QS World Future Skills Index 2025

- 17 Jan 2025

In News:

The QS World Future Skills Index 2025, released by Quacquarelli Symonds (QS), evaluates countries' readiness to meet the evolving demands of the global job market. It assesses nations based on skill development, education, and economic transformation, highlighting their preparedness for emerging technologies, artificial intelligence (AI), and sustainability.

India’s Performance in the Index:

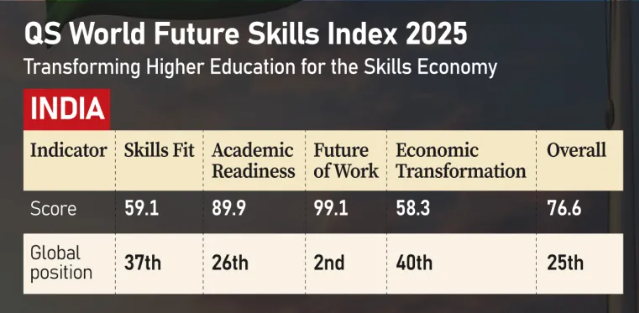

- Overall Ranking: India is ranked 25th globally, categorizing it as a “Future Skills Contender.”

- Future of Work Category: India ranked 2nd, only behind the United States, reflecting its preparedness for AI, digital, and green jobs.

- Economic Transformation: India scored 58.3, the lowest among the top 30 countries, reflecting challenges in innovation and sustainability.

- Skills Fit: India received a score of 59.1, the weakest among the top 30 nations, indicating a gap between workforce skills and industry requirements.

- Academic Readiness: India’s education system is struggling to keep pace with employer demands, necessitating curriculum reforms and stronger academia-industry collaboration.

Key Findings from the Report:

Strengths:

- Digital Readiness: India has demonstrated strong capabilities in integrating digital talent into the workforce.

- Youth Advantage: A large, young population provides a demographic dividend for sustained economic growth.

- Startup Ecosystem: India’s startup culture and government initiatives support technological advancement and innovation.

Weaknesses:

- Higher Education-Industry Gap: Mismatch between education and employer requirements, particularly in AI, green skills, and entrepreneurship.

- Limited R&D Investment: India’s research and development spending is 0.6% of GDP, far below the global average of 2.7%.

- Low Innovation in Sustainability: India scored 15.6 out of 100, ranking poorly in future-oriented innovation for sustainability.

Challenges and Concerns:

- Skilled Workforce Shortage: The National Skill Development Corporation (NSDC) estimates a 29 million skilled workforce gap in critical sectors such as healthcare, semiconductor manufacturing, and AI.

- Low Employability Rates: Only 25% of management professionals, 20% of engineers, and 10% of graduates meet global employability standards.

- Higher Education Accessibility: Many students face difficulties in accessing quality tertiary education, particularly in skill-intensive fields.

Opportunities for Growth:

- Leverage Demographic Dividend: India can capitalize on its young workforce to dominate skill-based industries while other nations struggle with aging populations.

- Policy Support:

- National Education Policy (NEP) 2020: Focuses on modular education and reskilling initiatives.

- ULLAS Program: Aims to expand lifelong learning and skill development.

- Technological Integration: Advancements in AI and digital learning can help modernize academic curricula and improve job readiness.

Recommendations for Improvement:

- Enhancing Academia-Industry Collaboration: Universities should prioritize problem-solving, entrepreneurship, and creativity to align education with employer needs.

- Increasing R&D Investment: Raising spending on research and development to promote innovation and sustainability.

- Expanding Access to Education: Bridging regional disparities in tertiary education through flexible and modular learning.

- Strengthening Policy Implementation: Ensuring effective execution of skilling programs to reduce the workforce-employability gap.

Global Economic Prospects (GEP) Report 2025

- 17 Jan 2025

In News:

The World Bank has released its Global Economic Prospects (GEP) report for 2025, a flagship biannual publication analyzing trends and projections in the global economy, with a focus on emerging markets and developing economies (EMDEs). The report highlights economic growth forecasts, trade dynamics, and the challenges and opportunities shaping the global economic landscape.

Global Economic Outlook

- The world economy is projected to expand at a steady yet subdued rate of 2.7% in both 2025 and 2026, maintaining the pace of 2024.

- Inflation, which peaked above 8% in recent years, is expected to stabilize at an average rate of 2.7% in 2025 and 2026, aligning with central bank targets.

- Despite growth, the global economy remains 0.4 percentage points below the 2010-2019 average, raising concerns about its ability to tackle poverty effectively.

Challenges and Risks

- Trade Restrictions: New trade restrictions imposed in 2024 were five times higher than the 2010-19 average, contributing to a slowdown in global trade and economic growth.

- Rising Protectionism: Increased fragmentation in global trade policies is limiting exports and hampering economic integration.

- Policy Uncertainty: Adverse policy shifts, sluggish progress in reducing inflation, and weaker performance in major economies pose downside risks to global recovery.

- Debt and Investment Concerns: Developing economies are experiencing sluggish investment growth and high debt levels, exacerbated by climate change-related costs.

Emerging Markets and Developing Economies (EMDEs)

- EMDEs have significantly evolved since 2000, now contributing about 45% of global GDP, compared to 25% at the start of the century.

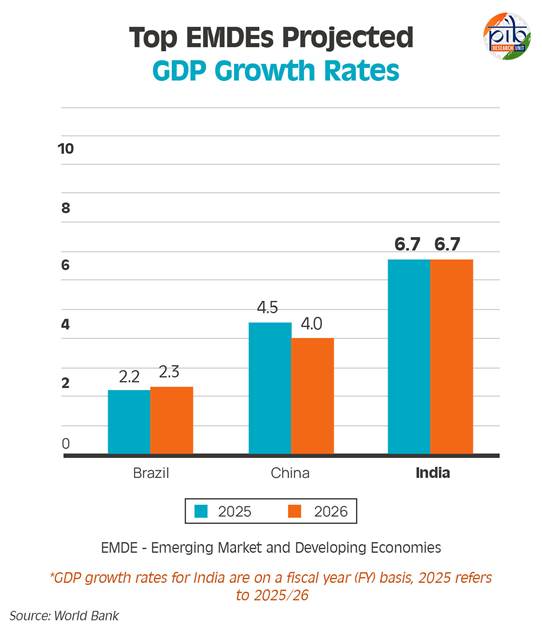

- The three largest EMDEs—India, China, and Brazil—have accounted for approximately 60% of annual global growth over the past two decades.

- Growth in low- and middle-income developing countries is expected at 4.1% in 2025 and 4% in 2026, with a notable slowdown compared to the early 2000s.

- Low-income countries are projected to rebound to 5.7% in 2025 and 5.9% in 2026, aided by easing conflicts in some regions.

- The world's poorest nations, with annual per capita incomes below USD 1,145, recorded growth of 3.6% in 2024, impacted by conflicts in regions like Gaza and Sudan, alongside lingering effects of COVID-19 and geopolitical tensions.

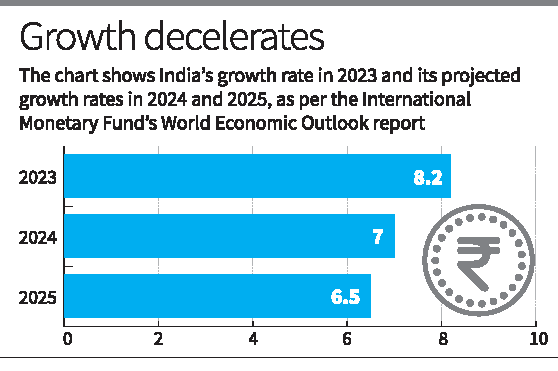

India-Specific Highlights

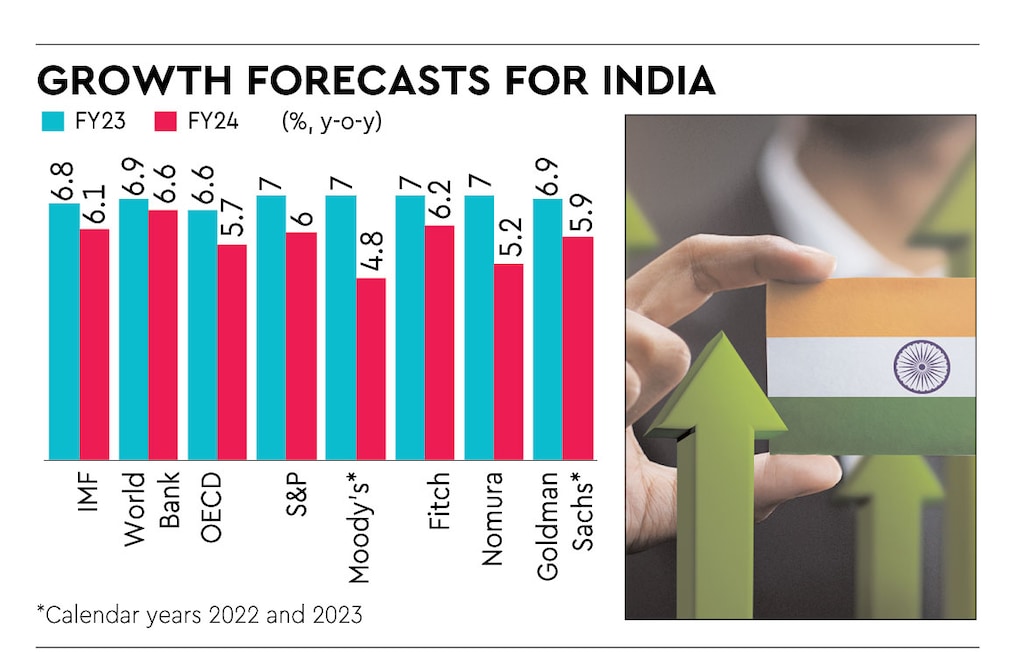

- Fastest-Growing Major Economy: India is expected to maintain its position as the world’s fastest-growing major economy, with a projected growth rate of 6.7% in both 2025 and 2026.

- Sectoral Growth: The services sector will remain robust, while manufacturing activity is expected to strengthen.

- Investment Growth: Supported by rising private investment, improved corporate balance sheets, and favorable financing conditions, investment growth in India is expected to remain steady.

- Key Growth Drivers:

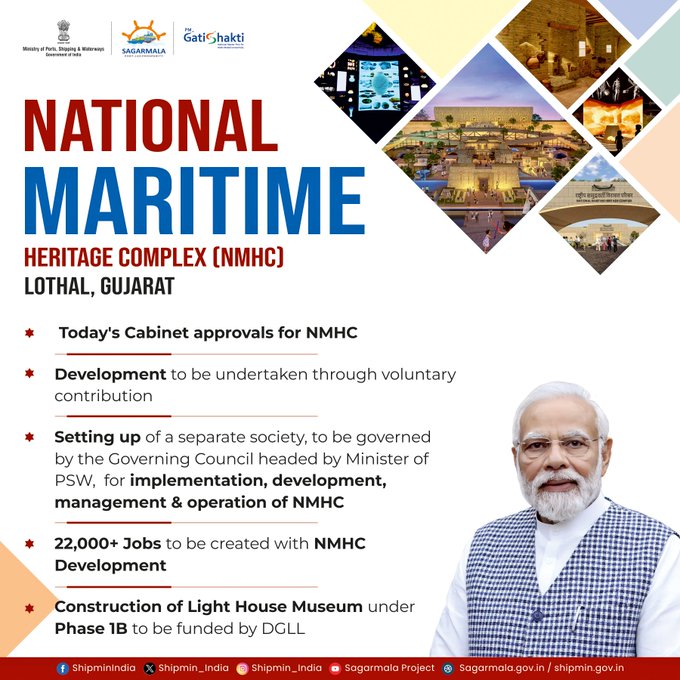

- Infrastructure development under the PM GatiShakti National Master Plan.

- Innovation-driven initiatives like Startup India and the Production Linked Incentive (PLI) Scheme.

- Expansion of the digital economy and financial inclusion efforts.

- Rural Demand and Consumption: Growth in rural demand and a recovery in farm production have bolstered consumer spending, although urban consumption remains affected by inflation and slow credit growth.

Nine Years of Startup India

- 16 Jan 2025

In News:

On January 16, 2025, India marks nine years of Startup India, a transformative journey that began in 2016. Designated as National Startup Day, this occasion celebrates the nation’s strides in fostering a robust and inclusive entrepreneurial ecosystem.

Current Status (as of Jan 2025)

Over 1.59 lakh startups recognized by DPIIT, making India the 3rd largest startup ecosystem globally.

- More than 100 unicorns (startups valued over $1 billion).

- Key hubs: Bengaluru, Hyderabad, Mumbai, Delhi-NCR; growing contribution from smaller cities.

Key Sectors

- Major sectors: Fintech, Edtech, Health-tech, E-commerce.

- Notable companies: Zomato, Nykaa, Ola exemplify India's shift from job seekers to job creators.

Key Milestones (2016–2025)

- Startups grew from around 500 in 2016 to 1.59 lakh in 2025.

- 73,151 startups with at least one-woman director as of 2024, showcasing rise in women entrepreneurship.

- Over 16.6 lakh jobs created by DPIIT-recognized startups by 2024.

Core Features of Startup India

- Ease of Doing Business: Simplified compliance, self-certification, and single-window clearances.

- Tax Benefits: Three-year tax exemptions for eligible startups.

- Funding Support: ?10,000 crore Fund of Funds for Startups (FFS) supports early-stage funding.

- Sector-Specific Policies: Policies focusing on sectors like biotechnology, agriculture, and renewable energy.

Industry-wise Jobs Created

- IT Services: 2.04 lakh jobs.

- Healthcare & Lifesciences: 1.47 lakh jobs.

- Professional & Commercial Services: 94,000 jobs.

- Total direct jobs created: 16.6 lakh (as of Oct 2024).

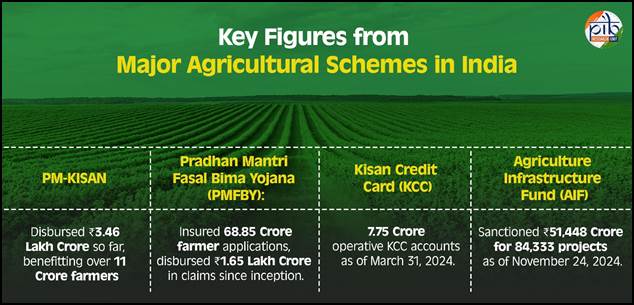

Flagship Schemes

- Startup India Seed Fund Scheme (SISFS).

- Credit Guarantee Scheme for Startups (CGSS).

- Fund of Funds for Startups (FFS) Scheme.

Other Key Initiatives

- Capacity Building & Handholding: Workshops for regional ecosystems, especially in non-metro cities.

- Outreach & Awareness: Initiatives to facilitate funding, incubation, and mentorship opportunities.

- Ecosystem Development: National-level events like Startup Mahakumbh to bring together key stakeholders.

- International Linkages: India’s G20 Presidency institutionalized Startup20 to enhance global collaborations.

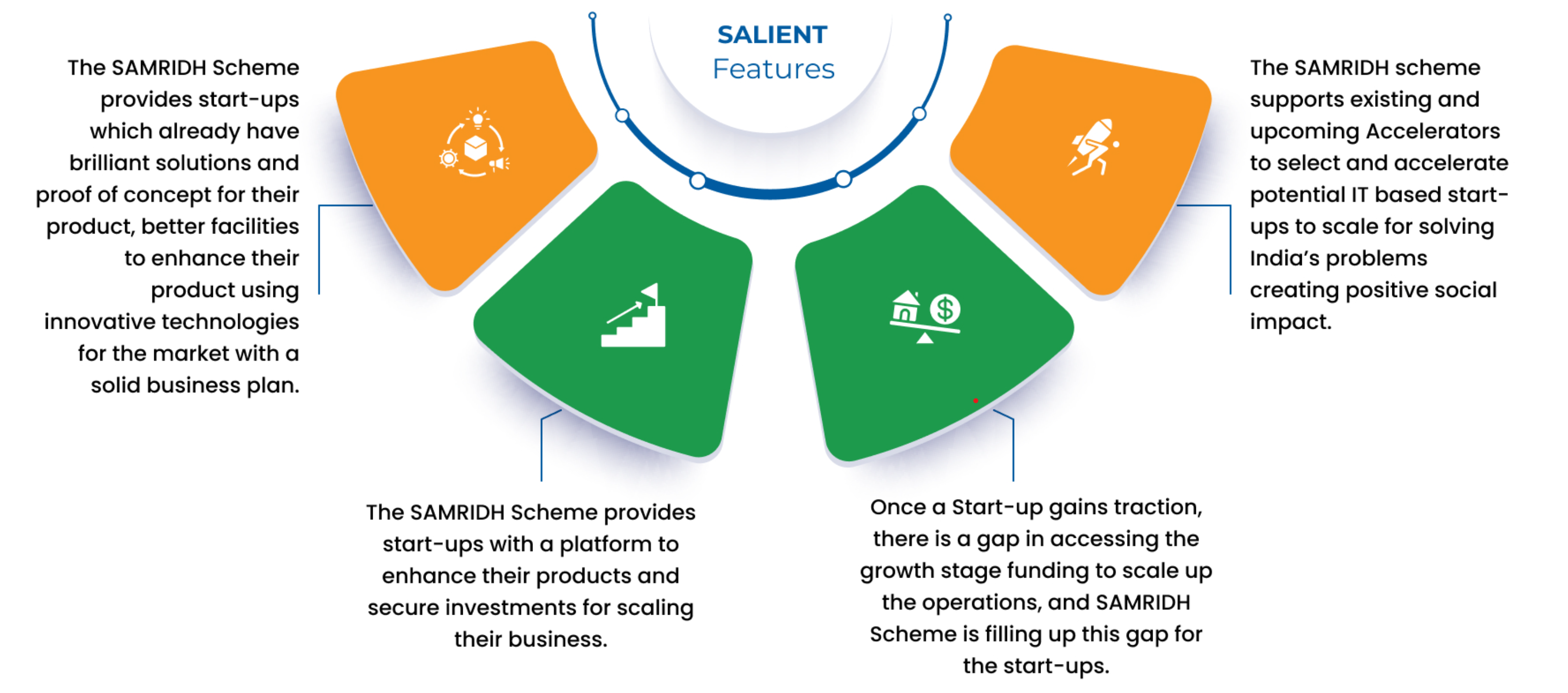

BHASKAR Platform (Launched in Sept 2024)

- Objective: Centralize and streamline interactions within the entrepreneurial ecosystem.

- Key Features:

- Networking: Connects startups, investors, mentors, and government bodies.

- Resources: Provides quick access to essential tools and knowledge for scaling startups.

- Global Outreach: Promotes India as a global innovation hub.

Startup Mahakumbh

- 2024 Edition: Hosted 1,300 exhibitors, 48,000 visitors, and 392 speakers, including unicorn founders and policymakers.

- 2025 Edition (3-5 April, New Delhi): Theme - “Startup India @ 2047 – Unfolding the Bharat Story.”

Bharat Cleantech Manufacturing Platform

- 14 Jan 2025

In News:

Union Minister of Commerce & Industry Shri Piyush Goyal launches Bharat Cleantech Manufacturing Platform.

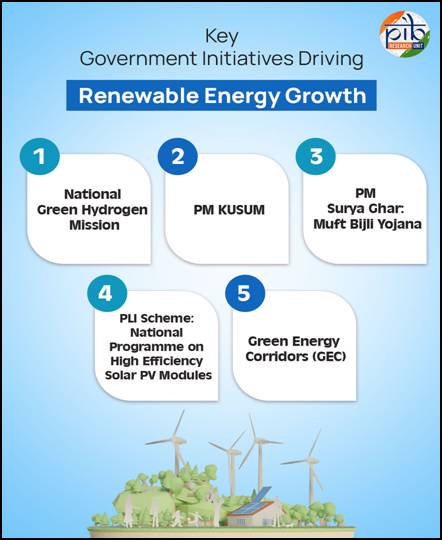

Bharat Cleantech Manufacturing Platform:

- Objective: Strengthen India's cleantech value chains, especially in solar, wind, hydrogen, and battery storage sectors.

- Platform Features:

- Aims to promote collaboration, co-innovation, and knowledge-sharing among Indian firms.

- Focus on scaling up manufacturing, sharing ideas, technologies, and resources.

- Acts as a financing platform for the cleantech sector.

- Designed to position India as a global leader in sustainability and cleantech innovation.

India's Clean Energy Commitment:

- Target: 500 GW of clean energy capacity by 2030.

- India has been a front-runner in fulfilling its Nationally Determined Contributions (NDCs) under the Paris Agreement and UNFCCC.

- Early Achievement: India achieved its 2022 renewable energy target of 200 GW, 8 years ahead of schedule.

- Largest Interconnected Grid: India boasts the world’s largest interconnected power grid, enhancing its renewable energy distribution capacity.

- Gujarat is a pioneer in solar power adoption in India.

Union Minister Shri Piyush Goyal's Views:

- On Product-Linked Incentives (PLIs):

- PLIs and subsidies are seen as short-term aids; long-term growth of the clean energy sector depends on it becoming self-sustaining.

- Urged Indian firms to innovate and scale up manufacturing within the country.

- On Clean Energy and Sustainability:

- Stressed the importance of innovation and collaboration to achieve sustainability goals.

- India aims to attract international investors by creating a compelling business case for cleantech investments.

- 3S Approach (Speed, Scale, and Skill): Key to implementing India's renewable energy program, emphasizing rapid deployment, large-scale adoption, and skill development in the sector.

Bharat Climate Forum 2025:

- Event Objective: A platform for policymakers, industry leaders, and stakeholders to discuss climate action, clean energy, and India’s role in global climate goals.

- Key Focus Areas:

- Aligning India’s clean energy initiatives with global climate goals (UNFCCC, Paris Agreement).

- Emphasizing India’s early achievements in clean energy adoption.

- Promoting sustainable development and clean energy solutions.

India's Performance in Renewable Energy:

- India’s progress has been commendable in meeting its climate targets and setting up clean energy capacity ahead of schedule.

- The government’s initiatives, led by Prime Minister Narendra Modi, have made solar power affordable and scalable through transparency in auctions, competitive bidding, and speed in project implementation.

Future of Jobs Report 2025

- 12 Jan 2025

In News:

The World Economic Forum's latest "Future of Jobs Report 2025" has highlighted significant trends and predictions for the global labor market by 2030.

Key Highlights:

Fastest Growing Jobs by 2030

The report identified the following jobs as the fastest-growing by 2030:

- Big Data Specialists

- FinTech Engineers

- AI and Machine Learning Specialists

- Software and Applications Developers

- Security Management Specialists

- Data Warehousing Specialists

- Autonomous and Electric Vehicle Specialists

- UI/UX Designers

- Delivery Drivers

- Internet of Things (IoT) Specialists

Job Disruption and Creation

- 22% of jobs globally will be disrupted by 2030 due to automation and technological advancements.

- 170 million new jobs are expected to be created, resulting in a net increase of 78 million jobs.

- Technological shifts, economic uncertainty, and demographic changes are expected to play significant roles in this transformation.

Skills in High Demand

- AI, Big Data, Cybersecurity: Skills related to artificial intelligence and big data are expected to see an 87% rise, while networks and cybersecurity skills are projected to increase by 70%.

- Creative Thinking, Flexibility: Skills like creative thinking, resilience, flexibility, and agility are also expected to see a significant rise, emphasizing the importance of soft skills in a technology-driven world.

Declining Jobs

The report lists the following positions as expected to decline by 2030:

- Postal Service Clerks

- Bank Tellers

- Data Entry Clerks

- Cashiers and Ticket Clerks

- Telemarketers

- Printing Workers

- Accounting and Bookkeeping Clerks

These roles are being replaced or transformed by automation and AI, which are reshaping traditional job functions.

Technological Advancements

- Digital Access: 60% of employers believe that expanding digital access will be the most transformative trend for businesses.

- AI and Robotics: Employers are investing heavily in AI, robotics, and energy technologies, creating a demand for skilled workers in these sectors.

- Energy Technologies: Jobs related to the green transition, including renewable energy and environmental engineering, will see an uptick as countries strive to meet climate goals.

Key Drivers of Change

- Technological Change: AI, machine learning, and automation will continue to reshape industries.

- Geoeconomic Fragmentation: Geopolitical tensions and economic shifts are prompting businesses to transform their models, leading to a greater demand for cybersecurity and security management roles.

- Aging Populations: The growing demand for healthcare services, especially in high-income economies, will result in more jobs in the care economy (e.g., nursing professionals, social workers).

- Green Transition: The global shift toward clean energy and environmental sustainability will create numerous opportunities for jobs in renewable energy and climate change mitigation.

Implications for India

- AI and Robotics Investment: Indian companies are leading the way in investing in AI, robotics, and autonomous systems.

- Growth Sectors: India’s rapidly developing tech sector will see a rising demand for AI, machine learning, and big data specialists.

- Disruptions in Traditional Jobs: Roles like postal clerks, cashiers, and data entry clerks in India are also expected to face significant reductions due to automation.

Challenges for Employment in India

- Skill Mismatch: There is a significant skill gap, with many workers lacking expertise in emerging fields like AI, cybersecurity, and data science.

- Digital Divide: Urban areas are adapting to new technologies faster than rural areas, which may widen employment disparities.

- Informal Sector: India’s large informal workforce faces challenges in transitioning to technology-driven jobs due to limited access to training and education.

Reskilling and Upskilling

- The WEF report emphasizes that 59% of the global workforce will need reskilling or upskilling by 2030 to remain competitive.

- Workers must adapt to new roles, especially in technology and the green transition, to meet the evolving demands of the job market.

GEAPP and ISA Sign $100 Million Agreement for Solar Projects

- 12 Jan 2025

In News:

The Global Energy Alliance for People and Planet (GEAPP) signed a Multi-Donor Trust Fund (MDTF) agreement with the International Solar Alliance (ISA) to mobilize $100 million for funding high-impact solar energy projects. This collaboration is part of a wider effort to accelerate India's clean energy transition, bridge financing gaps, and enhance the country's energy systems. Along with this agreement, two other key initiatives were announced:

- DUET (Digitalization of Utilities for Energy Transition)

- ENTICE 2.0 (Energy Transitions Innovation Challenge)

These programs aim to address energy transition challenges by fostering scalable, cost-efficient solutions, digitalizing utilities, and supporting innovations for sustainable energy.

Key Features:

- Multi-Donor Trust Fund (MDTF):

- The MDTF aims to raise and deploy $100 million to finance impactful solar energy projects, with ISA driving the strategic direction.

- GEAPP’s Project Management Unit will provide governance, fundraising, and technical expertise to ensure project success.

- The collaboration emphasizes the importance of solar energy in achieving India's clean energy goals.

- DUET (Digitalization of Utilities for Energy Transition):

- Focuses on transforming grid systems by digitalizing grid assets and integrating them with smart sensors.

- Real-time data will help reduce transmission losses and facilitate Battery Energy Storage Systems (BESS) deployment, assisting in the integration of Distributed Renewable Energy (DRE) into the grid.

- ENTICE 2.0 (Energy Transitions Innovation Challenge):

- A platform for identifying and scaling innovative solutions to accelerate the clean energy transition, especially within India's growing startup ecosystem.

- Focuses on supporting investable opportunities for energy transition solutions, building on the earlier success of ENTICE 1.0.

Global Impact of GEAPP:

GEAPP, launched with an initial commitment of $464 million, has already funded 130 projects across 40 countries. These projects have impacted over 50 million people, helping reduce 43 million tons of CO2 emissions. The collaboration with ISA is expected to deepen GEAPP's efforts in mobilizing capital to foster clean energy access and tackle climate change.

India’s Clean Energy Transition:

India has already extended electricity access to over 800 million people, but about 2.5% of households still remain unelectrified. Distributed renewable energy, especially solar energy, will play a pivotal role in reaching these underserved populations. India aims for 47 GW of battery energy storage systems by 2032, which will support grid stability and energy access.

Additional Initiatives and Impact:

- Battery Energy Storage Systems (BESS):

- GEAPP has also supported India’s first commercial standalone BESS project, which will provide 24/7 power to over 12,000 low-income customers.

- The project is set to lower electricity tariffs by 55%, benefiting economically disadvantaged communities.

- Strategic Alliances:

- The partnership with ISA and the strategic initiatives like DUET and ENTICE 2.0 aim to further India’s climate and energy goals, bringing renewable energy solutions to underserved regions, and supporting the country's energy security.

Role of GEAPP and ISA:

- GEAPP works to mobilize financing, provide technical expertise, and ensure effective implementation of renewable energy projects globally.

- ISA focuses on solar energy solutions, and with this agreement, it seeks to enhance the solar energy capacity in its member countries, aligning with climate targets.

About GEAPP:

GEAPP is a multi-stakeholder alliance comprising governments, philanthropy, technology partners, and financial institutions. Its goal is to transition developing economies to clean energy while enhancing economic growth. It aims to:

- Reduce 4 gigatons of carbon emissions.

- Provide clean energy access to 1 billion people.

- Create 150 million new jobs globally.

India’s First Organic Fisheries Cluster

- 12 Jan 2025

In News:

The Union Minister, Department of Fisheries, Ministry of Fisheries, Animal Husbandry and Dairying Shri Rajiv Ranjan Singh inaugurated and laid the foundation for 50 key projects worth Rs. 50 crores under Pradhan Mantri Matsya Sampada Yojana (PMMSY) covering all North East Region States Except Arunachal Pradesh and Mizoram.

Key Highlights:

- Initiative: India’s first Organic Fisheries Cluster, launched under the Pradhan Mantri Matsya Sampada Yojana (PMMSY). The cluster focuses on sustainable aquaculture, promoting the production of antibiotic, chemical, and pesticide-free organic fish.

- Target Markets: Eco-conscious domestic and global markets.

Sikkim's Role as India’s First Organic State:

- Sikkim's Organic Commitment: Sikkim is the first Indian state to embrace 100% organic farming, covering 75,000 hectares of land.

- Vision: The Organic Fisheries Cluster aligns with Sikkim’s broader goal of promoting organic, sustainable agricultural practices.

Objective of Organic Fisheries Cluster:

- To prevent pollution and protect aquatic ecosystems by using ecologically healthy practices.

- Promotes sustainable fish farming methods, reducing environmental damage.

- Focus on species like amur carp and other carp varieties, aligning with the state’s success in organic farming.

Support from NABARD:

- The National Bank for Agriculture and Rural Development (NABARD) will provide financial and technical assistance.

- Key support includes:

- Infrastructure development.

- Formation of Fisheries-based Farmer Producer Organizations (FFPOs).

- Capacity building of local fishers and farmers.

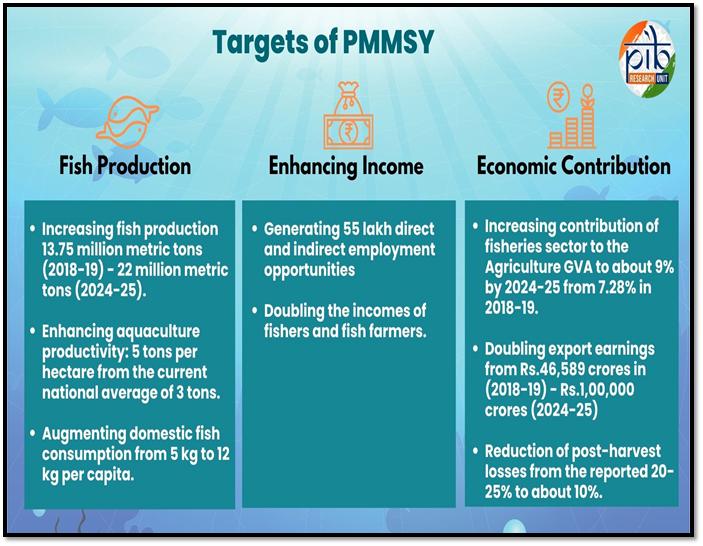

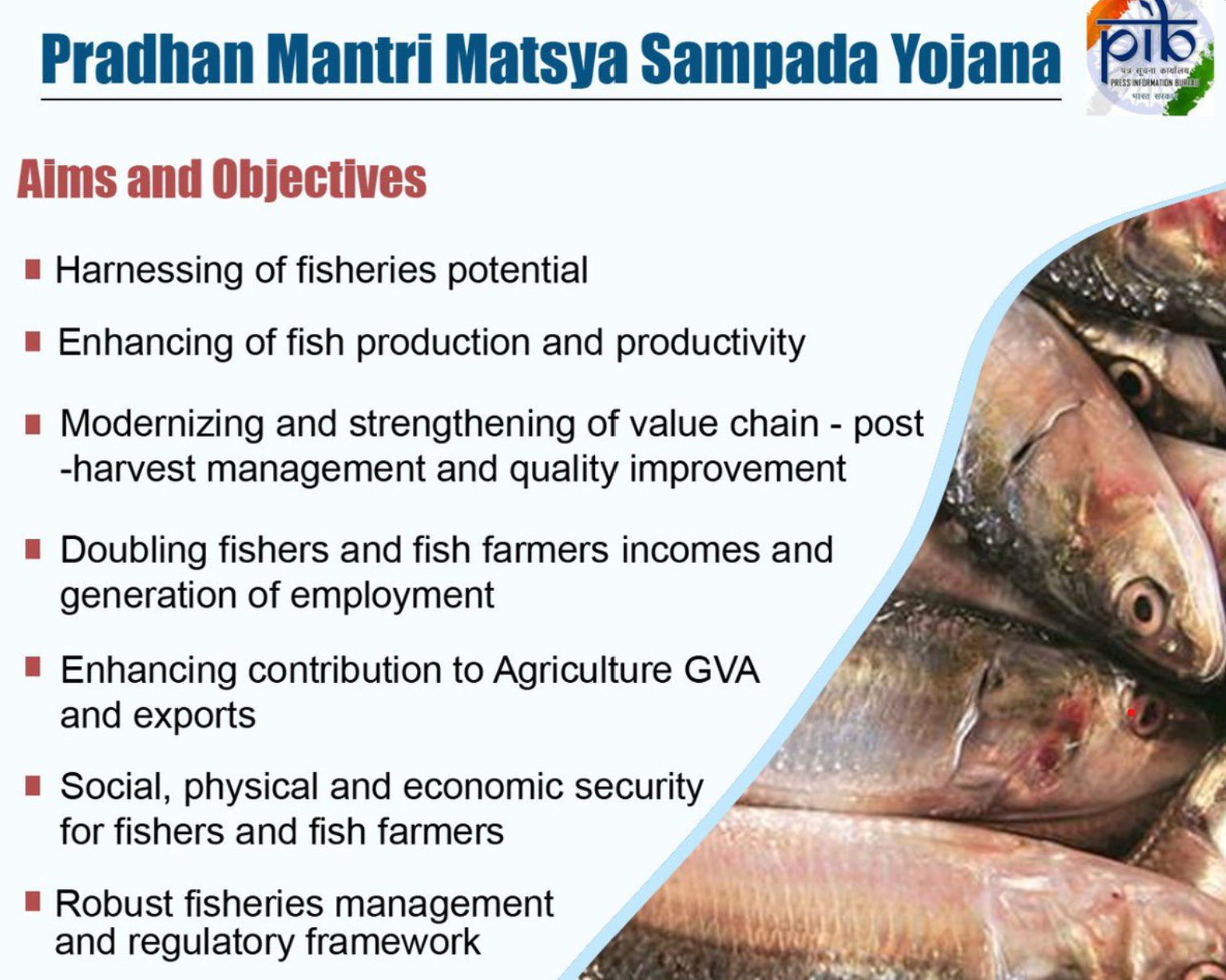

PMMSY: A Comprehensive Fisheries Development Scheme:

- Investment: ?20,050 crore under PMMSY.

- Objective: To revolutionize India’s fisheries sector by promoting sustainable growth, enhancing fish production, and improving infrastructure.

- Implementation Period: FY 2020-21 to FY 2024-25.

- Key Goals:

- Boosting fish production and exports.

- Enhancing welfare of fishers and farmers.

- Promoting cluster-based development for better efficiency and competitiveness.

Cluster-Based Approach in Fisheries:

- Objective: To bring together geographically connected enterprises to enhance economies of scale.

- Impact: This approach improves financial viability, strengthens the fisheries value chain, and creates new business and livelihood opportunities.

- Types of Clusters: Includes Pearl, Seaweed, Ornamental Fisheries, Cold Water Fisheries, Organic Fisheries, and more.

Fisheries Focus in the North Eastern Region (NER):

- Fisheries Potential: The North Eastern Region (NER) has abundant freshwater resources and is a biodiversity hotspot.

- Growth: Inland fish production in the NER surged from 4.03 lakh tonnes (2014-15) to 6.41 lakh tonnes (2023-24), marking an impressive 5% annual growth.

- Investment in NER: Over ?2,114 crore invested through schemes like Blue Revolution and PMMSY.

- Key Projects:

- 50 projects worth ?50 crore to boost the region’s fisheries infrastructure, generating over 4,500 jobs.

- Projects include hatcheries, cold storage units, aquaculture parks, and fish kiosks.

India’s Global Fisheries Standing:

- India is the second-largest fish producer in the world, contributing 8% to global fish production.

- Top Rankings:

- Second in aquaculture production.

- Leading in shrimp production and exports.

- Third in capture fisheries.

Government Commitments and Schemes:

- Total Investment: Since 2015, the government has committed ?38,572 crore to fisheries development through key schemes like:

- Blue Revolution.

- Fisheries and Aquaculture Infrastructure Development Fund (FIDF).

- PMMSY.

- Pradhan Mantri Matsya Kisan Samridhi Sah-Yojana (PM-MKSSY).

- These initiatives aim to promote sustainable growth, create jobs, and enhance infrastructure in the fisheries sector.

Economic, Environmental, and Social Benefits:

- Economic Impact:

- Higher incomes for fishers and farmers through better production and export.

- Employment generation through infrastructure development.

- Environmental Impact: Reduced pollution and protection of aquatic ecosystems.

- Social Impact: Empowerment of local communities, fostering sustainable livelihoods.

UJALA Scheme

- 10 Jan 2025

In News:

UJALA scheme completes 10 years, saves ?19,153 crore annually

UJALA Scheme (Unnat Jyoti by Affordable LEDs for All)

- Launch Date: 5th January 2015 by PM Narendra Modi

- Objective:

- To promote energy-efficient LED lighting across India

- To reduce energy consumption, lower electricity bills, and decrease carbon emissions

- Implementing Body: Energy Efficiency Services Limited (EESL), Ministry of Power

- Scheme Relevance: Aims to provide affordable LED bulbs, tube lights, and fans to every household

- Global Recognition: World’s largest zero-subsidy domestic lighting scheme

Key Features:

- Affordability: Subsidized LED bulbs (?70-80), reducing the cost of electricity for households

- Energy Efficiency: LEDs consume 90% less energy than incandescent bulbs, 50% less than CFLs

- Environmental Impact: Significant reduction in CO? emissions by avoiding millions of tonnes annually

- Market Transformation: Over 36.87 crore LED bulbs distributed, saving approximately ?19,153 crore on electricity bills each year

- Consumer Benefit:

- On-Bill Financing: LED bulbs available for purchase through deferred payment via electricity bills

- Targeted low-income communities through Self-Help Groups (SHGs)

Achievements:

- Energy Savings: 47.9 billion kWh annually

- Cost Savings: ?19,153 crore saved on electricity bills

- Carbon Emission Reduction: 38.7 million tonnes of CO? avoided per year

- Peak Demand Reduction: 9,586 MW reduction in peak electricity demand

- Street Lighting: Over 1.34 crore LED streetlights installed, saving 9,001 million units annually

Key Initiatives:

- GRAM UJALA Scheme (March 2021): Aimed at rural households, providing LED bulbs at ?10 each

- Street Lighting National Programme (SLNP): Aimed at reducing public lighting costs with energy-efficient streetlights

- Encouraging Domestic Manufacturing: Stimulated local LED production, aligning with the "Make in India" mission

- E-Procurement Transparency: Real-time procurement ensuring price reductions and maintaining quality

Impact on Environment:

- Energy Savings & Carbon Footprint: The scheme significantly reduced the carbon footprint by promoting energy-efficient appliances

- Reduction in Household Consumption: Consumers benefit from reduced energy consumption and lower utility bills

New Method to Improve Nitrogen Use Efficiency (NUE)

- 10 Jan 2025

In News:

A recent breakthrough in agricultural research offers a promising solution to improve Nitrogen Use Efficiency (NUE) in crops, particularly in rice and Arabidopsis, by reducing nitric oxide (NO) levels in plants. This innovative approach provides an environmentally sustainable way to enhance crop yields while minimizing the need for synthetic nitrogen fertilizers, which have significant ecological and economic drawbacks.

Key Findings and Research Overview:

- Reducing NO Levels: The study, conducted by researchers at the National Institute of Plant Genome Research (NIPGR), demonstrated that by reducing nitric oxide (NO) levels in plants, nitrogen uptake could be significantly improved. This leads to a better NUE, a crucial factor for enhancing crop yield sustainably.

- NUE and Its Importance: NUE refers to the efficiency with which plants use nitrogen for biomass production. Improving NUE allows for higher crop yields with less fertilizer input, reducing costs and minimizing nitrogen-related environmental pollution.

- Traditional Approaches and Their Limitations: Current techniques to improve NUE primarily rely on the use of inorganic nitrogen fertilizers. These methods, though effective, have several downsides:

- They involve high operational costs for farmers.

- Excessive fertilizer use contributes to the emission of nitrogen oxides (NOx) and other pollutants.

- The production of these fertilizers also contributes to greenhouse gas emissions.

In contrast, the new study proposes a genetic and pharmacological manipulation of NO levels, offering a sustainable alternative to these traditional, resource-heavy methods.

Study Methodology:

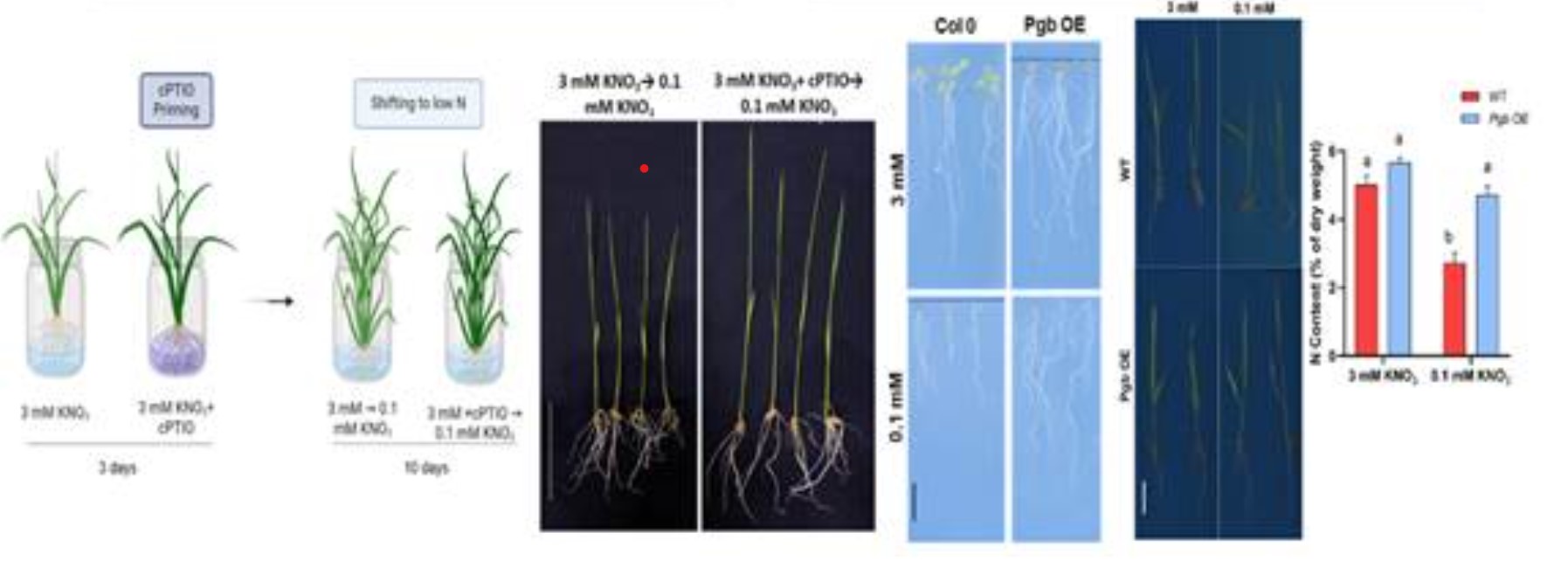

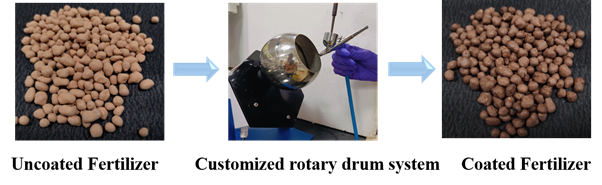

The research team employed both genetic and pharmacological approaches to regulate NO levels in plants:

- Phytoglobin Overexpression: By overexpressing phytoglobin (a natural NO scavenger), the researchers increased the expression of high-affinity nitrate transporters (HATs) like NRT2.1 and NRT2.4. These transporters are essential for efficient nitrogen uptake.

- NO Donor and Scavenger Treatments: Plants were treated with NO donor (SNAP) and NO scavenger (cPTIO) to monitor the effects on NUE.

- Results: The treatment led to more efficient nitrogen uptake, especially under low NO conditions, by enhancing the expression of HATs. This method could increase plant growth and nitrogen utilization without relying on excessive fertilizer use.

Significance and Impact:

This research provides a pathway to enhance crop yield sustainably by addressing one of the most critical challenges in modern agriculture—reducing the reliance on nitrogen fertilizers. By modulating NO levels to regulate nitrogen uptake, this approach offers:

- Reduced need for synthetic fertilizers, lowering farmers' operational costs.

- Minimized environmental impact, including lower nitrogen oxide emissions and less nitrogen runoff.

- Improved nitrogen uptake efficiency, ensuring better crop yields, especially under conditions with limited nitrogen availability.

Broader Implications:

- Global Nitrogen Challenges:

- The overuse of nitrogen fertilizers has been a major driver of nitrogen pollution, leading to issues like eutrophication, biodiversity loss, and climate change.

- According to the Food and Agriculture Organization (FAO), excessive nitrogen use has worsened environmental conditions globally, while many regions, particularly in low-income countries, suffer from nitrogen depletion, which reduces crop productivity.

- Health and Environmental Risks:

- Nitrogen pollution contributes to health issues like methemoglobinemia (blue baby syndrome) and various long-term diseases.

- Nitrogen compounds also play a role in greenhouse gas emissions, further exacerbating climate change.

- Future Directions for Sustainable Agriculture:

- This study highlights the need for innovative nitrogen management strategies, integrating both biological and genetic approaches to optimize nitrogen use.

- Research is underway to develop NO scavenging formulations and identify bacteria that could be used in soil to enhance NUE in plants.

- Policy Recommendations:

- Governments should focus on reducing the environmental and health impacts of nitrogen fertilizer production and usage by promoting sustainable farming practices.

- Encouraging biological nitrogen fixation through crops like soybeans and alfalfa, and investing in low-emission fertilizers, can help mitigate nitrogen pollution.

Anji Khad Bridge

- 08 Jan 2025

In News:

The Indian Railways has unveiled a monumental engineering achievement with the completion of the Anji Khad Bridge, India’s first cable-stayed rail bridge.

Overview:

- The Anji Khad Bridge is India's first cable-stayed rail bridge, located in Jammu and Kashmir’s Reasi district.

- It is a key part of the Udhampur-Srinagar-Baramulla Rail Link (USBRL) project aimed at enhancing connectivity between Jammu and Kashmir and the rest of India.

- The bridge crosses the Anji River, a tributary of the Chenab River, and is expected to transform regional transport, boost tourism, and promote economic growth.

Key Features:

- Dimensions:

- Total length: 725.5 meters.

- Main Pylon Height: 193 meters from the foundation, standing 331 meters above the riverbed.

- The bridge is designed for train speeds of up to 100 km/h and can withstand wind speeds of up to 213 km/h.

- Structure and Design:

- Asymmetrical cable-stayed design supported by 96 cables with varying lengths (82 to 295 meters).

- The structure includes:

- A 120-meter approach viaduct on the Reasi side.

- A 38-meter approach bridge on the Katra side.

- A 473.25-meter cable-stayed portion crossing the valley.

- A 94.25-meter central embankment linking the main bridge to the approach viaduct.

- Construction Techniques:

- Used advanced construction techniques such as DOKA Jump Form Shuttering, Pump Concreting, and Tower Crane Technique to enhance safety and reduce construction time by 30%.

- A 40-ton tower crane imported from Spain was employed for operations at great heights.

- The project utilized site-specific investigations by IIT Roorkee and IIT Delhi due to the region’s complex geological and seismic conditions.

- Engineering Challenges:

- The bridge had to be constructed in the difficult Himalayan terrain, with fragile geological features such as faults and thrusts.

- Seismic activity in the region required additional precautions in the design and construction process.

- Safety and Monitoring:

- Equipped with an integrated monitoring system that includes multiple sensors to ensure the structural health of the bridge during operation.

Importance and Impact:

- Connectivity: The bridge will significantly improve connectivity between Katra and Reasi, ensuring faster rail travel and linking the Kashmir Valley with the rest of India.

- Tourism and Economic Growth: Expected to boost tourism and economic development by improving access to the region, attracting visitors, and facilitating smoother transportation of goods and services.

- Sustainability: The bridge's design ensures it remains safe under extreme weather conditions, offering long-term reliability for the Indian Railways network.

Collaboration and International Expertise:

- The design and supervision were handled by ITALFERR (Italy), with proof-checking conducted by COWI (UK).

- The project combines Indian engineering codes with Eurocodes, adhering to international standards for structural integrity.

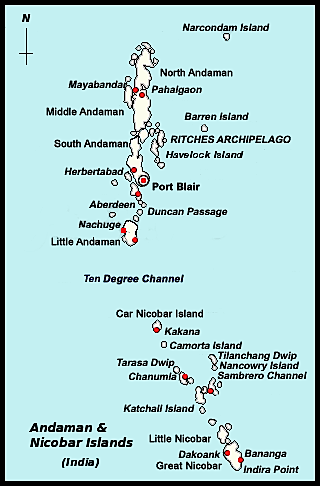

Great Nicobar Island Development Project

- 06 Jan 2025

In News:

An international cruise terminal to facilitate a “global” port-led city, “high-end” tourism infrastructure, and a ship-breaking yard are among the new additions to the ?72,000 crore mega-infrastructure project in Great Nicobar Island proposed by the Union Shipping Ministry.

Overview of the Project:

- The Great Nicobar Island Development Project is a ?72,000-crore initiative to transform the southernmost island of India into a hub for defense, logistics, commerce, eco-tourism, and infrastructure development.

- It is being implemented by the Andaman and Nicobar Islands Integrated Development Corporation Ltd (ANIIDCO) over 16,610 hectares of land.

- The project includes multiple components like an International Container Transshipment Terminal (ICTT), an international airport, greenfield cities, a mass rapid transport system, and a free trade zone.

Key Proposed Developments:

- International Container Transshipment Terminal (ICTT): To make Great Nicobar a key player in global maritime trade.

- Greenfield International Airport: To improve connectivity and serve as a strategic airport.

- Greenfield Cities: New urban settlements to support the infrastructure.

- Coastal Mass Rapid Transport System: An advanced transportation network along the coast.

- Free Trade Zone: To facilitate international trade activities.

- International Cruise Terminal (new addition): To attract global tourists and facilitate cruise tourism.

- Ship Breaking Yard (new addition): To establish a facility for ship building and breaking.

Geographical and Ecological Context:

- Great Nicobar Island is the largest island in the Nicobar group, located at the southern tip of India. It is covered in rainforests and hosts diverse species, including endangered ones like the leatherback turtle and the Nicobar megapode.

- The island's ecosystem is rich in biodiversity, with extensive mangroves, coral reefs, and rainforests.

Significance of the Project:

- Geo-strategic Importance: The island’s location near the Malacca Strait offers a strategic maritime advantage, enhancing India’s global maritime presence.

- National Security: With increasing Chinese influence in the region, the project aims to strengthen India's maritime security.

- Economic Growth: The ICTT and other infrastructure will boost economic activities, making the region a vital trade hub.

- Job Creation: The development will lead to numerous job opportunities for locals, especially in sectors like tourism, ports, and transport.

- Tourism Development: With eco-tourism at its core, the project is expected to generate substantial income through tourism, improving the local economy.

- Social Infrastructure: It will lead to improvements in healthcare, education, and digital services through initiatives like telemedicine and tele-education.

LEADS 2024 Report

- 06 Jan 2025

In News:

- Launch of the Logistics Ease Across Different States (LEADS) 2024 report and the Logistics Excellence, Advancement, and Performance Shield (LEAPS) 2024 awards in New Delhi.

Key Highlights:

- Objective of LEADS 2024 Report:

- Evaluate logistics performance across Indian states and union territories.

- Provide actionable insights for logistics reforms to foster competitive federalism.

- Assess logistics infrastructure, services, regulatory environment, and sustainability efforts.

- Performance Evaluation:

Region Achievers Fast Movers Aspirers

Coastal States Gujarat, Karnataka, Maharashtra, Odisha, Tamil Nadu Andhra Pradesh, Goa Kerala, West Bengal

Landlocked States Haryana, Telangana, Uttar Pradesh, Uttarakhand Bihar, Himachal Pradesh, Madhya Pradesh, Punjab, Rajasthan Chhattisgarh, Jharkhand

North-Eastern States Assam, Arunachal Pradesh Meghalaya, Mizoram, Nagaland, Sikkim, Tripura Manipur

Union Territories Chandigarh, Delhi Dadra and Nagar Haveli & Daman and Diu, Jammu and Kashmir, Andaman and Nicobar Islands, Ladakh

Lakshadweep, Puducherry

- Key Remarks:

- Action Plans for Better Logistics: States should develop regional and city-level logistics plans, including for last-mile connectivity, to attract investments.

- Green Logistics: Advocate for sustainable logistics practices to ensure environmentally responsible growth.

- Public-Private Partnerships (PPP): Encourage PPPs to promote multi-modal hubs and streamline logistics infrastructure.

- Technological Integration: Push for the adoption of Artificial Intelligence, Machine Learning, and Data Analytics to enhance efficiency in logistics operations.

- Skill Development & Gender Inclusivity: Focus on workforce inclusivity and skill development to boost sectoral growth. Promote gender diversity in logistics.

- LEAD Framework: Urge logistics sectors to embrace the LEAD framework (Longevity, Efficiency, Accessibility, Digitalisation) for transformation.

- LEAD Framework and Recommendations:

- Longevity, Efficiency, and Effectiveness: Improve long-term logistics strategies.

- Accessibility and Accountability: Ensure better reach and transparent logistics practices.

- Digitalisation: Enhance digital transformation across logistics processes.

- About LEADS:

- Full Form: Logistics Ease Across Different States.

- Launched: 2018 by the Department for Promotion of Industry and Internal Trade (DPIIT), Ministry of Commerce and Industry.

- Purpose: To assess and improve logistics infrastructure and services across Indian states and UTs.

- Methodology: Based on over 7,300 responses from a pan-India survey and inputs from over 750 stakeholder consultations.

- LEAPS 2024 Awards: Recognized excellence in the logistics sector across categories such as air, rail, road, maritime freight service providers, startups, MSMEs, and educational institutions.

- PM GatiShakti Course: Launched a 15-hour online course on “PM GatiShakti Concept for Efficient Infrastructure Planning and National Development”, hosted on iGOT Karmayogi platform and UGC SWAYAM portal.

- Logistics Cost Framework Report: Unveiled a report on the logistics cost framework, aiming to accurately estimate logistics costs in India through a hybrid methodology, incorporating both EXIM and domestic cargo data.

- Significance of LEADS:

- Provides critical insights into logistics performance, helping States and UTs to improve infrastructure, services, and regulatory practices.

- Plays a key role in India's vision of becoming a $32 trillion economy by 2047 by improving logistics efficiency, sustainability, and global competitiveness.

Centralized Pension Payments System (CPPS)

- 04 Jan 2025

In News:

- The CPPS aims to enhance pension accessibility and simplify the disbursement process for over 7.85 million pensioners in India.

- Key Benefit: Pensioners can now receive their pension from any bank or branch across India, eliminating the need for physical verifications and providing seamless nationwide pension disbursement.

Key Highlights:

- Key Features:

- No need for physical verification: Pensioners do not have to visit the bank for verification at the time of pension commencement.

- Seamless pension disbursement: Upon release, the pension amount is credited immediately.

- Nationwide access: Pensioners can withdraw their pension from any bank or branch, without needing to transfer Pension Payment Orders (PPO) when relocating or changing banks.

- Significance:

- Eliminates the decentralised pension system, where each regional office maintained separate agreements with a few banks.

- Ensures pension portability, especially for pensioners who move or change banks.

Employees’ Provident Fund Organisation (EPFO):

- Overview:

- EPFO is a statutory body under the Employees' Provident Funds and Miscellaneous Act, 1952, and works under the Ministry of Labour and Employment.

- Structure:

- Administered by a tripartite board called the Central Board of Trustees, consisting of representatives from:

- Government (Central & State)

- Employers

- Employees

- The Central Board of Trustees is chaired by the Union Minister of Labour and Employment.

- Administered by a tripartite board called the Central Board of Trustees, consisting of representatives from:

- Key Schemes Operated by EPFO:

- Employees’ Provident Funds Scheme, 1952 (EPF): A savings scheme for workers.

- Employees’ Pension Scheme, 1995 (EPS): A pension scheme for employees after retirement.

- Employees’ Deposit Linked Insurance Scheme, 1976 (EDLI): Provides life insurance coverage to workers.

- Global Coverage: EPFO is also the nodal agency for implementing Bilateral Social Security Agreements with other countries, offering reciprocal social security benefits to international workers from countries with such agreements.

- Impact: The EPFO schemes cover Indian workers and international workers from countries with which EPFO has signed bilateral agreements.

Key Facts:

- CPPS improves the convenience and accessibility of pension services for millions of pensioners across India by simplifying the pension disbursement process and providing nationwide access without the need for physical verifications.

- EPFO, a statutory body under the Ministry of Labour and Employment, plays a crucial role in managing provident funds, pensions, and insurance schemes for both domestic and international workers, fostering social security across India.

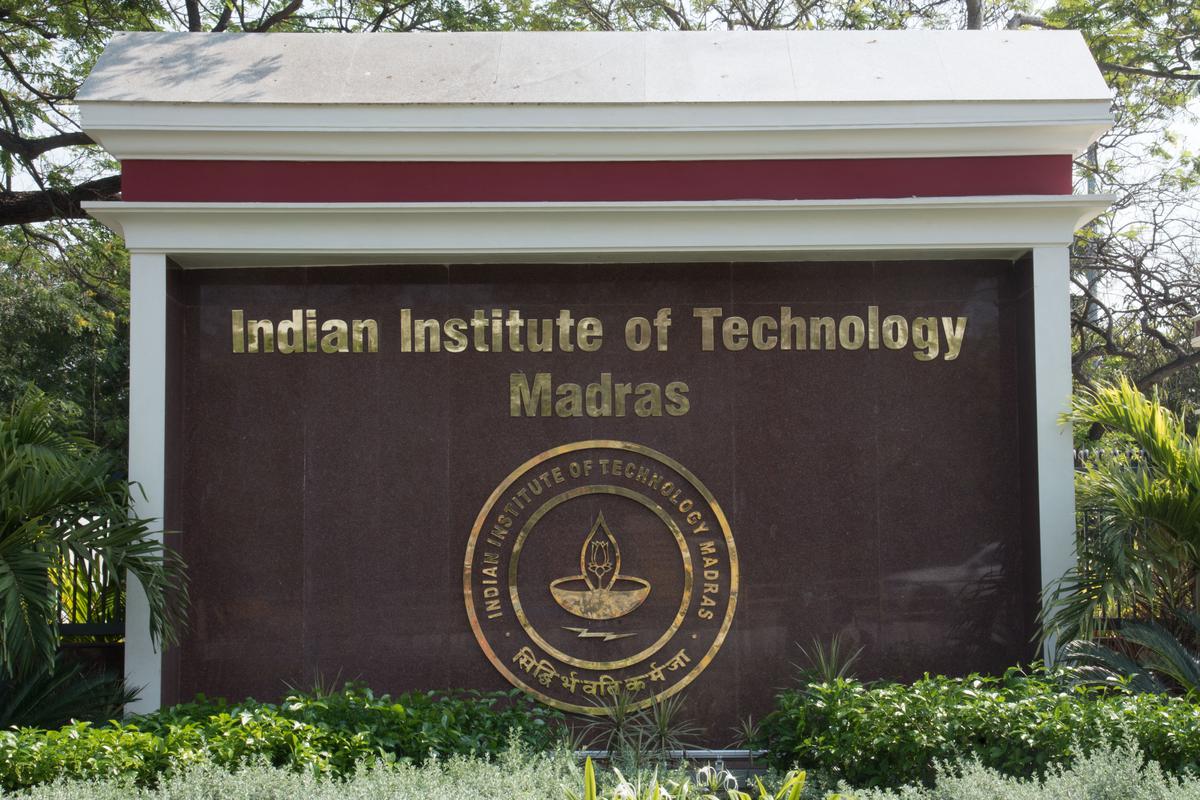

Project VISTAAR

- 04 Jan 2025

In News:

IIT Madras has partnered with the Ministry of Agriculture and Farmers’ Welfare on Project VISTAAR (Virtually Integrated System to Access Agricultural Resources). MoU signed between the Ministry and IIT Madras to integrate information about agricultural start-ups into the VISTAAR platform.

Key Highlights:

Project Objectives:

- Digitalisation of Agricultural Extension: To enhance the efficiency and effectiveness of the agricultural extension system through digital platforms.

- Access to Start-Up Innovations: Provide farmers easy access to over 12,000 start-ups in agriculture and allied sectors, connecting them to technological solutions and innovations.

- Support for Sustainable Agriculture: Focus on making farming more sustainable and climate-resilient by promoting adoption of innovative technologies.

Key Features of VISTAAR:

- Integration of start-up data via IIT Madras' startup information platform and its incubatee, YNOS Venture Engine.

- Advisory services covering:

- Crop production

- Marketing

- Value addition

- Supply chain management

- Information on government schemes for agriculture, allied sectors, and rural development.

- Real-time, contextual, and accurate information to enhance decision-making and improve farming practices.

Significance of the Project:

- The platform will expand the outreach of agricultural extension services, providing support to farmers across India.

- It will ensure farmers access high-quality advisory services that are critical for improving productivity and income.

- Integration of start-up-driven innovations will aid in the adoption of climate-resilient farming practices.

- Timely and accurate information will empower farmers to make informed decisions and improve the efficiency of agricultural processes.

Impact on Farmers:

- Digitalisation will provide farmers with easier access to expert advice and resources, enhancing productivity.

- Improved access to government schemes ensures farmers can avail themselves of financial and technical support for development.

- The project aligns with national objectives of enhancing agriculture’s contribution to India’s economy and ensuring food security.

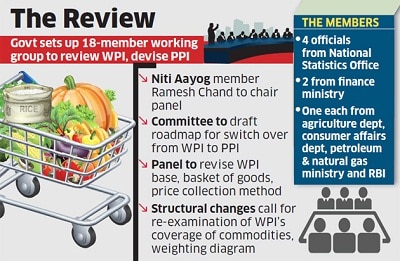

Ramesh Chand Panel

- 03 Jan 2025

In News:

The Government of India has formed an 18-member panel, headed by Ramesh Chand, a member of NITI Aayog, to revise the base year of the Wholesale Price Index (WPI) to 2022-23 from the current base year of 2011-12. The panel will also work on a roadmap for transitioning from WPI to the Producer Price Index (PPI).

Key Highlights:

Role and Mandates of the Panel:

- Revised Commodity Basket: The panel will recommend a new commodity basket for both WPI and PPI, reflecting structural changes in the economy.

- Review of Price Collection System: The panel will evaluate the current system for price collection and propose improvements.

- Computational Methodology: It will determine the computational methodology for both WPI and PPI to ensure accuracy in tracking price changes.

- The panel has been tasked with submitting its final report to the Office of the Economic Adviser at the Department for Promotion of Industry and Internal Trade (DPIT) within 18 months.

Understanding WPI vs. PPI:

- WPI (Wholesale Price Index) tracks the price of goods at the wholesale stage (i.e., goods sold in bulk to businesses), and excludes the service sector.

- Key Characteristics of WPI:

- Does not consider consumer-facing prices.

- Excludes services (about 55% of GDP).

- Can have double-counting bias due to multiple transactions before the final sale.

- Does not account for indirect taxes and may include export/import prices.

- Use: WPI helps in tracking bulk price movements between businesses, but doesn't fully represent consumer price inflation.

- Key Characteristics of WPI:

- PPI (Producer Price Index) tracks prices at various stages of production, considering both goods and services, and measures the average change in prices received by domestic producers.

- Key Characteristics of PPI:

- Excludes indirect taxes (making it more accurate for price movement tracking).

- Includes services, unlike WPI, giving a broader view of price trends across the economy.

- More aligned with international standards (System of National Accounts).

- Reflects prices before consumer consumption, providing a business-oriented perspective of price trends.

- Key Characteristics of PPI:

Why the Transition to PPI?

- The PPI is already used by major economies like the US, China, Germany, and Japan as it provides a more comprehensive measure of inflation from a producer’s perspective.

- It is expected to be a better indicator of inflationary trends in the overall economy, including both goods and services.

Challenges and Roadmap:

- The switch to PPI is complex, and the panel will need to ensure that the transition does not disrupt the current data collection and reporting systems. Both WPI and PPI will run concurrently until PPI stabilizes.

Business Ready (B-READY) Report 2024

- 02 Jan 2025

In News:

- The B-READY report, launched by the World Bank in 2024, replaces the Ease of Doing Business (EoDB) index.

- Focus: It evaluates the global business environment to foster inclusive private sector growth, assessing 10 core topics covering a firm's lifecycle, such as business entry, taxation, labor, and international trade.

India’s Potential Challenges

- Business Entry: India faces multiple steps and incomplete digital integration, making it slower compared to benchmarks like Singapore, which achieves one-day registration at minimal cost.

- Labor Regulations: While India has introduced four labor codes, the implementation remains slow and inconsistent, affecting labor flexibility and compliance.

- International Trade: India struggles with customs delays, inconsistent enforcement, and high logistics costs, unlike countries like Germany and Singapore, which promote trade efficiently.

- Business Location: Regulatory delays and inconsistent approvals hinder the establishment of business facilities, affecting investment decisions.

- Public Services Gap: While regulations may be strong, there is often a gap in the provision of public services that support their effective implementation, leading to inefficiencies.

Key Strengths for India

- India is expected to score well in the areas of Quality of Regulations, Effectiveness of Public Services, and Operational Efficiency.

- The country shows promise in promoting digital adoption and aligning with global environmental sustainability practices, though gender-sensitive regulations need more emphasis.

Significance

- The B-READY report serves as an essential benchmark for assessing India's business environment, offering insights into regulatory reforms and operational efficiency.

- Key policy implications for India include the need to:

- Streamline business operations by digitizing registration and regulatory approval processes.

- Improve logistics and trade efficiency by reducing customs delays.

- Address labor market inefficiencies through better implementation of labor codes.

- Invest in public services and promote digital transformation for better compliance and operational ease.

- Focus on sustainability and inclusivity, ensuring gender-sensitive policies and fostering green business practices.

Global Findings from the B-READY Report

- Economies with strong regulatory frameworks and digital tools (e.g., Rwanda, Georgia) show that even countries with varying income levels can achieve high scores.

- High-income countries like Estonia and Singapore still have room for improvement, especially in areas like taxation and dispute resolution.

Comparison of B-READY with Ease of Doing Business (EoDB)

- Scope: B-READY is broader, covering a firm’s lifecycle and social benefits, while EoDB focused mainly on regulatory burdens.

- Indicators: B-READY uses 1,200 indicators from expert consultations and firm-level surveys, offering more comprehensive insights compared to the EoDB's limited metrics.

- Focus on Public Services: Unlike EoDB, which provided limited attention to public services, B-READY explicitly evaluates public service efficiency and operational effectiveness.

Policy Recommendations

- Streamline Business Operations: Inspired by countries like Singapore, India should simplify business registration and reduce delays in customs and regulatory approvals.

- Strengthen Public Services: Focus on improving tax portals, utility access, and dispute resolution systems through digital tools.

- Promote Sustainability: Encourage environmentally sustainable business practices and adopt gender-sensitive regulations to ensure inclusive growth.

- Peer Learning and Global Collaboration: Encourage India to learn from best practices in countries like Singapore and Estonia for effective reforms.

- Tailored Reforms: India must design policies addressing unique local challenges while adhering to global standards.

Smart Cities Mission (SCM)

- 31 Dec 2024

In News:

The introduction of smart classrooms as part of the Smart Cities Mission (SCM) has had a significant impact on education, leading to a 22% increase in enrolment across 19 cities, according to a report from the Indian Institute of Management, Bangalore (IIM-B). The study covers the period from 2015-16 to 2023-24 and highlights several key benefits of this initiative, which aims to improve the overall learning environment in government schools.

Key Findings:

- Increased Enrolment: The introduction of smart classrooms has been linked to a 22% increase in student enrolment across 19 cities, suggesting that the initiative has made education more appealing and accessible.

- Smart Classroom Development: By 2023-24, 71 cities had developed 9,433 smart classrooms in 2,398 government schools. The states with the most smart classrooms are:

- Karnataka (80 classrooms)

- Rajasthan (53 classrooms)

- Tamil Nadu (23 classrooms)

- Delhi (12 classrooms)

- West Bengal has a very limited number, with just two classrooms.

- Improved Learning Experience: Teachers have expressed positive feedback, agreeing that the smart classrooms have improved learning experiences and attendance among students. Additionally, the smart classroom setup has contributed to increased comfort for teachers and higher preference for these modern facilities.

- Teacher Training: Special training provided to teachers has enhanced their comfort with using the smart classroom tools, with senior secondary teachers showing the highest comfort levels.

- Digital Libraries: The study also found that 41 cities have developed Digital Libraries with 7,809 seating capacity, offering essential resources for students. Cities like Raipur (Chhattisgarh) and Tumakuru (Karnataka) have seen positive outcomes from these libraries, particularly in supporting students preparing for competitive exams.

Smart Cities Mission (SCM)

- Launched in June 2015, the Smart Cities Mission aims to promote cities that offer core infrastructure, a decent quality of life, a sustainable environment, and the application of smart solutions. As of November 2024, 91% of the projects under the mission have been completed.

SAAR Platform and Research

- In 2022, the Smart Cities Mission introduced the SAAR (Smart Cities and Academia towards Action and Research) platform to bridge the gap between academia and the government. Under this platform, 50 impact assessment studies have been initiated by 29 premier institutions, including six Indian Institutes of Management (IIMs), eight Indian Institutes of Technology (IITs), and 12 specialized research institutes.

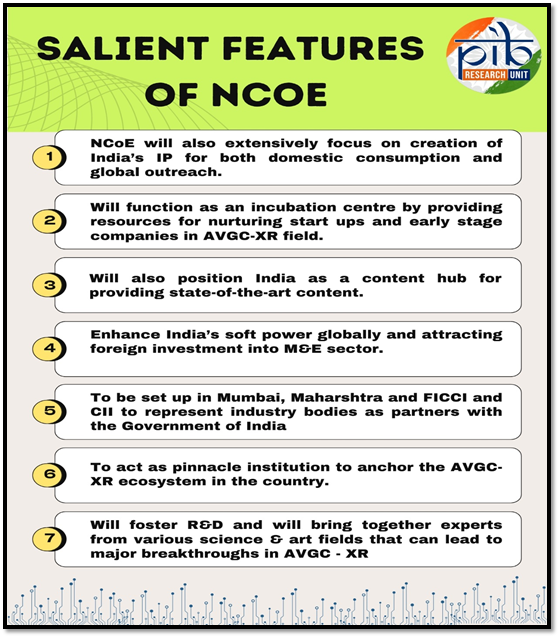

World Audio Visual & Entertainment Summit (WAVES) 2025

- 30 Dec 2024

In News:

India to Host World Audio Visual & Entertainment Summit (WAVES) 2025.

Key Highlights:

- Purpose: The summit aims to bolster India's media and entertainment (M&E) industry, expand its global influence, and foster innovation and collaboration within the sector.

- Significance: First-ever global summit to cover the entire media and entertainment industry spectrum.

- Objective:

- Foster Dialogue and Trade: WAVES aims to be a premier platform for industry leaders, stakeholders, and innovators to engage in meaningful discussions, explore opportunities, and tackle challenges in the M&E sector.

- Promote India's M&E Industry: Attract trade and investment to India, highlighting its strengths in animation, gaming, entertainment technology, and cinema (both regional and mainstream).

- Focus Areas:

- Industry Advancements: Discussions will revolve around India’s progress in animation, visual effects, gaming, and cinema.

- Global Positioning: Establish India as a global powerhouse in the M&E sector, setting new standards for creativity, innovation, and global influence.

WAVES India - Vision and Mission:

- Vision: Position India as a Global Powerhouse: Enhance India’s standing in the dynamic M&E sector, making it a hub of creativity and innovation worldwide.

- Mission:

- Provide exclusive investment opportunities for global M&E leaders through WAVES.

- Drive India’s Creative Economy through Intellectual Property (IP) Creation for both domestic and international markets.

- Develop M&E Infrastructure: Strengthen industry infrastructure and create a skilled workforce to meet global demands.

- Adapt to New Trends: Embrace emerging technologies and transformations in the M&E landscape.

Expected Outcomes:

- Global Collaboration: Engage global M&E leaders in discussions that provoke ideas and facilitate collaborations.

- Attract Investment: Promote India as a business-friendly investment destination in the M&E sector.

- Skills and Capacity Building: Build capacity in the M&E industry and develop skilled human resources to support international needs.

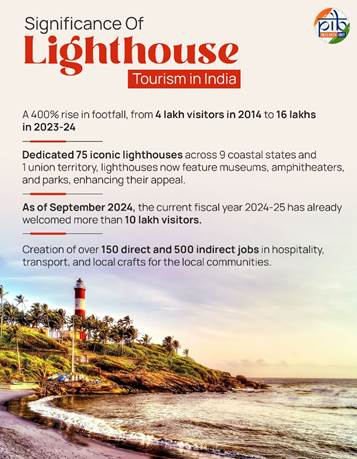

Lighthouse Tourism in India

- 27 Dec 2024

In News:

Lighthouse tourism in India is rapidly emerging as an exciting and profitable segment of the country's travel and tourism industry. India's coastline, stretching over 7,500 kilometers, is home to 204 lighthouses, many of which are being transformed into vibrant tourist destinations, celebrating both India's rich maritime history and its natural beauty.

Key Highlights:

- Historical and Scenic Appeal: Lighthouses in India are often located in breathtaking coastal or island locations, offering panoramic sea views and access to surrounding natural beauty. Some of these structures are centuries old and are situated near significant cultural landmarks or UNESCO World Heritage Sites, adding cultural depth to the visitor experience.

- Economic Growth: As part of the broader Maritime India Vision (MIV) 2030 and Amrit Kaal Vision 2047, the Government of India is keen to transform these historic lighthouses into hubs of economic activity. By developing infrastructure, creating new tourism-related jobs, and fostering local entrepreneurship, lighthouse tourism aims to benefit coastal communities and boost India's tourism economy. As of 2023-24, 75 lighthouses across 10 states have been equipped with modern amenities, attracting 16 lakh visitors—a 400% increase from previous years.

- Government Initiatives:

- Lighthouse Festivals: The annual Indian Lighthouse Festival, inaugurated in 2023, serves as a key event to promote lighthouse tourism and cultural heritage.

- The 1st Indian Lighthouse Festival, “Bharatiya Prakash Stambh Utsav”, was inaugurated on 23rd September, 2023 by the Union Minister of Ports, Shipping & Waterways, Shri Sarbananda Sonowal and Goa Chief Minister, Shri Pramod Sawant at the historic Fort Aguada in Goa.

- The 2nd Indian Lighthouse Festival was held in Odisha. Union Minister of Ports, Shipping & Waterways, Shri Sarbananda Sonowal, was also joined by Odisha Chief Minister, Mohan Charan Majhi. Shri Sonowal dedicated two new lighthouses at Chaumuck (Balasore) and Dhamra (Bhadrak) and emphasized empowering coastal communities to preserve and promote lighthouses as part of India’s rich maritime heritage.

- Sagarmala Programme: This government initiative integrates infrastructure development with sustainable practices, ensuring that the growth of lighthouse tourism benefits local communities while preserving the environment.

- Tourism Infrastructure: The government has invested ?60 crore in enhancing these sites, providing facilities like museums, parks, amphitheaters, and more to enrich the visitor experience.

- Lighthouse Festivals: The annual Indian Lighthouse Festival, inaugurated in 2023, serves as a key event to promote lighthouse tourism and cultural heritage.

- Sustainable Development: The Indian government places a strong emphasis on eco-friendly tourism. This includes integrating lighthouses into broader coastal circuits and launching digital awareness campaigns to attract domestic and international tourists.

- Community Empowerment and Employment: Lighthouse tourism has already created direct and indirect employment, from hospitality to transportation, local handicrafts, and artisan work, with more than 500 jobs being generated. Local communities are being trained to offer skills in hospitality and tourism services.

Future Plans:

- Skill Development: Programs are being introduced to equip local people with the necessary skills to cater to the tourism industry.

- Sustainable Practices: Eco-friendly practices will continue to be emphasized to protect coastal ecosystems.

- Integration with Coastal Circuits: Lighthouses will become key points of interest in broader coastal tourism itineraries, further enhancing their appeal to tourists.

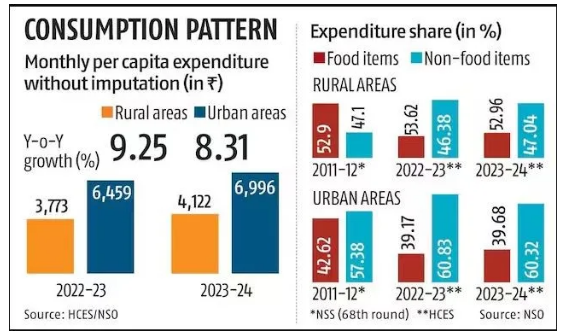

Household Consumption Expenditure Survey: 2023-24

- 27 Dec 2024

In News:

The latest Household Consumption Expenditure Survey (HCES) for 2023-24 reveals notable trends in consumption patterns in rural and urban India, reflecting economic shifts post-pandemic.

Key Highlights:

- Food Spending Increase: The share of food expenditure in household budgets has increased both in rural and urban areas, likely due to rising food prices.

- Rural households allocated 47.04% of their expenditure to food in 2023-24, up from 46.38% in 2022-23.

- Urban households spent 39.68% of their budgets on food, slightly up from 39.17% last year.

- Narrowing Urban-Rural Gap: The gap in Monthly Per Capita Consumption Expenditure (MPCE) between rural and urban households has steadily reduced over the past decade.

- In 2023-24, rural consumption spending was 69.7% of urban consumption, an improvement from 71.2% in 2022-23 and 83.9% in 2011-12.

- Increased Rural Spending: Rural India has seen significant increases in spending. The average monthly spending per person in rural areas rose by 9.3% to Rs 4,122 in 2023-24, surpassing the 8.3% rise to Rs 6,996 in urban areas.

- This suggests a growing momentum in rural consumption, which has outpaced urban consumption growth in the last year.

- Spending Trends Across Income Groups: While the top 5% of both rural and urban populations saw a decrease in their consumption spending, every other income group, including the bottom 5%, registered an increase in spending.

- The bottom 20% in both rural and urban areas saw the highest growth in expenditure, signaling rising economic activity among lower-income groups.

- Non-Food Expenditure Dominates: Non-food items make up a larger share of household spending, particularly in urban areas, where they account for 60.32% of total expenditure compared to 52.96% in rural areas.

- In rural India, major non-food expenses include medical, conveyance, and clothing, while urban households allocate more to entertainment, education, and miscellaneous goods.

- Regional Consumption Patterns: Consumption expenditure varied significantly across states, with western and northern states like Maharashtra, Punjab, and Tamil Nadu spending more than the national average.

- In contrast, eastern and central states, including West Bengal, Bihar, and Odisha, spent less. Sikkim reported the highest per capita expenditure in both rural (Rs 9,377) and urban (Rs 13,927) areas, while Chhattisgarh recorded the lowest.

- Declining Consumption Inequality: The Gini coefficient, which measures consumption inequality, has declined in both rural and urban areas.

- This reflects reduced disparity in spending, indicating a trend toward more equitable economic growth across regions.

- Food Expenditure Trends: Food categories like beverages, processed foods, and cereals continued to see rising shares in total expenditure. The rise in spending on food items was particularly notable in rural areas for eggs, fish, and meat.

Operation Green Scheme

- 27 Dec 2024

In News:

The government’s flagship Operation Greens scheme, designed to stabilise crop prices and benefit farmers, has spent just 34 per cent of its allocated budget for 2024-25, according to a parliamentary report, even as onion farmers in Maharashtra reel from massive losses and potato shortages grip eastern states.

Key Highlights:

Overview:

- Launched: November 2018 under the Pradhan Mantri Kisan SAMPADA Yojana.

- Objective: Stabilize prices and improve farmers' income by enhancing the production and marketing of perishable crops, initially focusing on Tomato, Onion, and Potato (TOP).

- Expanded Scope (2021): Includes 22 perishable crops like mango, banana, ginger, apple, and shrimp.

- Implemented by: Ministry of Food Processing Industries (MoFPI).

- Funding: Managed by the National Agricultural Cooperative Marketing Federation of India (NAFED).

Key Aims:

- Reduce price volatility in agricultural markets.

- Minimize post-harvest losses.

- Strengthen farm-to-market linkages.

- Enhance farmers’ earnings by stabilizing market prices.

- Promote value addition and food processing.

Scheme Components:

- Short-term Interventions:

- Subsidies on transportation (50%) and storage (50%) to protect farmers from distress sales.

- Price stabilization during periods of surplus or shortage.

- Long-term Interventions:

- Development of farm-gate infrastructure like cold storage and processing facilities.

- Strengthening production clusters and Farmer Producer Organizations (FPOs).

- Building efficient agri-logistics systems.

- Promoting food processing and value addition capacities.

Key Features:

- 50% subsidy on transportation and storage costs for eligible crops.

- Projects eligible for 50% subsidy (up to ?50 crore per project), and for FPOs, a 70% subsidy.

- Demand-driven funding based on applications, with no fixed crop or state-wise allocation.

Key Findings from Parliamentary Standing Committee (PSC) Report (2024):

- Underutilisation of Budget: Only 34% (?59.44 crore) of the allocated ?173.40 crore for 2024-25 spent by October 2024, leaving 65.73% unspent.

- Slow Implementation: Out of 10 targeted projects, only 3 were completed by October 2024.

- Limited Impact on Price Stabilization:

- Onion prices fell by nearly 50% in Maharashtra, despite the scheme's intent to stabilize prices.

- Potato shortages in states like Odisha and Jharkhand due to weather-induced production dips in West Bengal.

- Inconsistent Policies: Export bans and fluctuating export duties caused frustration among onion farmers, undermining the scheme’s effectiveness in ensuring fair prices.

Impact on Farmers:

- Price Stabilization: Despite the scheme’s aims, price fluctuations continue to affect farmers, especially in Maharashtra with the onion price crash.

- Post-Harvest Losses: The scheme aims to reduce wastage by building infrastructure like cold storage, but challenges remain in implementation.

- Market Linkages: Attempts to connect farmers and FPOs with retail markets have not yet yielded significant results.

Operational Challenges:

- The scheme faces challenges in fulfilling its dual mandate of ensuring fair prices for farmers while keeping consumer prices affordable.

- The slow utilization of funds and incomplete infrastructure projects raise concerns about the effectiveness of the program.

- Inconsistent policy decisions, like the export ban and imposition of export duties, have contributed to farmer discontent.

Dr. Pushpak Bhattacharyya Committee

- 27 Dec 2024

In News:

- The Reserve Bank of India (RBI) has set up an eight-member committee to create a framework for the responsible and ethical use of Artificial Intelligence (AI) in the financial sector.

- The committee is chaired by Dr. Pushpak Bhattacharyya, Professor in the Department of Computer Science and Engineering at IIT Bombay.

Key Highlights:

Committee's Objective:

- The primary goal is to develop a Framework for Responsible and Ethical Enablement of AI (FREE-AI) in the financial sector.

- It will guide the ethical adoption of AI in financial services to enhance operational efficiency, decision-making, and risk management.

Scope of the Committee's Work:

- Assess the current global and domestic adoption of AI in financial services.

- Identify potential risks and challenges associated with the integration of AI in the sector.

- Recommend a framework for evaluating, mitigating, and monitoring AI-related risks.

- Propose compliance requirements for various financial entities (e.g., banks, NBFCs, fintech firms).

- Suggest a governance framework for ethical AI usage.

Key Benefits of AI in Financial Services:

- Operational Efficiency: AI can automate repetitive tasks, process large datasets, and enhance accuracy (e.g., loan application processing).

- Enhanced Decision-Making: Predictive analytics in AI help forecast market trends, aiding in better financial decision-making (e.g., algorithmic trading).

- Customer Relationship Management: AI-powered chatbots and virtual assistants enhance customer interaction, offering 24/7 support.

- Improved Risk Management: AI enables proactive fraud detection, improving security and preventing financial losses.

Concerns Associated with AI in Finance:

- Embedded Bias: AI models can replicate biases present in training data, leading to discriminatory outcomes and financial exclusion.

- Data Privacy and Security: The use of AI poses risks to personal data security, with potential violations of privacy regulations.

- Operational Challenges: AI systems may exhibit inconsistent responses, leading to challenges in trust and effectiveness.

- Cybersecurity Risks: Increased use of AI can heighten vulnerability to cyber-attacks and exploitation.

RBI's Role & Governance:

- The RBI aims to ensure that AI adoption in the financial sector is ethical, transparent, and aligned with global best practices.

- The committee's recommendations will influence policies to prevent misuse and safeguard consumer interests.

Rupee and Real Effective Exchange Rate (REER)

- 27 Dec 2024

In News:

The real effective exchange rate (REER) index of the rupee touched a record 108.14 in November, strengthening by 4.5 per cent during this calendar year, according to the latest Reserve Bank of India (RBI) data.

Key Highlights:

- Record REER Index:

- The Real Effective Exchange Rate (REER) of the rupee reached an all-time high of 108.14 in November 2024.

- This marks a 4.5% appreciation in REER during the calendar year 2024, according to RBI data.

- What is REER?

- REER is a weighted average of a country’s currency value against the currencies of its major trading partners, adjusted for inflation differentials.

- It considers 40 currencies accounting for about 88% of India's trade.

- REER Calculation:

- Nominal Exchange Rates: The exchange rate between the rupee and each partner's currency.

- Inflation Differentials: Adjusts for inflation differences between India and its trading partners.

- Trade Weights: Based on the trade share with each partner.

- Recent Trends in REER:

- In 2023, REER dropped from 105.32 in January to 99.03 in April.

- It has since been on an appreciating trend, reaching 107.20 in October and 108.14 in November 2024.

- Dollar Strengthening Impact:

- Despite the rupee weakening against the US dollar (from 83.67 to 85.19 between September and December 2024), it has appreciated against the euro, British pound, and Japanese yen.

- The dollar's strengthening was fueled by global economic factors, including inflation expectations in the US and high bond yields, which led to capital outflows from other countries, including India.

- Impact on Exports and Imports:

- Overvaluation: A REER above 100 signals overvaluation, which can harm export competitiveness (exports become costlier) while making imports cheaper.

- Undervaluation: A REER below 100 indicates a currency is undervalued, boosting exports but increasing the cost of imports.

- India's Inflation and REER:

- India's higher inflation relative to trading partners is a key factor behind the rupee’s rising REER, despite its depreciation against major currencies.

- This suggests the rupee is overvalued, which could explain why the RBI may allow the rupee to depreciate further against the dollar.

- Global Context:

- The strengthening of the US dollar, influenced by factors such as tariff policies under the Trump administration and tighter US monetary policies, plays a significant role in the depreciation of the rupee against the dollar.

- This dynamic affects India's trade balance, with potential consequences for export growth.

- Implications for India’s Economy:

- Overvalued currency (as indicated by REER above 100) can lead to a trade deficit, as imports become cheaper and exports less competitive.

- A weaker rupee, particularly against the dollar, could boost Indian exports but raise the cost of imports.

Strengthening Fisheries Extension Services

- 26 Dec 2024

In News:

India possesses diverse fisheries resources that provide livelihood opportunities to approximately three crore fishers and fish farmers. The country has witnessed an 83% increase in the national fish production since 2013-14, that stands at a record 175 lakh tons in 2022-23.

Importance of Fisheries Extension Services:

- Livelihood Support: Fisheries provide livelihoods to over 3 crore fishers and fish farmers in India. The sector's growth is crucial for enhancing sustainable practices and ensuring long-term productivity.

- Growth in Fish Production: India’s fish production has seen an 83% increase since 2013-14, reaching 175 lakh tons in 2022-23, with 75% of production coming from inland fisheries. India is the second-largest fish and aquaculture producer globally.

- Role of Extension Services: Extension services bridge the gap between scientific advancements and fishers, offering guidance on:

- Species lifecycle management

- Water quality management

- Disease control

- Sustainable rearing technologies and business models.

Government Initiatives to Strengthen Fisheries Extension:

- Matsya Seva Kendras (MSKs):

- Launched under PMMSY (Pradhan Mantri Matsya Sampada Yojana) in 2020, MSKs are one-stop centers providing comprehensive extension services.

- Support to Fish Farmers: MSKs offer:

- Disease testing, water, and soil analysis.

- Training on sustainable aquaculture practices.

- Technology infusion in seed/feed management.

- Focus on Inclusivity: Government assistance (up to 60%) is available for women and marginalized communities to set up MSKs.

- Examples:

- Thrissur, Kerala: Equipped with labs for water and microbial analysis.

- Maharashtra (Nasik and Sangli): Capacity-building efforts on seed/feed inputs.