India’s $15 Billion Push for Chipmaking

- 07 Sep 2024

In News:

India is significantly ramping up its efforts to establish a semiconductor manufacturing industry, with plans to invest $15 billion in the second phase of its chipmaking incentive policy. This move aims to bolster the country's position in the global semiconductor supply chain, where it currently has minimal presence.

Key Points:

- Government Funding and Projects:

- Increased Investment: The Indian government is boosting its funding for chipmaking incentives to $15 billion, up from the $10 billion committed in the first phase.

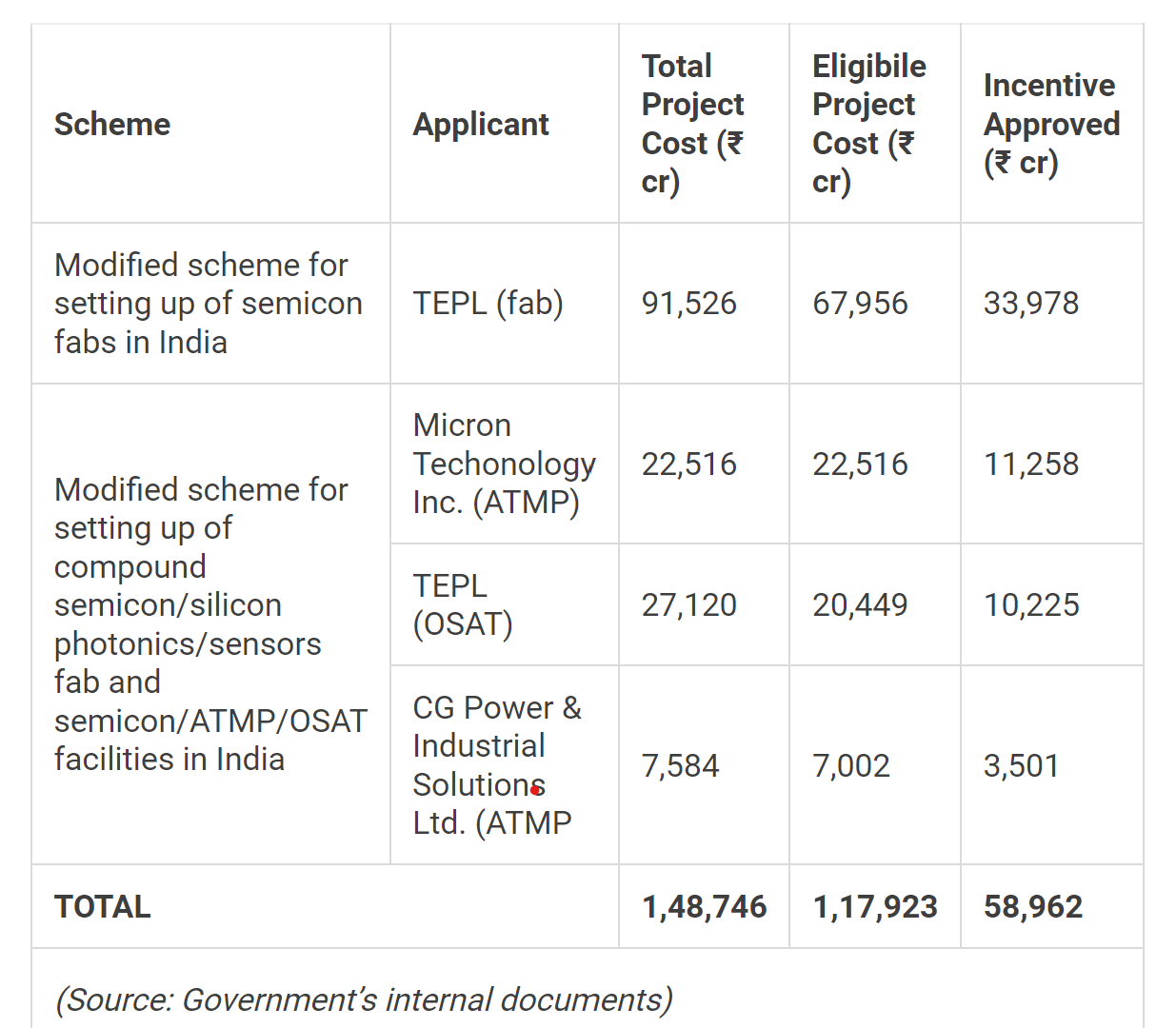

- Approved Projects: Four major semiconductor projects have been approved, totaling over Rs 1.48 lakh crore ($18 billion). This includes:

- Tata and PSMC Fabrication Plant: India’s first commercial semiconductor fabrication plant, with an investment of more than Rs 91,000 crore ($11 billion), developed in partnership with Taiwan’s Powerchip Semiconductor Manufacturing Corporation (PSMC).

- Assembly and Testing Plants (ATMP/OSAT): Three plants:

- Micron Technology is building the first plant, approved in June 2023.

- Tata is constructing an assembly plant in Assam.

- C G Power and Industrial Solutions, in partnership with Japan’s Renesas Electronics, is developing the third plant.

- Government Subsidies:

- Capex Subsidies: The central government will provide nearly Rs 59,000 crore ($7 billion) in capital expenditure subsidies for these projects.

- State Support: State governments are offering incentives such as discounted land and electricity rates.

- Strategic Importance:

- Economic and Strategic Impact: Semiconductor chips are critical to a wide range of industries, including defense, automotive, and consumer electronics. Developing domestic chipmaking capabilities is seen as essential for economic growth and strategic independence.

- Global Competition: India is entering a highly competitive field dominated by Taiwan and the US. The US has a $50 billion chip incentive scheme, while the EU has a similar program. India’s efforts are part of a broader strategy to reduce dependence on global chip supply chains and capitalize on geopolitical shifts.

- Challenges and Realities:

- Technology Barriers: The Tata-PSMC plant will not produce cutting-edge chips, as the technology for advanced nodes is currently beyond their reach. Manufacturing chips with smaller node sizes involves significant technological expertise and innovation, areas where leading companies like Taiwan Semiconductor Manufacturing Company (TSMC) excel.

- High Entry Barriers: The chipmaking industry has high entry barriers, and India’s new plants will face challenges in achieving technological and competitive parity with established global leaders.

India's push into semiconductor manufacturing represents a major step in its economic development and strategic planning, aiming to position itself as a significant player in the global tech landscape while addressing critical supply chain vulnerabilities.