?

In a recent guideline, the Reserve Bank of India (RBI) said banks and Non-Banking Financial Companies (NBFCs) don’t need to raise green deposits.

What are Green Deposits?

- A green deposit is essentially a fixed-term deposit designed for individuals seeking to invest in eco-friendly projects.

- Similar to a standard Fixed Deposit scheme, the green deposit offers interest to investors and has a predetermined term.

Key Features:

- Allocation to Green Finance: The funds deposited in a green deposit are specifically earmarked for allocation to green finance initiatives, promoting environmentally conscious investments.

- Environmentally Friendly Focus: Also referred to as an environmentally friendly fixed deposit, this financial instrument encourages sustainable development by directing funds toward projects related to renewable energy, clean technology, and other environmentally beneficial initiatives.

- Priority Sector Classification: Green activities or projects financed through this framework may be classified under the priority sector, provided they meet the requirements outlined in the Priority Sector Lending (PSL) guidelines of the Reserve Bank of India (RBI).

- Overdraft Facility: Banks are permitted to offer overdraft facilities to customers against their Green Deposits, providing added flexibility.

- Currency Denomination: As per the current framework, green deposits can only be denominated in Indian Rupees.

- Insurance Coverage: Deposits raised under this framework are covered by the Deposit Insurance and Credit Guarantee Corporation (DICGC) in accordance with the Deposit Insurance and Credit Guarantee Corporation Act, 1961, and the relevant regulations.

- Renewal or Withdrawal: Upon maturity, depositors have the option to either renew or withdraw their green deposits, providing flexibility and choice.

Advantages of Green Deposits:

- Contribution to Climate-Friendly Initiatives: Green deposits empower depositors to actively participate in climate-friendly initiatives, aligning with India's net-zero goals and promoting environmental sustainability.

- Support for Socially Responsible Activities: Although higher interest rates may not be the primary focus, depositors indirectly contribute to socially and environmentally responsible endeavours.

- Their funds play a pivotal role in supporting activities that benefit the community and the planet.

- Positive Environmental Impact: By investing in green deposits, depositors contribute to positive outcomes such as reduced emissions, improved air quality, and sustainable resource allocation.

- These actions foster positive externalities, creating a healthier environment for all.

- Contribution to Reduced Income Inequality: The support for eco-friendly initiatives and fair resource allocation facilitated by green deposits contributes to long-term reductions in income inequality, fostering a more equitable and sustainable society over time.

Challenges Associated with Green Deposits:

- Design Limitations: Flaws in the design of green deposit frameworks may restrict the scope of eligible green projects that banks can invest in, limiting the diversity of environmentally beneficial initiatives.

- Perceived Reality vs. Impact: There is a concern that some green investment products may serve more as a psychological boost for investors rather than delivering substantial environmental benefits.

- The actual impact on the environment may not align with the positive perception created.

- Uncertain Project Sustainability: The long-term sustainability of green projects funded by banks remains uncertain, raising questions about the enduring impact of investments in environmentally friendly initiatives.

- Lack of Awareness: Insufficient awareness among bank staff can result in delays in the process of acquiring green deposits, hindering the seamless integration of eco-friendly financial products into banking operations.

- Lower Interest Rate Perception: Investors often prioritize high returns, and the perception that green deposits may offer lower interest rates could deter them from choosing environmentally conscious financial products.

162 cases of Covid sub-variant JN.1 detected in India; highest from Kerala, Gujarat: INSACOG (Live Mint)

- 30 Dec 2023

Why is it in the News?

India reported a total of 109 JN.1 COVID variant cases in the country as of December 26, Health Ministry sources recently said.

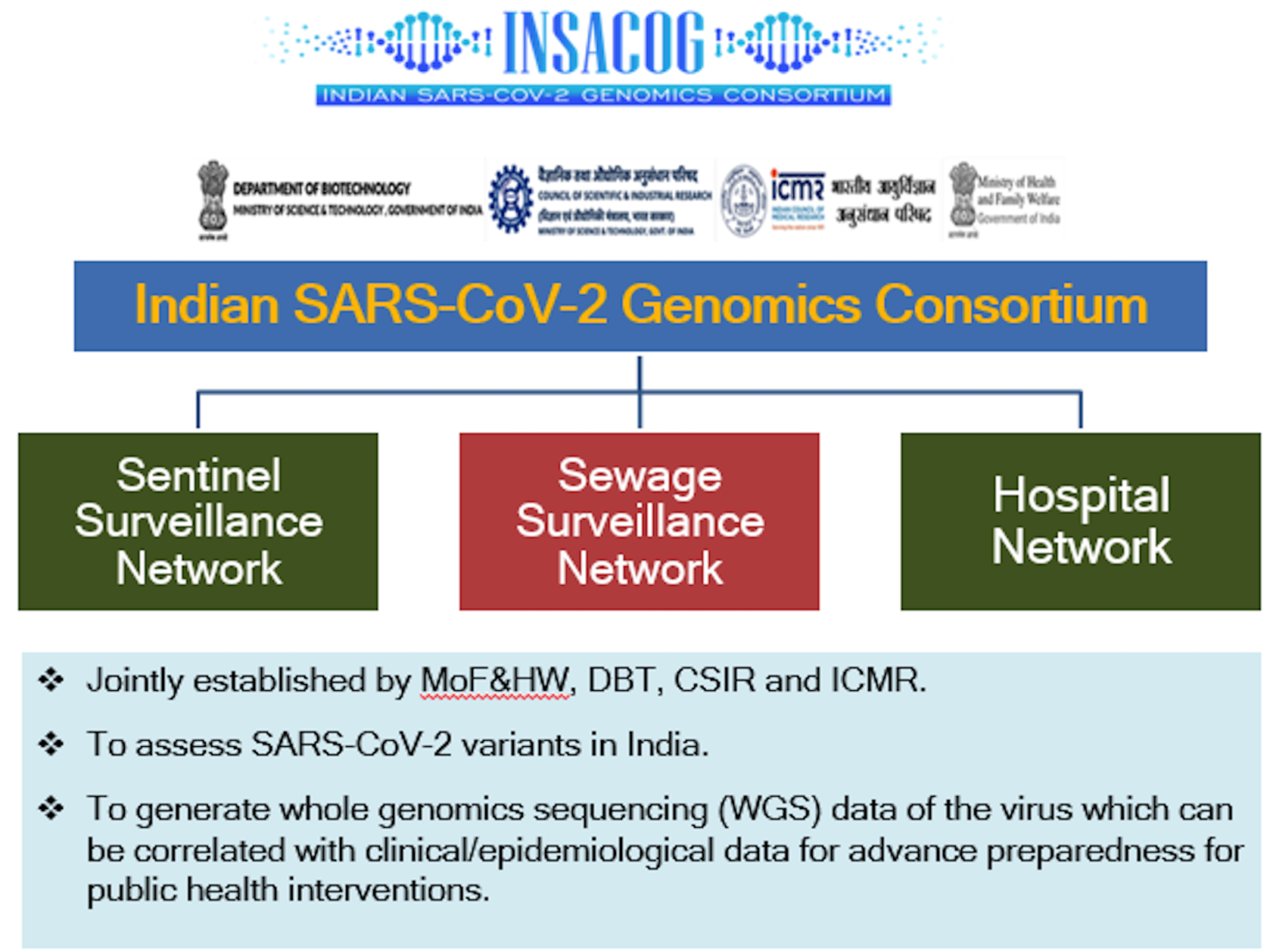

What is Indian SARS-CoV-2 Genomics Consortium (INSACOG)?

- Established in December 2020, INSACOG is a collaborative initiative involving the Union Ministry of Health, the Department of Biotechnology (DBT) under the Ministry of Science and Technology, the Council for Scientific & Industrial Research (CSIR), and the Indian Council of Medical Research (ICMR).

- The consortium's primary mission is to expand whole-genome sequencing of SARS-CoV-2, the coronavirus responsible for Covid-19, across India.

- This initiative aims to comprehend the virus's spread and evolution.

- INSACOG initially engaged 10 national research laboratories of the central government and has grown into a network of 38 labs, including private labs, following a hub-and-spoke model.

- The consortium's Genome Sequencing Laboratories guide new laboratories, working in tandem to monitor genomic variations through sentinel sequencing facilitated by the National Centre for Disease Control (NCDC) under the Integrated Disease Surveillance Programme (IDSP) of the central government.

- Beyond sequencing efforts, INSACOG endeavors to establish a systematic correlation between genome sequencing and clinical outcomes.

- It is actively building a nationwide hospital network to investigate clinical correlations in mild versus severe cases of Covid-19.

- Additionally, the consortium is conducting a longitudinal study to comprehend long-term post-Covid complications and changes in immunity.

- Looking ahead, INSACOG is exploring sewage surveillance as an early detection tool and assessing the spread of variants in hotspot localities.

SAT quashes Sebi's order against Kishore Biyani, and others (Live Mint)

- 21 Dec 2023

Why is it in the News?

The Securities Appellate Tribunal (SAT) on Wednesday quashed regulator Sebi's order banning Future Retail chairperson Kishore Biyani and some other promoters from the securities market for one year in an insider trading case.

About the Securities Appellate Tribunal (SAT):

- Established as a statutory and autonomous entity under the Securities and Exchange Board of India (SEBI) Act, 1992, the Securities Appellate Tribunal (SAT) serves as a crucial forum for adjudicating appeals against decisions made by SEBI or its adjudicating officers.

Key Functions:

- Appeals Jurisdiction: Primarily tasked with hearing appeals against orders issued by SEBI or its adjudicating officers under the SEBI Act.

- Extended Jurisdiction: Additionally, SAT entertains appeals concerning orders from the Insurance Regulatory and Development Authority of India (IRDAI) and the Pension Fund Regulatory and Development Authority (PFRDA) related to cases filed before them.

Composition:

- Presiding Officer: A retired or sitting Supreme Court judge, Chief Justice of a High Court, or a High Court judge with at least seven years of service.

- Judicial Member: High Court judge with a minimum of five years of service.

- Technical Member: Individual with expertise and a minimum of 15 years of experience in the financial sector, including securities market, pension funds, commodity derivatives, or insurance.

- This member can be a senior official in the Central or State Government or a person of proven ability and integrity.

Appointment and Tenure:

- Appointments made by the Central Government in consultation with the Chief Justice of India or its nominee.

- Presiding Officer and members serve a term of five years, eligible for reappointment for an additional term of up to five years.

- No member shall hold office after reaching the age of 70.

Powers and Authority:

- They are empowered with the same powers as a civil court under the code of civil procedure when adjudicating suits.

- Appeals to SAT can be made by any person aggrieved by SEBI or adjudicating officer orders, excluding those made with the consent of all parties.

Appeals Process:

- Appeals against SAT decisions can be filed in the Supreme Court, limited to questions of law.

- No appeal is permissible against orders made with the consent of all parties.

- The SAT, with its specific mandate and composition, plays a pivotal role in ensuring fairness and justice in the regulatory framework of the securities market in India.

What is Insider Trading?

- Insider trading is the act of buying or selling securities of a publicly traded company based on material information not yet disclosed to the public.

- Material information encompasses any data that could significantly influence an investor's decision to buy or sell the security.

- For instance, Consider a scenario where a government employee, possessing knowledge about an upcoming regulation that would favour a sugar-exporting company, takes advantage of this information by purchasing the company's shares before the regulation becomes public knowledge.