IMF retains India’s growth projection at 7% for FY25

- 23 Oct 2024

In News:

The International Monetary Fund (IMF) has revised India's GDP growth forecast for the fiscal year 2024-25 to 7%, up by 20 basis points from its previous estimate of 6.8%.

- India’s Growth Projections:

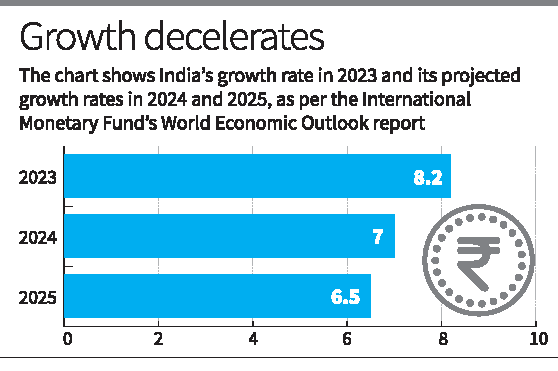

- Current Fiscal Year (FY2024-25): India’s GDP growth is projected at 7%, unchanged from June 2024 estimates.

- Next Fiscal Year (FY2025-26): Growth expected at 6.5%.

- Growth Decline from FY2023 (8.2%): The slowdown is attributed to the exhaustion of pent-up demand post-pandemic and the economy returning to its potential.

- Global Economic Growth:

- World Output: Projected global growth at 3.2% in both 2024 and 2025.

- Advanced Economies: U.S. GDP growth revised upward to 2.8% in 2024 and 2.2% in 2025.

- Emerging Markets & Developing Economies: Growth revised upwards, largely due to stronger economic activity in Asia, with China and India being key contributors.

- Global Inflation and Monetary Policy:

- Inflation Decline: Global inflation has decreased from its peak of 9.4% in Q3 2022 to 3.5% projected by end-2025.

- Inflation Outlook: Despite reductions in inflation, price pressures persist in some regions.

- Monetary Policy Tightening: IMF acknowledges challenges due to tight monetary conditions in several economies and their potential impacts on labor markets.

- Global Risks and Challenges:

- Geopolitical Tensions: Ongoing Russia-Ukraine war and escalating conflicts in West Asia (e.g., Lebanon) have increased geopolitical risks, potentially affecting commodity markets.

- Protectionism: Growing protectionist policies worldwide are a risk to global trade and economic stability.

- Sovereign Debt Stress: Debt burdens in several countries could become a source of instability.

- Weak Chinese Economy: Slower-than-expected recovery in China remains a significant concern for global economic growth.

- Monetary Policy Risks: Prolonged tight monetary policies in some countries could impact labor markets and economic recovery.

- IMF’s Policy Recommendations for Medium-Term Growth:

- Monetary Policy Neutrality: Countries should adopt a neutral monetary policy stance to balance growth and inflation control.

- Fiscal Policy Adjustment: Build fiscal buffers after years of loose fiscal policy to ensure stability.

- Structural Reforms: Implement structural reforms to boost productivity and cope with challenges like aging populations, the climate transition, and the need for youth employment.

- India’s Economic Outlook - Key Drivers:

- Rural Consumption Growth: The upward revision of India's FY2024-25 GDP forecast to 7% is driven by improved consumption, especially in rural areas.

- Upward Revisions for 2023: The increased growth forecast also reflects positive carryover effects from India's 8.2% growth in 2023.

- Emerging Asia's Growth: The growth outlook for emerging Asia is supported by India and China, though long-term growth prospects for China are weaker (projected to slow to 3.3% by 2029).

- Global Economic Outlook:

- World Growth Projections: Global growth is expected to remain at 3.2% in 2024 and 3.3% in 2025.

- Diverging Growth Rates: Growth across economies is converging as output gaps close, particularly in advanced economies (e.g., U.S. labor market cooling, euro area recovery).