Pradhan Mantri Mudra Yojana (PMMY)

- 27 Oct 2024

Introduction

The Pradhan Mantri Mudra Yojana (PMMY) was launched by Prime Minister Narendra Modi on April 8, 2015, with the aim of providing financial support to non-corporate, non-farm small and micro enterprises in India. Through this initiative, loans are provided to individuals and small businesses who are unable to access formal institutional finance.

In the Union Budget 2024-25, Finance Minister Nirmala Sitharaman announced an increase in the loan limit under PMMY from ?10 lakh to ?20 lakh, with the introduction of a new loan category, Tarun Plus, aimed at fostering growth in the entrepreneurial sector.

Key Features of the Pradhan Mantri Mudra Yojana

Loan Limit Increase

- Loan Limit Raised: The loan limit has been increased from ?10 lakh to ?20 lakh for eligible entrepreneurs.

- New Loan Category: The newly introduced Tarun Plus category caters to entrepreneurs who have previously availed and successfully repaid loans under the Tarun category.

- Credit Guarantee: The Credit Guarantee Fund for Micro Units (CGFMU) will cover these enhanced loans, further ensuring the security of micro-enterprises.

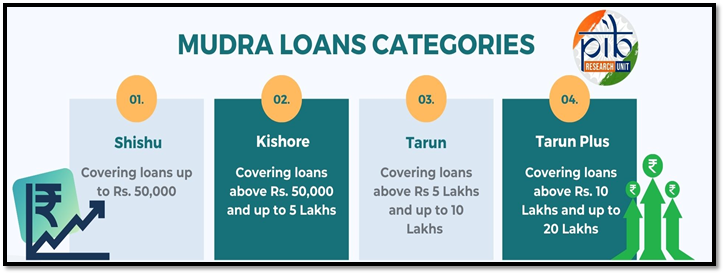

Categories of MUDRA Loans

PMMY provides collateral-free loans through financial institutions like Scheduled Commercial Banks, Regional Rural Banks (RRBs), Small Finance Banks (SFBs), Non-Banking Financial Companies (NBFCs), and Micro Finance Institutions (MFIs). These loans are provided for income-generating activities in sectors like manufacturing, trading, services, and allied agriculture activities.

Objectives of PMMY

- Financial Inclusion: PMMY targets marginalized and socio-economically neglected sections of society, promoting financial inclusivity.

- Support to Small Businesses: By providing affordable loans, the scheme encourages small-scale entrepreneurs, particularly women and minority groups, to establish and expand their businesses.

- Fostering Entrepreneurship: PMMY aims to unlock the potential of India’s entrepreneurial spirit, especially in rural and underserved areas.

MUDRA: The Institutional Backbone

Role of Micro Units Development & Refinance Agency Ltd. (MUDRA)

MUDRA is the primary institution set up by the Government of India to manage and implement the Mudra Yojana. It acts as a refinancing agency that provides financial support to small and micro-enterprises by working through financial intermediaries, such as banks and micro-finance institutions.

Funding Sources

- Scheduled Commercial Banks

- Regional Rural Banks (RRBs)

- Small Finance Banks (SFBs)

- Non-Banking Financial Companies (NBFCs)

- Micro Finance Institutions (MFIs)

Application Process

Applicants can avail loans through any of the aforementioned financial institutions or apply online via the Udyami Mitra Portal.

Benefits of Pradhan Mantri Mudra Yojana

- Collateral-free Loans: No security is required to obtain loans, which reduces the financial burden on borrowers.

- Easily Accessible: PMMY loans are available across India, making them accessible to entrepreneurs in both rural and urban areas.

- Quick and Flexible Loans: Loans can be disbursed quickly with flexible repayment terms (up to 7 years).

- Empowering Women Entrepreneurs: The scheme offers special incentives for women entrepreneurs, helping them to establish and grow their businesses.

- Support to Rural Areas: Special emphasis on empowering rural enterprises and reducing regional disparities.

- MUDRA Card: The MUDRA Card is a RuPay debit card that allows borrowers to access funds through an overdraft facility, enhancing liquidity for businesses.

- No Default Penalty: In case of loan defaults due to unforeseen circumstances, the government will step in to reduce the burden on entrepreneurs.

Categories of Loans Under PMMY

1. Shishu Category: Loans up to ?50,000

- Targeted at micro-enterprises at the initial stage of their business journey.

2. Kishore Category: Loans between ?50,000 and ?5 lakh

- Targeted at enterprises looking to expand their operations and upgrade their infrastructure.

3. Tarun Category: Loans between ?5 lakh and ?10 lakh

- For established businesses that are in need of funds to scale up.

4. Tarun Plus: Loans between ?10 lakh and ?20 lakh

- A new category designed for entrepreneurs who have repaid loans under the Tarun category and wish to further expand their business.

Achievements of PMMY (2023-24)

- Total Loans Sanctioned: ?5.4 trillion across 66.8 million loans in FY 2023-24.

- Loans Disbursed: Significant amounts were disbursed under each category:

- Shishu: ?1,08,472.51 crore

- Kishore: ?1,00,370.49 crore

- Tarun: ?13,454.27 crore

- Women Borrowers: A large share of loans have gone to women entrepreneurs, ensuring gender inclusivity.

- Minority Borrowers: The scheme also emphasizes financial empowerment of minority communities.

- NPA Reduction: The Non-Performing Assets (NPA) in Mudra loans have reduced to 3.4% in FY 2024, compared to higher levels in earlier years.

Digital Tools and Support Systems

MUDRA MITRA App

The MUDRA MITRA mobile app helps users access information about the PMMY scheme, loan application procedures, and other resources. The app is available for download on Google Play Store and Apple App Store.

Online Loan Application

Entrepreneurs can apply for loans online via portals such as PSBloansin59minutes and Udyamimitra, providing greater convenience and accessibility.

Steps to Improve Implementation

- Handholding Support: Assistance in submitting loan applications is available for applicants.

- Intensive Awareness Campaigns: The government conducts publicity campaigns to raise awareness about PMMY.

- Simplified Loan Process: The loan application forms have been simplified to encourage wider participation.

- Performance Monitoring: Regular monitoring of PMMY implementation to ensure its success.

- Interest Subvention: A 2% interest subvention is offered for prompt repayment of Shishu loans.

Conclusion

The Pradhan Mantri Mudra Yojana has been a transformative scheme in fostering entrepreneurship and ensuring financial inclusion for small and micro-businesses across India. With the recent increase in loan limits and the addition of the Tarun Plus category, the scheme continues to empower emerging entrepreneurs and provides a crucial lifeline for business growth and sustainability. By supporting women, minorities, and new entrepreneurs, PMMY has contributed significantly to economic upliftment and inclusive growth in the country.