Union's Control of Financial Flows to State Governments (Indian Express)

- 07 Feb 2024

Why is it in the News

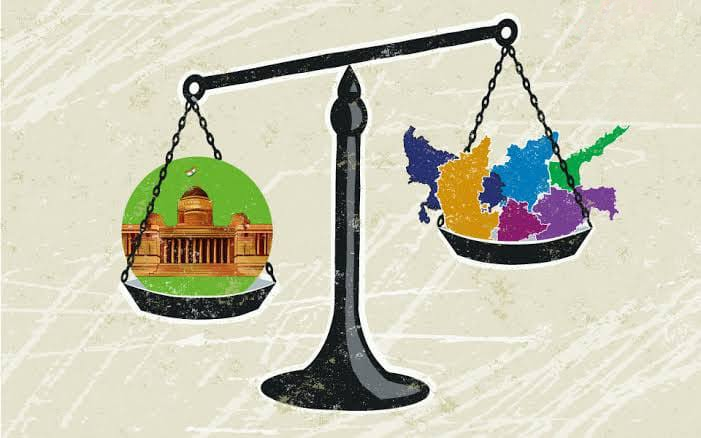

The Union government’s moves, which reduce the aggregate financial transfers to States, are weakening cooperative federalism.

Background:

- The fiscal dynamics between the Union government and the states in India have experienced notable shifts since the tenure of the 14th Finance Commission (FC) award period (2015-16).

- Official data indicates a trend of diminishing financial transfers from the Union government to the states.

- Thus, it becomes imperative to analyze the nuances of these financial transfers, delving into the deviations from the recommendations of FCs, their repercussions on states, and the potential ramifications for federal fiscal policies.

An Evaluation of Deviation from Finance Commission Recommendations:

- Recommendation of Substantial Shift in Devolution by 14th FC: Recognising the imperative of empowering the States, the 14th FC recommended a significant increase in the devolution of Union tax revenues.

- Specifically, the recommendation was to devolve 42% of Union tax revenues to the States, marking a substantial 10 percentage points increase from the preceding 13th FC's suggestion.

- This ambitious shift was intended to enhance the financial autonomy of the States, aligning with the principles of cooperative federalism.

- Deviation from FC Recommendations by the Union Government: Instead of adhering to the recommended increase, there has been a consistent reduction in financial transfers to the States.

- This deviation is particularly perplexing given that the 15th FC retained the recommendation of 41%.

- It excluded the devolution to Jammu and Kashmir (J&K) and Ladakh, which were reorganized as Union Territories.

- If the shares of J&K and Ladakh are included, the recommended devolution should stand at 42%.

- The Dynamics of Financial Transfers of Tax Revenue: The analysis of tax revenue provides a critical understanding of dynamics of financial transfers between the Union government and the States.

- The Finance Commissions recommend the States' share based on the net tax revenue of the Union government.

- It is derived after accounting for various factors such as collection costs, revenue assigned to Union territories, and the impact of cess and surcharge.

Analysis of Tax Revenue Disparities:

- Contrasting Trends in States' Share: A Departure from FC Guidelines: The Fourteenth and Fifteenth Finance Commissions recommended states' shares of 42% and 41%, respectively, of the net tax revenue.

- However, the actual share of gross tax revenue stood at only 35% in 2015-16, dwindling further to 30% in the 2023-24 Budget Estimate.

- This discrepancy assumes significance, particularly against the backdrop of a significant surge in the Union government's gross tax revenue, soaring from ?14.6 lakh crore in 2015-16 to ?33.6 lakh crore in 2023-24.

- Disparities in Revenue Growth: The more than two-fold increase in the Union government's gross tax revenue over this period starkly contrasts with the doubling of states' share in Union tax revenue.

- This discrepancy raises concerns regarding equitable resource distribution.

- Essentially, the widening gap between the Union government's revenue generation and states' share indicates a disproportionate augmentation in the former's fiscal capacity.

- Declining Grants-in-Aid: The disparity becomes more evident when analyzing grants-in-aid to states, another statutory grant recommended by the Finance Commission.

- The absolute amount of grants-in-aid declined from ?1.95 lakh crore in 2015-16 to ?1.65 lakh crore in 2023-24.

- Consequently, the collective share of statutory financial transfers in the Union government's gross tax revenue witnessed a notable decline, plummeting from 48.2% to 35.32%.

Potential Factors Contributing to Decreasing States’ Share:

- Calculation Methodology: One of the primary factors behind the dwindling share of states in gross revenue lies in the calculation method.

- The net tax revenue, used to determine states' share, excludes revenue collections under cess and surcharge, revenue from Union Territories, and tax administration expenditure.

- Role of Cess and Surcharge: In 2015-16, revenue collection through cess and surcharge accounted for 5.9% (?85,638 crore) of gross tax revenue, increasing to 10.8% (?3.63 lakh crore) by 2023-24.

- This notable surge underscores the Union government's strategic utilization of cess and surcharge to channel funds for specific sectoral schemes, enhancing its financial autonomy.

- Exclusion of States from Cess and Surcharge Revenues: The revenues generated through these additional levies are not shared with states, highlighting a more centralized control over financial resources by the Union government.

- This selective exclusion limits resources available for devolution to states, potentially impacting their financial autonomy.

Centralization of Public Expenditure and Its Implications:

- Union Government’s Routes of Financial Transfer: Apart from traditional financial transfers like tax devolution and grants-in-aid, the Union government employs Centrally Sponsored Schemes (CSS) and Central Sector Schemes (CSec Schemes) for direct financial transfers to states.

- Influencing State Priorities Through CSS: Under CSS, the Union government proposes schemes and provides partial funding, compelling states to align their priorities with those proposed by the Union government.

- The allocation for CSS has substantially increased from ?2.04 lakh crore to ?4.76 lakh crore between 2015-16 and 2023-24, although actual financial transfers to states under CSS remain lower than allocated funds.

- CSec Schemes and Exclusive Control: Fully funded by the Union government, CSec Schemes operate in sectors where the Union government holds exclusive legislative or institutional controls.

- The significant increase in allocation for CSec Schemes from ?5.21 lakh crore to ?14.68 lakh crore between 2015-16 and 2023-24 underscores the Union government's preference for such schemes.

- Potential Bias in Resource Allocation: The decentralized implementation of CSec Schemes grants the Union government considerable latitude in allocating financial resources, raising concerns about potential bias in resource distribution.

- Challenges for Cooperative Federalism: The downward revision of states' share in Union tax revenue from 42% to 41%, despite recommendations by the 15th Finance Commission, poses challenges to cooperative federalism.

- Future discussions before the 16th Finance Commission might continue to address such challenges, potentially impacting collaborative federalism.

Conclusion

The evolving financial landscape between the Union government and states in India underscores the imperative for a comprehensive review of the fiscal architecture. Deviations from Finance Commission recommendations, increasing reliance on non-statutory transfers, and potential biases in resource allocation challenge the principles of cooperative federalism. Addressing these issues is essential to ensure equitable distribution of resources and foster collaborative governance between the Union and states, thus reinforcing the foundation of cooperative federalism for inclusive and sustainable development across the nation.