India’s Growing Gig Economy

- 12 Jun 2025

In News:

India’s gig and platform economy is undergoing a significant transformation, driven by digital technologies, evolving labour market dynamics, and an increasing preference for flexible work arrangements. According to a recent study by the VV Giri National Labour Institute (VVGNLI), affiliated with the Ministry of Labour and Employment, India’s gig workforce is projected to grow to 62 million by 2047, accounting for 15% of the total non-agricultural workforce.

This forecast builds on estimates from the 2022 NITI Aayog report, which pegged the number of gig workers at 3 million in 2020, employed across 11 major platform companies. This figure is expected to rise to 23 million by 2030 (7% of the non-farm workforce). Under optimistic scenarios, gig employment could expand to 90.8 million, though external shocks like policy shifts or technological disruptions may cap growth at 32.5 million.

The gig economy in India initially found its foothold in ride-sharing and food delivery services. Over time, it has diversified into sectors such as healthcare, education, digital content creation, and professional consulting, indicating its expanding relevance in the overall employment landscape.

Despite this rapid growth, gig workers face significant structural challenges. These include the lack of social security, unregulated working hours, occupational stress, and the absence of effective grievance redressal mechanisms. Many gig workers are also vulnerable to retaliatory practices, such as app-based ID deactivation, for voicing concerns against unfair algorithms or wage-related issues.

One of the most pressing issues highlighted by the study is the ambiguous classification of gig workers. While countries such as the UK, Canada, Spain, France, and Denmark have legally recognised gig workers and provided appropriate labour protections, India continues to grapple with defining the boundary between employees and independent contractors. This ambiguity deprives workers of legal safeguards, especially those working full-time on digital platforms.

The VVGNLI study calls for urgent regulatory interventions. These include:

- Legal recognition of gig workers and their right to unionize and collectively bargain.

- Algorithmic accountability, to ensure transparency in task allocation and wage determination.

- Minimum income guarantees, regulated working hours, and integration of occupational health and safety standards.

- Establishing a National Registry for Platform and Gig Workers, managed jointly by central and state governments, to facilitate social security coverage.

Additionally, the Code on Social Security, 2020, provides a legislative foundation to extend health insurance, accident coverage, and retirement benefits to gig and platform workers. It proposes a social security fund, with contributions from aggregators, to support these provisions.

To ensure long-term sustainability, the government must also invest in skill development and upskilling initiatives, particularly in digital literacy, entrepreneurship, and emerging trades, to improve employability and economic resilience among gig workers.

In conclusion, India’s gig economy holds the potential to redefine employment patterns and contribute substantially to inclusive economic growth. However, this potential can only be fully realised through a rights-based, inclusive, and regulation-driven framework that balances innovation with worker welfare.

NITI Aayog Recommends Dedicated Credit Support and Reforms to Boost Medium Enterprises

- 28 May 2025

In News:

Medium enterprises (MEs), a vital yet under-recognized segment of India’s MSME ecosystem, have long faced significant challenges, especially in accessing affordable and timely credit. Though they constitute only about 0.3% of registered MSMEs, medium enterprises contribute nearly 40% of MSME exports, highlighting their critical role in India’s industrial growth and global trade competitiveness.

Significance of Medium Enterprises in the Indian Economy

The MSME sector as a whole contributes around 29% to India’s GDP and employs over 60% of the workforce. However, while micro and small enterprises dominate in number (97% and 2.7% respectively), medium enterprises represent a minuscule share by count but a disproportionately large share in exports and innovation. Medium enterprises have a turnover range of ?100–500 crore and investment in plant and machinery between ?25–125 crore, as per the revised FY26 classification norms announced in the Union Budget 2025-26.

Credit Gap and Financing Challenges

NITI Aayog’s 2025 report, Designing Policy for Medium Enterprises, reveals a credit deficit of approximately $10 billion faced by medium enterprises. This gap stems from institutional biases and structural constraints. Unlike micro units that benefit extensively from priority sector lending, medium enterprises receive fewer such loans and face borrowing costs about 4% higher than those for large companies. Moreover, out of 18 government MSME schemes, only 8 specifically target medium enterprises, which receive less than 18% of total scheme funds (?5,442 crore overall). The absence of dedicated working capital schemes exacerbates liquidity issues, limiting growth and scale-up prospects.

NITI Aayog’s Key Policy Recommendations

- Working Capital Financing Scheme: A sector-specific loan scheme, administered by the Ministry of MSME, is proposed to provide medium enterprises with working capital loans capped at ?25 crore, with individual requests up to ?5 crore. Loans would be linked to enterprise turnover and offered at concessional interest rates, addressing their substantial capital needs.

- Medium Enterprise Credit Card: To meet immediate liquidity requirements—such as payroll, inventory, and equipment maintenance—a credit card facility with a pre-approved limit of ?5 crore is recommended. This facility would follow market interest rates but include a repayment grace period.

- Expedited Credit Disbursal via Retail Banks: Leveraging local retail banks for faster fund distribution under MSME ministry supervision aims to reduce bureaucratic delays and enhance timely access to credit.

- Technology and Skilling Initiatives: The report advocates transforming existing MSME technology centres into ‘India MSME 4.0 Competence Centres’ tailored to sectoral and regional demands, spanning industries like engineering, electronics, and specialized manufacturing. It also proposes incorporating medium enterprise-specific modules into entrepreneurship training and skilling programmes to bridge labour skill mismatches.

- Digital Access and Compliance Support: NITI Aayog recommends creating a dedicated sub-portal within the Udyam platform that facilitates scheme discovery, compliance guidance, and AI-powered navigation to help medium enterprises efficiently access government resources.

Broader Structural Challenges

Apart from financing, medium enterprises face low adoption of advanced technologies, limited R&D support, inadequate sector-specific testing infrastructure, and a disconnect between training programmes and industry needs. These gaps impede innovation and scalability.

Strategic Importance and Policy Outlook

NITI Aayog emphasizes that medium enterprises have the potential to be major employment generators and innovation drivers if provided focused policy attention and financial support. Drawing lessons from global examples like Germany’s Mittelstand and Italy’s fashion industry, the report envisions India’s medium enterprises evolving into globally competitive firms over the next decade.

The medium sector’s formal labour structure also makes it key to transitioning India’s economy from informal to formal. Therefore, a coordinated and inclusive policy framework focusing on finance, technology, skill development, and digital infrastructure is vital to unlock this segment’s full potential and enhance India’s industrial competitiveness, export growth, and self-reliance.

Growth and Challenges of India’s Private Space Sector

- 03 Mar 2025

Introduction

India’s space sector has experienced remarkable growth, especially with the advent of the Space Sector Reforms of 2020. These reforms have opened the door for greater private sector participation, spurring innovation, investment, and commercial growth. The Indian Space Research Organisation (ISRO) remains at the forefront of technological advancements, while a burgeoning ecosystem of space tech startups is positioning India as a key player in the global space economy.

Private Participation in India’s Space Industry

- Emerging Startups: Over 200 space startups have emerged, leveraging ISRO’s infrastructure such as testing, launch, and ground station facilities.

- Regulatory and Financial Support: The Indian National Space Promotion and Authorization Center (IN-SPACe) was created to facilitate private participation in space activities. It also launched a ?1,000 crore Venture Capital Fund to accelerate innovation within the sector.

- Commercial Arm of ISRO: Antrix Corporation, ISRO’s commercial arm, plays a crucial role in facilitating satellite launches and technology transfers, thus enhancing private capabilities.

- Growth in Payloads: The PSLV Orbital Experimental Module (POEM) program has increased startup payloads significantly, from 6 in 2022 to 24 in 2024.

Private Investment and Startup Innovations

- Venture Capital Investment: Private funding, particularly from MountTech Growth Fund – Kavachh (MGF-Kavachh), has been instrumental in driving growth. Over ?2,500 crore have been invested in space startups over the past three years.

- Startup Innovations:

- GalaxEye integrated Synthetic Aperture Radar (SAR) with optical imagery, a world-first achievement in rapid data compression.

- Pixxel is developing Firefly, the world’s most advanced hyperspectral satellite constellation.

- InspeCity (IIT Bombay) is working on innovative in-orbit satellite repair and refueling technologies.

- Skyroot and Agnikul are pioneering cost-effective private launch vehicles for satellite deployment.

Space Sector Reforms of 2020

The Space Sector Reforms of 2020 have been transformative in enabling greater private sector involvement across the entire spectrum of space activities, from satellite design to launch vehicle manufacturing:

- Expansion of Private Roles: The reforms allow private companies to engage in activities such as satellite design, launch vehicle manufacturing, and ground station services.

- Establishment of IN-SPACe: IN-SPACe was created as a regulatory body to facilitate the engagement of private entities in space activities, empowering them to operate independently from ISRO.

- Technology Transfer: The reforms have encouraged ISRO to transfer technology to private players through NewSpace India Limited (NSIL), enabling commercialization of indigenous space technologies.

Challenges Facing India’s Space Industry

- Funding Gaps: While venture capital interest is rising, early-stage funding remains limited, making it difficult for startups to scale effectively.

- Talent Shortage: There is a shortage of specialized educational institutions focused on space technology. Currently, India only has one Indian Institute of Space Technology (IIST), underscoring the need for more educational institutions and industry-academia collaborations.

- Global Competition: India faces stiff competition from countries like the US, China, and Russia, which have advanced space programs and capabilities such as reusable spacecraft and space tourism.

- Dependence on Foreign Launch Vehicles: Despite progress in domestic launch capabilities, many startups still depend on foreign rockets like SpaceX’s Falcon-9 due to cost and scheduling constraints.

Strategic Way Forward

- Boosting R&D and Infrastructure:

- Expand the domestic manufacturing of satellite components through the Production Linked Incentive scheme for space-grade components.

- Establish more space-focused educational institutions and create a dedicated space industrial corridor to boost satellite and launch vehicle manufacturing.

- Global Collaboration:

- Strengthen bilateral agreements with leading space agencies (NASA, ESA, Roscosmos) to foster collaboration in research and development.

- Promote rideshare missions to reduce satellite launch costs, benefiting startups.

- Technology Transfer and Commercialization:

- Enhance ISRO’s technology transfer initiatives to allow startups to commercialize homegrown innovations, driving economic growth in space-related industries.

Conclusion

India’s private space sector is undergoing a transformative shift, with increasing private sector participation, supportive reforms, and growing venture capital investment. While challenges such as funding gaps, talent shortages, and global competition remain, strategic measures to enhance R&D, infrastructure, and global collaborations can position India as a leading player in the global space economy. This growth aligns with India’s broader goals of technological advancement and economic development, while also contributing to global space exploration and sustainability.

India's Gig Economy: Growth and Impact on Employment

- 03 Dec 2024

Introduction

India’s gig economy is experiencing rapid growth, with projections indicating it will significantly contribute to the national economy and employment generation. A recent report by the Forum for Progressive Gig Workers estimates the gig economy could reach $455 billion by the end of 2024, growing at a 17% compounded annual growth rate (CAGR). By 2030, it may add 1.25% to India’s GDP and create 90 million jobs.

What is the Gig Economy?

- Definition: The gig economy refers to a labor market based on short-term, flexible jobs, typically facilitated by digital platforms. Gig workers, also called freelancers or independent contractors, are compensated for each task they complete.

- Key Features:

- Flexibility in work schedule and location.

- Task-based employment through digital platforms.

- Common sectors: e-commerce, transportation, delivery services, and freelance work.

Status of the Gig Economy in India

- Market Growth:

- In 2020-21, India had 7.7 million gig workers, which is expected to grow to 23.5 million by 2029-30.

- Key sectors contributing to growth include e-commerce, transportation, and delivery services.

- Driving Factors:

- Digital Penetration: With over 936 million internet subscribers and 650 million smartphone users, digital infrastructure is a key enabler of the gig economy.

- Startup and E-commerce Growth: The rise of startups and e-commerce platforms has increased demand for flexible labor.

- Changing Work Preferences: Younger generations seek work-life balance, opting for flexible gig work.

Gig Economy and Employment Generation

- Contribution to GDP: The gig economy is expected to contribute 1.25% to India’s GDP by 2030.

- Job Creation:

- The gig economy could create up to 90 million jobs by 2030.

- It is estimated that by 2030, gig workers will comprise 4.1% of India’s total workforce.

- Benefits:

- Women’s Empowerment: Gig work provides financial independence and flexibility, especially benefiting women in the workforce.

- Regional Growth: Tier-II and Tier-III cities are seeing accelerated growth in gig work opportunities.

Challenges Faced by Gig Workers

- Job Insecurity: Many gig workers experience instability in their employment, especially in low-skilled jobs.

- Income Volatility: Earnings are unpredictable, and workers face difficulty in financial planning.

- Regulatory Gaps: There is no comprehensive legal framework to protect gig workers’ rights and ensure fair working conditions.

- Delayed Payments: A significant number of workers face delayed payments, affecting their financial well-being.

- Skill Development: Many workers report a lack of opportunities for career advancement and skill development.

Government Initiatives for Gig Workers

- Code on Social Security, 2020: Recognizes gig workers and aims to extend social security benefits, though it lacks comprehensive coverage.

- e-Shram Portal & Welfare Schemes: Initiatives like Pradhan Mantri Shram Yogi Maandhan Yojana and PMJJBY aim to provide financial security to gig workers.

- State-level Initiatives:

- Rajasthan’s Platform-Based Gig Workers Act (2023) focuses on registration and welfare.

- Karnataka’s bill mandates formal registration and grievance mechanisms.

The Way Forward

- Legal Reforms: India can draw from international models like California and the Netherlands, where gig workers are reclassified as employees to ensure protections such as minimum wages and regulated working hours.

- Portable Benefits System: Implementing a system where gig workers can access benefits like healthcare and retirement plans regardless of their employer.

- Skill Development: Strengthening collaborations with vocational institutions to enhance skills and improve earning potential.

- Technological Solutions: Establishing robust feedback mechanisms for workers to report exploitation and ensure fairness within the gig economy.

Conclusion

The gig economy in India is poised to become a significant driver of economic growth and job creation. However, addressing challenges such as income volatility, job insecurity, and regulatory gaps is crucial to ensuring sustainable growth.

Inter-State Council

- 14 Nov 2024

In News:

The Inter-State Council, which works for Centre-State and interstate coordination and cooperation, has been reconstituted with Prime Minister Narendra Modi as its chairman, all chief ministers and nine Union ministers as members and 13 Union ministers as permanent invitees.

About the Inter-State Council (ISC)

Formation of ISC

- Establishment: Created on May 28, 1990, through a Presidential Order following the recommendations of the Sarkaria Commission (1988).

- Headquarters: New Delhi.

- Meetings: The Council has convened 12 times since its formation.

Constitutional Provisions

- Not a Constitutional Body: It was established under Article 263 of the Constitution, making it a non-permanent advisory body.

- Role: Article 263 empowers the President to create the ISC for improving coordination between States and the Union.

Powers and Functions

- Investigate and Discuss: The ISC discusses subjects of common interest between the Centre and States.

- Recommendations: It recommends measures for better coordination and addressing inter-state issues.

- Deliberations: The ISC also deliberates on matters referred by the Chairman.

Composition of the ISC

- Chairperson: Prime Minister of India.

- Members:

- Chief Ministers of all States and Union Territories with legislative assemblies.

- Lieutenant Governors/Administrators of Union Territories without assemblies.

- 6 Union Cabinet Ministers nominated by the Prime Minister.

- Governors of States under President’s rule.

- Standing Committee:

- Chaired by the Union Home Minister.

- Includes 5 Union Cabinet Ministers and 9 Chief Ministers.

Functions and Role of the ISC

Role in Centre-State Cooperation

- Facilitates better coordination and cooperation between the Centre and States.

- Addressing disputes related to Centre-State and Inter-State relations.

Additional Functions

- Make Recommendations: Based on discussions, it recommends actions to align policies.

- Promote Social Legitimacy: Through consensus-driven decisions, ISC strengthens policy acceptance among states.

Key Bodies Related to Centre-State Relations

Zonal Councils

- Purpose: Promote interstate cooperation and coordination.

- Constitution: There are five Zonal Councils (Northern, Central, Eastern, Western, Southern) and a separate North Eastern Council established in 1972.

River Water Dispute Tribunals

- Function: Set up under the Inter-State River Water Disputes Act, 1956, these tribunals resolve disputes over river water sharing between States.

GST Council

- Constitution: Established under Article 279A, the GST Council is responsible for decisions related to GST implementation, ensuring cooperative federalism.

Uttar Pradesh Board of Madarsa Education Act, 2004

- 09 Nov 2024

In News:

The Supreme Court recently upheld the constitutional validity of the Uttar Pradesh Board of Madarsa Education Act, 2004 (also called the Madarsa Act), while striking down certain provisions related to the granting of higher education degrees. The Court overturned the Allahabad High Court's previous decision, which had deemed the Act unconstitutional on the grounds that it violated the principle of secularism.

What is the Madarsa Act?

The Madarsa Act provides a legal framework for regulating madrasas (Islamic educational institutions) in Uttar Pradesh. The Act:

- Establishes the Uttar Pradesh Board of Madarsa Education, which oversees the curriculum and examinations for madrasas.

- Ensures that madrasas follow the National Council of Educational Research and Training (NCERT) curriculum for mainstream secular education alongside religious instruction.

- Empowers the state government to create rules for regulating madrasa education.

Allahabad High Court's Ruling

In March 2024, the Allahabad High Court declared the Madarsa Act unconstitutional, citing:

- Violation of secularism: The Court argued that the Act's emphasis on compulsory Islamic education, with modern subjects being optional, discriminated on religious grounds, violating the secular nature of the Constitution.

- Right to Education: The Court also claimed that the Act denied quality education under Article 21A, which guarantees free and compulsory education to children.

- Higher Education Degrees: The Act's provisions allowing the granting of Fazil and Kamil degrees were found to conflict with the University Grants Commission Act, 1956, which regulates higher education.

Supreme Court's Ruling

The Supreme Court overturned the Allahabad High Court's decision on several grounds:

- Basic Structure Doctrine: The Court clarified that the basic structure doctrine, which applies to constitutional amendments, does not apply to ordinary legislation like the Madarsa Act. Therefore, a law cannot be struck down simply for violating secularism unless explicitly prohibited by the Constitution.

- State's Authority to Regulate Education: The Court held that the state has the right to regulate education in minority institutions, as long as the regulation is reasonable and rational. It emphasized that the Madarsa Act does not deprive these institutions of their minority character.

- Right to Education for Minority Institutions: Referring to a 2014 decision, the Court ruled that the Right to Education Act (RTE) does not apply to minority institutions, as it would undermine their right to impart religious education and self-administer.

Striking Down Higher Education Provisions

While upholding most of the Act, the Supreme Court struck down the provisions related to higher education degrees (Fazil and Kamil). It ruled that:

- Section 9 of the Act, which allowed the Board to grant these degrees, is in conflict with the University Grants Commission Act, which only permits degrees to be awarded by universities recognized by the UGC.

Implications of the Ruling

- Regulation of Madrasa Education: The ruling affirms the state's authority to ensure quality education in madrasas, balancing religious instruction with secular subjects.

- Protection of Minority Rights: By upholding the Madarsa Act, the Court protected the rights of religious minorities to run educational institutions while ensuring they meet educational standards.

- Focus on Inclusivity: The judgment emphasizes the integration of madrasas within the broader educational framework, ensuring that madrasa students receive quality education.

In conclusion, the Supreme Court's decision supports the regulation of madrasa education while safeguarding the rights of minority institutions, except in areas related to the granting of higher education degrees, which remain under the jurisdiction of the UGC Act.

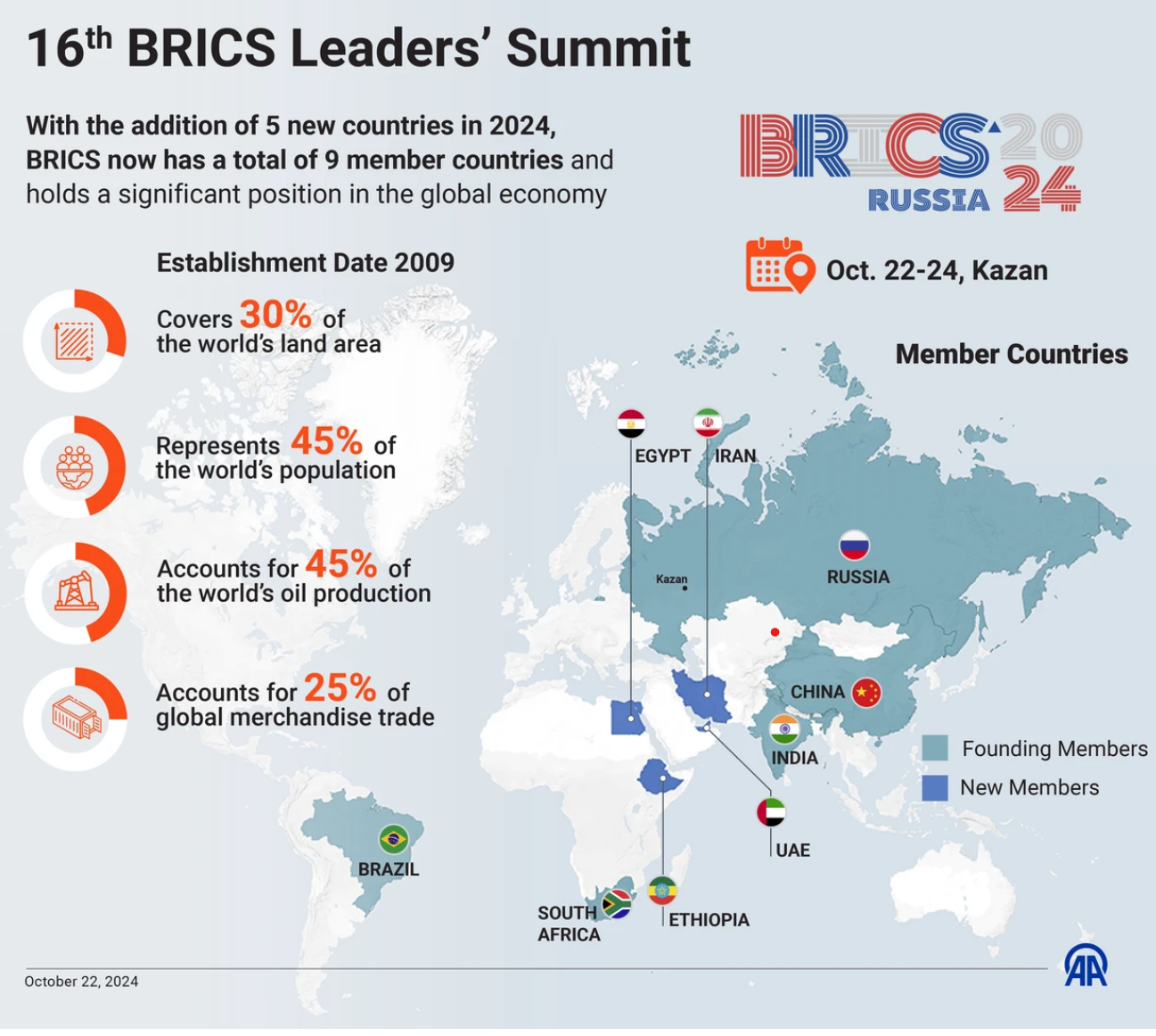

16th BRICS Summit

- 25 Oct 2024

In News:

Recently, the 16th BRICS Summit was held in Kazan, Russia.

Key Highlights:

Overview of the Bilateral Meeting between PM Modi and President Xi

- Location & Context: The meeting took place on the sidelines of the 16th BRICS Summit in Kazan, Russia (October 23, 2024), marking the first bilateral interaction between PM Modi and President Xi Jinping in nearly five years.

- Significance: The meeting focused on India-China relations, specifically the border dispute that arose following the 2020 standoff in Ladakh.

- Agreement on Border Disengagement: Both leaders welcomed an agreement for "complete disengagement" along the Line of Actual Control (LAC), which could pave the way for the resolution of issues that emerged after the Galwan Valley clashes in June 2020.

Key Points of the India-China Border Pact

- Resolution of Border Issues: The agreement addresses longstanding disputes, including in Depsang Plains and Demchok, where Chinese forces had encroached on Indian territory.

- Restoration of Patrolling: Both nations agreed to restore patrols to old patrolling points (PPs) along the LAC in these disputed areas.

- Next Steps: The Special Representatives (SRs) on the India-China boundary will meet soon to oversee the management of peace and tranquility in the border areas and explore mutually acceptable solutions.

- Diplomatic Mechanisms: Dialogue mechanisms at the foreign ministers and other official levels will be utilized to stabilize and rebuild bilateral relations, contributing to regional and global stability.

Strategic Importance of the Bilateral Meeting

- Maintaining Peace and Stability: PM Modi emphasized that differences between India and China should be managed carefully to ensure that broader peace and tranquility are maintained.

- Global Impact: Both leaders affirmed that stable India-China relations would have a positive impact on regional and global peace and contribute to a multipolar world.

- Long-Term Strategic Perspective: The leaders discussed progressing bilateral relations from a strategic perspective, enhancing communication, and exploring cooperation to address developmental challenges.

Key Takeaways from the 16th BRICS Summit

- Expansion and New Membership: The summit saw the inclusion of five new members—Egypt, Ethiopia, Iran, the UAE, and Saudi Arabia (pending formalization). This expansion reflects BRICS’s growing influence as a forum representing the Global South.

- Focus on Multilateralism: Leaders emphasized multilateral cooperation to address challenges such as global security, economic growth, and sustainable development.

- Kazan Declaration: The declaration touched upon key issues:

- Geopolitical Conflicts: It called for dialogue and diplomacy to resolve disputes like the Ukraine crisis and the West Asia conflict.

- Sanctions and Trade: Criticized unilateral sanctions and their disruptive effects on global trade and development goals.

- Grain Exchange: A proposal was made to establish a BRICS Grain Exchange, aimed at improving agricultural trade among member states.

- Financial Integration: There was a push for greater financial integration through the use of local currencies for trade, exemplified by India’s UPI system as a successful model.

Importance of BRICS in the Global Context

- Global Influence: BRICS continues to be a key player in global geopolitics, representing 40% of the world’s population and 26% of global GDP (as of 2023).

- Strategic Goals: BRICS has consistently called for reform of international institutions like the UNSC, IMF, and World Bank, advocating for a more equitable global governance structure.

- Economic Collaboration: The New Development Bank (NDB), established in 2015, continues to play a vital role in funding development projects across BRICS countries, though the group’s influence in global finance remains limited compared to the World Bank.

Challenges Facing BRICS Expansion

- Geopolitical Contradictions: The inclusion of diverse new members (e.g., UAE, Egypt, Iran) could complicate decision-making due to geopolitical rivalries.

- Decision-Making Hurdles: Achieving consensus among an expanding membership will become more challenging. The expansion may dilute the cohesiveness of the group, as seen in other multilateral forums like the Non-Aligned Movement (NAM) and G77.

- De-Dollarisation Efforts: While BRICS aims to de-dollarize trade and reduce reliance on the SWIFT system, efforts to develop alternatives like a BRICS payment system and BRICS currency are still in nascent stages.

- Economic Disparities: Economic gaps among members—China’s GDP is significantly larger than the combined GDP of other members—could also create imbalances in decision-making.

India’s Role and Strategic Positioning in BRICS

- Geopolitical Balancing: India's participation in BRICS is a strategic maneuver to balance its global position and strengthen ties with emerging economies, particularly in the Global South.

- Diplomatic Relations with Russia: India continues to prioritize its relationship with Russia, which remains crucial for regional security and energy cooperation.

- India-China Ties: The agreement on the India-China border represents a significant shift in relations, with potential for a reset in Sino-Indian ties.

Key Themes in the Kazan Declaration

- Global Governance: Calls for reforming global institutions to give developing nations more representation.

- Energy and Sustainability: Proposals for strengthening energy cooperation, including the creation of energy corridors and the promotion of sustainable energy practices.

- Security: Emphasized the need for universal security by addressing the security concerns of all nations and promoting dialogue over confrontation.

Conclusion: Future of India-China and BRICS Relations

- India-China Relations: The border disengagement pact is a critical step towards stabilizing the India-China relationship, with potential positive impacts on regional security and global geopolitics.

- BRICS’s Growing Influence: As BRICS expands, it faces internal challenges but remains a potent voice for the Global South, aiming to reshape global governance and financial systems.

- India’s Strategic Positioning: India is likely to play a pivotal role in BRICS, especially as the group’s focus shifts towards regional stability, economic cooperation, and de-dollarization in the coming years.

India - Canada Relations

- 18 Oct 2024

In News:

India-Canada relations have recently faced serious setbacks following allegations of India's involvement in the killing of Khalistani leader Hardeep Singh Nijjar in Canada. These claims have led to escalating diplomatic tensions and mutual expulsions of diplomats between the two countries.

Recent Developments in India-Canada Relations

- Assassination of Hardeep Singh Nijjar:

- Nijjar, a prominent Khalistani leader, was assassinated in British Columbia, Canada.

- The Canadian Prime Minister accused Indian officials of involvement, which India has denied as "absurd."

- Diplomatic Fallout:

- Both nations expelled each other's diplomats, reducing diplomatic staff and freezing consular services, exacerbating the tensions.

- Support from the Five Eyes Alliance:

- Canada enlisted the Five Eyes intelligence alliance to gain international backing amid the escalating diplomatic crisis with India.

What is the Five Eyes Alliance?

- About:

- The Five Eyes is a multilateral intelligence alliance composed of Australia, Canada, New Zealand, the United Kingdom, and the United States.

- These countries cooperate on signals intelligence under the UK-USA Agreement.

- Expansion:

- The alliance later grew into the Nine Eyes and Fourteen Eyes alliances, incorporating additional countries like the Netherlands, Denmark, France, Norway, and others.

Key Areas of India-Canada Relations

- Political Relations:

- Diplomatic ties began in 1947, with both countries sharing democratic values, human rights, and pluralism.

- Collaborative efforts in global forums like the UN, G20, and Commonwealth focus on climate change, security, and sustainable development.

- Economic Cooperation:

- Bilateral trade in 2023 was worth USD 9.36 billion.

- Canada is the 18th largest investor in India with investments totaling USD 3.3 billion (2000-2023).

- Ongoing Comprehensive Economic Partnership Agreement (CEPA) negotiations aim to boost trade in goods, services, and investments.

- Diaspora Connections:

- Over 1.8 million people of Indian origin in Canada, contributing significantly to cultural and economic exchanges.

- Canada is home to one of the largest Indian diaspora populations globally.

- Education and Space Innovation:

- IC-IMPACTS promotes joint research in healthcare, agricultural biotechnology, and waste management.

- Space collaboration includes partnerships between ISRO and the Canadian Space Agency.

- Indian students represent nearly 40% of Canada's international student population.

- Nuclear Cooperation:

- A 2010 nuclear agreement allows the supply of uranium to India and establishes a Joint Committee for oversight.

- Strategic Importance:

- India’s role is key in Canada’s Indo-Pacific strategy, including collaboration on maritime security, counter-terrorism, and regional stability.

Challenges in India-Canada Relations

- Diplomatic Immunity Issues:

- Canada invoked the Vienna Conventions to protect its diplomatic staff amid tensions, with both sides highlighting the importance of maintaining diplomatic norms.

- Khalistan Issue:

- India views Canada’s tolerance of Khalistani separatist groups as a threat to its territorial integrity.

- Canada’s investigation into India’s alleged role in Nijjar’s assassination has exacerbated diplomatic mistrust.

- Economic and Trade Barriers:

- The political rift has stalled negotiations for the CEPA and slowed bilateral trade.

- Canadian investments in India face increased uncertainty due to deteriorating relations.

- Visa and Immigration Delays:

- Reduced Canadian diplomatic staff in India has caused significant delays in visa processing, especially for students.

- Geopolitical Implications:

- Tensions between India and Canada risk damaging India’s reputation on the global stage, particularly if allegations of intelligence overreach are substantiated.

- Canada’s membership in the G7 and ties with the Five Eyes make the situation complex, affecting relations with other strategic partners of India, including the US, UK, Australia, and Japan.

The Vienna Convention on Diplomatic Immunity

- Vienna Convention on Diplomatic Relations (1961): Establishes the framework for the treatment and protection of diplomatic missions and their personnel.

- Diplomatic Immunity: Diplomats are protected from arrest and detention by the host country.

- Inviolability of Diplomatic Premises: Diplomatic missions cannot be entered without permission.

- Protection of Consular Officers: Ensures consular officers can assist their nationals without interference.

Way Forward for India-Canada Relations

- Address the Khalistan Issue: Engage in active dialogue to resolve concerns about the Indian diaspora and the Khalistan movement, respecting each other’s sovereignty.

- Strengthen Economic Ties:

- Revitalize CEPA negotiations, with a focus on sectors like technology, renewable energy, and infrastructure.

- Enhance trade and investment frameworks for mutually beneficial opportunities.

- Balance Geopolitical Interests:

- Both nations should navigate relationships with major powers like the US, China, and Russia with care.

- A cautious approach is necessary to maintain strategic partnerships without further conflict.

- Leverage Multilateral Platforms: Utilize forums like the G7 and Five Eyes to address global challenges and promote shared values, while working to stabilize bilateral ties.

Conclusion

India-Canada relations are at a critical juncture due to recent tensions. While historical ties and shared interests provide a strong foundation, the diplomatic fallout requires careful management. Both nations must seek ways to restore dialogue, address sensitive issues like the Khalistan movement, and focus on economic cooperation to stabilize and strengthen the relationship moving forward.

Asset Monetisation

- 15 Oct 2024

In News

The NITI Aayog has recently increased the asset monetisation target for the fiscal year 2024-25 (FY25) by ?23,000 crore, bringing the total to ?1.9 trillion. This adjustment aligns with the broader target of ?6 trillion set under the National Monetisation Pipeline (NMP) for the period from FY 2022 to FY 2025.

Understanding Asset Monetisation

Definition

Asset monetisation refers to the process of converting public assets into revenue-generating assets without selling them outright. This includes using assets to generate profit or cash, thereby unlocking their economic value.

Importance

- Revenue Generation: Monetisation creates new revenue streams for governments by leveraging underutilised public assets.

- Focus on Public Assets: The emphasis is on monetising existing infrastructure such as roads, airports, railways, and pipelines, primarily targeting brownfield assets—those that can be improved or repurposed.

Monetisation vs. Privatisation

While privatisation involves complete ownership transfer to the private sector, asset monetisation allows public authorities to retain ownership while benefiting from private sector efficiencies through structured partnerships.

The National Monetisation Pipeline (NMP)

Overview

The NMP is an initiative aimed at promoting sustainable infrastructure financing through the monetisation of operational public assets. It envisions a monetisation potential of ?6 lakh crore, focusing on leasing core assets from the Central government and public sector entities.

Preparation and Coverage

- Collaborative Approach: Developed by NITI Aayog in consultation with infrastructure ministries such as Roads, Railways, and Power.

- Sector Coverage: Encompasses various sectors including roads (27% of the total value), railways (25%), power (15%), and telecom (6%).

Framework for Monetisation

- Retention of Rights: The government retains ownership, with assets reverting to public authorities post-transaction.

- Stable Revenue Streams: Focus on de-risked brownfield assets that provide consistent revenue.

- Defined Partnerships: Establishment of contractual frameworks with strict performance indicators.

Alignment with National Infrastructure Pipeline (NIP)

The NMP is integrated with the NIP, which seeks to attract investments in both greenfield and brownfield projects across all sectors.

Current Status of the NMP

Revenue Generation

As of FY24, the NMP has generated ?3.9 trillion, slightly below the original target of ?4.3 trillion for the initial three years.

Successful Monetisation Examples

- The Ministry of Coal exceeded its target, raising ?1.54 trillion against a goal of ?80,000 crore.

- Mining assets have also been monetised significantly, surpassing their revised targets.

Sectors Lagging

- Railways: Only ?20,417 crore monetised, achieving just 30% of the target.

- Civil Aviation: A mere 14% of its targeted monetisation has been achieved.

Challenges Facing the NMP

- Low Monetisation Potential: The NMP's ?6 lakh crore target represents only a small fraction (5-6%) of the total capital expenditure under the NIP.

- Disinvestment Issues: Many sectors chosen for monetisation have consistently fallen short of their disinvestment targets, raising doubts about achieving future goals.

- Long-Term Rights Concerns: Granting private entities long-term operational rights may be perceived as a form of privatisation, potentially leading to public distrust.

- Budget Clarity: There is a lack of transparency regarding how monetisation proceeds will be allocated within the government budget.

- Potential for Monopolies: Consolidation of asset ownership could lead to monopolistic practices, especially in critical infrastructure sectors.

- Taxpayer Concerns: Taxpayers are wary of the potential for double charges on public assets they initially funded.

Way Forward

- Accelerating Monetisation: The government should expedite contract-based monetisation through Public-Private Partnerships (PPP), particularly in sectors like railways and airports.

- Land Monetisation Initiatives: Engaging real estate companies to develop multi-storey buildings can generate additional revenue while enhancing housing options.

- Establishing Budget Guidelines: Clear budgeting guidelines should be developed to clarify the allocation of funds generated from monetisation, ensuring they are used for infrastructure development rather than operational expenses.

RBI Increases Risk Weights on Unsecured Loans (Business Standard)

- 29 Nov 2023

Why is it in the News?

Context:

- The Reserve Bank of India (RBI) recently issued regulatory measures to banks and NBFCs to increase risk weights associated with consumer credit and bank credit by an additional 25 percentage points.

- Currently, at 100% risk weight, loans to consumers will see an increase to 125%, excluding loans for housing, education, vehicles, and against gold.

- This would be applicable to unsecured personal loans, credit cards, and lending to NBFCs.

- The directions are expected to result in higher capital requirements for lenders and thereby, an increase in lending rates for consumers.

What is ‘Risk Weights'?

- Risk weight is capital required to be set aside, stipulated by the Reserve Bank of India for Banks, or National Housing Bank for housing finance companies, that has to be made by banks for giving the loan.

- In other words, it is the amount (depicted as a percentage of loan disbursed) that institutions need to set aside for assets.

- The risk weight is a function of the risk perception the apex bank has on loans for different sectors.

- It is applicable to all categories of retail (personal, home, car, and education loans) as well as corporate lending.

- The one that often impacts borrowers directly, and the most, is the risk weight on home loans.

- It is an essential tool for banks to manage this risk.

Why do risk weights matter?

- Risk weights are pivotal in banking regulation, as they dictate the capital set aside for different loan types, reflecting their risk profiles.

- Unsecured loans, perceived as riskier, have higher weights, thus requiring more capital.

- Home loans, for instance, attract a risk weight of 35-50%, depending on the size of the loan.

- In comparison, personal loans will now have a risk weight of 125%.

Why were the Changes by RBI Deemed Necessary?

- Governor Shaktikanta Das had flagged concerns about the “high growth” in “certain components of consumer credit.” while presenting the monetary policy statement in October this year.

- He advised banks and NBFCs to “strengthen their internal surveillance mechanisms, address the build-up of risks, if any, and institute suitable safeguards, in their own interest.”

- The governor said these were being closely monitored by the apex banking regulator for “any signs of incipient stress.”

- Rating agency Moody’s also put forth that higher risk weights are intended to “dampen lenders’ consumer loan growth appetite.”

- The unsecured segment, it adds, has grown rapidly in the past few years, exposing financial institutions to a potential spike in credit costs in the event of a sudden economic or interest rate shock.

- RBI’s latest figures stipulate that unsecured personal loans have increased approximately 23% on a year-over-year basis, as of September 22 this year.

- Outstanding loans from credit cards increased by about 30% during the same period.

- Major concerns emerge for loans below Rs 50,000 – these carry the utmost default risk.

- Delinquencies in this segment stood at 5.4% as of June this year.

- Ratings agency S&P in their assessment held that borrowers in this segment are often highly leveraged and may have other lending products.

- According to Moody’s, several NBFCs that until now focused on secured lending categories (such as infrastructure, real estate, and vehicle loans) have pivoted to riskier segments.

What are the main concerns?

- The primary concerns are about how these changes might affect the amount of money banks have and how well they can make a profit.

- Having enough money, called capital adequacy, is crucial for banks.

- It helps them handle unexpected problems or risks in their business without losing too much money.

- A recent report from S&P, which is a group that studies these things, says that if banks are more careful and focus on managing risks, it could make their loans safer.

- However, it predicts that a measure called Tier-1 capital adequacy, which is like the best kind of money banks have, might go down a bit—about 60 basis points.

- This is important because Tier-1 capital helps banks deal with losses right away.

- S&P thinks that this might make banks that don't have a lot of this kind of money think about getting more.

- Also, it noticed that government-owned banks generally have less of this important money than big private banks.

- But, the report says that finance companies might face the biggest impact because they could end up borrowing more from banks, and it might affect how much good money they have.

How It will affect Consumers?

- As the risk weightage goes up, banks may become more careful about giving loans to consumers, especially those seen as having a higher risk.

- This could make it harder for some people to get credit cards or personal loans.

- Even those who still qualify for credit might face stricter terms and conditions.

- Experts suggest that by increasing the risk weightage, the RBI is trying to handle the increasing number of people not repaying their loans and the risks connected to unsecured loans.

- Lenders will now have to consider the higher credit risk in this type of loan, which could make lending more expensive.

- As a result, borrowers taking out these loans may face higher costs.

Way Forward

Banks and NBFCs may need to review their approaches to risk and lending specifically for unsecured loans. This could involve placing greater emphasis on evaluating creditworthiness and exploring alternative strategies to effectively handle risk while still providing loans. Financial institutions might also consider diversifying their loan portfolios by placing more emphasis on secured lending or exploring other creditworthy segments. This approach aims to balance the effects of the heightened risk-weighting associated with unsecured loans.

What is the Capital Adequacy Ratio (CAR)?

- The Capital Adequacy Ratio (CAR) is a financial metric used to evaluate a bank's stability and risk management.

- Calculated as a percentage, it compares a bank's capital—comprising Tier-1 and Tier-2 capital—to its risk-weighted assets.

- Tier-1 capital includes core elements like common equity

- Tier-2 capital consists of supplementary items.

- Regulatory authorities, such as the RBI, establish minimum CAR requirements to ensure banks can absorb potential losses.

- A higher CAR reflects greater financial resilience, emphasizing a bank's ability to navigate economic challenges and adhere to regulatory standards.

Production Linked Incentive (PLI) Scheme for IT Hardware (Business Standard)

- 01 Sep 2023

Why in the News?

As many as 38 companies, including big names like Foxconn Group, HP, Dell and Lenovo, have applied for incentives under the mega Production Linked Incentive (PLI) IT hardware scheme for manufacturing laptops, PCs and servers.

Context:

- In addition to Asus, Dell, HP, and Foxconn, several other companies, including Lenovo, Acer, and Flex, have submitted applications for the scheme. Notably, Flex is reportedly involved in manufacturing Reliance's JioBook laptop.

- HP Enterprises (HPE) has also sought approval for server manufacturing operations within India.

- Although the expected incremental production over the scheme's six-year duration is projected to reach Rs 3.35 lakh crore, the anticipated additional investment during this period is relatively modest, at just Rs 4,000 crore.

- The government anticipates that the manufacturing activities enabled by the scheme will create approximately 75,000 direct jobs, with the potential to generate up to 2 lakh indirect jobs when considering the broader economic impact.

What is the PLI Scheme?

- The PLI scheme was created to boost domestic manufacturing, reduce reliance on imports, and create more jobs.

- The government has allocated Rs 1.97 lakh crore for various sectors under the PLI schemes, with an additional Rs 19,500 crore designated for PLI in solar PV modules in the 2022-23 Budget.

- Initiated in March 2020, the scheme initially focused on three industries:

- Mobile and allied Component Manufacturing

- Electrical Component Manufacturing

- Medical Devices

- Incentives Under the Scheme:

- The incentives, based on increased sales, vary from 1% for electronics and technology products to 20% for critical key starting drugs and certain drug intermediaries.

- In some sectors like advanced chemistry cell batteries, textile products, and the drone industry, incentives are calculated based on sales, performance, and local value addition over a five-year period.

- Sectors Covered by the PLI Scheme:

- The government has introduced PLI schemes for 14 sectors, including automobiles and auto components, electronics and IT hardware, telecom, pharmaceuticals, solar modules, metals and mining, textiles and apparel, white goods, drones, and advanced chemistry cell batteries.

- Objectives:

- The government introduced this scheme to reduce India's dependence on foreign countries, particularly China.

- It aims to support labor-intensive sectors and increase employment in India while reducing import bills and promoting domestic production.

- The PLI Yojana also encourages foreign companies to establish operations in India and domestic enterprises to expand their production facilities.

What is the PLI scheme for IT Hardware?

- The PLI scheme for IT Hardware was initially announced in February 2021, with an initial allocation of approximately Rs 7,300 crore over a four-year period.

- Incentive Structure:

- Under this scheme, domestic companies that invest Rs 20 crore and achieve sales of Rs 50 crore in the first year, Rs 100 crore in the second year, Rs 200 crore in the third year, and Rs 300 crore in the final year can receive incentives ranging from 1% to 4% on incremental sales compared to the base year of 2019-20.

- Revised Version:

- The initial version of the scheme had limited success, with only two companies, Dell and Bhagwati, meeting the first-year targets.

- Consequently, the industry called for a revamped scheme with a larger budget.

- In response, the Union Cabinet approved a revised PLI scheme for IT hardware in May 2023, allocating Rs 17,000 crore, more than doubling the budget.

- Potential Impact:

- PLI 2.0 has the potential to attract major global IT hardware manufacturers to establish their production operations in India, bolstering the local production of laptops, servers, personal computers, and more.

- Over a six-year period, the average incentive is expected to be around 5%, compared to the previous 2% over four years.

- Achieving Digital Economy Goals:

- With the IT hardware industry aiming for a production value of $24 billion by 2025-26 (with exports estimated at $12-17 billion), this scheme plays a crucial role in realizing the goal of a $1 trillion digital economy, including $300 billion from electronics manufacturing by 2025-26.

How Will the PLI Scheme Drive Local Production in India?

- Despite identifying electronics manufacturing as a pivotal sector for future economic growth, India has witnessed a surge in the import of electronic goods in recent years.

- Import Scenario:

- For instance, the import of electronic goods surged to $6.96 billion during April-June this year, up from $4.73 billion in the same period last year, constituting 4-7% of overall imports.

- The category with the highest import share includes personal computers, including laptops and palmtops.

- China Dominance:

- China commands a significant portion, approximately 70-80%, of India's imports in the personal computer and laptop category.

- Incentives for Component Manufacturers:

- Companies engaged in local manufacturing of specific components like memory modules and display panels will receive supplementary incentives under the revised scheme.

- Performance-Driven Approach:

- The PLI scheme is designed to encourage companies to meet production targets.

- If companies fall short of these thresholds, they may face deductions of up to 10% from their subsidies.

- Synergy with Semiconductor Scheme:

- The PLI scheme will complement the government's semiconductor scheme, with domestically produced chips finding application in laptop manufacturing, further bolstering the local industry.

Mains Question:

- Discuss the impact of the PLI Scheme for IT Hardware on the Indian electronics manufacturing sector. Evaluate its effectiveness in reducing imports and critically assess its potential to stimulate job growth in the country. (15M)