India’s Startup Revolution

- 15 Jan 2025

Context

India has solidified its position as one of the most dynamic startup ecosystems globally, emerging as a hub for innovation, entrepreneurship, and technological progress. However, realizing its ambition of becoming the top startup ecosystem requires addressing critical challenges and leveraging available opportunities.

Current Landscape of Indian Startups

Growth and Innovation

India ranks as the third-largest startup ecosystem in the world, following the U.S. and China. As of January 15, 2025, over 1.59 lakh startups have been officially recognized by DPIIT, with more than 120 attaining unicorn status (valuation exceeding $1 billion).

Investment Trends

Despite economic fluctuations, India's startups continue to attract significant investments. In 2022, venture capitalists infused $25 billion into the ecosystem, reaffirming India’s position as a preferred destination for global investors. Although there was a slowdown in 2023, domains like Software as a Service (SaaS) and climate tech continue to secure substantial funding.

Government Support

India’s startup-friendly policies, including Startup India, Digital India, and Atmanirbhar Bharat, have created an enabling environment. Notable initiatives include:

- Tax incentives, faster patent approvals, and regulatory relaxations.

- The launch of a ?10,000 crore Fund of Funds for Startups (FFS) in 2023 to improve capital accessibility.

- The Bharat Startup Knowledge Access Registry (BHASKAR) to streamline collaboration among startups and investors.

Regional Growth

- Tier II and III Expansion: Nearly 50% of startups are now based in emerging hubs such as Indore, Jaipur, and Ahmedabad.

- Tamil Nadu: The state boasts a $28 billion startup ecosystem, growing at 23%. Chennai alone houses around 5,000 startups, significantly contributing to employment generation.

- Kerala: With a $1.7 billion startup ecosystem, Kerala exhibits a compound annual growth rate of 254%, emphasizing cost-effective tech talent hiring.

Key Challenges Faced by Startups

1. Funding Constraints

The global economic downturn, coupled with rising interest rates, has limited venture capital inflows, resulting in layoffs and operational cutbacks.

2. Regulatory and Compliance Barriers

Despite government support, startups grapple with complex tax structures, evolving data protection laws, and stringent compliance requirements, including ESOP taxation policies.

3. Scaling and Market Adaptability

Many startups struggle with operational inefficiencies, limited market penetration, and inadequate infrastructure, hampering growth potential.

4. High Failure Rate

Approximately 90% of Indian startups fail within five years due to poor product-market fit, lack of financial planning, and insufficient adaptation to market needs.

5. Talent Shortages

India faces stiff competition in acquiring skilled professionals in areas like AI, cybersecurity, and machine learning, making retention increasingly difficult amid economic uncertainties.

Strategic Measures to Strengthen India’s Startup Ecosystem

1. Enhancing Policy Frameworks

- Simplified Regulations: Streamline startup registration, funding approvals, and international business operations.

- IP Protection: Strengthen intellectual property laws to boost R&D investment.

- Sector-Specific Initiatives: Develop targeted policies for AI, deep tech, healthcare, and green technologies.

2. Expanding Funding Access

- Encouraging Domestic Investment: Leverage pension and sovereign wealth funds to invest in startups.

- Public-Private Partnerships: Foster large-scale government-industry collaboration to finance emerging ventures.

- Decentralized Funding: Expand angel investor networks and micro-investment opportunities, particularly in Tier II and III cities.

3. Building Robust Infrastructure

- Tech Parks and Incubation Centers: Establish state-of-the-art facilities with mentorship programs.

- Improved Digital Connectivity: Ensure high-speed internet access in underserved regions.

- Enhanced Logistics and Supply Chains: Strengthen infrastructure to support startup scalability.

4. Developing a Skilled Workforce

- STEM and Entrepreneurial Education: Introduce curriculum enhancements in technical and business disciplines.

- Upskilling Programs: Collaborate with industry leaders to train professionals in high-demand skills.

- Diversity and Inclusion: Promote initiatives encouraging women and marginalized communities in entrepreneurship.

5. Fostering Innovation and Risk-Taking

- Strengthened R&D Funding: Increase allocations to universities and private research sectors.

- Encouraging Entrepreneurship: Reduce societal stigma surrounding startup failures to promote risk-taking.

- Leveraging Domestic Challenges: Address local issues like climate change and urbanization through innovation.

6. Expanding Global Reach

- International Collaborations: Partner with foreign accelerators and governments.

- Ease of Cross-Border Trade: Simplify export and import regulations for startups.

- Engaging the Indian Diaspora: Encourage successful overseas entrepreneurs to mentor and invest in Indian startups.

7. Advancing Sustainability Goals

- Green Tech Promotion: Support startups focusing on renewable energy and circular economy initiatives.

- Eco-Friendly Incentives: Offer financial support to ventures aligning with sustainability targets.

- Inclusive Growth Strategies: Expand agritech, edtech, and health-tech startups in rural areas, supporting platforms like the Women Entrepreneurship Platform (WEP) by NITI Aayog.

Building a Resilient Digital Economy

To fortify India's digital economy, startups should leverage existing infrastructure like UPI and Aadhaar while capitalizing on emerging technologies such as AI, 5G, and blockchain. A robust cybersecurity framework and data protection policies will be essential to ensure investor confidence.

Why Farmers Deserve Price Security

- 11 Jan 2025

Introduction:

The future of Indian agriculture is at a crossroads. With the shrinking of the agricultural workforce and the diversion of fertile farmlands for urbanization, ensuring the sustainability of farming is a strategic imperative. Among the various support mechanisms for farmers, the Minimum Support Price (MSP) remains a central point of debate. Should there be a legal guarantee for MSP? This question has gained prominence, especially with the rising challenges in agriculture, from unpredictable climate patterns to volatile market prices.

The Decline of Agriculture and Its Impact

India’s agricultural sector faces a dual crisis: loss of both land and human resources. Prime agricultural lands across river basins, such as the Ganga-Yamuna Doab or the Krishna-Godavari delta, are being repurposed for real estate, infrastructure, and industrial projects. Additionally, the number of "serious farmers" – those deriving at least half of their income from agriculture – is dwindling. The number of operational holdings may be 146.5 million, but only a small fraction of these farmers remains committed to agriculture.

This decline threatens the future of India’s food security, as the country will need to feed a population of 1.7 billion by the 2060s. To sustain farming and ensure long-term food security, we must secure farmers' livelihoods. Price security, particularly through MSP, plays a crucial role in this context.

The Role of MSP in Securing Farmers

MSP is the government-mandated price at which it guarantees the purchase of crops if market prices fall below a certain threshold. It provides a safety net for farmers against price volatility. The process of fixing MSP involves recommendations by the Commission for Agricultural Costs and Prices (CACP), which takes into account factors such as the cost of production and market trends. Once approved by the Cabinet Committee on Economic Affairs (CCEA), MSP is set for various crops, including rice, wheat, and sugarcane.

For farmers to stay in business, there must be a balance between production costs and returns. Farming is a risky business – yield losses can occur due to weather anomalies, pest attacks, or other natural factors. However, price risks can be mitigated with a guaranteed MSP. This would encourage farmers to invest in their land and adopt modern farming technologies, which would boost productivity and reduce costs.

Arguments for and Against Legal MSP Guarantee

Supporters of a legal MSP guarantee argue that it would provide financial security to farmers, protecting them from unpredictable market conditions. It would also promote crop diversification, encourage farmers to shift from water-intensive crops to those less dependent on irrigation, and inject resources into rural economies, thus addressing distress in rural areas.

However, critics highlight several challenges with a legal guarantee for MSP. The most significant concern is the fiscal burden it would impose on the government, potentially reaching Rs. 5 trillion. Furthermore, such a system could distort market dynamics, discouraging private traders and leading to a situation where the government becomes the primary buyer of agricultural produce. This could be economically unsustainable, especially for crops with low yields. Additionally, legal MSP guarantees could violate World Trade Organization (WTO) subsidy principles, adversely impacting India’s agricultural exports.

The Way Forward: A Balanced Approach

Given the challenges associated with a legal MSP guarantee, alternative measures should be explored. Price Deficiency Payment (PDP) schemes, such as those implemented in Madhya Pradesh and Haryana, could be expanded at the national level. These schemes compensate farmers for the difference between market prices and MSP, ensuring price security without the fiscal burden of procurement.

Additionally, the government can focus on improving agricultural infrastructure, such as cold storage facilities, to help farmers better access markets and increase price realization. Supporting Farmer Producer Organizations (FPOs) could also help farmers by enhancing collective bargaining power and ensuring better prices for their produce. Moreover, gradual expansion of MSP coverage to include a wider range of crops would encourage diversification, reducing the dominance of rice and wheat.

Government Extends Special Subsidy on DAP

- 03 Jan 2025

In News:

The Indian government has decided to extend the special subsidy on Di-Ammonium Phosphate (DAP) fertilizer for another year, a decision aimed at stabilizing farmgate prices and addressing the challenges posed by the depreciation of the Indian rupee.

Key Government Decision

- Extension of Subsidy: The Centre has extended the Rs 3,500 per tonne special subsidy on DAP from January 1, 2025 to December 31, 2025.

- Objective: This extension aims to contain farmgate price surges of DAP, India’s second most-consumed fertilizer, which is being impacted by the fall in the rupee's value against the US dollar.

Fertilizer Price Dynamics and Impact

- MRP Caps on Fertilizers: Despite the decontrol of non-urea fertilizers, the government has frozen the maximum retail price (MRP) for these products.

- Current MRPs:

- DAP: Rs 1,350 per 50-kg bag

- Complex fertilizers: Rs 1,300 to Rs 1,600 per 50-kg bag depending on composition.

- Current MRPs:

- Subsidy on DAP: The subsidy includes Rs 21,911 per tonne on DAP, plus the Rs 3,500 one-time special package.

- Impact of Currency Depreciation:

- The rupee's depreciation has made imported fertilizers significantly more expensive.

- The landed price of DAP has increased from Rs 52,960 per tonne to Rs 54,160 due to the rupee falling from Rs 83.8 to Rs 85.7 against the dollar.

- Including additional costs (customs, port handling, insurance, etc.), the total cost of imported DAP is now Rs 65,000 per tonne, making imports unviable without further subsidy or MRP adjustments.

- The rupee's depreciation has made imported fertilizers significantly more expensive.

Industry Concerns and Viability Issues

- Import Viability:

- Fertilizer companies face significant cost pressures due to rising import prices and the current MRP caps.

- Without an increase in government subsidies or approval to revise MRPs upwards, imports will be unviable.

- Even with the extended subsidy, companies estimate a Rs 1,500 per tonne shortfall due to currency depreciation.

- Stock Levels and Supply Challenges:

- Current stock levels for DAP (9.2 lakh tonnes) and complex fertilizers (23.7 lakh tonnes) are below last year's levels.

- With inadequate imports, there are concerns about fertilizer supply for the upcoming kharif season (June-July 2025).

Government’s Strategy and Fiscal Implications

- Compensation for Imports:

- In September 2024, the government approved compensation for DAP imports above a benchmark price of $559.71 per tonne, based on an exchange rate of Rs 83.23 to the dollar.

- With the rupee falling below Rs 85.7, these previous compensation calculations have become outdated.

- Fiscal Impact:

- The extended subsidy will cost the government an additional Rs 6,475 crore. Despite this, political implications of raising the MRP are minimal, as only non-major agricultural states are facing elections in 2025.

Future Outlook and Priorities

- Immediate Priority: The government’s primary concern is securing adequate fertilizer stocks for the kharif season, focusing on ensuring sufficient imports of both finished fertilizers and raw materials.

- Balancing Factors: The government will need to navigate the complex balance of maintaining fertilizer affordability for farmers, ensuring the viability of fertilizer companies, and managing fiscal constraints.

As the subsidy extension is implemented, all eyes will be on the government's ability to ensure a stable supply of fertilizers while safeguarding both farmer interests and economic sustainability in the face of an increasingly challenging exchange rate environment.

Introduction to Dr. Manmohan Singh's Economic Reforms

- 31 Dec 2024

In News:

Dr. Manmohan Singh, a distinguished economist, played a crucial role in shaping India’s economic trajectory. His leadership, as Finance Minister (1991–96) and Prime Minister (2004–14), is particularly noted for the economic liberalization and reform policies that transformed India’s economy.

India’s Economic Crisis of 1991

- Economic Collapse: India faced a severe balance of payments crisis, with dwindling foreign reserves and rising inflation.

- Key Challenges: Fiscal deficit, industrial stagnation, and trade imbalances worsened by the collapse of the Soviet Union.

- Urgent Measures: Dr. Singh was appointed Finance Minister during this crisis and initiated bold reforms to stabilize and grow the economy.

Key Reforms in 1991

- Devaluation of the Rupee

- Aimed at making Indian exports competitive in global markets.

- Reduced import tariffs and liberalized foreign trade.

- Industrial Policy Reforms

- Abolition of Licence Raj: Deregulated the industrial sector, promoting private enterprises.

- Reduced state control and encouraged foreign investment, leading to industrial growth.

- Banking and Financial Reforms

- Reduced the statutory liquidity ratio (SLR) and cash reserve ratio (CRR).

- Allowed for more credit flow, fostering economic expansion and banking sector efficiency.

- Global Integration

- Introduced economic liberalization policies, integrating India with the global economy and attracting foreign investments.

Economic Growth and Social Welfare Initiatives

- Poverty Reduction: Reforms helped lift millions out of poverty by fostering job creation and industrial growth.

- Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA): Launched in 2005, providing 100 days of wage employment to rural households.

- Right to Information (RTI) and Right to Education (RTE)

- Empowered citizens by ensuring transparency and access to government information.

- RTE guaranteed free and compulsory education for children aged 6-14.

- Financial Inclusion: Aadhar project introduced to facilitate welfare delivery and financial inclusion.

Legacy of Economic Liberalization and Growth

- Economic Growth: Under his leadership, India’s GDP grew at an average rate of 8%, establishing India as one of the fastest-growing economies.

- Shift to a Market-Driven Economy: Reforms dismantled socialist controls, facilitating the rise of the private sector.

- Attracting Foreign Investment: Economic liberalization and policy reforms made India an attractive destination for foreign capital.

Leadership During Political and Economic Challenges

- Reluctant Prime Minister

- In 2004, Singh became Prime Minister despite initial reluctance, emerging as a unifying figure during coalition politics.

- His tenure saw India’s rise as a global economic power, particularly from 2004–2009.

- Challenges

- Singh’s second term was marred by allegations of corruption and policy paralysis, leading to criticism of his administration.

- However, his personal integrity remained intact, and he maintained focus on governance.

- Historic India-US Nuclear Deal (2008)

- The deal marked a significant shift in India’s foreign relations and energy policies, enabling civilian nuclear trade.

Conclusion

Dr. Manmohan Singh’s economic policies are central to India's modern economic framework. His vision transformed India from a closed, socialist economy to a vibrant, globalized economy, promoting inclusive growth and institutional reforms. Despite facing challenges and criticisms, his legacy remains a testament to strategic policymaking that continues to influence India’s economic landscape.

Sustainable Groundwater Management in India’s Agriculture

- 30 Dec 2024

Introduction: Groundwater Crisis and Agriculture

- India's Agricultural Dependence on Groundwater: India is a leading producer of water-intensive crops like rice, wheat, and pulses. The country’s agricultural sector heavily depends on groundwater for irrigation, especially for paddy cultivation.

- Over-exploitation of Groundwater: Groundwater extraction for irrigation is increasingly unsustainable, threatening agricultural sustainability in the long term.

Rising Groundwater Usage and Its Implications

- Population Growth and Groundwater Use: Between 2016 and 2024, global population grew from 7.56 billion to 8.2 billion, and India’s population rose from 1.29 billion to 1.45 billion. Concurrently, groundwater used for irrigation increased from 38% in 2016-17 to 52% in 2023-24, exacerbating the water crisis.

- Over-extraction in Major Paddy-Producing States: States like Rajasthan, Punjab, and Haryana have witnessed severe over-exploitation of groundwater for irrigation.

- Rajasthan: Highest groundwater salinisation (22%) despite receiving the highest average rainfall (608 mm) among these states.

- Punjab and Haryana: Lesser groundwater salinity due to canal irrigation and micro-irrigation systems.

Impact of Excessive Fertilizer Use on Groundwater Quality

- Soil Salinity and Groundwater Contamination: Excessive use of fertilizers, particularly for paddy cultivation, increases soil salinity and contributes to groundwater contamination.

- Toxic Chemicals in Groundwater: Nitrate contamination, caused by nitrogen-based fertilizers, and uranium contamination due to phosphate fertilizers are key concerns in states like Maharashtra, Telangana, Andhra Pradesh, and Tamil Nadu.

- Health Risks: Contaminated groundwater poses health risks such as thyroid disorders, cancer, and dental fluorosis, along with reduced agricultural productivity.

Projected Impact on Future Groundwater Availability

- Unsustainable Groundwater Levels: The Central Groundwater Board (CGWB) reports that if current practices continue, over half of the districts in Punjab could face groundwater depletion. Similarly, 21-23% of districts in Haryana and Rajasthan may experience a similar crisis.

- Population Growth and Water Scarcity: With India’s population expected to reach 1.52 billion by 2036, the need for sustainable groundwater management becomes even more critical.

Government Initiatives for Groundwater Management

- National Mission for Sustainable Agriculture (2014): Promotes sustainable practices like zero tillage, cover cropping, and micro-irrigation for efficient water and chemical use.

- Pradhan Mantri Krishi Sinchai Yojana (2015): Aims to boost irrigation efficiency through drip and sprinkler irrigation methods.

- Atal Bhujal Yojana (2019): Targets efficient groundwater management in water-stressed states like Gujarat, Haryana, Rajasthan, Maharashtra, and Uttar Pradesh.

- Success of Government Initiatives: CGWB data shows that the percentage of districts with unsustainable groundwater levels dropped from 23% in 2016-17 to 19% in 2023-24.

Role of State Governments in Groundwater Management

- State-Level Initiatives: States with unsustainable groundwater levels must take proactive measures to manage water resources efficiently.

- Example - Odisha: Odisha's Integrated Irrigation Project for Climate Resilient Agriculture emphasizes irrigation efficiency and climate-smart practices, supported by World Bank funding.

- Encouraging Resource-Efficient Agriculture: States with safe groundwater levels, like Chhattisgarh, Bihar, Jharkhand, Telangana, and Odisha, should adopt water-efficient practices to protect groundwater resources.

Conclusion: Ensuring Agricultural Sustainability and Water Security

- Need for Urgent Action: Scaling up efforts to improve irrigation practices and groundwater management is crucial to securing India’s agricultural future.

- Global Food Security: Protecting groundwater resources will not only ensure water security within India but also contribute to global food security amid climate challenges.

- Blueprint for Sustainable Agriculture: States like Odisha are providing a model for sustainable water management, which can be replicated across water-stressed regions in India.

Bank Credit to Women Self-Help Groups (SHGs)

- 21 Dec 2024

Introduction

The Deendayal Antyodaya Yojana – National Rural Livelihoods Mission (DAY-NRLM) is a flagship program by the Ministry of Rural Development (MoRD) that aims to reduce poverty by empowering women, especially through Self-Help Groups (SHGs). These SHGs have been instrumental in improving financial inclusion, providing access to credit, and enhancing the economic and social status of women across India. The program has made significant strides in mobilizing women, improving their access to financial services, and facilitating entrepreneurial ventures in rural areas.

Key Features and Initiatives of DAY-NRLM

- Self-Help Groups (SHGs):

- Formation: DAY-NRLM supports the creation and strengthening of SHGs, primarily focusing on rural women from economically disadvantaged backgrounds.

- Mobilization: As of 2024, over 10.05 crore women have been mobilized into 90.87 lakh SHGs across India.

- Objective: The main goal is to reduce poverty through empowerment by providing access to financial services and sustainable livelihoods.

- Start-up Village Entrepreneurship Programme (SVEP):

- Support for Rural Enterprises: SVEP, a sub-scheme under DAY-NRLM, encourages SHG women and their families to set up small-scale businesses.

- Impact: As of October 2024, 3.13 lakh rural enterprises have been supported under this initiative.

- State-wise Distribution: The program has supported enterprises across various states, with notable contributions from Andhra Pradesh (27,651 enterprises), Kerala (34,569), and Uttar Pradesh (28,904).

- Banking Correspondent Sakhis:

- Role: Women in SHGs are trained as Banking Correspondent Sakhis to enhance access to banking services such as deposits, credit, remittances, pensions, and insurance in rural areas.

- Current Deployment: 1,35,127 Sakhis have been deployed under DAY-NRLM, empowering women to be financial intermediaries in their communities.

- Financial Support for SHGs:

- Revolving Fund: SHGs receive funds ranging from Rs. 20,000 to Rs. 30,000 to boost their operations and financial stability.

- Community Investment Fund: SHGs can avail of up to Rs. 2.50 lakh under the Community Investment Fund to strengthen their financial position.

- Interest Subvention: To make bank loans more affordable, DAY-NRLM provides interest subvention to SHGs, reducing their overall credit costs.

- Online Marketing Platform:

- www.esaras.in: This online platform allows SHGs to market their products, improving their access to broader markets and enhancing their income-generating potential.

Impact of DAY-NRLM and SHGs

- Financial Inclusion: SHGs play a vital role in financial inclusion by providing access to banking services, loans, and insurance to women, especially in rural and remote areas.

- Credit Mobilization: As of November 2024, SHGs have leveraged Rs. 9.71 lakh crore in bank credit, thanks to the capitalization support provided by DAY-NRLM, including Revolving Funds and Community Investment Funds.

- Empowerment of Women: SHGs have significantly contributed to the empowerment of women, providing them with financial independence, social support, and the ability to make decisions in their households and communities.

Challenges Faced by SHGs

- Beneficiary Identification: Ensuring that the most marginalized individuals are included in SHGs can be challenging.

- Training Gaps: There is a lack of quality training programs and expert trainers to build the capacity of SHG members.

- Financial Literacy: Many SHG members have limited knowledge of formal financial services, hindering effective financial management.

- Market Linkages: Poor integration with markets limits the growth potential of SHGs, especially in terms of product sales and business expansion.

- Community Support: Insufficient business environment support and value chain linkages pose challenges to SHG sustainability and growth.

Government Initiatives Supporting SHGs

- SHG-Bank Linkage Programme (SBLP): Launched by NABARD in 1992, this initiative aims to link SHGs with formal banking institutions, facilitating financial inclusion.

- Mission for Financial Inclusion (MFI): A broader initiative to ensure that rural populations have access to affordable financial services such as savings, credit, insurance, and pensions.

- Lakhpati Didi Initiative: Launched in 2023, this initiative empowers SHG women to adopt sustainable livelihood practices and aim for an annual household income exceeding Rs. 1 lakh.

Role of SHGs in Rural Development

- Women Empowerment: SHGs have emerged as a powerful tool for empowering women through financial independence, social security, and the ability to make informed decisions.

- Economic Growth: SHGs foster small-scale entrepreneurship, thereby creating local businesses that contribute to rural economic growth.

- Social Cohesion: By promoting collective action, SHGs provide a social support system that helps in addressing common issues faced by their members, such as health, education, and safety.

Future Prospects and Way Forward

- Technological Integration: SHGs should leverage advanced digital platforms for transaction management, record-keeping, and communication, enhancing efficiency and accessibility.

- Reducing Informal Borrowing: Linking SHGs with formal financial institutions will reduce reliance on informal lenders, promoting financial inclusion.

- Inclusive Approach: SHGs should adopt an inclusive model to ensure that members from diverse socio-economic backgrounds are fairly represented and benefit equally.

- Training and Capacity Building: There is a need for more Community Resource Persons (CRPs) who can guide SHGs in beneficiary identification, financial management, and scaling their activities.

The Costly Push for 100% Electrification of Indian Railways

- 19 Dec 2024

Introduction

RITES Ltd., the consultancy arm of the Indian Railways, has secured two contracts to repurpose six broad gauge diesel-electric locomotives for export to African railways. These locomotives, originally designed for India’s broad gauge of 1,676 mm, will be modified for use on railways with the narrower Cape Gauge of 1,067 mm. While this is a commendable re-engineering effort, it also highlights a larger issue within Indian Railways: the unnecessary redundancy of functional diesel locomotives, leading to significant wastage of resources.

The Growing Problem of Idle Diesel Locomotives

As of March 2023, there were 585 diesel locomotives idling across the Indian Railways network due to electrification. This number has now reportedly grown to 760 locomotives, many of which still have more than 15 years of serviceable life. The root cause of this redundancy lies in the government’s mission to electrify the entire broad gauge network at an accelerated pace. This electrification push has resulted in the premature retirement of locomotives that could still serve the network for years, raising questions about the economic and environmental logic behind this decision.

The Justification for Electrification: Foreign Exchange and Environmental Concerns

The Indian government’s electrification drive is often justified on two primary grounds: saving foreign exchange by reducing the import of crude oil and reducing environmental pollution. Additionally, electrification is framed as a step toward a “green railway” powered by renewable energy sources like solar and wind. However, the reality of these claims is more complicated.

Foreign Exchange Savings: A Small Impact on National Diesel Consumption

While electrification may reduce India’s diesel consumption, the impact on national fuel use is minimal. Railways account for just 2% of the country’s total diesel consumption. A report by AC Nielsen in 2014 indicated that the transport sector consumed 70% of the total diesel, with railways accounting for only 3.24%. Even with 100% electrification, the savings in foreign exchange would have little impact on the country’s overall diesel consumption, leaving other sectors like trucking and agriculture as the main contributors.

Environmental Concerns: Shifting Pollution, Not Reducing It

The environmental argument for electrification is also flawed. Electricity in India is still largely generated from coal-fired power plants, with nearly 50% of the country’s electricity coming from coal. Since the Indian Railways is heavily involved in transporting coal, switching from diesel to electric locomotives simply shifts pollution from the tracks to the power plants. This means that the transition to electric traction will not result in a cleaner environment unless the country significantly reduces its reliance on coal. Without a substantial increase in renewable energy generation, the push for a “green railway” remains unrealistic.

The Dilemma of Retaining Diesel Locomotives for Strategic Purposes

Despite the goal of 100% electrification, a significant number of diesel locomotives will remain in service. Reports indicate that 2,500 locomotives will be kept for “disaster management” and “strategic purposes,” although it is unclear why such a large fleet is necessary for these purposes. Additionally, about 1,000 locomotives will continue to operate for several more years to meet traffic commitments. This suggests that even with a fully electrified network, Indian Railways will continue to rely on thousands of diesel locomotives, many of which have substantial residual service life left.

Financial Sustainability and Coal Dependency

The financial sustainability of this transition remains a concern. Currently, the Indian Railways generates a significant portion of its freight revenue from transporting coal—40% of its total freight earnings in 2023-24. If the railways become fully electrified, it will need to find alternative revenue sources, as coal is a primary contributor. Until non-coal freight options can replace this income, the financial health of the railways may be at risk.

Conclusion: Wasted Resources and Unmet Goals

The mission to electrify the Indian Railways, while ambitious, is an example of how vanity projects can lead to colossal waste. Thousands of diesel locomotives are being discarded prematurely, despite their potential to continue serving the network. The environmental and financial justifications for 100% electrification, while appealing in theory, fail to account for the complexities of India’s energy landscape. As a result, the drive to create a “green railway” is likely to fall short, leaving behind a legacy of wasted taxpayer money and unfinished goals.

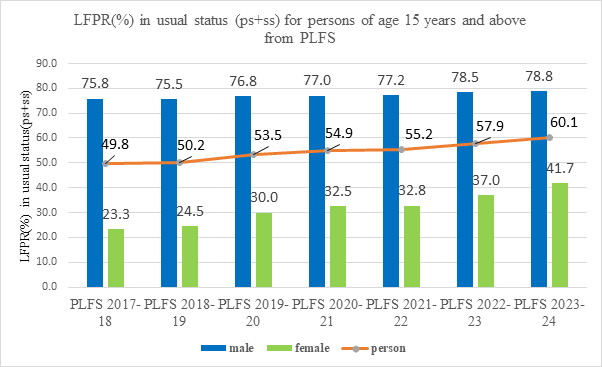

Analysis of Female Labour Force Participation Rate (LFPR) Trends in India: 2017-2023

- 11 Dec 2024

In News:

The Economic Advisory Council to the Prime Minister (EAC-PM) recently released a working paper revealing critical insights into the trends of female Labour Force Participation Rate (LFPR) in India from 2017-18 to 2022-23. The report highlights an overall increase in female LFPR, with rural areas experiencing more significant growth compared to urban areas. This article delves into the key findings, regional disparities, influencing factors, and government initiatives aimed at promoting female workforce participation.

Key Findings on Female LFPR

The period between 2017-18 and 2022-23 witnessed a notable rise in female LFPR, both in rural and urban regions, though rural areas saw higher gains.

Rural female LFPR surged by approximately 69%, from 24.6% to 41.5%, while urban female LFPR increased from 20.4% to 25.4%. This consistent growth was observed even after excluding unpaid family workers or household helpers, reinforcing the long-term trend of increased female workforce participation across India.

However, a significant point of discussion in the report was the regional variations in female LFPR. States like Bihar, Punjab, and Haryana have consistently reported low female LFPR, which is noteworthy considering that Punjab and Haryana are among India's wealthiest states, while Bihar is the poorest. This regional disparity suggests that economic prosperity does not automatically translate into higher female labour force participation, highlighting deeper socio-cultural and structural barriers.

Regional Disparities in Female LFPR

The report emphasizes the persistent challenges in northern and eastern India. Punjab and Haryana, despite their affluence, have struggled with low female LFPR. Cultural and societal norms in these regions may contribute to the underrepresentation of women in the workforce, particularly in rural areas where traditional gender roles are more entrenched.

On the other hand, Bihar, the poorest state in India, had the lowest female LFPR in the country, particularly in rural areas. However, there has been a significant improvement in recent years, especially among rural married women. This indicates a slow but positive shift in attitudes towards female employment in these states.

In contrast, northeastern states such as Nagaland and Arunachal Pradesh have shown significant improvements in female LFPR, particularly in rural areas. These states have demonstrated that regional and cultural factors can also create conducive environments for female workforce participation.

Demographic Factors Affecting Female LFPR

Several demographic patterns influence female LFPR, including marital status and age. The report notes that married men consistently exhibit higher LFPR compared to women. Marriage, however, has a detrimental impact on female LFPR, particularly in urban areas, where women often face greater familial and societal pressures to prioritize domestic responsibilities over formal employment.

Age dynamics also play a crucial role in female LFPR trends. The data reveals a bell-shaped curve for female participation, peaking around the age of 30-40 years and sharply declining thereafter. This is in stark contrast to male LFPR, which remains almost universally high between the ages of 30-50 before gradually declining. These trends underscore the challenges women face in sustaining their participation in the workforce due to familial responsibilities, especially after marriage and childbirth.

Government Initiatives and the Rise in Female LFPR

The government's focus on women-led development is evident through various schemes aimed at increasing female workforce participation. Programs like Mudra Loans, the Drone Didi Scheme, and the Deendayal Antyodaya Yojana have been particularly instrumental in empowering women, especially in rural areas. These initiatives provide women with access to financial resources, skill development opportunities, and avenues for entrepreneurship, all of which contribute to the rise in female LFPR.

The EAC-PM's analysis acknowledges the positive impact of these government schemes, but it also stresses the need for further research to evaluate their long-term effectiveness. While the descriptive analysis highlights a substantial increase in female LFPR between 2017-18 and 2022-23, especially in rural areas, there remains a need for continuous monitoring and assessment of these schemes to ensure their sustained impact.

Conclusion: A Positive Shift, but Challenges Remain

The increase in female LFPR across India from 2017-18 to 2022-23 signals a positive shift in employment trends, particularly in rural areas. However, regional disparities, societal norms, and demographic factors continue to pose challenges. The rise in female LFPR is encouraging, but it is essential to understand the deeper socio-economic factors that shape women's participation in the workforce.

Government schemes have contributed to this growth, but future research is necessary to gauge their long-term effects and ensure that women’s participation in the workforce is not just a short-term trend. It is crucial that the government continues to refine policies that support women in overcoming socio-cultural and economic barriers, especially in less prosperous states like Bihar, Punjab, and Haryana. Sustained efforts, including education, skill development, and gender-sensitive policies, will be key to ensuring that the rise in female LFPR is both inclusive and long-lasting.

The analysis by the EAC-PM provides an essential framework for policymakers to design more targeted interventions to address regional disparities and create a more inclusive labor market for women in India.

Building on the Revival of the Manufacturing Sector

- 07 Dec 2024

In News:

India’s manufacturing sector has shown remarkable signs of recovery and growth, thanks to strategic policy initiatives like the Production Linked Incentive (PLI) scheme. To fully capitalize on this momentum and become a global manufacturing hub, however, deeper reforms are needed.

The Success of the PLI Scheme: A Catalyst for Growth

The government’s PLI scheme has been instrumental in revitalizing key sectors like electronics, pharmaceuticals, automobiles, and textiles. It has not only boosted production but also increased exports and job creation. According to the Annual Survey of Industries (ASI) 2022-23, manufacturing output grew by an impressive 21.5%, while gross value added (GVA) increased by 7.3%. Sectors such as basic metals, refined petroleum products, food products, and motor vehicles, which are beneficiaries of the PLI scheme, contributed 58% of total manufacturing output, registering growth of 24.5%.

This success underlines the potential of India’s manufacturing sector, with the PLI scheme acting as a key enabler. However, while the recovery is promising, there are significant challenges to overcome to sustain long-term growth.

Expanding PLI Incentives to New Sectors

The PLI scheme has largely benefitted traditional industries like electronics and automotive manufacturing. To further accelerate growth, the scope of the scheme must be extended to labour-intensive sectors such as apparel, footwear, and furniture, which hold immense potential for job creation. Additionally, emerging sectors like aerospace, space technology, and maintenance, repair, and overhaul (MRO) services offer new avenues for growth. By diversifying the incentive structure to these sectors, India could establish a more robust and resilient manufacturing ecosystem.

In sectors like capital goods, where India is heavily import-dependent, the potential for reducing supply chain vulnerabilities is significant. Moreover, promoting green manufacturing and advanced technologies could further bolster India’s competitiveness in global markets.

Addressing the Divergence Between Output and Value Addition

Despite a surge in production, India’s gross value added (GVA) has not kept pace with output growth. The ASI data shows that input prices soared by 24.4% in 2022-23, indicating that while production volumes are up, industries are grappling with high input costs. A more streamlined import regime could mitigate these costs. Simplifying tariffs into a three-tier system (for raw materials, intermediates, and finished goods) would reduce input costs, enhance competitiveness, and improve integration into global value chains.

Regional Imbalance: A Barrier to Inclusive Growth

The manufacturing sector’s growth is heavily concentrated in a few states such as Maharashtra, Gujarat, Tamil Nadu, Karnataka, and Uttar Pradesh, which account for over 54% of manufacturing GVA. This concentration not only restricts equitable development but also hampers the overall growth potential of the sector. To address this, it is crucial that states actively participate in India's manufacturing growth story by implementing market reforms in land, labour, and power. Additionally, infrastructure development and investment promotion in less industrialized regions could help balance growth and ensure that the benefits of manufacturing reach all corners of the country.

Fostering MSME Growth and Enhancing Female Workforce Participation

Micro, small, and medium enterprises (MSMEs) contribute about 45% of India’s manufacturing GDP and employ around 60 million people. To scale these businesses and integrate them into global value chains, PLIs should be tailored to accommodate their needs, such as lowering capital investment thresholds and reducing production targets.

Equally important is the enhancement of female workforce participation. Studies suggest that India’s manufacturing output could increase by 9% if more women enter the workforce. The development of supportive infrastructure, such as hostels and childcare facilities, can play a pivotal role in enabling women’s participation, thus driving inclusive growth.

Conclusion: The Path Forward

To transform into a developed economy by 2047, India must continue to focus on strengthening its manufacturing sector. According to industry estimates, manufacturing’s share in Gross Value Added (GVA) can rise from 17% to 25% by 2030 and further to 27% by 2047. Achieving this will require sustained efforts to enhance competitiveness through business reforms, cost reduction, and policy support. India is well-positioned to harness its manufacturing potential, but timely and focused interventions are necessary to turn this vision into reality.

Scrapping of Windfall Gains Tax

- 05 Dec 2024

Introduction

On December 2, 2024, the Indian government withdrew the windfall gains tax on domestic crude oil production and fuel exports (diesel, petrol, and aviation turbine fuel - ATF). This tax, initially imposed in July 2022, was introduced in response to the surge in global oil prices following Russia's invasion of Ukraine. Its removal reflects the current global oil market stability and the improved fuel supply situation in India.

What is Windfall Gains Tax?

Definition

A windfall tax is a levy imposed on unexpected profits that result from extraordinary events, such as geopolitical crises or market disruptions. In the case of India, the tax was applied to the super-normal profits of oil producers and fuel exporters due to the global energy turmoil.

Key Features

- Domestic Crude Oil: The Special Additional Excise Duty (SAED) was imposed on domestic crude oil production.

- Fuel Exports: A combination of SAED and Road and Infrastructure Cess (RIC) was levied on diesel, petrol, and ATF exports.

Rationale Behind the Windfall Gains Tax

Immediate Context

The tax was introduced during a period of soaring global crude oil prices, driven by the Russia-Ukraine conflict. India, which imports over 85% of its oil, faced concerns about the availability of fuels and the impact of rising prices on domestic consumption. The tax was seen as a way to:

- Ensure Domestic Fuel Supply: By discouraging excessive fuel exports during a period of global supply chain disruptions.

- Increase Government Revenue: The tax aimed to capture windfall profits and offset the duty cuts on domestic fuel sales.

Global Context

Other countries also implemented similar windfall taxes during this period, as energy companies saw record profits due to the price surge.

Decline in Windfall Gains Tax Revenue

Revenue Collection

The windfall gains tax initially raised significant revenue, but the amount has decreased over time due to falling global oil prices:

- FY 2022-23: Rs 25,000 crore

- FY 2023-24: Rs 13,000 crore

- FY 2024-25 (so far): Rs 6,000 crore

This decline, combined with reduced oil prices, led to the tax being effectively inactive before its formal withdrawal.

Withdrawal of the Windfall Gains Tax

Reasons for the Withdrawal

- Global Stabilization: Crude oil prices, which had exceeded $100 per barrel, have now stabilized under $75 per barrel, with no immediate signs of a significant price surge.

- Domestic Fuel Availability: There is now a robust fuel supply in the domestic market, making the tax less necessary.

- Declining Revenues: With the tax generating diminishing returns, it was no longer economically viable for the government to maintain it.

Impact of the Scrapping

The government's move to scrap the windfall gains tax is seen as a signal of stability and predictability in the taxation regime. It assures the oil industry that the government is confident in the stability of global oil prices and supply chains.

Criticism of the Windfall Tax

Industry Opposition

The windfall tax faced opposition from the oil industry, which argued that it:

- Reduced Profitability: The tax limited the profits of publicly listed companies like ONGC and Reliance Industries.

- Discouraged Oil Production: By making the taxation environment unpredictable, it deterred investment in oil exploration and production in a country that is heavily dependent on oil imports.

- Created Uncertainty: Frequent revisions of the tax led to an unstable business environment.

Conclusion

The scrapping of the windfall gains tax is a significant policy shift. It not only provides relief to oil companies but also signals a more predictable and stable taxation regime. By withdrawing the tax, the government is fostering a conducive environment for future investments in domestic oil production and signaling its confidence in the stability of global oil prices. This move is a crucial step in ensuring that India’s energy policies remain adaptable and aligned with the evolving global market conditions.

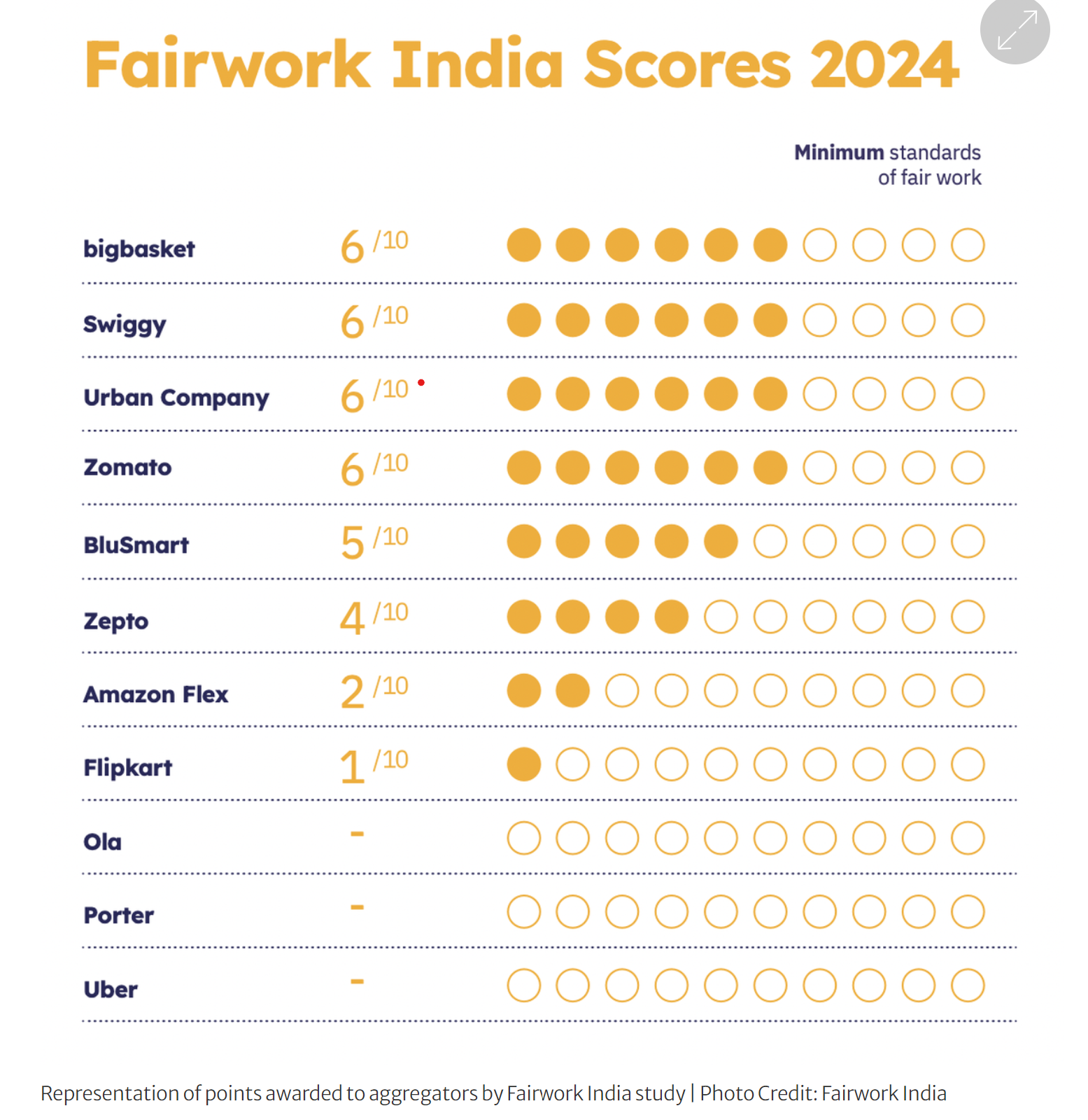

India's Gig Economy: Growth and Impact on Employment

- 03 Dec 2024

Introduction

India’s gig economy is experiencing rapid growth, with projections indicating it will significantly contribute to the national economy and employment generation. A recent report by the Forum for Progressive Gig Workers estimates the gig economy could reach $455 billion by the end of 2024, growing at a 17% compounded annual growth rate (CAGR). By 2030, it may add 1.25% to India’s GDP and create 90 million jobs.

What is the Gig Economy?

- Definition: The gig economy refers to a labor market based on short-term, flexible jobs, typically facilitated by digital platforms. Gig workers, also called freelancers or independent contractors, are compensated for each task they complete.

- Key Features:

- Flexibility in work schedule and location.

- Task-based employment through digital platforms.

- Common sectors: e-commerce, transportation, delivery services, and freelance work.

Status of the Gig Economy in India

- Market Growth:

- In 2020-21, India had 7.7 million gig workers, which is expected to grow to 23.5 million by 2029-30.

- Key sectors contributing to growth include e-commerce, transportation, and delivery services.

- Driving Factors:

- Digital Penetration: With over 936 million internet subscribers and 650 million smartphone users, digital infrastructure is a key enabler of the gig economy.

- Startup and E-commerce Growth: The rise of startups and e-commerce platforms has increased demand for flexible labor.

- Changing Work Preferences: Younger generations seek work-life balance, opting for flexible gig work.

Gig Economy and Employment Generation

- Contribution to GDP: The gig economy is expected to contribute 1.25% to India’s GDP by 2030.

- Job Creation:

- The gig economy could create up to 90 million jobs by 2030.

- It is estimated that by 2030, gig workers will comprise 4.1% of India’s total workforce.

- Benefits:

- Women’s Empowerment: Gig work provides financial independence and flexibility, especially benefiting women in the workforce.

- Regional Growth: Tier-II and Tier-III cities are seeing accelerated growth in gig work opportunities.

Challenges Faced by Gig Workers

- Job Insecurity: Many gig workers experience instability in their employment, especially in low-skilled jobs.

- Income Volatility: Earnings are unpredictable, and workers face difficulty in financial planning.

- Regulatory Gaps: There is no comprehensive legal framework to protect gig workers’ rights and ensure fair working conditions.

- Delayed Payments: A significant number of workers face delayed payments, affecting their financial well-being.

- Skill Development: Many workers report a lack of opportunities for career advancement and skill development.

Government Initiatives for Gig Workers

- Code on Social Security, 2020: Recognizes gig workers and aims to extend social security benefits, though it lacks comprehensive coverage.

- e-Shram Portal & Welfare Schemes: Initiatives like Pradhan Mantri Shram Yogi Maandhan Yojana and PMJJBY aim to provide financial security to gig workers.

- State-level Initiatives:

- Rajasthan’s Platform-Based Gig Workers Act (2023) focuses on registration and welfare.

- Karnataka’s bill mandates formal registration and grievance mechanisms.

The Way Forward

- Legal Reforms: India can draw from international models like California and the Netherlands, where gig workers are reclassified as employees to ensure protections such as minimum wages and regulated working hours.

- Portable Benefits System: Implementing a system where gig workers can access benefits like healthcare and retirement plans regardless of their employer.

- Skill Development: Strengthening collaborations with vocational institutions to enhance skills and improve earning potential.

- Technological Solutions: Establishing robust feedback mechanisms for workers to report exploitation and ensure fairness within the gig economy.

Conclusion

The gig economy in India is poised to become a significant driver of economic growth and job creation. However, addressing challenges such as income volatility, job insecurity, and regulatory gaps is crucial to ensuring sustainable growth.

National Mission on Natural Farming (NMNF)

- 29 Nov 2024

In News:

The Union Cabinet recently approved the launch of the National Mission on Natural Farming (NMNF), marking a significant shift in the government's approach to agriculture. This initiative, a standalone Centrally Sponsored Scheme under the Ministry of Agriculture & Farmers' Welfare, aims to promote natural farming across India, focusing on reducing dependence on chemical fertilizers and promoting environmentally sustainable practices.

What is Natural Farming?

Natural farming, as defined by the Ministry of Agriculture, is a chemical-free agricultural method that relies on inputs derived from livestock and plant resources. The goal is to encourage farmers to adopt practices that rejuvenate soil health, improve water use efficiency, and enhance biodiversity, while reducing the harmful effects of fertilizers and pesticides on human health and the environment. The NMNF will initially target regions with high fertilizer consumption, focusing on areas where the need for sustainable farming practices is most urgent.

Evolution of Natural Farming Initiatives

The NMNF is not an entirely new concept but a scaled-up version of the Bhartiya Prakritik Krishi Paddhti (BPKP) introduced during the NDA government's second term (2019-24). The BPKP was part of the larger Paramparagat Krishi Vikas Yojna (PKVY) umbrella scheme, and natural farming was also promoted along the Ganga River under the NamamiGange initiative in 2022-23. With the renewed focus on natural farming following the 2024 elections, the government aims to extend the lessons learned from BPKP into a comprehensive mission mode, setting a clear direction for sustainable agriculture.

In Budget speech for 2024-25, it was announced a plan to initiate one crore farmers into natural farming over the next two years. The mission will be implemented through scientific institutions and willing gram panchayats, with the establishment of 10,000 bio-input resource centers (BRCs) to ensure easy access to the necessary inputs for natural farming.

Key Objectives

The NMNF aims to bring about a paradigm shift in agricultural practices by:

- Expanding Coverage: The mission plans to bring an additional 7.5 lakh hectares of land under natural farming within the next two years. This will be achieved through the establishment of 15,000 clusters in gram panchayats, benefiting 1 crore farmers.

- Training and Awareness: The mission will establish around 2,000 model demonstration farms at Krishi Vigyan Kendras (KVKs), Agricultural Universities (AUs), and farmers' fields. These farms will serve as hubs for training farmers in natural farming techniques and input preparation, such as Jeevamrit and Beejamrit, using locally available resources.

- Incentivizing Local Inputs: The creation of 10,000 bio-input resource centers will provide farmers with easy access to bio-fertilizers and other natural farming inputs. The mission emphasizes the use of locally sourced inputs to reduce costs and improve the sustainability of farming practices.

- Farmer Empowerment: 30,000 Krishi Sakhis (community resource persons) will be deployed to assist in mobilizing and guiding farmers. These trained individuals will play a key role in generating awareness and providing on-ground support to the farmers practicing natural farming.

- Certifications and Branding: A major aspect of the mission is to establish scientific standards for natural farming produce, along with a national certification system. This will help in creating a market for organically grown produce and encourage more farmers to adopt sustainable practices.

Targeting High Fertilizer Consumption Areas

The Ministry of Agriculture has identified 228 districts in 16 states, including Uttar Pradesh, Punjab, Maharashtra, and West Bengal, where fertilizer consumption is above the national average. These districts will be prioritized for the NMNF rollout, as they have high fertilizer usage but low adoption of natural farming practices. By focusing on these areas, the mission seeks to reduce the over-dependence on chemical fertilizers and foster a transition to more sustainable farming practices.

Benefits of Natural Farming

The NMNF aims to deliver multiple benefits to farmers and the environment:

- Cost Reduction: Natural farming practices can significantly reduce input costs by decreasing the need for costly chemical fertilizers and pesticides.

- Soil Health and Fertility: By rejuvenating the soil through organic inputs, natural farming improves soil structure, fertility, and microbial activity, leading to long-term agricultural sustainability.

- Climate Resilience: Natural farming enhances resilience to climate-induced challenges such as drought, floods, and waterlogging.

- Healthier Produce: Reduced use of chemicals results in safer, healthier food, benefitting both farmers and consumers.

- Environmental Conservation: The promotion of biodiversity, water conservation, and carbon sequestration in soil leads to a healthier environment for future generations.

Conclusion

The launch of the National Mission on Natural Farming represents a critical step toward transforming India's agricultural practices into a more sustainable and environmentally friendly model. By targeting regions with high fertilizer usage, providing farmers with the tools and knowledge for natural farming, and creating a system for certification and branding, the government hopes to make natural farming a mainstream practice. As India continues to grapple with the challenges of climate change, soil degradation, and health risks from chemical inputs, the NMNF provides a promising framework for sustainable agriculture that benefits farmers, consumers, and the environment alike.

India’s Urban Infrastructure

- 28 Nov 2024

Introduction

India’s urban population is projected to double from 400 million to 800 million by 2050. This demographic shift presents both challenges and opportunities for transforming the country’s urban infrastructure. To meet the growing needs of urban areas, India will require an investment of approximately ?70 lakh crore by 2036, a figure significantly higher than current spending levels.

Financial Challenges in Urban Infrastructure

- Investment Gap

- The current annual investment in urban infrastructure stands at ?1.3 lakh crore, which is only 28% of the ?4.6 lakh crore needed annually.

- A large portion of the existing investment, around 50%, is directed towards basic urban services, with the remainder allocated to urban transport.

- Municipal Finances

- Municipal finances have remained stagnant at 1% of GDP since 2002.

- Despite increased transfers from the central and state governments, municipal bodies face financial strain.

- The contribution of municipal own-revenue has decreased from 51% to 43%, indicating a reduced financial independence.

- Revenue Collection Inefficiencies

- Urban local bodies (ULBs) are collecting only a small fraction of their potential revenues, with property tax collections representing just 0.15% of GDP.

- Cost recovery for essential services like water supply and waste management ranges between 20% and 50%, pointing to a significant funding gap.

- Underutilization of Resources

- Cities like Hyderabad and Chennai utilized only 50% of their capital expenditure budgets in 2018-19.

- Central schemes such as AMRUT and the Smart Cities Mission also showed suboptimal fund utilization, with utilization rates of 80% and 70%, respectively.

- Decline in Public-Private Partnerships (PPPs)

- Investments through PPPs in urban infrastructure have seen a sharp decline, from ?8,353 crore in 2012 to ?467 crore in 2018.

- This drop is attributed to limited project-specific revenues and inadequate funding mechanisms.

Structural and Administrative Challenges

- Weak Governance and Fragmented Management

- Fragmented governance and limited administrative autonomy hinder effective urban planning and resource allocation.

- Municipal bodies often lack the ability to undertake long-term planning and project execution due to these governance challenges.

- Climate Vulnerability and Sustainability: Urban areas are increasingly vulnerable to climate risks like floods and heatwaves. However, many urban infrastructure projects fail to incorporate climate resilience in their planning, exacerbating the long-term vulnerability of investments.

- Inadequate Land Management

- There is poor coordination between land use planning and infrastructure development, resulting in urban sprawl and inefficient transportation systems.

- Opportunities to capitalize on the land value generated by metro and rail projects remain underutilized.

Measures for Transforming Urban Infrastructure

- Streamline Revenue Collection: Leverage technology to improve property tax collection systems and enhance cost recovery in essential services.

- Enhance Fund Utilization: Strengthen municipal capacities for effective project planning and incentivize the timely use of allocated grants.

- Scale Public-Private Partnership (PPP) Investments: Develop a pipeline of bankable projects and create risk-sharing mechanisms to attract private sector investments.

- Decouple Project Preparation from Funding: Ensure that infrastructure projects are thoroughly prepared for financial, social, and environmental sustainability before seeking funding.

- Promote Urban Innovation: Establish urban innovation labs and encourage public-private-academic collaborations to foster the adoption of advanced technologies.

- Empower Municipalities: Grant municipalities greater financial autonomy, enabling them to raise capital through municipal bonds and other debt mechanisms.

- Integrated Urban Planning: Align infrastructure development with land use, transport, and housing requirements, while integrating climate resilience into planning.

- Capacity Building: Invest in the training of municipal staff to improve governance and financial management capabilities.

Conclusion

India’s expanding urban population presents a major opportunity for economic growth. However, addressing the financial and structural challenges in urban infrastructure is crucial for harnessing this potential. By adopting a combination of short-term actions, medium-term strategies, and long-term reforms, India can create sustainable, resilient urban infrastructure that meets the growing needs of its cities, fostering inclusive development and long-term prosperity.

RBI brings back 102 tonnes gold from BoE; 60 per cent reserves in India

- 04 Nov 2024

In News:

England over the past two-and-a-half years, reflecting a strategic shift in its approach to safeguarding gold reserves. This move marks a significant increase in the RBI's domestic gold holdings.

Rise in the RBI's Domestic Gold Holdings

- Current Status (September 2024):The RBI's domestic gold reserves have grown to 510.46 metric tonnes, up from 295.82 metric tonnes in March 2022.

- Reduction in Gold Held Abroad:The gold held under the custodianship of the Bank of England has decreased to 324 metric tonnes from 453.52 metric tonnes in March 2022.

- Gold as a Share of Foreign Exchange Reserves:The proportion of gold in India's total foreign exchange reserves increased from 8.15% in March 2024 to 9.32% in September 2024.

Gold Kept in the Bank of England

- Overview of the Bank of England's Gold Vault:The Bank of England is home to one of the largest gold vaults in the world, second only to the New York Federal Reserve, housing around 400,000 bars of gold.

- India’s Gold Held Abroad:The RBI continues to retain 324 metric tonnes of its gold with the Bank of England and the Bank for International Settlements (BIS).

- Additional Gold Management:Around 20 tonnes of gold are managed through gold deposit schemes.

- Strategic Role of London’s Gold Market:Storing gold in London provides immediate access to the global London bullion market, enhancing liquidity for India’s gold assets.

Historical Context of India’s Gold Holdings

- 1991 Balance of Payments Crisis:During a financial crisis in 1991, India had to send 47 tonnes of gold to the Bank of England to secure loans for repaying international creditors.

RBI’s Strategy to Bring Gold Back to India

- Global Trend of Central Banks Buying Gold:Since the imposition of U.S. sanctions on Russia in 2022, central banks globally have been increasing their gold reserves as a hedge against inflation and to reduce reliance on the U.S. dollar. India has outpaced other G20 nations in this trend, surpassing Russia and China in gold purchases.

- De-dollarisation:This shift is part of a broader strategy of de-dollarisation, aiming to diversify away from the U.S. dollar amidst rising gold prices and growing geopolitical tensions.

Significance of Repatriating Gold to India

- Sign of Economic Strength

- Recovery from the 1991 Crisis:The decision to repatriate gold reflects a significant improvement in India's economic position, a stark contrast to the 1991 economic crisis when India had to pledge gold for financial survival.

- Optimizing Financial Resources

- Reducing Storage Costs:Storing gold domestically allows the RBI to save on storage fees paid to foreign custodians, such as the Bank of England.

- Strategic Significance

- Enhanced Resilience Amid Global Instability:By repatriating its gold, India enhances its strategic autonomy and strengthens its economic position in a world of rising uncertainties and currency volatility.

RBI's Capacity to Safeguard Gold Domestically

- Increasing Domestic Storage Capacity:The RBI has been increasing its domestic capacity for gold storage to accommodate rising reserves and reduce dependence on foreign gold safekeeping facilities.

- Current Foreign Exchange Reserves:As of October 2024, India’s total foreign exchange reserves stand at $684.8 billion, sufficient to cover over 11.2 months of imports.

Diversification of Foreign Exchange Reserves

- Mitigating Currency Risks:By increasing gold reserves, India diversifies its foreign exchange holdings, reducing reliance on any single currency and shielding itself from global currency fluctuations and economic volatility.

- Gold as a Stable Asset:Gold serves as a stable asset, providing a safeguard against global economic shocks, and balances India’s reserves portfolio.

Gold as a Hedge against Inflation

- Preserving Wealth amid Inflation:Gold is traditionally viewed as a hedge against inflation, maintaining or appreciating in value when other currencies weaken. By increasing its gold reserves, India positions itself to better withstand the adverse effects of inflation and ensure long-term financial stability.

Conclusion

The repatriation of gold by the RBI reflects a strategic move to bolster India's economic strength and diversify its financial assets. The decision to bring gold back to India not only signifies an improvement in India's economic fundamentals but also aligns with global trends of central banks increasing their gold reserves to ensure long-term stability and reduce reliance on the U.S. dollar.

Analysis of Growing Economic Divide in India

- 29 Oct 2024

Overview

The Economic Advisory Council to the Prime Minister (EAC-PM)'s report titled "Relative Economic Performance of Indian States: 1960-61 to 2023-24" highlights an alarming trend of widening economic disparities across India's states, which is increasingly threatening the principles of federalism and national unity. The findings reveal significant regional imbalances in terms of contributions to the national income, per capita income, and overall economic development. This analysis delves into the key insights from the report and explores the broader implications for India's federal structure, governance, and policy approaches.

Key Insights from the Report

- Regional Economic Disparities:

- Western and Southern States' Dominance: States such as Maharashtra, Gujarat, Tamil Nadu, and Karnataka have consistently outperformed others. These states have benefited from higher private investments, better infrastructure, and a more business-friendly environment. They also enjoy proximity to international markets, especially coastal regions like Gujarat and Tamil Nadu, which have access to ports and export markets.

- Underperformance of Northern and Eastern States: On the other hand, northern states (with exceptions like Delhi and Haryana) and eastern states like Bihar, Odisha, and West Bengal lag behind in economic performance. These regions face challenges such as poor infrastructure, low levels of investment, and weak governance structures, which hinder their growth potential.

- Impact of Liberalization (1991):

- The 1991 economic reforms marked a shift toward market-oriented growth, benefiting states that were already more industrialized or had better urban infrastructure. Southern states, in particular, adapted well to the liberalized environment, attracting higher levels of private investment and expanding their economies.

- The liberalization process disproportionately favored urban centers like Delhi, Mumbai, Chennai, and Bengaluru, where investments were channelized into growing service sectors, technology, and industries, creating a feedback loop of wealth accumulation in these hubs. Meanwhile, the hinterland remained underdeveloped due to insufficient public investment and the lack of private sector interest in these regions.

- Investment Disparities:

- Private Investment: Wealthier states attract a disproportionate share of private investment, which is driven by profitability and market opportunities. These states have better infrastructure, which reduces transaction costs and increases returns on investment. In contrast, underdeveloped states struggle to attract investment due to poor governance, inadequate infrastructure, and perceived higher risks.

- Public Investment: While the public sector still plays a role in investment, the New Economic Policies (NEP) since 1991 have shifted the focus towards private sector-driven growth. This has further widened the investment gap, as the poorer states receive less public investment relative to their needs.

- Role of Infrastructure and Governance:

- The availability and quality of infrastructure are significant determinants of economic performance. States with better roads, energy supply, ports, and communication networks tend to attract more investments. Additionally, good governance, characterized by reduced corruption, better policy implementation, and transparency, also plays a critical role in fostering economic development.

- In contrast, states with weaker governance structures and poor infrastructure struggle to create an enabling environment for businesses, further compounding regional disparities.

- Impact on Federalism:

- The growing economic divide is leading to tensions between the Centre and state governments, particularly in wealthier states that contribute significantly to national income but feel short-changed in resource allocation. These states argue that they are not receiving a fair share of national resources in return for their contributions, leading to growing dissatisfaction with the federal system.

- The tension is exacerbated by political factors, such as accusations from opposition-led states that the Centre uses public investment to favor states aligned with the ruling party. The growing perception of politicization of resource allocation has the potential to undermine the spirit of cooperative federalism.

Structural Causes of Regional Inequality

- Economic and Investment Magnetism:

- Wealthier states attract more private investments, as they offer better returns due to established markets, skilled labor, and urbanization. Cities like Mumbai, Delhi, and Bengaluru serve as economic magnets, drawing talent, technology, and capital, which further consolidates their economic dominance.

- In contrast, states without such economic hubs or access to global markets struggle to attract investment. The absence of urban agglomerations and the concentration of wealth and resources in a few states perpetuate regional disparities.

- Policy and Investment Bias:

- Post-liberalization policies have disproportionately benefited the organized sector, often at the expense of the unorganized sector, which is more prevalent in poorer states. The emphasis on industrial growth and infrastructure development has largely bypassed the rural and informal sectors, which are critical in underdeveloped states.

- The organized sector has also benefited from government support, such as tax concessions and subsidized infrastructure, which have enabled these industries to thrive in already developed regions. This has widened the gap between the haves and the have-nots.

- Cronyism and the Black Economy:

- Crony capitalism and the prevalence of the black economy in poorer states further exacerbate regional imbalances. In some cases, political patronage and corruption divert resources and investments from areas that need them most. This weakens the investment climate, especially in states with higher levels of informal and illegal economic activity.

Implications for Federalism

The growing economic disparity poses a serious threat to India's federal structure. The increasing dissatisfaction of wealthier states with the current fiscal arrangements and the growing demand for fairer resource allocation challenge the spirit of cooperative federalism. A well-functioning federal system relies on equitable distribution of resources and opportunities for all regions to develop.

Policy Recommendations

To address these disparities and strengthen India's federal framework, several policy measures need to be implemented:

- Enhancing Governance and Infrastructure in Lagging States:

- Improved governance and reducing corruption are essential in attracting both private and public investments. Additionally, there must be a focus on developing critical infrastructure, such as roads, energy, and health facilities, which are essential for economic growth.

- States need to increase public investment in sectors like education, healthcare, and social security to improve human capital and productivity.

- Focus on the Unorganized Sector:

- A significant portion of the labor force in poorer states is employed in the unorganized sector. Policies should aim to formalize this sector by providing social security benefits, improving labor rights, and increasing productivity through skill development. This could help raise incomes and stimulate local demand, attracting more private investment.

- Balancing the Organized and Unorganized Sectors:

- While the organized sector has benefited from liberalization, more attention should be given to the unorganized sector, which forms the backbone of the economy in many poorer states. A balanced approach to economic growth, which includes both organized and unorganized sectors, can help reduce disparities.

- Shifting Focus from Urban Centers to Hinterlands:

- Private sector investment must be incentivized in underdeveloped regions through tax breaks, subsidies, and targeted infrastructure projects. This will encourage businesses to expand beyond the major urban centers, thus promoting a more balanced distribution of economic activities.

Conclusion

The widening economic divide in India, as revealed by the EAC-PM report, poses a significant challenge to the country's federalism and unity. To ensure inclusive and balanced development, policy reforms must focus on reducing regional disparities by improving governance, infrastructure, and investment in lagging states. A shift towards equitable growth, addressing the needs of both the organized and unorganized sectors, is essential to promoting national cohesion and ensuring sustainable economic progress across all regions.

Pradhan Mantri Mudra Yojana (PMMY)

- 27 Oct 2024

Introduction

The Pradhan Mantri Mudra Yojana (PMMY) was launched by Prime Minister Narendra Modi on April 8, 2015, with the aim of providing financial support to non-corporate, non-farm small and micro enterprises in India. Through this initiative, loans are provided to individuals and small businesses who are unable to access formal institutional finance.

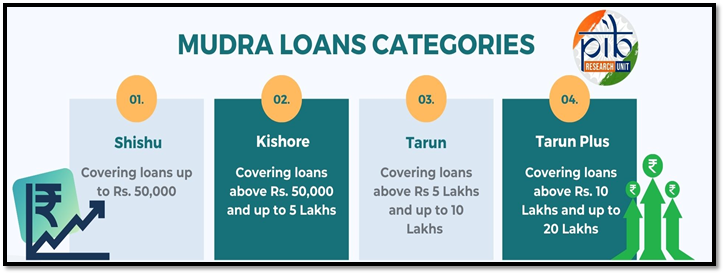

In the Union Budget 2024-25, Finance Minister Nirmala Sitharaman announced an increase in the loan limit under PMMY from ?10 lakh to ?20 lakh, with the introduction of a new loan category, Tarun Plus, aimed at fostering growth in the entrepreneurial sector.

Key Features of the Pradhan Mantri Mudra Yojana

Loan Limit Increase

- Loan Limit Raised: The loan limit has been increased from ?10 lakh to ?20 lakh for eligible entrepreneurs.

- New Loan Category: The newly introduced Tarun Plus category caters to entrepreneurs who have previously availed and successfully repaid loans under the Tarun category.

- Credit Guarantee: The Credit Guarantee Fund for Micro Units (CGFMU) will cover these enhanced loans, further ensuring the security of micro-enterprises.

Categories of MUDRA Loans

PMMY provides collateral-free loans through financial institutions like Scheduled Commercial Banks, Regional Rural Banks (RRBs), Small Finance Banks (SFBs), Non-Banking Financial Companies (NBFCs), and Micro Finance Institutions (MFIs). These loans are provided for income-generating activities in sectors like manufacturing, trading, services, and allied agriculture activities.

Objectives of PMMY

- Financial Inclusion: PMMY targets marginalized and socio-economically neglected sections of society, promoting financial inclusivity.