RBI Cuts CRR, Keeps Repo Rate Unchanged

- 07 Dec 2024

In News:

The Reserve Bank of India (RBI) has recently made significant monetary policy decisions that could have a broad impact on the economy.

Key Highlights:

Cut in Cash Reserve Ratio (CRR)

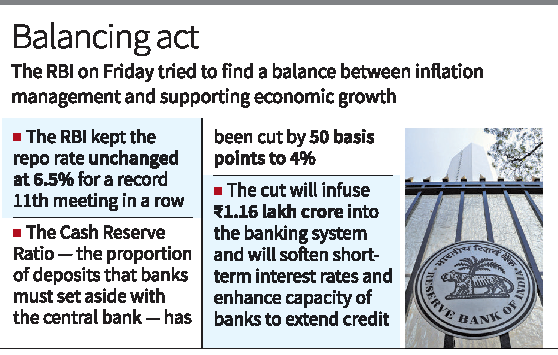

- CRR Reduction: The RBI has reduced the CRR by 50 basis points (bps), from 4.5% to 4%.

- Impact on Banks: This move will free up ?1.16 lakh crore in liquidity, which banks can use to lend, boosting the credit flow in the economy.

- Objective: The CRR cut is aimed at easing the liquidity stress in the financial system, which has been tightening due to RBI's foreign exchange interventions.

- Bank Benefits: Banks will benefit as they don’t earn interest on the CRR, and the extra liquidity may help them reduce deposit rates. Additionally, it may encourage banks to pass on benefits to borrowers, particularly in terms of lending rates.

Repo Rate Kept Unchanged at 6.5%

- Decision: The MPC decided to keep the key policy rate, the Repo rate, unchanged at 6.5%, continuing its stance for the 11th consecutive meeting.

- Reasons for Keeping Repo Rate Steady:

- Persistent inflation, particularly food prices, is a key concern. Despite strong growth in sectors like rural consumption, inflation remains high and continues to affect disposable income.

- RBI Governor emphasized that durable price stability is essential for strong, sustained economic growth.

Impact on Borrowers

- Borrowing Costs: With the Repo rate unchanged, external benchmark lending rates (EBLR) linked to the Repo rate will not rise, providing relief to borrowers by keeping Equated Monthly Installments (EMIs) stable.

- Deposit Rates: However, the CRR cut may lead to a marginal reduction in deposit rates due to increased liquidity in the system.

Economic Growth Forecast Adjusted

- Reduced GDP Growth Estimate: The RBI has downgraded the GDP growth forecast for FY25 to 6.6%, down from the earlier estimate of 7.2%. This revision comes after the economy showed signs of slowdown in the second quarter of FY25.

- Growth Outlook: Despite the downgrade, the RBI remains cautiously optimistic about recovery driven by festive demand and rural consumption. Governor Das indicated that the slowdown had likely bottomed out and the economy is set to recover in the coming quarters.

Inflation Forecast Raised

- Inflation Outlook: The inflation estimate for FY25 has been revised upward to 4.8%, compared to the earlier forecast of 4.5%. This is largely due to rising food prices, which surged to a 14-month high of 6.21% in October.

- Inflationary Pressures: The MPC noted that inflation has remained above the RBI’s target of 4%, primarily driven by food inflation. As inflation impacts consumption, the RBI aims to balance growth support with inflation management.

Monetary Policy Stance

- Neutral Stance Retained: The RBI has maintained a ‘neutral’ stance, meaning it is neither tightening nor easing monetary policy drastically, focusing instead on bringing inflation closer to its target of 4%.

- Inflation Control: While the RBI is aware of the economic slowdown, it continues to prioritize inflation control to ensure price stability and support sustainable growth.

Global and Domestic Economic Context

- Global Factors: The RBI has also been cautious about global developments, including capital outflows and the impact of U.S. monetary policy on the Indian economy. A rate cut could have further weakened the rupee by narrowing the interest rate differential with the U.S.

- Domestic Concerns: Domestically, the economy faces challenges such as weak manufacturing growth and high inflation. The GDP growth in Q2 FY25 dropped to 5.4%, a seven-quarter low, highlighting concerns over demand and inflationary pressures.