India’s Startup Revolution

- 15 Jan 2025

Context

India has solidified its position as one of the most dynamic startup ecosystems globally, emerging as a hub for innovation, entrepreneurship, and technological progress. However, realizing its ambition of becoming the top startup ecosystem requires addressing critical challenges and leveraging available opportunities.

Current Landscape of Indian Startups

Growth and Innovation

India ranks as the third-largest startup ecosystem in the world, following the U.S. and China. As of January 15, 2025, over 1.59 lakh startups have been officially recognized by DPIIT, with more than 120 attaining unicorn status (valuation exceeding $1 billion).

Investment Trends

Despite economic fluctuations, India's startups continue to attract significant investments. In 2022, venture capitalists infused $25 billion into the ecosystem, reaffirming India’s position as a preferred destination for global investors. Although there was a slowdown in 2023, domains like Software as a Service (SaaS) and climate tech continue to secure substantial funding.

Government Support

India’s startup-friendly policies, including Startup India, Digital India, and Atmanirbhar Bharat, have created an enabling environment. Notable initiatives include:

- Tax incentives, faster patent approvals, and regulatory relaxations.

- The launch of a ?10,000 crore Fund of Funds for Startups (FFS) in 2023 to improve capital accessibility.

- The Bharat Startup Knowledge Access Registry (BHASKAR) to streamline collaboration among startups and investors.

Regional Growth

- Tier II and III Expansion: Nearly 50% of startups are now based in emerging hubs such as Indore, Jaipur, and Ahmedabad.

- Tamil Nadu: The state boasts a $28 billion startup ecosystem, growing at 23%. Chennai alone houses around 5,000 startups, significantly contributing to employment generation.

- Kerala: With a $1.7 billion startup ecosystem, Kerala exhibits a compound annual growth rate of 254%, emphasizing cost-effective tech talent hiring.

Key Challenges Faced by Startups

1. Funding Constraints

The global economic downturn, coupled with rising interest rates, has limited venture capital inflows, resulting in layoffs and operational cutbacks.

2. Regulatory and Compliance Barriers

Despite government support, startups grapple with complex tax structures, evolving data protection laws, and stringent compliance requirements, including ESOP taxation policies.

3. Scaling and Market Adaptability

Many startups struggle with operational inefficiencies, limited market penetration, and inadequate infrastructure, hampering growth potential.

4. High Failure Rate

Approximately 90% of Indian startups fail within five years due to poor product-market fit, lack of financial planning, and insufficient adaptation to market needs.

5. Talent Shortages

India faces stiff competition in acquiring skilled professionals in areas like AI, cybersecurity, and machine learning, making retention increasingly difficult amid economic uncertainties.

Strategic Measures to Strengthen India’s Startup Ecosystem

1. Enhancing Policy Frameworks

- Simplified Regulations: Streamline startup registration, funding approvals, and international business operations.

- IP Protection: Strengthen intellectual property laws to boost R&D investment.

- Sector-Specific Initiatives: Develop targeted policies for AI, deep tech, healthcare, and green technologies.

2. Expanding Funding Access

- Encouraging Domestic Investment: Leverage pension and sovereign wealth funds to invest in startups.

- Public-Private Partnerships: Foster large-scale government-industry collaboration to finance emerging ventures.

- Decentralized Funding: Expand angel investor networks and micro-investment opportunities, particularly in Tier II and III cities.

3. Building Robust Infrastructure

- Tech Parks and Incubation Centers: Establish state-of-the-art facilities with mentorship programs.

- Improved Digital Connectivity: Ensure high-speed internet access in underserved regions.

- Enhanced Logistics and Supply Chains: Strengthen infrastructure to support startup scalability.

4. Developing a Skilled Workforce

- STEM and Entrepreneurial Education: Introduce curriculum enhancements in technical and business disciplines.

- Upskilling Programs: Collaborate with industry leaders to train professionals in high-demand skills.

- Diversity and Inclusion: Promote initiatives encouraging women and marginalized communities in entrepreneurship.

5. Fostering Innovation and Risk-Taking

- Strengthened R&D Funding: Increase allocations to universities and private research sectors.

- Encouraging Entrepreneurship: Reduce societal stigma surrounding startup failures to promote risk-taking.

- Leveraging Domestic Challenges: Address local issues like climate change and urbanization through innovation.

6. Expanding Global Reach

- International Collaborations: Partner with foreign accelerators and governments.

- Ease of Cross-Border Trade: Simplify export and import regulations for startups.

- Engaging the Indian Diaspora: Encourage successful overseas entrepreneurs to mentor and invest in Indian startups.

7. Advancing Sustainability Goals

- Green Tech Promotion: Support startups focusing on renewable energy and circular economy initiatives.

- Eco-Friendly Incentives: Offer financial support to ventures aligning with sustainability targets.

- Inclusive Growth Strategies: Expand agritech, edtech, and health-tech startups in rural areas, supporting platforms like the Women Entrepreneurship Platform (WEP) by NITI Aayog.

Building a Resilient Digital Economy

To fortify India's digital economy, startups should leverage existing infrastructure like UPI and Aadhaar while capitalizing on emerging technologies such as AI, 5G, and blockchain. A robust cybersecurity framework and data protection policies will be essential to ensure investor confidence.

Sustainable Groundwater Management in India’s Agriculture

- 30 Dec 2024

Introduction: Groundwater Crisis and Agriculture

- India's Agricultural Dependence on Groundwater: India is a leading producer of water-intensive crops like rice, wheat, and pulses. The country’s agricultural sector heavily depends on groundwater for irrigation, especially for paddy cultivation.

- Over-exploitation of Groundwater: Groundwater extraction for irrigation is increasingly unsustainable, threatening agricultural sustainability in the long term.

Rising Groundwater Usage and Its Implications

- Population Growth and Groundwater Use: Between 2016 and 2024, global population grew from 7.56 billion to 8.2 billion, and India’s population rose from 1.29 billion to 1.45 billion. Concurrently, groundwater used for irrigation increased from 38% in 2016-17 to 52% in 2023-24, exacerbating the water crisis.

- Over-extraction in Major Paddy-Producing States: States like Rajasthan, Punjab, and Haryana have witnessed severe over-exploitation of groundwater for irrigation.

- Rajasthan: Highest groundwater salinisation (22%) despite receiving the highest average rainfall (608 mm) among these states.

- Punjab and Haryana: Lesser groundwater salinity due to canal irrigation and micro-irrigation systems.

Impact of Excessive Fertilizer Use on Groundwater Quality

- Soil Salinity and Groundwater Contamination: Excessive use of fertilizers, particularly for paddy cultivation, increases soil salinity and contributes to groundwater contamination.

- Toxic Chemicals in Groundwater: Nitrate contamination, caused by nitrogen-based fertilizers, and uranium contamination due to phosphate fertilizers are key concerns in states like Maharashtra, Telangana, Andhra Pradesh, and Tamil Nadu.

- Health Risks: Contaminated groundwater poses health risks such as thyroid disorders, cancer, and dental fluorosis, along with reduced agricultural productivity.

Projected Impact on Future Groundwater Availability

- Unsustainable Groundwater Levels: The Central Groundwater Board (CGWB) reports that if current practices continue, over half of the districts in Punjab could face groundwater depletion. Similarly, 21-23% of districts in Haryana and Rajasthan may experience a similar crisis.

- Population Growth and Water Scarcity: With India’s population expected to reach 1.52 billion by 2036, the need for sustainable groundwater management becomes even more critical.

Government Initiatives for Groundwater Management

- National Mission for Sustainable Agriculture (2014): Promotes sustainable practices like zero tillage, cover cropping, and micro-irrigation for efficient water and chemical use.

- Pradhan Mantri Krishi Sinchai Yojana (2015): Aims to boost irrigation efficiency through drip and sprinkler irrigation methods.

- Atal Bhujal Yojana (2019): Targets efficient groundwater management in water-stressed states like Gujarat, Haryana, Rajasthan, Maharashtra, and Uttar Pradesh.

- Success of Government Initiatives: CGWB data shows that the percentage of districts with unsustainable groundwater levels dropped from 23% in 2016-17 to 19% in 2023-24.

Role of State Governments in Groundwater Management

- State-Level Initiatives: States with unsustainable groundwater levels must take proactive measures to manage water resources efficiently.

- Example - Odisha: Odisha's Integrated Irrigation Project for Climate Resilient Agriculture emphasizes irrigation efficiency and climate-smart practices, supported by World Bank funding.

- Encouraging Resource-Efficient Agriculture: States with safe groundwater levels, like Chhattisgarh, Bihar, Jharkhand, Telangana, and Odisha, should adopt water-efficient practices to protect groundwater resources.

Conclusion: Ensuring Agricultural Sustainability and Water Security

- Need for Urgent Action: Scaling up efforts to improve irrigation practices and groundwater management is crucial to securing India’s agricultural future.

- Global Food Security: Protecting groundwater resources will not only ensure water security within India but also contribute to global food security amid climate challenges.

- Blueprint for Sustainable Agriculture: States like Odisha are providing a model for sustainable water management, which can be replicated across water-stressed regions in India.

Bank Credit to Women Self-Help Groups (SHGs)

- 21 Dec 2024

Introduction

The Deendayal Antyodaya Yojana – National Rural Livelihoods Mission (DAY-NRLM) is a flagship program by the Ministry of Rural Development (MoRD) that aims to reduce poverty by empowering women, especially through Self-Help Groups (SHGs). These SHGs have been instrumental in improving financial inclusion, providing access to credit, and enhancing the economic and social status of women across India. The program has made significant strides in mobilizing women, improving their access to financial services, and facilitating entrepreneurial ventures in rural areas.

Key Features and Initiatives of DAY-NRLM

- Self-Help Groups (SHGs):

- Formation: DAY-NRLM supports the creation and strengthening of SHGs, primarily focusing on rural women from economically disadvantaged backgrounds.

- Mobilization: As of 2024, over 10.05 crore women have been mobilized into 90.87 lakh SHGs across India.

- Objective: The main goal is to reduce poverty through empowerment by providing access to financial services and sustainable livelihoods.

- Start-up Village Entrepreneurship Programme (SVEP):

- Support for Rural Enterprises: SVEP, a sub-scheme under DAY-NRLM, encourages SHG women and their families to set up small-scale businesses.

- Impact: As of October 2024, 3.13 lakh rural enterprises have been supported under this initiative.

- State-wise Distribution: The program has supported enterprises across various states, with notable contributions from Andhra Pradesh (27,651 enterprises), Kerala (34,569), and Uttar Pradesh (28,904).

- Banking Correspondent Sakhis:

- Role: Women in SHGs are trained as Banking Correspondent Sakhis to enhance access to banking services such as deposits, credit, remittances, pensions, and insurance in rural areas.

- Current Deployment: 1,35,127 Sakhis have been deployed under DAY-NRLM, empowering women to be financial intermediaries in their communities.

- Financial Support for SHGs:

- Revolving Fund: SHGs receive funds ranging from Rs. 20,000 to Rs. 30,000 to boost their operations and financial stability.

- Community Investment Fund: SHGs can avail of up to Rs. 2.50 lakh under the Community Investment Fund to strengthen their financial position.

- Interest Subvention: To make bank loans more affordable, DAY-NRLM provides interest subvention to SHGs, reducing their overall credit costs.

- Online Marketing Platform:

- www.esaras.in: This online platform allows SHGs to market their products, improving their access to broader markets and enhancing their income-generating potential.

Impact of DAY-NRLM and SHGs

- Financial Inclusion: SHGs play a vital role in financial inclusion by providing access to banking services, loans, and insurance to women, especially in rural and remote areas.

- Credit Mobilization: As of November 2024, SHGs have leveraged Rs. 9.71 lakh crore in bank credit, thanks to the capitalization support provided by DAY-NRLM, including Revolving Funds and Community Investment Funds.

- Empowerment of Women: SHGs have significantly contributed to the empowerment of women, providing them with financial independence, social support, and the ability to make decisions in their households and communities.

Challenges Faced by SHGs

- Beneficiary Identification: Ensuring that the most marginalized individuals are included in SHGs can be challenging.

- Training Gaps: There is a lack of quality training programs and expert trainers to build the capacity of SHG members.

- Financial Literacy: Many SHG members have limited knowledge of formal financial services, hindering effective financial management.

- Market Linkages: Poor integration with markets limits the growth potential of SHGs, especially in terms of product sales and business expansion.

- Community Support: Insufficient business environment support and value chain linkages pose challenges to SHG sustainability and growth.

Government Initiatives Supporting SHGs

- SHG-Bank Linkage Programme (SBLP): Launched by NABARD in 1992, this initiative aims to link SHGs with formal banking institutions, facilitating financial inclusion.

- Mission for Financial Inclusion (MFI): A broader initiative to ensure that rural populations have access to affordable financial services such as savings, credit, insurance, and pensions.

- Lakhpati Didi Initiative: Launched in 2023, this initiative empowers SHG women to adopt sustainable livelihood practices and aim for an annual household income exceeding Rs. 1 lakh.

Role of SHGs in Rural Development

- Women Empowerment: SHGs have emerged as a powerful tool for empowering women through financial independence, social security, and the ability to make informed decisions.

- Economic Growth: SHGs foster small-scale entrepreneurship, thereby creating local businesses that contribute to rural economic growth.

- Social Cohesion: By promoting collective action, SHGs provide a social support system that helps in addressing common issues faced by their members, such as health, education, and safety.

Future Prospects and Way Forward

- Technological Integration: SHGs should leverage advanced digital platforms for transaction management, record-keeping, and communication, enhancing efficiency and accessibility.

- Reducing Informal Borrowing: Linking SHGs with formal financial institutions will reduce reliance on informal lenders, promoting financial inclusion.

- Inclusive Approach: SHGs should adopt an inclusive model to ensure that members from diverse socio-economic backgrounds are fairly represented and benefit equally.

- Training and Capacity Building: There is a need for more Community Resource Persons (CRPs) who can guide SHGs in beneficiary identification, financial management, and scaling their activities.

The Costly Push for 100% Electrification of Indian Railways

- 19 Dec 2024

Introduction

RITES Ltd., the consultancy arm of the Indian Railways, has secured two contracts to repurpose six broad gauge diesel-electric locomotives for export to African railways. These locomotives, originally designed for India’s broad gauge of 1,676 mm, will be modified for use on railways with the narrower Cape Gauge of 1,067 mm. While this is a commendable re-engineering effort, it also highlights a larger issue within Indian Railways: the unnecessary redundancy of functional diesel locomotives, leading to significant wastage of resources.

The Growing Problem of Idle Diesel Locomotives

As of March 2023, there were 585 diesel locomotives idling across the Indian Railways network due to electrification. This number has now reportedly grown to 760 locomotives, many of which still have more than 15 years of serviceable life. The root cause of this redundancy lies in the government’s mission to electrify the entire broad gauge network at an accelerated pace. This electrification push has resulted in the premature retirement of locomotives that could still serve the network for years, raising questions about the economic and environmental logic behind this decision.

The Justification for Electrification: Foreign Exchange and Environmental Concerns

The Indian government’s electrification drive is often justified on two primary grounds: saving foreign exchange by reducing the import of crude oil and reducing environmental pollution. Additionally, electrification is framed as a step toward a “green railway” powered by renewable energy sources like solar and wind. However, the reality of these claims is more complicated.

Foreign Exchange Savings: A Small Impact on National Diesel Consumption

While electrification may reduce India’s diesel consumption, the impact on national fuel use is minimal. Railways account for just 2% of the country’s total diesel consumption. A report by AC Nielsen in 2014 indicated that the transport sector consumed 70% of the total diesel, with railways accounting for only 3.24%. Even with 100% electrification, the savings in foreign exchange would have little impact on the country’s overall diesel consumption, leaving other sectors like trucking and agriculture as the main contributors.

Environmental Concerns: Shifting Pollution, Not Reducing It

The environmental argument for electrification is also flawed. Electricity in India is still largely generated from coal-fired power plants, with nearly 50% of the country’s electricity coming from coal. Since the Indian Railways is heavily involved in transporting coal, switching from diesel to electric locomotives simply shifts pollution from the tracks to the power plants. This means that the transition to electric traction will not result in a cleaner environment unless the country significantly reduces its reliance on coal. Without a substantial increase in renewable energy generation, the push for a “green railway” remains unrealistic.

The Dilemma of Retaining Diesel Locomotives for Strategic Purposes

Despite the goal of 100% electrification, a significant number of diesel locomotives will remain in service. Reports indicate that 2,500 locomotives will be kept for “disaster management” and “strategic purposes,” although it is unclear why such a large fleet is necessary for these purposes. Additionally, about 1,000 locomotives will continue to operate for several more years to meet traffic commitments. This suggests that even with a fully electrified network, Indian Railways will continue to rely on thousands of diesel locomotives, many of which have substantial residual service life left.

Financial Sustainability and Coal Dependency

The financial sustainability of this transition remains a concern. Currently, the Indian Railways generates a significant portion of its freight revenue from transporting coal—40% of its total freight earnings in 2023-24. If the railways become fully electrified, it will need to find alternative revenue sources, as coal is a primary contributor. Until non-coal freight options can replace this income, the financial health of the railways may be at risk.

Conclusion: Wasted Resources and Unmet Goals

The mission to electrify the Indian Railways, while ambitious, is an example of how vanity projects can lead to colossal waste. Thousands of diesel locomotives are being discarded prematurely, despite their potential to continue serving the network. The environmental and financial justifications for 100% electrification, while appealing in theory, fail to account for the complexities of India’s energy landscape. As a result, the drive to create a “green railway” is likely to fall short, leaving behind a legacy of wasted taxpayer money and unfinished goals.

Asset Monetisation

- 15 Oct 2024

In News

The NITI Aayog has recently increased the asset monetisation target for the fiscal year 2024-25 (FY25) by ?23,000 crore, bringing the total to ?1.9 trillion. This adjustment aligns with the broader target of ?6 trillion set under the National Monetisation Pipeline (NMP) for the period from FY 2022 to FY 2025.

Understanding Asset Monetisation

Definition

Asset monetisation refers to the process of converting public assets into revenue-generating assets without selling them outright. This includes using assets to generate profit or cash, thereby unlocking their economic value.

Importance

- Revenue Generation: Monetisation creates new revenue streams for governments by leveraging underutilised public assets.

- Focus on Public Assets: The emphasis is on monetising existing infrastructure such as roads, airports, railways, and pipelines, primarily targeting brownfield assets—those that can be improved or repurposed.

Monetisation vs. Privatisation

While privatisation involves complete ownership transfer to the private sector, asset monetisation allows public authorities to retain ownership while benefiting from private sector efficiencies through structured partnerships.

The National Monetisation Pipeline (NMP)

Overview

The NMP is an initiative aimed at promoting sustainable infrastructure financing through the monetisation of operational public assets. It envisions a monetisation potential of ?6 lakh crore, focusing on leasing core assets from the Central government and public sector entities.

Preparation and Coverage

- Collaborative Approach: Developed by NITI Aayog in consultation with infrastructure ministries such as Roads, Railways, and Power.

- Sector Coverage: Encompasses various sectors including roads (27% of the total value), railways (25%), power (15%), and telecom (6%).

Framework for Monetisation

- Retention of Rights: The government retains ownership, with assets reverting to public authorities post-transaction.

- Stable Revenue Streams: Focus on de-risked brownfield assets that provide consistent revenue.

- Defined Partnerships: Establishment of contractual frameworks with strict performance indicators.

Alignment with National Infrastructure Pipeline (NIP)

The NMP is integrated with the NIP, which seeks to attract investments in both greenfield and brownfield projects across all sectors.

Current Status of the NMP

Revenue Generation

As of FY24, the NMP has generated ?3.9 trillion, slightly below the original target of ?4.3 trillion for the initial three years.

Successful Monetisation Examples

- The Ministry of Coal exceeded its target, raising ?1.54 trillion against a goal of ?80,000 crore.

- Mining assets have also been monetised significantly, surpassing their revised targets.

Sectors Lagging

- Railways: Only ?20,417 crore monetised, achieving just 30% of the target.

- Civil Aviation: A mere 14% of its targeted monetisation has been achieved.

Challenges Facing the NMP

- Low Monetisation Potential: The NMP's ?6 lakh crore target represents only a small fraction (5-6%) of the total capital expenditure under the NIP.

- Disinvestment Issues: Many sectors chosen for monetisation have consistently fallen short of their disinvestment targets, raising doubts about achieving future goals.

- Long-Term Rights Concerns: Granting private entities long-term operational rights may be perceived as a form of privatisation, potentially leading to public distrust.

- Budget Clarity: There is a lack of transparency regarding how monetisation proceeds will be allocated within the government budget.

- Potential for Monopolies: Consolidation of asset ownership could lead to monopolistic practices, especially in critical infrastructure sectors.

- Taxpayer Concerns: Taxpayers are wary of the potential for double charges on public assets they initially funded.

Way Forward

- Accelerating Monetisation: The government should expedite contract-based monetisation through Public-Private Partnerships (PPP), particularly in sectors like railways and airports.

- Land Monetisation Initiatives: Engaging real estate companies to develop multi-storey buildings can generate additional revenue while enhancing housing options.

- Establishing Budget Guidelines: Clear budgeting guidelines should be developed to clarify the allocation of funds generated from monetisation, ensuring they are used for infrastructure development rather than operational expenses.

Fairwork India Report

- 06 Oct 2024

In News:

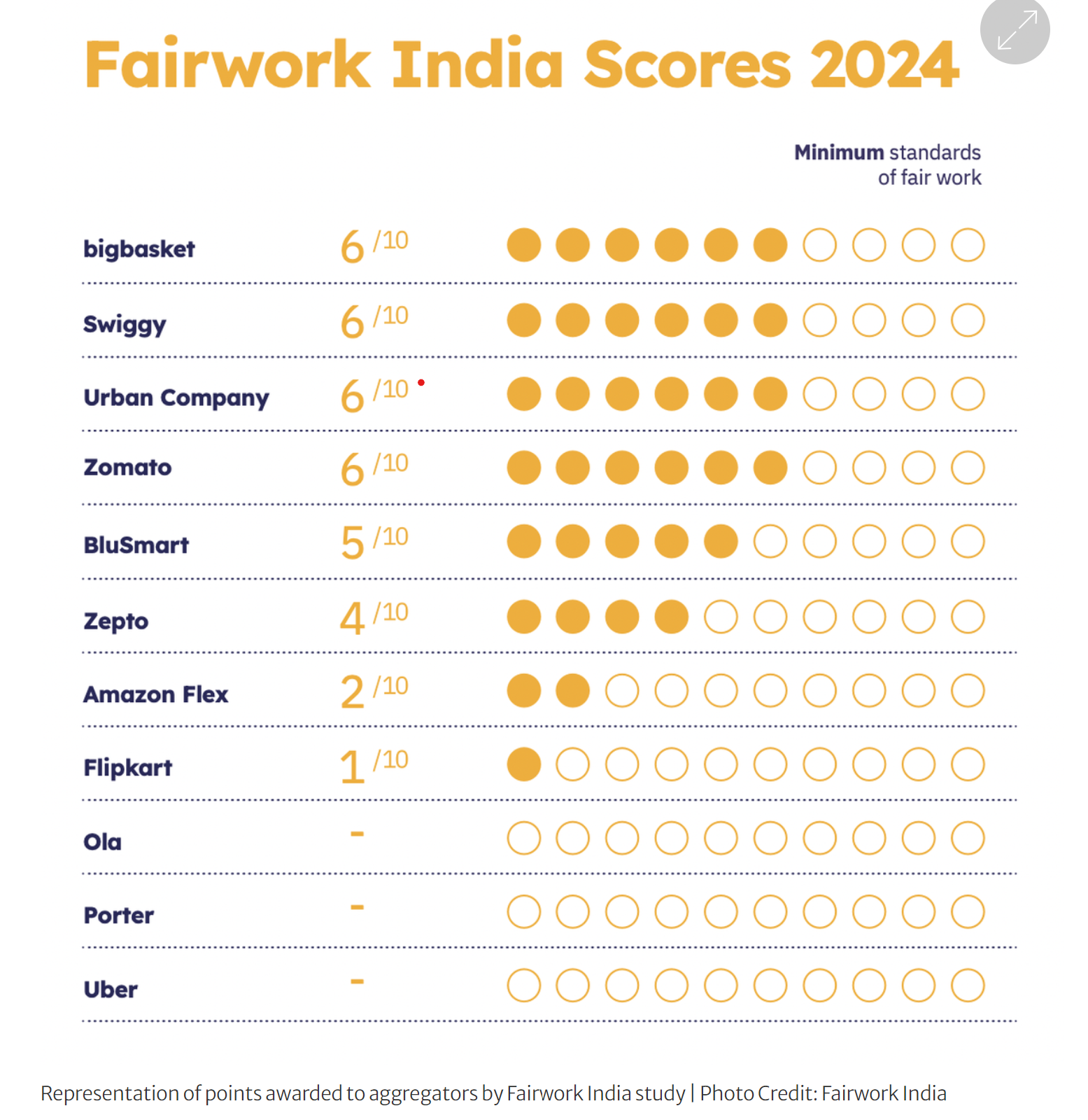

The Fairwork India Ratings 2024 report, which analyses the work conditions of platform workers on digital labour platforms in India, draws a picture of aggregators who are non-committal to ensuring that workers earn the local living wage and unwilling to recognise collectivisation of workers.

Key Findings:

- Overall Performance: No platform scored above six out of ten, and none achieved top points across the five assessed principles: Fair Pay, Fair Conditions, Fair Contracts, Fair Management, and Fair Representation.

- Study Background: This report is the sixth annual analysis conducted by the Fairwork India Team, in collaboration with the Centre for IT and Public Policy (CITAPP), IIIT-Bangalore, and Oxford University.

Analysis of Welfare Legislation

- The report discusses the evolving nature of platform work and its implications for proposed legislation affecting gig workers in Karnataka and Jharkhand.

- Political interest in gig workers' welfare has increased, but the effectiveness of these initiatives remains uncertain.

- Professors Balaji Parthasarathy and Janaki Srinivasan highlight the importance of ongoing research and advocacy for improving gig worker conditions.

Methodology

- Principles of Assessment: Platforms were evaluated based on five principles, each consisting of two points—one that could only be awarded if the first point was fulfilled.

- Data Collection: Worker interviews were conducted across multiple cities, including Bengaluru, Chennai, Delhi, Kochi, and Thiruvananthapuram.

- Platforms Analyzed: The study included 11 platforms from various sectors, such as logistics, food delivery, and personal care.

Detailed Findings by Principle

Fair Pay

- First Point: Bigbasket and Urban Company were recognized for implementing a minimum wage policy ensuring workers earn at least the local minimum wage.

- Second Point: No platform met the criteria for committing to a local living wage after work-related costs.

Fair Conditions

- First Point: Platforms such as Amazon Flex, BigBasket, and Swiggy provided adequate safety equipment and training.

- Second Point: BigBasket, Swiggy, Urban Company, Zepto, and Zomato offered additional protections, including accident insurance and compensation for medical-related work absences.

Fair Contracts

- First Point: BigBasket, BluSmart, and others ensured contract accessibility and data protection protocols.

Fair Management

- First Point: Amazon Flex, BigBasket, and several others provided due process in disciplinary decisions.

- Second Point: BluSmart, Swiggy, Urban Company, and Zomato were noted for regular external audits and anti-discrimination policies.

Fair Representation

- Despite increased collectivization efforts among platform workers, no platform showed a willingness to recognize collective bodies, underscoring a critical gap in worker representation.

Conclusion

The Fairwork India Ratings 2024 report highlights significant challenges in ensuring fair work conditions for platform workers in India, stressing the need for continuous advocacy and reform in the gig economy.

National Urban Livelihood Mission (NULM)

- 05 Oct 2024

In News:

The Government is set to launch NULM 2.0, the latest iteration of the National Urban Livelihood Mission (NULM), aimed at enhancing the livelihoods of urban poor and vulnerable populations. This version will specifically target six key groups: construction workers, gig workers, waste management workers, care workers, domestic workers, and transportation workers.

Overview of DAY-NULM

The Deendayal Antyodaya Yojana-National Urban Livelihoods Mission (DAY-NULM) was initiated in 2014 by the Ministry of Housing and Urban Affairs to replace the Swarna Jayanti Shahari Rozgar Yojana. It aims to uplift urban poor through organized self-help groups (SHGs), skill development, and access to credit.

Key Features:

- Funding Structure: DAY-NULM operates as a Centrally Sponsored Scheme, with a funding ratio of 75:25 between the central and state governments, adjusted to 90:10 for North Eastern and Special Category states.

- Mobilization of Women: The mission has successfully formed over 831,000 SHGs, mobilizing more than 8.4 million urban poor women by 2023.

- Objectives: It focuses on sustainable livelihoods through skill development, financial access, and entrepreneurship, particularly for women.

Components and Achievements

DAY-NULM includes various initiatives such as:

- Skill training programs.

- Support for self-employment.

- Rehabilitation for street vendors.

Performance Highlights:

- Over 89.33 lakh women have joined SHGs, with 6.12 lakh receiving initial funds.

- Approximately 15 lakh individuals have undergone skill training, leading to employment for 8.20 lakh.

- Surveys have identified 53.76 lakh street vendors, resulting in significant documentation and support.

Introduction of NULM 2.0

NULM 2.0 is a revamped initiative designed to further support urban livelihoods through financial aid and infrastructure enhancements.

Key Features:

- Microcredit Access: Eligible individuals can obtain microcredit of up to ?4 lakh, while groups can access up to ?20 lakh, with a subsidized interest rate of 5%.

- Support for Enterprises: The funding aims to assist beneficiaries in starting small businesses, creating social infrastructure, and providing grants for innovative projects, such as sanitation machinery.

Pilot Initiative

To effectively implement NULM 2.0, the government will conduct a pilot program in 25 cities. This will focus on:

- Identifying urban poor populations.

- Ensuring targeted assistance to improve beneficiaries’ earnings and living conditions.

Conclusion

The rollout of NULM 2.0 represents a significant step in addressing the needs of the urban poor, with a comprehensive framework designed to provide financial support and improve livelihoods. By focusing on critical worker groups and leveraging microcredit, the initiative aims to foster sustainable development and enhance the quality of life for urban vulnerable communities.

India's Surprising GDP Growth Rate

- 02 Mar 2024

Why is it in the News?

India's gross domestic product (GDP) growth for the third quarter (October-December) of the fiscal year 2023-24 has surpassed expectations, coming in at 8.4% compared to the estimated 6.7%.

News Summary:

- India's economy saw a growth of 8.4% in the December quarter compared to the same period last year, surpassing the 7.6% growth recorded in the previous quarter and the forecast of 6.7% as per a Reuters poll of economists.

- Further, the NSO pegged a higher GDP growth rate of 7.6% for the entire fiscal year, up from the initial estimate of 7.3%.

- To comprehend India’s unexpected growth, it is imperative to delve into the diverse aspects of the country's economic landscape, and evaluating the factors underpinning this surprising growth is equally crucial, including consumption patterns, savings dynamics, and investment trends.

What are the Factors Driving India’s Growth Surplus?

- Enhanced Economic Momentum: Initially estimated at 7.3 percent, the GDP growth set a promising tone for the fiscal year.

- However, the subsequent second advance estimate, incorporating third-quarter data, surpassed expectations.

- This signals a bolstered economic momentum, notably fueled by increased net taxes contributing significantly to the growth trajectory.

- Impact of Rising Net Taxes and Subsidies: An essential aspect of this growth narrative is the comparison between gross value added (GVA) and GDP growth.

- While GDP growth stands impressively at 7.6 percent, GVA, excluding net tax effects, registers a slightly lower 6.9 percent.

- This nuanced distinction underscores the influence of net taxes and subsidies on overall economic performance.

- Furthermore, with an average growth rate of 8.2 percent for the first three quarters, extrapolations suggest a projected fourth-quarter growth of approximately 5.9 percent.

- Effective Policy Measures and Financial Resilience: Despite GDP figures still below pre-pandemic levels, concerted domestic efforts and policy initiatives have steered the economy toward a 7 percent growth trajectory.

- A significant factor contributing to this progress is the reinforced state of banking and corporate balance sheets, indicative of the efficacy of strategic policy interventions.

Assessment of Challenges and Expected Downturn:

- Impact of High-Interest Rates: The enduring prevalence of high interest rates presents a formidable obstacle to sustained economic advancement.

- Elevated interest rates have the potential to deter borrowing and investment, thereby affecting both consumer expenditure and corporate expansion initiatives.

- This concern is further compounded by the limited effectiveness of monetary policy, given that inflation projections persist above the Reserve Bank of India's (RBI) 4% target.

- Normalisation of Net Tax Effects: The current fiscal period has significantly contributed to GDP growth from the escalation of net taxes (taxes minus subsidies).

- However, there is an anticipation that the net tax influence on GDP will revert to normal levels in the upcoming year.

- This normalization implies that the impetus provided by the net tax element to the economic growth rate may diminish, potentially leading to a slowdown.

- Influence of Global Economic Conditions: India's economic performance is intricately intertwined with global economic circumstances.

- Uncertainties prevailing in the global market, such as trade tensions, geopolitical dynamics, and external disruptions, could trigger spill-over ramifications on India's economy.

- Consequently, external factors beyond the nation's jurisdiction may exert influence on the overall economic outlook.

Private Consumption, Household Savings, and Evolving Trends:

- Disparities in Growth: The growth disparity between rural and urban areas is notable, with rural consumption likely trailing urban consumption.

- This discrepancy can be attributed primarily to the disproportionate impact of high food inflation on rural households.

- The sluggish growth of agriculture, at a mere 0.7%, underscores the challenges faced by the rural economy, where food inflation significantly affects discretionary spending.

- Impact of Food Inflation: High food inflation has exerted a considerable influence on consumption patterns, particularly in rural regions.

- Nominal food consumption spending surged by 13% last year, indicative of the inflationary pressure on essential commodities.

- This trend is expected to persist, impacting purchasing power and discretionary spending across both rural and urban landscapes.

- Shifting Consumption Patterns: Household consumption expenditure data reflects a gradual shift towards non-food items over time, mirroring rising per capita income and evolving consumer preferences.

- This transition underscores the necessity to recalibrate weights in the consumer price index basket, which currently reflects consumption patterns from 2011-12.

- Household Savings: Disaggregated data reveals that household savings constitute a substantial portion, comprising 61% of total savings in the economy.

- Despite its prominence, the share of household savings in GDP declined to 18.4% in 2022-23, indicating changing trends in savings composition.

- Household savings are further categorized into financial and physical savings, with financial savings, including bank deposits and securities, witnessing a significant decline to 5.3% of GDP in 2022-23.

- Conversely, physical savings, driven by borrowings for assets like houses, have increased, reflecting evolving preferences and market dynamics.

Analysis of Investment Trends: Public, Corporate, and Household:

- Private Corporate Investment Patterns: The data indicates a stagnant trajectory in private corporate investments, with no clear signs of revival evident in the fiscal year 2022-23.

- This stagnation raises concerns, as private sector investments play a pivotal role in propelling economic growth, fostering job creation, and stimulating innovation.

- Public and Household Investment Dynamics: In contrast to private corporate investments, both public and household investments have exhibited substantial growth during the fiscal year 2022-23.

- Public investments, often influenced by government policies and infrastructure projects, contribute significantly to economic development.

- On the other hand, household investments, encompassing expenditures on residences and durable goods, serve as indicators of consumer confidence and economic stability.

Way Forward:

- Mitigating Policy Uncertainty: The government must mitigate policy uncertainty and streamline compliance costs.

- A stable and foreseeable policy landscape is indispensable for fostering private-sector investments.

- Addressing these concerns is paramount to cultivating an environment conducive to long-term corporate strategizing and sustained economic expansion.

- Encouraging a Comprehensive Revival of Private Investments: Recognizing the pivotal role of a comprehensive revival of private investments in sustaining high growth rates over the medium term is imperative for the government.

- While the government's emphasis on infrastructure development and targeted initiatives like the Production-Linked Incentive (PLI) scheme has yielded positive outcomes, a more holistic approach is warranted to invigorate investments across diverse sectors of the economy.

Conclusion

India's unexpected GDP growth, underpinned by resilient domestic fundamentals and strategic policy emphasis, necessitates a nuanced examination of various economic facets. As India traverses through these multifaceted dimensions, focused attention on private corporate investments, consumption trends, and savings dynamics emerges as pivotal for achieving sustained and inclusive economic progress. Furthermore, the government's role in ensuring policy stability and minimizing compliance burdens emerges as a decisive factor in unlocking the full potential of India's economic prowess.