NITI Aayog’s Framework for Future Pandemic Preparedness

- 02 Dec 2024

Introduction

In response to the evolving threat of pandemics, NITI Aayog has released an Expert Group report titled "Future Pandemic Preparedness and Emergency Response — A Framework for Action." The report offers a strategic blueprint for India to enhance its pandemic preparedness, drawing from the lessons learned during the COVID-19 crisis and global best practices. This framework aims to create a rapid, well-coordinated response system for future public health emergencies.

Rationale Behind the Expert Group

The COVID-19 pandemic underscored the vulnerability of global and national health systems to emerging infectious diseases. As future pandemics are inevitable, especially with increasing zoonotic threats, India has taken a proactive step in planning for such eventualities. The WHO has warned that 75% of future pandemics may be zoonotic, caused by pathogens transmitted from animals to humans.

Key Findings from COVID-19 Response

India's response to COVID-19 highlighted several strengths and weaknesses in the public health system. Key efforts included developing vaccines, enhancing research and development frameworks, and deploying digital tools for data management across its 1.4 billion population. However, gaps were identified in governance, data management, and cross-sectoral coordination. These lessons have been integrated into the expert group’s framework for future preparedness.

The 100-Day Response Framework

A crucial aspect of the report is the emphasis on the first 100 days of a pandemic. The expert group argues that a rapid response within this period is essential for minimizing the impact of any outbreak. The framework outlines a detailed roadmap for preparedness, which includes tracking, testing, treating, and managing outbreaks efficiently. A robust system for quick deployment of countermeasures, including vaccines and treatments, is pivotal during these critical days.

Four Pillars of Pandemic Preparedness

The report's recommendations are organized around four pillars:

- Governance, Legislation, Finance, and Management:

- Proposes a new Public Health Emergency Management Act (PHEMA) to address modern pandemic needs.

- Creation of an empowered group of secretaries (EGoS) for rapid decision-making and coordination.

- Data Management, Surveillance, and Predictive Tools:

- Calls for a unified data platform to aggregate and analyze data for timely decision-making.

- Emphasizes strengthening genomic surveillance and establishing a national biosecurity network.

- Research, Innovation, and Infrastructure:

- Recommends a high-risk innovation fund to support research on diagnostics, vaccines, and therapeutics.

- Suggests enhancing manufacturing capacity and building biosafety containment facilities.

- Partnerships and Community Engagement:

- Stresses the importance of private sector involvement and community engagement in managing pandemics.

- Proposes a risk communication unit at the National Centre for Disease Control (NCDC) to manage public information and prevent misinformation.

International and National Collaboration

The report underscores the need for cross-border collaboration, aligning India’s efforts with international frameworks such as the WHO’s revised International Health Regulations and the Pandemic Accord negotiations. Collaboration with global institutions, academia, and the private sector is essential for sharing data, technology, and expertise during health crises.

Lessons from Past Epidemics

The report draws lessons from several past epidemics, including SARS, H1N1, and Ebola, which revealed the importance of timely diagnostics, coordinated surveillance, and rapid response. These lessons highlight the need for stronger international regulations, integrated data systems, and enhanced public-private partnerships in tackling future pandemics.

Conclusion and Recommendations

The framework offers actionable recommendations to strengthen India’s pandemic preparedness. From institutionalizing governance structures and creating a dedicated pandemic fund to enhancing surveillance and fostering innovation, these steps are designed to ensure rapid response and minimize the impact of future health crises. By focusing on governance, data management, research, and community partnerships, India aims to build a resilient health system capable of facing future challenges effectively.

Pradhan Mantri Mudra Yojana (PMMY)

- 27 Oct 2024

Introduction

The Pradhan Mantri Mudra Yojana (PMMY) was launched by Prime Minister Narendra Modi on April 8, 2015, with the aim of providing financial support to non-corporate, non-farm small and micro enterprises in India. Through this initiative, loans are provided to individuals and small businesses who are unable to access formal institutional finance.

In the Union Budget 2024-25, Finance Minister Nirmala Sitharaman announced an increase in the loan limit under PMMY from ?10 lakh to ?20 lakh, with the introduction of a new loan category, Tarun Plus, aimed at fostering growth in the entrepreneurial sector.

Key Features of the Pradhan Mantri Mudra Yojana

Loan Limit Increase

- Loan Limit Raised: The loan limit has been increased from ?10 lakh to ?20 lakh for eligible entrepreneurs.

- New Loan Category: The newly introduced Tarun Plus category caters to entrepreneurs who have previously availed and successfully repaid loans under the Tarun category.

- Credit Guarantee: The Credit Guarantee Fund for Micro Units (CGFMU) will cover these enhanced loans, further ensuring the security of micro-enterprises.

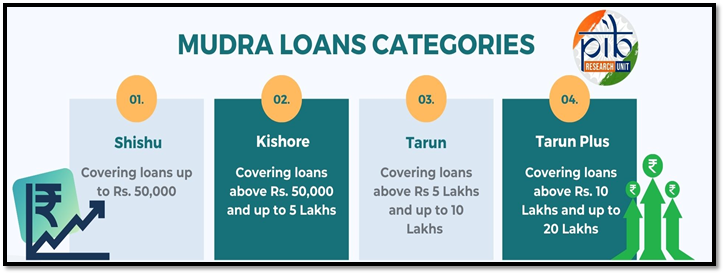

Categories of MUDRA Loans

PMMY provides collateral-free loans through financial institutions like Scheduled Commercial Banks, Regional Rural Banks (RRBs), Small Finance Banks (SFBs), Non-Banking Financial Companies (NBFCs), and Micro Finance Institutions (MFIs). These loans are provided for income-generating activities in sectors like manufacturing, trading, services, and allied agriculture activities.

Objectives of PMMY

- Financial Inclusion: PMMY targets marginalized and socio-economically neglected sections of society, promoting financial inclusivity.

- Support to Small Businesses: By providing affordable loans, the scheme encourages small-scale entrepreneurs, particularly women and minority groups, to establish and expand their businesses.

- Fostering Entrepreneurship: PMMY aims to unlock the potential of India’s entrepreneurial spirit, especially in rural and underserved areas.

MUDRA: The Institutional Backbone

Role of Micro Units Development & Refinance Agency Ltd. (MUDRA)

MUDRA is the primary institution set up by the Government of India to manage and implement the Mudra Yojana. It acts as a refinancing agency that provides financial support to small and micro-enterprises by working through financial intermediaries, such as banks and micro-finance institutions.

Funding Sources

- Scheduled Commercial Banks

- Regional Rural Banks (RRBs)

- Small Finance Banks (SFBs)

- Non-Banking Financial Companies (NBFCs)

- Micro Finance Institutions (MFIs)

Application Process

Applicants can avail loans through any of the aforementioned financial institutions or apply online via the Udyami Mitra Portal.

Benefits of Pradhan Mantri Mudra Yojana

- Collateral-free Loans: No security is required to obtain loans, which reduces the financial burden on borrowers.

- Easily Accessible: PMMY loans are available across India, making them accessible to entrepreneurs in both rural and urban areas.

- Quick and Flexible Loans: Loans can be disbursed quickly with flexible repayment terms (up to 7 years).

- Empowering Women Entrepreneurs: The scheme offers special incentives for women entrepreneurs, helping them to establish and grow their businesses.

- Support to Rural Areas: Special emphasis on empowering rural enterprises and reducing regional disparities.

- MUDRA Card: The MUDRA Card is a RuPay debit card that allows borrowers to access funds through an overdraft facility, enhancing liquidity for businesses.

- No Default Penalty: In case of loan defaults due to unforeseen circumstances, the government will step in to reduce the burden on entrepreneurs.

Categories of Loans Under PMMY

1. Shishu Category: Loans up to ?50,000

- Targeted at micro-enterprises at the initial stage of their business journey.

2. Kishore Category: Loans between ?50,000 and ?5 lakh

- Targeted at enterprises looking to expand their operations and upgrade their infrastructure.

3. Tarun Category: Loans between ?5 lakh and ?10 lakh

- For established businesses that are in need of funds to scale up.

4. Tarun Plus: Loans between ?10 lakh and ?20 lakh

- A new category designed for entrepreneurs who have repaid loans under the Tarun category and wish to further expand their business.

Achievements of PMMY (2023-24)

- Total Loans Sanctioned: ?5.4 trillion across 66.8 million loans in FY 2023-24.

- Loans Disbursed: Significant amounts were disbursed under each category:

- Shishu: ?1,08,472.51 crore

- Kishore: ?1,00,370.49 crore

- Tarun: ?13,454.27 crore

- Women Borrowers: A large share of loans have gone to women entrepreneurs, ensuring gender inclusivity.

- Minority Borrowers: The scheme also emphasizes financial empowerment of minority communities.

- NPA Reduction: The Non-Performing Assets (NPA) in Mudra loans have reduced to 3.4% in FY 2024, compared to higher levels in earlier years.

Digital Tools and Support Systems

MUDRA MITRA App

The MUDRA MITRA mobile app helps users access information about the PMMY scheme, loan application procedures, and other resources. The app is available for download on Google Play Store and Apple App Store.

Online Loan Application

Entrepreneurs can apply for loans online via portals such as PSBloansin59minutes and Udyamimitra, providing greater convenience and accessibility.

Steps to Improve Implementation

- Handholding Support: Assistance in submitting loan applications is available for applicants.

- Intensive Awareness Campaigns: The government conducts publicity campaigns to raise awareness about PMMY.

- Simplified Loan Process: The loan application forms have been simplified to encourage wider participation.

- Performance Monitoring: Regular monitoring of PMMY implementation to ensure its success.

- Interest Subvention: A 2% interest subvention is offered for prompt repayment of Shishu loans.

Conclusion

The Pradhan Mantri Mudra Yojana has been a transformative scheme in fostering entrepreneurship and ensuring financial inclusion for small and micro-businesses across India. With the recent increase in loan limits and the addition of the Tarun Plus category, the scheme continues to empower emerging entrepreneurs and provides a crucial lifeline for business growth and sustainability. By supporting women, minorities, and new entrepreneurs, PMMY has contributed significantly to economic upliftment and inclusive growth in the country.