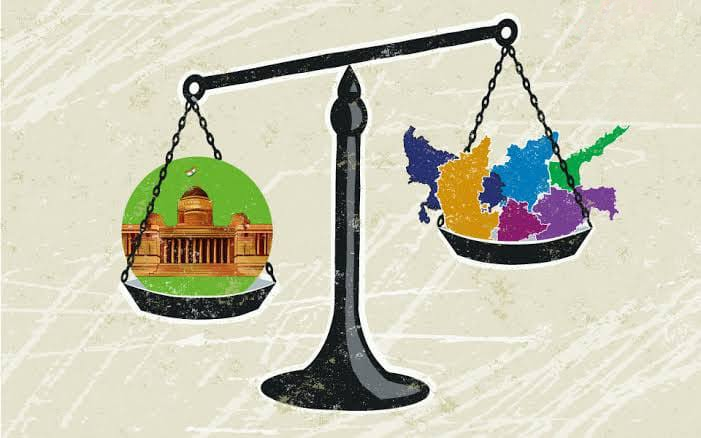

Are States getting funds they are entitled from the Centre?

- 29 Feb 2024

Why is it in the News?

The recent agitations by the governments of Kerala and Karnataka, and the support extended by several State governments, have highlighted many disquieting issues in the practice of fiscal federalism in India.

Context:

- The recent protests by the governments of Kerala and Karnataka, supported by several other state governments, have brought to light several concerning issues regarding fiscal federalism in India.

- These protests underscore the pressing need for the newly constituted 16th Finance Commission (FC) to approach the matter with seriousness and innovation to address grievances related to growing vertical and horizontal inequalities in resource allocation.

What is Fiscal Federalism?

- Fiscal federalism refers to the distribution of financial authority and obligations among various tiers of government within a nation.

- It encompasses considerations like determining the roles and responsibilities of the central and state governments in delivering services, devising mechanisms for revenue generation and allocation among these entities, and establishing fair and efficient systems for transfers or grants distribution to promote equity and effectiveness.

Fiscal Federalism in India:

- The framers of the Constitution stipulated that the Central government would share its tax revenues with the states and provide grants from the Consolidated Fund based on a formula determined by the Finance Commission every five years.

- India operates under a three-tier federal tax system, delineating the powers of the Central government, state governments, and local bodies to levy taxes.

- The Central government possesses the authority to impose taxes on individual and corporate incomes, along with indirect taxes like central goods and services tax (CGST), integrated goods and services tax (IGST), and customs duties. Additionally, it collects surcharges and cesses on various taxes.

- State governments are responsible for levying state goods and services tax (SGST), stamp duties, land revenue, state excise duties, and professional taxes.

- Local bodies exercise jurisdiction over taxes such as property or house taxes, tolls, and utility taxes on services like electricity and water.

What are the Constitutional Provisions?

- The Constitution of India outlines the taxation authority of both the Union and States, categorizing them into the Union List and the State List respectively (as outlined in the Seventh Schedule under Article 246).

- Initially, there was no taxation provision in the Concurrent List.

- However, with the introduction of GST, the need for a concurrent taxation framework arose, leading to the insertion of Article 246A (as the 101st Amendment in August 2016).

- This amendment empowered the Union to legislate for CGST (Central GST) and IGST (Integrated GST), while the States were granted the authority to enact SGST laws.

- Article 270 of the Constitution outlines the mechanism for distributing net tax proceeds collected by the Union government among the Centre and the States.

What are the Concerns with the States?

- Growing Vertical and Horizontal Inequalities: States have raised concerns about increasing disparities both vertically, pertaining to the sharing of resources between the Union and States, and horizontally.

- The Union government's inclination to retain a larger share of its proceeds outside the divisible pool has exacerbated these inequalities.

- Retention of Proceeds: The Union government's practice of withholding a greater portion of its proceeds from the divisible pool has diminished the share allocated to States, contravening mandates from successive Finance Commissions.

- Proliferation of Cesses and Surcharges: Various cesses and surcharges, such as the Agriculture Infrastructure and Development Cess, have been introduced by the Union government, leading to an expansion of these revenue streams.

- This expansion has resulted in a larger portion of the gross tax revenue being excluded from net proceeds, thereby depriving States of their rightful share.

- Financial Exclusion of States: Over the period from 2009-10 to 2023-24, the Union government collected a substantial cumulative amount of ?36.6 lakh crore through cesses and surcharges, all of which remained unshared with the States.

- The imposition of cesses and surcharges has faced criticism from the Comptroller and Auditor General (CAG), further highlighting concerns about their impact on state finances.

Way Forward

- Rectifying disparities in resource sharing and addressing the proliferation of cesses and surcharges are critical imperatives for the 16th Finance Commission (FC).

- The FC should proactively address historical imbalances in vertical devolution by compensating States appropriately and ensuring accurate estimates of "net proceeds" in budgetary documents.

- Moreover, it should consider providing lump sum untied grants to States to offset shortfalls in devolution over the past decade.

- Simultaneously, legislative measures must be enacted by the Union government to impose strict limits on the collection of cesses and surcharges, ensuring their automatic expiration after a defined period and preventing their rebranding under different names.

- Furthermore, States must adhere to the principles of fiscal federalism by allocating sufficient resources to local bodies and promoting dynamic and transparent development initiatives at the grassroots level.

What is the Finance Commission?

- The Finance Commission is constituted by the President under Article 280 of the Constitution, mainly to give its recommendations on the distribution of tax revenues between the Union and the States and amongst the States themselves.

- Two distinctive features of the Commission’s work involve redressing the vertical imbalances between the taxation powers and expenditure responsibilities of the center and the States respectively and equalization of all public services across the States.

Functions of the Finance Commission:

- It is the duty of the Commission to make recommendations to the President as to the distribution between the Union and the States of the net proceeds of taxes which are to be:

- Divided between them and the allocation between the States of the respective shares of such proceeds;

- The principles which should govern the grants-in-aid of the revenues of the States out of the Consolidated Fund of India;

- The measures needed to augment the Consolidated Fund of a State to supplement the resources of the Panchayats in the State based on the recommendations made by the Finance Commission of the State;

- The measures needed to augment the Consolidated Fund of a State to supplement the resources of the Municipalities in the State based on the recommendations made by the Finance Commission of the State;

- Any other matter referred to the Commission by the President in the interests of sound finance.

- The Commission determines its procedure and has such powers in the performance of its functions as Parliament may by law confer on them.

Appointment of the Finance Commission and Qualifications for Members:

- The Finance Commission is appointed by the President under Article 280 of the Constitution.

- As per the provisions contained in the Finance Commission Act, 1951 and The Finance Commission (Salaries & Allowances) Rules, 1951, the Chairman of the Commission is selected from among persons who have had experience in public affairs, and the four other members are selected from among persons who:

- (a) are, or have been, or are qualified to be appointed as Judges of a High Court; or

- (b) have special knowledge of the finances and accounts of the Government; or

- (c) have had wide experience in financial matters and administration; or

- (d) have special knowledge of economics

How are the recommendations of the Finance Commission implemented?

- The recommendations of the Finance Commission are implemented as under:

- Those to be implemented by an order of the President:

- The recommendations relating to the distribution of Union Taxes and Duties and Grants-in-aid fall in this category.

- Those to be implemented by executive orders:

- Other recommendations to be made by the Finance Commission, as per its Terms of Reference

When was the first Commission Constituted and how many Commissions have been Constituted so far?

- The First Finance Commission was constituted under the chairmanship of Shri K.C. Neogy on 6th April 1952.

- 15th Finance Commissions have been Constituted so far at intervals of every five years.

- The 16th Finance Commission was constituted on 31 Dec 2023 with Shri Arvind Panagariya, former Vice-Chairman, NITI Aayog as its Chairman.

- The 16th Finance Commission is required to submit its recommendations by October 31st, 2025.

- However, the recommendations of the 15th FC cover the six years up to 31st March 2026.

Sustainable Practices and Urging for Eco-Friendly Elections in India

- 28 Feb 2024

Why is it in the News?

In August 2023, ahead of the Assembly elections in five States, the Election Commission of India (ECI) voiced its concern over the environmental risks associated with the use of non-biodegradable materials in elections.

Context:

- The Election Commission of India (ECI) has emphasized the environmental impact of traditional election materials, urging a shift towards eco-friendly practices, particularly given India's status as the world's largest democracy.

- India must prioritize environmental sustainability in its electoral procedures, recognizing successful eco-friendly initiatives in Kerala, Sri Lanka, and Estonia, and strategizing a comprehensive green transition involving diverse stakeholders.

Why Conducting Elections Require a Paradigm Shift?

- Unrecognized Environmental Impact of Elections: The emissions generated by campaign flights in the 2016 US presidential elections underscore the substantial carbon footprint linked to conventional election methodologies.

- Conventional election practices, marked by paper-based materials, energy-intensive rallies, and disposable items, contribute to environmental harm and affect public health.

- Given the colossal scale of India's elections, these concerns become more pressing, calling for a shift towards eco-friendly election processes.

- Startling Research Findings: Recent research from Estonia (2023) pinpoints transportation to and from polling booths as the primary contributor to carbon emissions in elections, closely followed by the operational footprint of polling booths.

- Adopting digital voting systems has the potential to slash the overall carbon footprint by as much as 40%.

What are Some Successful Models of Eco-Friendly Elections?

- Pioneering Initiatives in Kerala and Goa: During the 2019 general election, the Kerala State Election Commission spearheaded efforts to eliminate single-use plastic materials from campaign activities.

- Subsequently, the Kerala High Court enforced a ban on non-biodegradable materials, leading to the adoption of eco-friendly alternatives like paper posters and wall graffiti.

- Collaborative endeavors between government bodies and district administrations in Thiruvananthapuram ensured the implementation of green election practices, including training sessions for election workers in rural areas.

- In 2022, the Goa State Biodiversity Board showcased eco-friendly election booths crafted from biodegradable materials by local artisans during the Assembly elections.

- Innovative Strategies from Sri Lanka: In 2019, the Sri Lanka Podujana Peramuna (SLPP) party initiated the world's first carbon-sensitive, environmentally friendly election campaign.

- This groundbreaking campaign measured carbon emissions from campaign vehicles and electricity usage, offsetting them by planting trees across districts with public participation.

- By addressing the immediate carbon footprint of the campaign and raising awareness about the importance of forest cover, Sri Lanka set a notable example for sustainable election practices.

- Estonia's Digital Voting Model: Estonia pioneered digital voting as an online alternative, significantly enhancing voter participation while reducing environmental impact.

- The success of Estonia's approach underscores the feasibility of digital voting, complemented by stringent security measures, as an eco-friendly and voter-centric solution.

A Roadmap for Sustainable Green Elections:

- Political Leadership and Digital Campaigning: Political parties should enact legislation mandating eco-friendly election practices, integrating them into the Model Code of Conduct governing campaign activities.

- Encouraging the adoption of digital platforms for campaigning and door-to-door outreach can substantially reduce the carbon footprint associated with traditional public rallies.

- Incentivizing Sustainable Practices and Infrastructure Development: Offering incentives for political parties to use sustainable materials like natural fabrics and recycled paper in place of plastic and paper-based campaign materials, alongside supporting waste management and local artisans.

- Government investment in digital voting infrastructure, particularly in rural areas, ensures reliable internet access and accessible digital devices for all voters.

- Role of the Election Commission of India (ECI) with Government Backing: The ECI can advocate for digital voting systems, highlighting their environmental benefits and addressing security concerns through comprehensive measures.

- Public Awareness and Civil Society Engagement: Civil society organizations can lead public awareness campaigns, educating citizens about the environmental impact of traditional election methods and advocating for eco-friendly alternatives.

- Monitoring the implementation of green initiatives and advocating for transparency and accountability in the electoral process.

- Media's Advocacy Role: Media outlets can spotlight the environmental consequences of conventional election methods through investigative reporting and by showcasing successful eco-friendly initiatives.

- Global Collaboration for Sustainable Elections: Collaborating with countries like Sri Lanka and Estonia, which have successfully implemented eco-friendly election practices, to share insights and support international platforms for exchanging best practices in sustainable electoral initiatives.

Hurdles and Potential Solutions for Conducting Eco-Friendly Elections:

- Technology Barriers: Ensuring a seamless transition to digital voting demands robust technological infrastructure, particularly in remote regions where connectivity may be sparse.

- Upholding the integrity and security of digital systems is paramount, requiring comprehensive safeguards against cyber threats and manipulation to uphold public trust.

- Financial Impediments: Embracing eco-friendly materials and technologies entails significant initial investments, posing challenges for governments constrained by budgetary limitations.

- Competing priorities may hinder the allocation of funds toward sustainable electoral practices, despite their long-term environmental advantages.

- Cultural Shifts and Public Doubts: Cultural norms often associate physical polling booth presence with democratic participation, necessitating efforts to shift perceptions towards digital methods.

- Addressing public skepticism regarding new technologies, particularly concerns about security and reliability, requires proactive measures to build trust and confidence.

- Promoting Transparency and Accountability: The adoption of eco-friendly and digital strategies must be accompanied by transparent processes and robust auditing mechanisms.

- Establishing clear protocols for auditing new practices fosters accountability and addresses concerns about fairness and impartiality, enhancing public trust.

- Tackling Logistical Complexities: Executing large-scale electoral reforms demands meticulous planning and coordination across various stages.

- From sourcing eco-friendly materials to training personnel, addressing logistical challenges systematically is essential for smooth implementation.

Conclusion

Adopting environmentally conscious electoral practices represents not only an imperative for India but also a chance to lead by example on the global stage. Harmonizing high-level policies with ground-level efforts and engaging various stakeholders—political entities, Election Commissions, governments, citizens, media, and civil society—can position India as a trailblazer in conducting sustainable elections. This transformative approach not only integrates environmental responsibility but also reinforces the connection between ecological stewardship and the core tenets of democracy.

An expansive land management policy is overdue

- 27 Feb 2024

Why is it in the News?

The global economic impact of land degradation on ecosystem services amounts to an estimated $6 trillion annually.

Context:

- Land plays a crucial role across various human endeavors, offering ecological, economic, social, and cultural benefits.

- However, the multi-faceted nature of land is often overlooked in management practices, leading to heightened stress, degradation, and environmental strain.

- Globally, land degradation results in annual losses of ecosystem services estimated at USD 6 trillion.

- The 14th Conference of Parties (COP14) of the United Nations Convention to Combat Desertification (UNCCD), held in New Delhi in 2019, highlighted the widespread challenge of land degradation faced by different nations and emphasized the importance of achieving Land Degradation Neutrality (LDN).

What is Land Degradation?

- Land degradation refers to the deterioration of the quality and productivity of land resources, typically caused by human activities and natural processes.

- It involves the loss of soil fertility, reduction in vegetation cover, depletion of water resources, and overall decline in the capacity of the land to support various ecosystem functions and human activities.

- Land degradation can take various forms, including soil erosion, desertification, deforestation, salinization, and contamination by pollutants.

- It poses significant environmental, economic, and social challenges, impacting agricultural productivity, food security, biodiversity, and the livelihoods of millions of people around the world.

- Addressing land degradation is crucial for sustainable land use, environmental conservation, and the well-being of present and future generations.

What is the Current Status of Land Degradation in India?

- From 2015 to 2019, UNCCD data reported that 30.51 million hectares of India's land had degraded, accounting for 9.45% of the nation's total landmass by 2019, up from 4.42% in 2015.

- During this period, 251.71 million Indians, constituting 18.39% of the population, were exposed to land degradation, with 854.4 million individuals experiencing drought from 2015 to 2018.

- According to the Desertification and Land Degradation Atlas of India, published by the Space Applications Centre (SAC) of the Indian Space Research Organisation (ISRO), the extent of land degradation and desertification in India reached 97.84 million hectares in 2018-19.

- This atlas offers state-wise data on degraded land, aiding in the planning and execution of initiatives aimed at land restoration by providing crucial data and technical insights.

Global Scenario:

- Land degradation exhibits significant regional variations, with Sub-Saharan Africa, Western and Southern Asia, Latin America, and the Caribbean witnessing degradation rates surpassing the global average between 2015 and 2019.

- In Eastern and Central Asia, Latin America, and the Caribbean, over 20% of the total land area faced severe degradation by 2019.

- Since 2015, Sub-Saharan Africa saw its degraded land increase from 6.7% to 14.63%, while Western Asia and Northern Africa experienced a rise from 3.78% to 7.18%.

What are the Different Causes of Land Degradation?

- Deforestation: Driven by population growth and resource demand, deforestation weakens soil structure, making it prone to erosion by wind and water.

- Deforestation is particularly rampant in areas like Maharashtra, Rajasthan, Madhya Pradesh, and Gujarat.

- Mineral Processing: Industries such as limestone grinding and ceramic production release substantial dust, settling in surrounding areas and contributing to land degradation.

- Soil Erosion: Processes like water flow, wind, rainfall, and landslides strip away the fertile topsoil layer, leaving behind less fertile subsoil, and rendering land unsuitable for cultivation and agriculture.

- Overgrazing: Excessive grazing by animals removes grass cover, making soil susceptible to erosion by wind and water.

- This phenomenon, common in hilly areas like Maharashtra, Rajasthan, Madhya Pradesh, and Gujarat, disrupts soil structure and fertility.

- Over-Irrigation: In states like Punjab, Haryana, and Uttar Pradesh, excessive irrigation leads to soil salinity and alkalinity, diminishing its fertility and suitability for agriculture.

- Mining Sites: After mining activities, abandoned sites leave deep scars and harmful materials that degrade the soil, rendering it unsuitable for productive use.

- Deforestation due to mining in states like Chhattisgarh, Jharkhand, Madhya Pradesh, and Odisha exacerbates land degradation.

- Industrial Effluents: Waste disposal from industries is a significant source of land and water pollution, contributing to land degradation.

- Mining and Developmental Projects: Large-scale clearing of forests for mining and construction projects further accelerates land degradation under the guise of development.

- Commercial Exploitation of Forests: High-value trees and plants are harvested for economic gain, disrupting soil-plant interactions essential for soil stability.

- Overgrazing, mining, agricultural expansion, floods, and forest fires are key drivers of deforestation, exacerbating land degradation.

- Desertification: Human activities and climate change contribute to desert-like conditions in arid or semi-arid regions, leading to the spread of sand onto fertile agricultural lands, reducing soil fertility, and hampering agricultural productivity.

Challenges in the Management of Land Degradation in India:

- India with only 2.4% of the world’s geographical area and more than 17% of the world's population experiences several land management challenges.

- Arable land in India is around 55% of the total geographical area and forest cover accounts for another 22%.

- The rest is desert, mountains, etc.

- Around 30% of the total geographical area is degraded land.

- Access to agricultural land continues to be an important livelihood issue as a significant share of the population depends on agriculture for their sustenance.

- Development targets and the demand for land to accommodate the growing population, infrastructure, rapid urbanization, and social, cultural, and environmental aspects are placing unprecedented pressure on land.

- This is resulting in more competition among farmers and between agriculture and other land resource-based sectors, as well as land use conflicts, escalation of land prices, and changing land rights.

- Across the country, natural areas are being squeezed and ecological functions are being lost.

- Not only does this adversely affect the livelihood opportunities of the people who directly depend on environmental resources, but also the buffering effects of natural ecosystems in the face of disasters such as floods and droughts, temperature rise, and environmental pollution are severely compromised.

- Climate change has brought with it another set of challenges.

- In India, current land management practices are sectoral with each department following its own approach.

- Land management falls under the purview of State governments.

- Further, cultural land is privately owned and land-use decisions are constitutionally vested with the owner.

- Apart from this administrative complexity, the challenges to adopting and implementing appropriate land management practices in the country include knowledge gaps, a short-term planning bias, a fragmented approach, a lack of action for unforeseen events, and regulatory barriers.

What Steps Need to be Taken for Land Management?

- Set up a Multi-stakeholder Platform: As a critical mechanism to achieving sectoral integration and addressing these challenges, it is imperative to set up a multi-stakeholder platform at the district and sub-district levels to bring together farmers, other land managers, policymakers, civil society organizations, business leaders, and investors under a common platform.

- Article 243ZD (1) of the Constitution provides for district planning committees to consolidate plans from panchayats and municipalities.

- This committee may be activated in the direction of preparing a land management plan, covering both agricultural and non-agricultural sectors.

- Landscape Approach: A landscape approach will be useful in this context as it will provide deep insights to assess the potential of land and the scope of allocation and reallocation of land for appropriate uses.

- This will help with evaluation, negotiation, trade-off, and decision-making.

- A climate-smart landscape approach will contribute to climate objectives, increased agricultural production, improved local livelihoods, and the conservation of biodiversity.

Government Initiatives to Combat Land Degradation and Desertification in India:

- Desertification and Land Degradation Atlas of India, published by Space Applications Centre (SAC) Indian Space Research Organisation, Ahmedabad, which provides the extent of land degradation and desertification in India, states that the land degradation and desertification in the country has been estimated to be 97.84 million hectares in 2018-19.

- It provides state-wise areas of degraded land which is helpful in the planning and implementation of schemes aimed at the restoration of land by providing important data and technical inputs.

- An online portal has been developed with the help of Space Application Center(SAC), Ahmedabad for visualization of degraded areas of land with the processes causing degradation.

- A Centre of Excellence has been envisaged at the Indian Council for Forestry Research and Education (ICFRE) Dehradun for enhanced South-South Cooperation.

- It aims at knowledge sharing, promotion of best practices, sharing India’s experiences with cost-effective and sustainable land management strategies, developing ideas for transformative projects and programs, and capacity building.

Way Forward:

- Advancing Integrated Landscape Management: Despite existing on-ground experiences, there is a lack of systematic institutional support for this approach, highlighting the need for concerted efforts to promote it.

- Embracing the Value of Landscape: Echoing the European Landscape Convention's recognition of landscape as vital for individual and societal well-being, greater emphasis should be placed on understanding and preserving landscapes.

- Recognizing the Role of Sustainable Land Management: Reports like the U.K. Parliamentary Office of Science and Technology's assessment underscore the importance of managing land sustainably for environmental benefits, including addressing climate change, ensuring food security, and mitigating biodiversity loss.

- Parliamentary Action in India: Indian lawmakers can spearhead discussions on the evolving challenges of integrated land management practices and play a pivotal role in crafting policies for long-term sustainability.

- This necessitates the involvement of stakeholders at all levels, fostering collaboration horizontally and vertically across the spectrum.

Preserving Democratic Integrity Through Privacy Safeguards in the Digital Age

- 26 Feb 2024

Why is it in the News?

The big data economy, powered by massive datasets and unprecedented levels of personal information has fundamentally altered how a country conducts elections, and how people vote.

Background:

- The emergence of the big data economy has significantly altered the landscape of elections and individual voting patterns, offering both benefits and challenges.

- As the general elections approach in two months, it becomes imperative to delve into the far-reaching effects of extensive datasets on political scenarios.

- Equally important is a comprehensive understanding of the privacy implications, emphasizing the critical necessity for robust data protection measures, especially in anticipation of the upcoming elections in India.

What are the Challenges Arising from Big Data's Influence on Elections?

- Precision Targeting and Tailoring: Big data enables political campaigns to engage in micro-targeting, tailoring messages and campaign content to specific demographics or individual voters.

- By analyzing extensive datasets, candidates gain insights into voters' preferences, behaviors, and opinions, facilitating highly customized outreach efforts across various communication channels.

- Lack of Transparency and Consent: A significant concern is the opacity surrounding collecting, processing, and utilizing personal information.

- Voters often lack awareness of databases containing detailed personal data and the extent to which it's used for political purposes.

- Informed consent becomes elusive, as individuals are unaware of how their data is harnessed, limiting their ability to control its usage.

- Reinforcement of Power Dynamics: The abundance of data amplifies the power of political entities to influence voters through targeted messaging and strategic communication.

- Candidates can craft narratives tailored to specific groups, addressing issues and concerns discerned from data analysis.

- This sophisticated targeting extends beyond demographic attributes, delving into personal preferences and habits.

- Risks of Manipulation and Exploitation: While big data offers campaign efficiency and targeted communication, it also presents risks of manipulation and exploitation.

- Unethical practices, such as the strategic dissemination of misinformation to exploit voter sentiments, can undermine the integrity of the electoral process.

- Information asymmetry between political entities and voters raises concerns about privacy invasion and democratic principles.

What are the Consequences of Social Media and Networks Effects?

- Network Effect: The network effect, central to social media platforms, describes the increasing value and utility of a network as more users join.

- Larger user bases offer enhanced connectivity, content creation, and interaction opportunities, drawing individuals to these platforms.

- Profound Data Collection and User Profiling: Social media platforms thrive on comprehensive data collection, going beyond basic demographics to create detailed user profiles.

- Users' interactions provide valuable insights into their preferences, behaviors, and associations, enabling targeted advertising and personalized content delivery.

- Lack of Transparency in Data Practices: Users often lack awareness of the extent and granularity of data collected by social media platforms, raising concerns about privacy invasion and potential misuse.

- Limited transparency results in minimal user control over data utilization, highlighting the need for greater transparency and accountability.

- Algorithmic Personalization and Decision-Making: Algorithms drive personalized user experiences on social media platforms, curating content based on collected data.

- While personalization enhances user satisfaction, it also introduces concerns regarding algorithmic biases and selective information presentation, influencing user perspectives and behaviors.

- Commercialization and Data Exploitation: Social media platforms monetize user data through direct sales or personalized advertising, leveraging extensive user profiling for targeted marketing.

- While this practice benefits platforms economically, it sparks ethical debates surrounding the commercialization and commodification of user information.

The Indian Data Protection Act has Critical Flaws.:

- India’s Data Protection Act has not yet come into force. Its critical flaws include:

- Absence of Limitations on Government’s Powers to Access Data: The Act lacks clear limitations on governmental powers to access data, raising concerns about potential misuse and infringing on citizens' right to privacy.

- This ambiguity undermines the fundamental principle of safeguarding individuals from unwarranted surveillance.

- Lack of Independence for the Data Protection Board: The absence of proper checks and balances compromises the independence and effectiveness of the Data Protection Board, leaving it vulnerable to external influences and pressures.

- Instances of withholding information by authorities, citing the Data Protection Act, underscore the potential for confusion and misuse during this transitional phase.

- Challenges in Enforcement and Redressal: The non-functional status of the Data Protection Board exacerbates challenges in enforcement and redressal mechanisms.

- Individuals lack a reliable channel for seeking recourse in privacy violations, further complicating the protection of individual rights.

- Deficiencies in Actionable Rights: The Act needs to adequately address individual rights, notably omitting essential provisions such as the right to compensation.

- This limitation restricts individuals' ability to seek appropriate remedies for privacy infringements, weakening the overall efficacy of the data protection framework.

Way Forward:

- Seizing the Opportunity for Improvement: The forthcoming rules to operationalize the Data Protection Act represent a pivotal moment to address existing shortcomings and enhance privacy safeguards.

- Engaging stakeholders through multi-stakeholder consultations is imperative to ensure a comprehensive and diverse range of perspectives informs the regulatory framework.

- Placing Individuals at the Core: Prioritizing the impact on individuals is paramount in shaping the rules.

- By emphasizing individuals' rights and privacy concerns, the regulatory framework can better serve the needs and interests of citizens.

- Sustained and inclusive consultation processes must remain ongoing, fostering an environment conducive to incorporating feedback from diverse stakeholders.

- The urgency for Legislative Reforms: While the rules offer avenues for corrective action, the imperative for legislative reforms cannot be overstated.

- Foundational flaws, particularly concerning governmental powers and the independence of the Data Protection Board, necessitate substantive changes at the legislative level.

- Striking a delicate balance between feasibility and inclusivity is essential to avoid hasty amendments that may compromise the integrity and effectiveness of the data protection regime.

Conclusion

As India approaches elections, the need for a people-centric data protection framework becomes evident, striking a delicate balance between the advantages of digitization and the preservation of privacy and democratic values. Emphasizing inclusive and rights-based models is crucial in effectively addressing the complexities presented by the big data landscape, fostering a resilient and equitable digital future that cannot be underestimated.

India Allows 100% Foreign Direct Investment in Space Sector

- 22 Feb 2024

Why is it in the News?

Recently, the government of India has approved the amendment in the Foreign Direct Investment (FDI) policy for the space sector.

Context:

- India’s space industry, though nascent compared to global leaders such as the US, Russia, and China, has made significant strides in cutting-edge technologies, as evidenced by successful missions like Chandrayaan-3, Aditya-L1, and XpoSat.

- These achievements have not only demonstrated India’s economic prowess in space technology but have also positioned the Country favourably on the global map.

- However, the sector faces challenges, particularly in funding.

- Despite the sector’s expansion from 10 to 150 startups within three years, the absence of a substantial domestic investor pool interested in space ventures, which are inherently slow to yield returns, has hindered growth.

- The only other way out was to look at Foreign Direct Investment (FDI) policy.

- According to experts, “India stands at a critical juncture in its space journey.

- With strategic investments in infrastructure and manufacturing, alongside fostering innovation and education, India can achieve its goal of a US$44 billion space economy by 2033, enhancing its position as a global leader in space technology and services.

What is the Current Status of India’s Space Sector?

- India's expertise in the space sector is globally acknowledged, with achievements ranging from cost-effective satellite construction to launching foreign satellites.

- Aligned with its commitment to the Geneva Conference on Disarmament (1979), India advocates for the peaceful and civilian utilization of outer space, opposing any militarization efforts.

- The Indian Space Economy is valued at approximately $8.4 billion, constituting around 2-3% of the global space economy.

- ISRO stands as the 6th largest space agency globally, boasting an impressive success rate.

- India also ranks 5th worldwide in the number of private space companies, with over 400 such entities.

- Budgetary Allocation: The Department of Space has witnessed a nominal 4% increase in its allocation in the Interim Union Budget for 2024-25, rising from ?12,545 crore to ?13,043 crore.

- Future Projections: Implementation of the Indian Space Policy 2023 could propel the Indian space economy to reach $44 billion by 2033.

- Growth in Space Start-Ups: The number of Space Start-Ups has surged from just 1 in 2014 to 189 in 2023, as reported by the DPIIT Start-Up India Portal.

- Investment in Indian Space Start-Ups has concurrently risen to $124.7 million in 2023.

Key Changes in FDI Policy:

- With the privatization of space launches, India aims for a significant five-fold increase in its share of the global launch market.

- The recent changes in the FDI policy reflect a more welcoming approach to foreign investment.

- Specifically, the satellite sector which used to have strict rules has now been split into different parts each with its own limits on how much foreign investment is allowed.

- Launch Vehicles and Associated Systems/Subsystems: Foreign investment up to 49% is permitted under the automatic route with government approval mandated for anything beyond this threshold.

- This includes activities related to the establishment of spaceports for spacecraft launches and receptions.

- Satellite Manufacturing and Operation: The automatic route allows for up to 74% FDI covering satellite manufacturing, operation, satellite data products and both the Ground Segment and User Segment.

- Approval from the government is required for FDI exceeding 74% in these activities.

- Manufacturing of Components and Systems/Subsystems: Foreign investors are now allowed to invest up to 100% in manufacturing components and systems for satellites, ground segments and user segments through the automatic route.

- The decision to liberalize FDI norms in the space sector stems from a strategic vision outlined in the Indian Space Policy 2023.

- By fostering a more investor-friendly environment the government aims to tap into the potential of non-government entities (NGEs) encouraging them to invest in Indian companies within the space domain.

- This move is expected to drive technological advancements, scale up operations globally and boost India's position in the global space economy.

Recent Advancements in the India’s Space Sector:

- Indian Space Policy 2023: This policy delineates the roles and responsibilities of entities like ISRO, NewSpace India Limited (NSIL), and private sector players with the aim of bolstering involvement from research, academia, startups, and industry.

- Strategic Proposals by SIA: The Space Industry Association – India (SIA-India) has recommended in its Pre-Budget Memorandum for FY 2024-25 a substantial increase in India's space budget.

- Defence Space Agency (DSA): India inaugurated its Defence Space Agency (DSA) alongside the Defence Space Research Organisation (DSRO), tasked with developing space-based weapons to counter adversaries.

- Defence Space Mission Launch: The Indian Prime Minister unveiled the Defence Space Mission during the Defence Expo 2022 in Gandhinagar.

- Expansion of Satellite Manufacturing: India's satellite manufacturing sector is forecasted to grow to USD 3.2 billion by 2025, up from USD 2.1 billion in 2020.

- SAMVAD Program: ISRO introduced the SAMVAD Student Outreach Program at its Bengaluru facility, aimed at fostering space research among young minds.

- The objective is to bolster India's expanding space program, encourage private sector participation, drive technological innovation, and position the nation as a prominent player in the global space landscape.

Importance of Foreign Direct Investment (FDI) in the Space Sector:

- Advancement in Space Missions: India's achievements in space missions have positioned it as a reliable provider of cost-effective space solutions globally, with FDI expected to further enhance technological capabilities and expand operations.

- Boost to Manufacturing: Encourages the establishment of manufacturing facilities within India, aligning with the government's 'Make In India' initiative and bolstering domestic manufacturing capabilities.

- Private Sector Engagement: FDI facilitates greater private sector involvement in India's space endeavours, transitioning from ISRO-driven initiatives to leveraging space technology for commercial applications and fostering industry participation.

- Integration into Global Value Chains: Expected to integrate Indian companies into global value chains, enabling them to contribute significantly to the global space economy.

- Technology Uptake and Global Collaboration: FDI promotes the absorption of advanced technology and facilitates global integration, enabling companies to enhance product sophistication, scale operations globally, and increase their share in the global space economy.

- Enhanced Business Environment: FDI policy reforms improve the Ease of Doing Business in India, attracting greater FDI inflows and fostering investment, income, and employment growth.

- Stimulus for Research and Innovation: FDI in the space sector stimulates technology transfer, fosters research collaborations, and encourages innovation, driving advancements in space technology and applications.

What are the Challenges?

- Limited Investor Engagement: Investors show limited interest in the later stages of space tech development, likely due to perceived high risks and long-term investment horizons.

- Talent Shortage: The space tech sector faces a shortage of skilled professionals, highlighting the need for expanded talent development initiatives.

- Policy Ambiguity: Ambiguous policies in the space sector create uncertainty, necessitating clear and consistent regulatory frameworks to attract foreign investment.

- Streamlining FDI Procedures: Simplification of foreign direct investment processes is essential to remove barriers and encourage investor participation in the space industry.

- High Capital Requirements: Space technology ventures demand substantial capital investments, posing challenges for startups and smaller enterprises in accessing necessary funds.

- Competition Concerns with ISRO: Foreign investors express reservations due to competition concerns with ISRO, highlighting the importance of addressing perceived conflicts of interest to instil investor confidence.

Conclusion

The amendment in the FDI policy on the space sector heralds a new era of growth and opportunity for India’s space industry. By opening doors to foreign investment, India aims to leverage private sector participation to enhance its space capabilities, drive innovation, and foster economic development. The policy reform underscores India’s commitment to becoming a global leader in space exploration and technology.

Having panchayats as self-governing institutions

- 21 Feb 2024

Why is it in the News?

There is a need to educate elected representatives and the public on the significance and the need for panchayats to be able to survive on its own resources

Context:

- Three decades have passed since the enactment of the 73rd and 74th Constitutional Amendment Acts, designed to institutionalize local bodies as entities of local self-government.

- Presently, the degree of devolution in India's Panchayati Raj institutions exhibits variations among states, with some making substantial strides and others trailing behind.

- Therefore, there is a pressing need to scrutinize the fiscal devolution dimension, underscoring the pivotal role of state government commitment in enhancing the effectiveness of Panchayati Raj institutions at the grassroots level.

What is the Local Self Government?

- The system of local self-government, more commonly known as ‘panchayats’, had been established to empower the grassroots of democracy in India.

- Panchayats or local-self rule is a three-tier system in each state which has elected bodies at the village, taluk and district levels.

- The concept of panchayats has been present in Indian society since ancient times.

- Over the centuries the concept has undergone various changes and modifications and in the recent past has taken the form of panchayati raj institutions after decentralization reforms in the early 1990s.

- These institutions for grassroots-level democracy were formally included in the Constitution through the 73rd and 74th Amendments Act in 1993.

- The constitutional amendments also ensured the reservation of one-third of all elected positions for women in both rural and urban areas.

- Derived from the Central Act, various State Panchayati Raj Acts have incorporated provisions for taxation and revenue collection.

- The main idea of setting up local-self government institutions was to enable and empower the local people to manage their affairs by being a part of the decision-making process and participating in the implementation of policies in a more effective manner.

The Present State of Fiscal Devolution of Panchayats:

- Reliance on External Funds: The 73rd and 74th Constitutional Amendments Acts underscored the importance of fiscal devolution, urging Panchayati Raj institutions and urban local bodies to achieve financial self-sufficiency.

- These amendments explicitly stated the necessity for local bodies to generate their own revenues to reduce reliance on grants from higher levels of government.

- However, the current scenario indicates that Panchayati Raj institutions still heavily depend on external funding, with only 1% of their revenue originating from taxes.

- Panchayats' Struggle to Generate Revenue Through Taxation: The data highlights the challenge that, despite constitutional provisions, Panchayats are not effectively utilizing taxation as a primary revenue source.

- Merely 1% of revenue is generated through taxes, while a significant 80% is sourced from the Central government and 15% from the States.

- This disparity raises concerns about the commitment of state governments to decentralization and the overall efficacy of devolution initiatives implemented over the past three decades.

- Centralization of Financial Resources Despite Constitutional Emphasis on Fiscal Devolution: Despite the constitutional emphasis on fiscal devolution, the centralization of financial resources remains a persistent issue.

- Panchayats are envisioned as self-governing entities with the authority to raise their own revenue, yet the reality paints a different picture.

- The disproportionate distribution of revenue indicates a lack of fiscal empowerment at the grassroots level, undermining the fundamental principles of local self-government.

What are the Challenges Faced by Panchayati Raj Institutions in Revenue Generation?

- Dependency on Grants: The reliance on grants is exacerbated by the heightened allocations from Central Finance Commissions (CFC).

- A comparative analysis reveals a significant increase in grants disbursed through the 14th and 15th CFCs, amounting to ?2,00,202 crore and ?2,80,733 crore, respectively.

- This substantial influx of grants has inadvertently diminished incentives for generating own-source revenue.

- Panchayats, buoyed by augmented financial assistance, have gradually shifted focus away from revenue generation, fostering a culture of dependence on external funds.

- The Culture of Entitlement: A prevalent cultural mindset fosters resistance to taxation, with individuals expecting a range of services and benefits without contributing financially to the sustenance of Panchayats.

- This aversion to taxation arises from the belief that public services should be provided without imposing a direct financial burden on the local populace.

- Dilemma of Elected Representatives: Elected representatives, crucial to the functioning of Panchayati Raj institutions, grapple with their own set of challenges.

- There exists a tangible apprehension among these representatives that levying taxes might adversely affect their popularity and electoral prospects.

- This fear often results in hesitancy to take decisive steps towards revenue generation.

- Addressing this challenge necessitates targeted efforts to educate elected representatives about the enduring benefits of financial self-sufficiency and its positive impact on local development endeavours.

- Decline in Tax Collection: Tax collection, which stood at ?3,12,075 lakh in 2018-19, dwindled to ?2,71,386 lakh by 2021-2022.

- This downward trend raises concerns, signalling a waning commitment to financial autonomy at the local level.

- Similarly, non-tax revenue also experienced a decline from ?2,33,863 lakh to ?2,09,864 lakh during the same period.

- These patterns underscore the imperative for revitalized efforts in revenue generation and a departure from grant dependency.

Government's Efforts to Implement Constitutionally Mandated Fiscal Devolution:

- Establishment of an Expert Committee: To address this challenge, the Ministry of Panchayati Raj constituted an expert committee tasked with examining the own source of revenue (OSR) of rural local bodies.

- The committee's findings delineate various revenue-generating avenues accessible to Panchayati Raj institutions through State Acts.

- These mechanisms include property tax, land revenue cess, stamp duty surcharge, tolls, professional tax, advertisement tax, and user charges for essential services like water, sanitation, and lighting.

- While these avenues exist, their effective implementation is imperative for Panchayats to attain financial autonomy.

- Focus on Effective Taxation Mechanisms: The report underscores the significance of establishing an enabling environment for taxation, encompassing decisions on tax and non-tax bases, enactment of robust tax management and enforcement laws, etc.

- This strategic approach aims to empower Panchayats to fully leverage their revenue generation potential.

- While taxation constitutes a vital aspect of fiscal devolution, the report also acknowledges the potential of non-tax revenue streams, including Fees, rent, income from investment sales and hire charges,

- Along with revenue from innovative initiatives such as rural business hubs, commercial ventures, renewable energy projects, carbon credits, CSR funds, and donations.

- Diversification of revenue sources can bolster the financial resilience of Panchayati Raj institutions, reducing their reliance on grants.

The Role of Gram Sabhas:

- Gram sabhas have a significant role in fostering self-sufficiency and sustainable development at the grass-roots level by leveraging local resources for revenue generation.

- They can be engaged in planning, decision-making, and implementation of revenue-generating initiatives that range from agriculture and tourism to small-scale industries.

- They have the authority to impose taxes, fees, and levies, directing the funds towards local development projects, public services, and social welfare programmes.

- Through transparent financial management and inclusive participation, gram sabhas ensure accountability and foster community trust, ultimately empowering villages to become economically independent and resilient.

- Thus, gram sabhas need to promote entrepreneurship, and foster partnerships with external stakeholders to enhance the effectiveness of revenue generation efforts.

Way Forward:

- Education and Awareness: There is a pressing need to raise awareness among elected representatives and the public about the importance of revenue generation for developing Panchayats as self-sustaining institutions.

- Ultimately, the dependency syndrome for grants has to be minimised and in due course, panchayats will be able to survive on their own resources.

- Achieving this goal requires concerted efforts at all levels of governance, including the state and central levels.

- Promotion of Entrepreneurship: Gram Sabhas plays a crucial role in promoting entrepreneurship and fostering partnerships with external stakeholders to bolster revenue generation efforts.

- Encouraging entrepreneurial ventures within local communities can stimulate economic growth and reduce dependency on external funding.

- Collaboration and Support: Panchayats need to collaborate closely with higher tiers of governance and external stakeholders to enhance their revenue generation capabilities.

- This collaborative approach can facilitate the implementation of innovative initiatives and the efficient utilization of resources, thereby fostering financial self-reliance among Panchayats.

Greece’s gateway to Asia, India’s gateway to Europe

- 20 Feb 2024

Why is it in the News?

The state visit by Greek Prime Minister Kyriakos Mitsotakis to India will be another important step in building a strategic relationship between India and Greece — a process which began with the historic visit of the Indian Prime Minister, Narendra Modi, to Greece in August 2023.

Context:

- The upcoming state visit of Greek Prime Minister Kyriakos Mitsotakis to New Delhi signifies a pivotal milestone in the ongoing initiatives to forge a strategic partnership between Greece and India.

- This diplomatic initiative follows the landmark visit of the Indian Prime Minister to Greece in August 2023, which generated enthusiasm among Greek political and business circles.

- The anticipation surrounding the visit of the Greek Prime Minister underscores the mutual dedication to enhancing bilateral relations and collaboration across diverse sectors.

Historical Connections:

- India and Greece share a rich historical bond spanning more than 2500 years, characterized by cultural exchanges and a mutual embrace of democratic values.

- Presently, their bilateral relations are multifaceted, covering political, economic, and military cooperation.

- Trade Routes: Ancient maritime trade routes linked the Indus Valley Civilization with the Aegean region, facilitating the exchange of commodities such as spices, textiles, and intellectual ideas.

- Archaeological evidence, including the discovery of Indus seals in Mesopotamia, suggests the existence of trade connections between the two civilizations.

- Alexander the Great (326 BCE): Alexander's conquest of parts of northwest India fostered cultural and diplomatic exchanges between Greece and India.

- Greek philosophies and ideologies potentially influenced various aspects of Indian art, mathematics, and astronomy during this period.

- Indo-Greek Kingdoms (2nd century BCE – 1st century CE): Hellenistic kingdoms established in northwest India witnessed a fusion of Greek and Indian cultures.

- This blending is evident in Gandhara art, which exhibits Greco-Buddhist influences and serves as a testament to the cultural interplay between the two civilizations.

The Current Status of Bilateral Relations between India and Greece:

- Steady Progress in Bilateral Relations: While India and Greece share a historical connection and mutual enthusiasm, the pace of their bilateral cooperation has been characterized by gradual progress.

- In this context, it is essential to delve into the various facets of collaboration, recognizing both the positive developments and the need for enhanced momentum.

- Military Cooperation: Over time, military collaboration between the two nations has witnessed notable advancements.

- Joint exercises involving the Indian Navy, Indian Air Force, and the Greek armed forces have been conducted, underscoring a shared commitment to fostering mutual understanding and coordination.

- Reciprocal exercises are in the pipeline, illustrating an ongoing endeavour to deepen military bonds.

- These joint military endeavours not only bolster regional security but also signify an increasing level of confidence and collaboration between the armed forces of Greece and India.

- Economic Engagement: On the economic front, there have been significant instances of collaboration signalling a burgeoning partnership.

- For instance, an Indian construction company has joined forces with a prominent Greek construction firm to undertake a significant project: the construction of a new airport on the island of Crete.

- Such initiatives highlight the potential for cross-border investments and partnerships that can contribute to economic development and diversification.

Advancing Economic Reforms And Greece's Role:

- Greece's proactive stance in promoting deeper EU-India relations adds another layer of importance to ongoing economic reforms.

- As Greece endeavours to swiftly finalize the EU-India bilateral trade and investment agreement (BTIA), it underscores its dedication to establishing a conducive environment for heightened economic cooperation.

- The BTIA is poised to act as a catalyst, providing a structured framework for trade and investment, thereby nurturing closer economic bonds between the EU and India.

A Path to Closer Ties: Economic Reforms in Greece

- The economic facet of the Greece-India relationship assumes greater prominence as Greece, under the leadership of Prime Minister Kyriakos Mitsotakis, embarks on substantial economic reforms.

- Over the past half-decade, the Mitsotakis administration has implemented measures aimed at steering the Greek economy towards a more sustainable growth trajectory.

- This transformation positions Greece not only as a dependable eastern frontier of the European Union (EU) but also as a potential linchpin in broader geopolitical and economic strategies.

IMEEC Corridor: A Vision of Significance

- As Greece solidifies its role in the Eastern Mediterranean, the concept of establishing the India-Middle East-Europe Economic Corridor (IMEEC) emerges as a compelling vision.

- The IMEEC embodies a comprehensive economic initiative aimed at seamlessly connecting India, the Middle East, and Europe, thereby stimulating trade, investment, and economic collaboration.

- This ambitious proposition aligns with the shared vision of both nations to deepen their economic bonds and explore novel avenues for cooperation.

The Geopolitical Significance of the Indo-Greek Relationship:

- A Robust Foundation Rooted in Historical Bonds: The historical backdrop of the evolving ties between Greece and India (with diplomatic relations established in 1950) enriches their contemporary diplomatic endeavours.

- Furthermore, these diplomatic exchanges acquire significance amidst India's ascent as a global power, being perceived not only as an enduring ally but also as a dynamic and influential player on the world stage.

- Contemporary Diplomacy: The momentous visit of the Indian Prime Minister to Greece in August 2023 served as a watershed, laying the groundwork for enhanced collaboration.

- The enthusiasm witnessed in Greece, particularly among political and business circles, underscores the perceived opportunities in forging a strategic partnership with India.

- Strategic Importance of Both Nations' Locations: The geopolitical relevance of this burgeoning relationship is amplified by the strategic locations of Greece and India.

- Situated in regions pivotal to the global system, both nations grapple with geopolitical complexities and volatility.

- Recent events in the Red Sea highlight the interconnectedness of the East Mediterranean, where Greece is positioned, and the Indian Ocean region, accentuating the imperative for collaboration to promote security, stability, and prosperity.

- A Strategic Vision: Gateway to Europe and Asia: The Greek Prime Minister's assertion that "India will find no better gateway to Europe than my country, and for Greece, there is no better gateway to Asia than a close strategic relationship with India" encapsulates the acknowledgement of each nation's unique role in bridging the other's region.

- This pragmatic understanding not only acknowledges geographical realities but also reflects a strategic vision to leverage mutual strengths for collective advancement.

Way Forward to Enhance Indo-Greek Relations:

- Promoting Cross-Cultural Understanding: By expanding university student exchange programs, deliberate steps will be taken to familiarize the younger generation with the cultures, traditions, and educational systems of both nations.

- This fosters not only cross-cultural appreciation but also establishes a groundwork for future collaborations and friendships.

- Fostering Cultural Exchanges: Cultural exchanges serve as a cornerstone in fortifying the bonds between Greece and India.

- Through the promotion of cultural events, exhibitions, and festivals, both countries create platforms for their citizens to immerse themselves in and celebrate the richness of each other's cultural heritage.

- These initiatives act as bridges, connecting hearts and minds, and nurturing a sense of shared identity and mutual respect for cultural diversity.

- Media Collaboration: Bridging Information Gaps: Media collaboration emerges as a pivotal avenue to bridge geographical distances and keep the citizens of both nations abreast of developments, cultural nuances, and societal trends.

- Joint efforts in media, including co-productions, cultural documentaries, and news coverage, facilitate a nuanced understanding of each other's realities.

Conclusion

The swift exchange of visits between the political leadership of Greece and India underscores their commitment and the urgency in advancing their strategic partnership. As the world navigates through a pivotal year in 2024, the onus lies on policymakers and businesses to capitalize on this momentum and fortify the strategic partnership between Greece and India.

With elections in at least 83 countries, will 2024 be the year of AI freak-out?

- 19 Feb 2024

Why is it in the News?

Regulatory panic could do more harm than good. Rather than poor risk management today, rules should anticipate the greater risks that lie ahead.

Context:

- The year 2024 will see 4.2 billion people go to the polls, which, in the era of artificial intelligence (AI), misinformation and disinformation may not be the democratic exercise intended.

- The Global Risks Report 2024 named misinformation and disinformation a top risk, which could destabilise society as the legitimacy of election results may be questioned.

- Therefore, it is crucial to scrutinise the possible drawbacks of swiftly formulated regulations to counter AI-driven disinformation during this crucial period.

What are the Major Challenges Arising from Hasty Regulatory Responses to AI?

Escalation of Disinformation: Unintended Ramifications of Resource Allocation

- The surge in disinformation, demonstrated by manipulated videos impacting political figures, presents a formidable obstacle.

- For instance, consider the case of Tarique Rahman, a leader of the Bangladesh Nationalist Party, whose manipulated video suggested a reduction in support for Gaza's bombing victims—an action with potential electoral repercussions in a Muslim-majority country.

- Meta, the parent company of Facebook, exhibited delayed action in removing the fabricated video, raising concerns about the effectiveness of content moderation.

- Moreover, the reduction in content moderation staff due to widespread layoffs in 2023 exacerbates the challenge.

- The pressure to prioritize interventions in more influential markets may leave voters in less prominent regions, such as Bangladesh, vulnerable to disinformation, potentially leading to a global surge in disinformation due to the focus on catching misinformation from powerful governments.

Reinforcement of Industry Dominance: Amplifying Concentration and Ethical Concerns

- While well-intentioned, AI regulations risk bolstering industry concentration. Mandates such as watermarking (which are not foolproof) and red-teaming exercises (which are expensive) may inadvertently favour tech giants, as smaller companies encounter compliance obstacles.

- Such regulations could further entrench the power of already dominant players by erecting barriers to entry or rendering compliance unfeasible for startups.

- This concentration not only consolidates power but also raises apprehensions regarding ethical lapses, biases, and the centralization of consequential decisions within a select few entities.

Navigating Ethical Quagmires: Pitfalls of Sincere Guidelines

- The formulation of ethical frameworks and guidelines introduces its own complexities.

- The question of whose ethics and values should underpin these frameworks gains prominence in polarized times. Divergent perspectives on prioritizing regulation based on risk levels add layers of complexity, with some viewing AI risks as existential threats while others emphasize more immediate concerns.

- The absence of laws mandating audits of AI systems raises transparency issues, leaving voluntary mechanisms vulnerable to conflicts of interest.

- In the Indian context, members of the Prime Minister's Economic Advisory Council have even argued that the concept of risk management itself is precarious concerning AI, given its non-linear, evolving, and unpredictably complex nature.

Navigating the Complexity of AI Regulation: Strategies for Policymakers

- Acknowledge and Address Democracy's Inherent Challenges Alongside AI Threats:

- Before delving into the intricacies of AI-related risks, policymakers must acknowledge the persistent challenges facing democracy globally.

- Instances of unjust political imprisonments, threats to electoral processes, and disruptions to communication networks underscore the vulnerability of democratic systems.

- Furthermore, the enduring issues of vote-buying and ballot-stuffing tarnish the integrity of elections.

- These entrenched challenges within the democratic process provide context for evaluating the novelty of AI threats.

- Strike a Balance Between Addressing AI Risks and Implementing Sensible Regulation:

- The rush among regulators to enact AI regulations ahead of the 2024 elections, following the AI fervour of 2023, underscores the need for caution.

- While it is essential to confront the emerging threats posed by AI, hastily devised regulations may inadvertently worsen the situation.

- Policymakers must carefully consider the potential for unintended consequences and the complexities inherent in regulating a swiftly evolving technological landscape.

- It is crucial for regulators to appreciate the delicate balance required to manage AI risks without unintentionally creating new challenges or hindering democratic processes.

- Prepare for Future Challenges: Policymakers must adopt a forward-thinking approach to AI regulation, anticipating and formulating rules that not only address current risks but also proactively tackle future challenges.

- Recognizing the rapid evolution of technology, regulatory frameworks must evolve accordingly.

- By planning several steps ahead, regulators can contribute to the resilience of democratic processes, ensuring that voters in elections beyond 2024 benefit from an adaptive, proactive, and effective regulatory environment.

How Major Tech Companies Join Hands to Combat AI Misuse in Elections?

- On February 16th, 2024, a major step was taken in the fight against AI misuse in elections.

- 20 tech giants, including Microsoft, Google, Meta, and Adobe, signed a voluntary agreement called the "Tech Accord to Combat Deceptive Use of AI in 2024 Elections."

- This agreement marks a significant step towards collective action against the potential manipulation of democratic processes through deepfakes and other AI-generated content.

Key features of the Tech Accord:

- Collaborative detection and labelling: Companies pledge to develop tools and techniques for identifying and labelling deepfakes, fostering transparency and facilitating content removal.

- Transparency and user education: The accord emphasizes transparency in company policies regarding deepfakes and aims to educate users on identifying and avoiding them, raising public awareness about the technology's capabilities and limitations.

- Rapid response and information sharing: The signatories commit to sharing information and collaborating on takedown strategies for identified deepfakes, aiming for faster removal and a unified front against malicious actors.

- Additional measures: The agreement includes further commitments to invest in threat intelligence, empower candidates and officials with reporting tools, and collaborate on open standards and research.

However, critical analysis reveals potential limitations:

- Voluntary nature: The accord's voluntary character raises concerns about its enforceability and long-term effectiveness.

- Companies may prioritize competing interests over their goals.

- Technical challenges: Deepfake detection remains an evolving field with limitations.

- Continuous innovation by malicious actors can outpace detection capabilities.

- Potential for bias: Concerns exist about potential biases in detection algorithms, particularly regarding marginalized groups, further complicating the issue.

- Freedom of expression and censorship: Balancing the need for content moderation with upholding freedom of expression requires careful consideration and potential legal challenges.

Conclusion

Balancing immediate concerns with long-term implications, and addressing AI-related electoral risks requires careful regulatory foresight. While the Tech Accord offers promise in combatting AI-driven election interference, its effectiveness depends on rigorous implementation and continuous adaptation to evolving threats. Ongoing research and dialogue are crucial to address ethical concerns and ensure a balanced approach to safeguarding democracy and individual rights.

The Cost of Legal MSP is Greatly Exaggerated (Indian Express)

- 17 Feb 2024

Why is it in the News?

Farmers have resumed protests without a specific trigger, unlike their previous march against contentious farm laws. Their main demand is a legal guarantee for Minimum Support Prices (MSP).

Context:

- The renewed protest by farmers, advocating for a legal assurance of Minimum Support Prices (MSP), underscores the enduring battle for agricultural sector stability.

- Amidst this, it's crucial to delve into the intricacies of MSP, address prevailing misconceptions, and explore the advantages of formalising this system.

What is the Minimum Support Price (MSP)?

- MSP (Minimum Support Price) is the cost at which the government buys crops from the farmers, to guarantee farmers against any sharp fall in agricultural income.

- It is declared by the Government based on the proposal of the Commission for Agricultural Cost and Prices (CACP), at the start of the planting season.

- This mechanism aims to protect small and marginal farmers from financial losses and ensure an adequate supply of food grains for public distribution across India.

- Since its inception in 1966-67 for wheat, the MSP framework has expanded to cover various essential food crops, facilitating their availability to the public through subsidized rates under the public distribution system.

- However, only a small percentage, approximately 6% or less, of farmers are able to sell their produce at prices higher than the MSP.

Is the MSP Different in different states?

- Because of the variety in irrigation and wages, the expense of a similar yield changes from one state to another.

- However, there is no draft of the local Minimum Support Price, so there is one MSP for the whole country.

Significance of Minimum Support Price:

- Fixed Remunerations: The farmers are financially insured against the impulses of price fall in the market.

- It gives security to farmers from crop loss and price uncertainty.

- Help in Decision Making: MSPs are reported toward the start of the planting season, this assists farmers with settling on the best choices of crop that they should plant.

- This development data assists the farmer with settling on the best choice with regards to which yield to plant for the most extreme monetary advantage inside the restrictions of his agricultural land size, environment, and irrigation framework.

- Crop Diversification: The MSP declared by the Government of India without precedent for 1966-67 for wheat has reached out to around 24 crops at the present.

- This has urged the farmers to develop these different crops to maximize their agricultural income.

- Price Limitations for Private Purchasers: MSP conveys a value message to advertise that if vendors don’t offer higher than MSP costs the farmer may not sell them his produce.

- In this manner, it goes about as an anchor or benchmark for agricultural produce.

- It guarantees the market costs won’t be radically lower than the Minimum Support Price.

- Commercial Crops: MSP is utilized as an instrument to boost the creation of explicit food crops which is short in supply.

- MSP spurs farmers to develop commercial crops and expand creation on a commercial basis.

- Purchasing Power Enhancement: MSP provides fixed amounts in framers’ hands which makes them financially stable.

- It helps in upgrading the buying limit and updating the style of living of farmers and their families.

Challenges in Implementation of MSP:

- Selective Intervention and Limited Coverage: Despite the annual announcement of MSP for 23 crops, actual implementation tends to be selective, primarily focusing on major crops like rice and wheat.

- This limited coverage undermines the broader objective of ensuring stability across various agricultural commodities.

- MSP Implementation Bias: The unequal application of MSP, favouring specific crops, marginalizes farmers cultivating other essential commodities.

- This bias exacerbates regional disparities and impacts the economic well-being of farmers engaged in non-major crop cultivation.

- Disconnect Between Market Price and MSP: The disparity between market prices and MSP poses a significant challenge, as government intervention is triggered primarily when market prices fall below the MSP.

- Inconsistent intervention exacerbates uncertainties for farmers, leading to financial distress during market downturns.

- Perceived Government Apathy: Farmers perceive a lack of genuine interest or urgency from the government in effectively implementing MSP.

- This perceived apathy breeds distrust and frustration among farmers, fueling demands for a legal guarantee to ensure consistent and widespread implementation.

- Political Hesitation and Decision-Making Delays: While there is political consensus supporting a legal guarantee for MSP, successive governments have hesitated to formalize this mechanism.

- Delayed decision-making perpetuates uncertainties in the agricultural sector, undermining the effectiveness of MSP as a stabilizing force.

What Does a Legal Guarantee of MSP Mean and What Obstacles in Legalising MSP?

- It means that anyone paying less than the price set by the government for crops could be criminally charged.

- Currently, there is an MSP for 23 crops.

- However, the highest procurement by the government is of wheat and rice.

- According to experts, if MSP is legally guaranteed, the government will have to pay it regardless of supply and demand dynamics.

- At the moment, about 60 per cent of the total field crop production in India comes from wheat and paddy.

- Fiscal Concerns: Misconceptions regarding the fiscal implications of guaranteeing MSP have posed obstacles to its legalization.

- Despite the political consensus, concerns over perceived excessive fiscal burdens have deterred governments from formalizing MSP.