Union Budget 2025–26

- 03 Feb 2025

In News:

Union Minister for Finance and Corporate Affairs Smt Nirmala Sitharaman presented Union Budget 2025-26 in the Parliament.

Key Highlights:

Fiscal Policy and Macroeconomic Indicators

- Total Expenditure: ?50.65 lakh crore

- Total Receipts (excl. borrowings): ?34.96 lakh crore

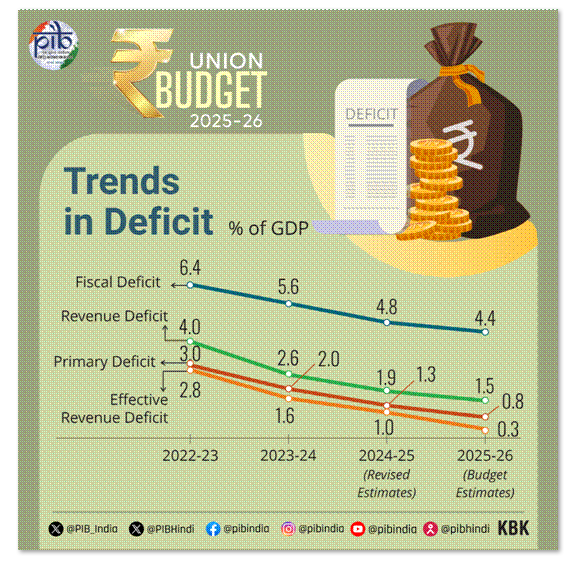

- Fiscal Deficit: 4.4% of GDP

- Gross Market Borrowing: ?14.82 lakh crore

- Capital Expenditure: ?11.21 lakh crore (3.1% of GDP)

Agriculture and Allied Sectors

- Prime Minister Dhan-Dhaanya Krishi Yojana: 100 low-productivity districts targeted; 1.7 crore farmers to benefit.

- Mission for Aatmanirbharta in Pulses: 6-year mission on Tur, Urad, and Masoor; NAFED/NCCF to procure for 4 years.

- Vegetables & Fruits Program: Comprehensive initiative for production, pricing, processing, and logistics.

- Makhana Board: New board in Bihar for production, value addition, and export.

- National Mission on High Yielding Seeds: To commercialize over 100 high-yielding seed varieties.

- Cotton Mission: 5-year initiative to boost productivity and Extra Long Staple (ELS) varieties.

- Fisheries: New EEZ and High Seas Framework focusing on Islands.

- Credit through KCC: Loan limit increased from ?3 lakh to ?5 lakh.

- Urea Plant in Assam: New plant at Namrup (12.7 lakh MT annual capacity).

MSMEs and Startups

- MSME Classification: Investment and turnover limits doubled (2.5x & 2x).

- Credit Cards for Micro Units: ?5 lakh limit; 10 lakh cards in year one.

- ?10,000 Cr Fund of Funds for Startups

- First-Time Entrepreneurs Scheme: Loans up to ?2 crore for 5 lakh women, SC/ST entrepreneurs.

- Footwear & Leather Sector Scheme: Aims ?4 lakh crore turnover and 22 lakh jobs.

- Toy Manufacturing Support: High-quality, eco-friendly toy ecosystem.

- Food Tech Institute: To be established in Bihar.

- National Manufacturing Mission: Across small, medium, and large units.

Infrastructure and Investment

- PPP Pipeline: 3-year project pipeline to be announced.

- ?1.5 lakh crore 50-year interest-free loans to states for CapEx.

- Urban Challenge Fund: ?1 lakh crore outlay; ?10,000 crore for FY26.

- Asset Monetization Plan 2025–30: Capital recycling worth ?10 lakh crore.

- Jal Jeevan Mission: Extended to 2028 with enhanced outlay.

- UDAN 2.0: Targeting 120 new destinations, 4 crore passengers in 10 years.

- Maritime Development Fund: ?25,000 crore; up to 49% govt contribution.

- Nuclear Energy Mission: ?20,000 crore outlay for Small Modular Reactors (SMRs).

- Greenfield Airports: Announced for Bihar.

Welfare and Social Security

- Saksham Anganwadi & Poshan 2.0: Enhanced nutritional cost norms.

- Medical Education: 10,000 new MBBS seats; 75,000 in 5 years.

- Day Care Cancer Centres: In all district hospitals; 200 in FY26.

- PM SVANidhi Revamp: ?30,000 UPI-linked credit cards.

- Online Platform Workers: E-Shram ID, PMJAY coverage.

- Urban Livelihood Scheme: For sustainable urban worker incomes.

Education and Skilling

- 50,000 Atal Tinkering Labs: Govt schools in 5 years.

- Bharatiya Bhasha Pustak Scheme: Digital books in Indian languages.

- National Skilling Centres of Excellence: With global partners.

- AI in Education: Centre of Excellence with ?500 crore outlay.

- IIT Expansion: Additional capacity for 6,500 students.

Innovation and R&D

- ?20,000 crore Innovation Fund (private-led R&D).

- Deep Tech Fund of Funds: For next-gen startups.

- PM Research Fellowships: 10,000 fellowships with higher support.

- 2nd Gene Bank: 10 lakh germplasm lines for food security.

- National Geospatial Mission

- Gyan Bharatam Mission: Conservation of 1 crore+ manuscripts.

Exports and Trade

- Export Promotion Mission: With ministerial and sectoral targets.

- BharatTradeNet (BTN): Unified platform for trade finance and docs.

- GCC Framework: Promote Global Capability Centres in Tier-2 cities.

Financial Sector Reforms

- FDI in Insurance: Raised from 74% to 100% for domestic investment.

- NaBFID Credit Enhancement Facility: For infra bonds.

- Grameen Credit Score: For SHGs and rural borrowers.

- Investment Friendliness Index: To rank states in 2025.

- Jan Vishwas Bill 2.0: Decriminalization of 100+ provisions.

- Tonnage Tax Extended: To inland vessels.

- Startups: Tax benefit eligibility extended to incorporation by 1 April 2030.

Taxation Reforms

Direct Taxes

- No Personal Tax: Income up to ?12 lakh (?12.75 lakh for salaried) under new regime.

- Revised Tax Slabs (New Regime):

- 0–4L: Nil | 4–8L: 5% | 8–12L: 10%

- 12–16L: 15% | 16–20L: 20% | 20–24L: 25% | 24L+: 30%

- Standard Deduction: ?75,000

- Compliance Relief: Trusts registration extended to 10 years.

- TDS/TCS Rationalization: Fewer thresholds, higher limits for senior citizens and rent.

- Tax Certainty: Safe harbour rules, startup extensions, presumptive taxation for electronics.

Indirect Taxes

- Tariff Rationalization: Only 8 remaining tariff rates.

- Customs Relief: ?2,600 crore forgone, key lifeline drugs exempted.

- Support to Domestic Manufacturing:

- EV/mobile battery manufacturing: 63 capital goods exempted

- Ships: BCD exemption extended for 10 years

- Marine, leather, textiles: Several BCD reductions/exemptions

- Voluntary Compliance Scheme: Without penalty for post-clearance corrections.