Gig Economy and Gig Workers (Indian Express)

- 26 Jul 2023

Why in the News?

The Rajasthan government recently enacted the Rajasthan Platform Based Gig Workers (Registration and Welfare) Bill in the year 2023.

- Highlights of the Bill:

Rajasthan Platform-based Gig Workers Welfare Board will formulate welfare policies and address grievances of piece-rate gig workers.

- The board can determine the aggregator's cess percentage for the social welfare corpus, based on transaction volumes on the platform.

- Unique ID:

- All gig workers registered with any platform will automatically be registered with the board, receiving a unique ID valid for three years.

- Penalty:

- Violating data sharing and worker employment rules can result in fines up to 10 lakh for the first offense and up to 1 crore for subsequent ones.

- Suspension Authority:

- The board is authorized to recommend temporary or permanent suspension of errant aggregators in the state.

- Public Feedback:

- The draft Bill will soon be made available to the public for feedback, currently with the Law department.

- What is Gig Economy?

- The Gig economy offers flexible work arrangements, allowing individuals to take up short-term or part-time jobs based on their availability and preferences.

- It heavily relies on digital platforms and apps that connect gig workers with customers or clients seeking specific services.

- Many people engage in gig work to supplement their income or as a source of additional earnings, making it easier to diversify their income streams.

- The gig economy has faced controversies regarding worker rights, fair pay, and debates over whether gig workers should be classified as employees with access to employment benefits.

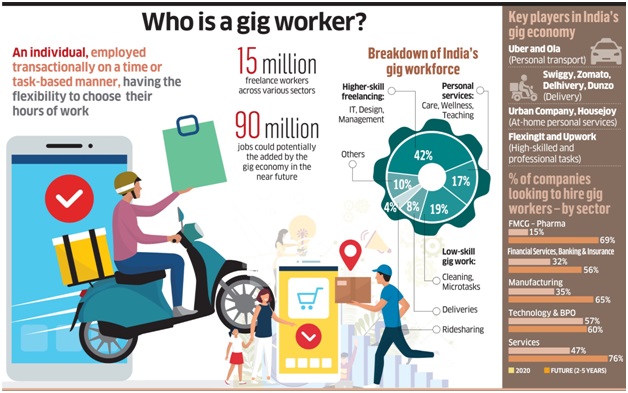

- Who are gig workers?

- As per the Code on Social Security, 2020, a gig worker is an individual who engages in work or work arrangements and earns from such activities independently, outside the scope of a conventional employer-employee relationship.

- Gig workers can be broadly classified into platform and non-platform-based workers.

- Platform Workers:

- These workers refer to individuals who perform tasks or services through online software apps or digital platforms like Zomato, Swiggy, Ola, and others.

- Non-platform Workers:

- These workers are typically casual wage and own-account workers in traditional sectors, working either part-time or full-time.

- Gig Economy in India:

- As per NITI Aayog's report titled 'India's Booming Gig and Platform Economy':

- Gig workers are individuals involved in income-earning activities beyond the conventional employer-employee arrangement and may also operate within the informal sector.

- According to a 2019 report by the India Staffing Federation, India is the fifth largest in flexi-staffing globally, after the US, China, Brazil and Japan.

- In 2020, approximately 7.7 million workers were actively engaged in the gig economy.

- The gig workforce is expected to grow significantly, reaching 23.5 million workers by the year 2029-30.

- Currently, around 47% of gig work falls under medium-skilled jobs, 22% in high-skilled, and 31% in low-skilled jobs.

- There is a noticeable trend showing a gradual decline in medium-skilled workers' concentration, while the number of low-skilled and high-skilled workers is on the rise.

- Challenges faced by Gig workers:

- Impact on Full-time Employment Growth: The gig economy trend can hinder the growth of full-time employment as some employers may prefer to hire contracted workers due to cost-effectiveness and flexibility.

- Disruption of Work-life Balance: For certain workers, the flexibility of gig work can lead to disruptions in work-life balance, affecting sleep patterns and daily activities.

- Potential Replacement of Full-time Employees: Freelance workers in the gig economy may replace the need for a higher number of full-time employees within a company.

- Lack of Job Security: In the gig economy, workers have a more entrepreneurial role, which means they may experience less job security with no guaranteed steady income, pay, or benefits.

- Absence of Regular Job Benefits: Employers often avoid providing benefits such as health coverage and paid vacation time to gig workers, as they are not part of a formal employment relationship with the platform company. This lack of benefits can make short-term contracts less appealing and challenging to include on resumes.

- Government Initiatives for Gig Workers India:

- Code of Social Security, 2020: The Government introduced the Code on Social Security, 2020, aiming to develop suitable social security schemes for gig workers and platform workers, covering aspects like life and disability insurance, accident coverage, health and maternity benefits, and old age protection.

- However, these provisions are yet to be implemented.

- e-Shram Portal: In 2021, the Government launched the e-Shram portal, designed for the registration and establishment of a Comprehensive National Database of Unorganized Workers, including gig workers and platform workers.

- This portal facilitates self-declaration registration for individuals engaged in approximately 400 different occupations.

- Way Forward

The Gig Economy holds promising opportunities for India's extensive workforce, particularly for low-skilled laborers. To harness its potential, the Government should take proactive measures to foster the growth of gig economy platforms. Simultaneously, safeguarding the welfare of gig workers is crucial, ensuring fair working conditions and access to social security benefits. Striking this balance will require collaborative efforts from all stakeholders involved.

- Mains Question:

Discuss the Government's role in supporting the Gig Economy while safeguarding gig workers' interests. How can a balance be achieved between promoting the gig economy and protecting the welfare of gig workers? (20 M)