Digital Governance in India

- 16 Jan 2025

In News:

India is making significant strides toward digital governance, an initiative aimed at enhancing both citizen services and the capabilities of government employees. This transition to a digitally-driven framework is designed to improve the efficiency, transparency, and accountability of government operations, positioning India as a global leader in modern governance practices.

What is Digital Governance?

Digital governance refers to the application of technology to enhance the functioning of government processes. By integrating digital tools and platforms, it aims to streamline administrative operations, reduce inefficiencies, and improve public service delivery. This approach also extends to ensuring greater transparency and accountability in government dealings.

Key Initiatives in Digital Governance

India has launched several critical initiatives to modernize governance through digital means. Some of the key programs include:

- iGOT Karmayogi Platform: The iGOT Karmayogi platform is a government initiative to provide online training to public employees. It aims to enhance public administration skills, foster expertise in data analytics, and equip employees with the necessary tools in digital technologies. This initiative aims to prepare government personnel to handle the challenges of a digitally evolving governance landscape.

- e-Office Initiative: The e-Office program is designed to reduce paper-based work by digitizing workflows within government departments. This initiative facilitates real-time communication among offices and ensures more efficient and transparent management of tasks. It also helps streamline decision-making processes and improves the speed of governance operations.

- Government e-Marketplace (GeM): The Government e-Marketplace (GeM) is an online platform developed to optimize procurement processes. It allows government agencies to procure goods and services efficiently, transparently, and with accountability. This platform has contributed to reducing corruption and ensuring that government purchases represent the best value for public money.

- Cybersecurity Training for Employees: As digital operations increase, ensuring the safety of sensitive data is paramount. The cybersecurity training program for government employees is designed to enhance their ability to recognize and respond to potential cyber threats. This initiative ensures data protection, safe online practices, and cyber resilience across digital governance platforms.

Challenges in Implementing Digital Governance

Despite its benefits, India faces several challenges in the successful implementation of digital governance. These obstacles must be addressed to unlock the full potential of technology-driven governance.

- Resistance to Technological Change: One of the key barriers to digital transformation in government is the resistance among employees to adopt new technologies. Many government officials remain accustomed to traditional, paper-based processes and are reluctant to transition to digital systems due to concerns about complexity and job security.

- Digital Divide in Rural Areas: While urban regions in India have better access to high-speed internet and digital infrastructure, many rural areas face significant digital divide challenges. Limited access to technology hampers the successful implementation of digital governance in these regions, restricting equitable service delivery across the country.

- Cybersecurity Risks: The rise of digital operations in governance increases the risk of cyberattacks and data breaches. With government data being digitized, the threat of cybercrimes becomes more pronounced, making it critical to implement robust cybersecurity measures and data protection strategies to safeguard sensitive information.

- Lack of Incentives for Training Outcomes: Although government employees are encouraged to take part in training programs such as iGOT Karmayogi, the absence of clear incentives to complete these programs can undermine their effectiveness. Establishing tangible rewards or career progression linked to the successful completion of training would encourage employees to fully engage in capacity-building initiatives.

Solutions to Overcome Challenges

To ensure the success of digital governance, several strategies must be put in place to address the challenges identified.

- Foster Innovation-Friendly Environments: Promoting an innovation-friendly culture within government offices can help reduce resistance to new technologies. Encouraging employees to engage with digital tools, offering regular training, and providing ongoing support will facilitate a smoother transition to a technology-driven governance system.

- Invest in Digital Infrastructure for Rural Areas: Addressing the digital divide requires significant investment in digital infrastructure in rural and remote areas. Ensuring that these regions have reliable internet access and the necessary technological resources will empower citizens across India to benefit from digital governance.

- Continuous Capacity-Building Programs: Establishing continuous training programs for government employees will ensure that they remain up-to-date with the latest technological trends. Regular updates to training content will help employees stay prepared to handle emerging challenges in digital governance.

- Strengthen Cybersecurity Protocols: To mitigate cybersecurity risks, it is essential to implement stringent cybersecurity measures across all levels of government operations. This includes regular cybersecurity awareness programs, proactive threat management systems, and rigorous data protection protocols to safeguard both government data and citizens’ personal information.

Conclusion

India’s shift towards digital governance represents a significant step toward modernizing administrative systems, enhancing transparency, and improving service delivery to citizens. However, challenges such as resistance to change, the digital divide, cybersecurity risks, and the lack of clear incentives for training must be addressed. By investing in digital infrastructure, offering continuous training programs, and reinforcing cybersecurity measures, India can create an effective and secure framework for digital governance that benefits both its citizens and the government workforce.

India’s Startup Revolution

- 15 Jan 2025

Context

India has solidified its position as one of the most dynamic startup ecosystems globally, emerging as a hub for innovation, entrepreneurship, and technological progress. However, realizing its ambition of becoming the top startup ecosystem requires addressing critical challenges and leveraging available opportunities.

Current Landscape of Indian Startups

Growth and Innovation

India ranks as the third-largest startup ecosystem in the world, following the U.S. and China. As of January 15, 2025, over 1.59 lakh startups have been officially recognized by DPIIT, with more than 120 attaining unicorn status (valuation exceeding $1 billion).

Investment Trends

Despite economic fluctuations, India's startups continue to attract significant investments. In 2022, venture capitalists infused $25 billion into the ecosystem, reaffirming India’s position as a preferred destination for global investors. Although there was a slowdown in 2023, domains like Software as a Service (SaaS) and climate tech continue to secure substantial funding.

Government Support

India’s startup-friendly policies, including Startup India, Digital India, and Atmanirbhar Bharat, have created an enabling environment. Notable initiatives include:

- Tax incentives, faster patent approvals, and regulatory relaxations.

- The launch of a ?10,000 crore Fund of Funds for Startups (FFS) in 2023 to improve capital accessibility.

- The Bharat Startup Knowledge Access Registry (BHASKAR) to streamline collaboration among startups and investors.

Regional Growth

- Tier II and III Expansion: Nearly 50% of startups are now based in emerging hubs such as Indore, Jaipur, and Ahmedabad.

- Tamil Nadu: The state boasts a $28 billion startup ecosystem, growing at 23%. Chennai alone houses around 5,000 startups, significantly contributing to employment generation.

- Kerala: With a $1.7 billion startup ecosystem, Kerala exhibits a compound annual growth rate of 254%, emphasizing cost-effective tech talent hiring.

Key Challenges Faced by Startups

1. Funding Constraints

The global economic downturn, coupled with rising interest rates, has limited venture capital inflows, resulting in layoffs and operational cutbacks.

2. Regulatory and Compliance Barriers

Despite government support, startups grapple with complex tax structures, evolving data protection laws, and stringent compliance requirements, including ESOP taxation policies.

3. Scaling and Market Adaptability

Many startups struggle with operational inefficiencies, limited market penetration, and inadequate infrastructure, hampering growth potential.

4. High Failure Rate

Approximately 90% of Indian startups fail within five years due to poor product-market fit, lack of financial planning, and insufficient adaptation to market needs.

5. Talent Shortages

India faces stiff competition in acquiring skilled professionals in areas like AI, cybersecurity, and machine learning, making retention increasingly difficult amid economic uncertainties.

Strategic Measures to Strengthen India’s Startup Ecosystem

1. Enhancing Policy Frameworks

- Simplified Regulations: Streamline startup registration, funding approvals, and international business operations.

- IP Protection: Strengthen intellectual property laws to boost R&D investment.

- Sector-Specific Initiatives: Develop targeted policies for AI, deep tech, healthcare, and green technologies.

2. Expanding Funding Access

- Encouraging Domestic Investment: Leverage pension and sovereign wealth funds to invest in startups.

- Public-Private Partnerships: Foster large-scale government-industry collaboration to finance emerging ventures.

- Decentralized Funding: Expand angel investor networks and micro-investment opportunities, particularly in Tier II and III cities.

3. Building Robust Infrastructure

- Tech Parks and Incubation Centers: Establish state-of-the-art facilities with mentorship programs.

- Improved Digital Connectivity: Ensure high-speed internet access in underserved regions.

- Enhanced Logistics and Supply Chains: Strengthen infrastructure to support startup scalability.

4. Developing a Skilled Workforce

- STEM and Entrepreneurial Education: Introduce curriculum enhancements in technical and business disciplines.

- Upskilling Programs: Collaborate with industry leaders to train professionals in high-demand skills.

- Diversity and Inclusion: Promote initiatives encouraging women and marginalized communities in entrepreneurship.

5. Fostering Innovation and Risk-Taking

- Strengthened R&D Funding: Increase allocations to universities and private research sectors.

- Encouraging Entrepreneurship: Reduce societal stigma surrounding startup failures to promote risk-taking.

- Leveraging Domestic Challenges: Address local issues like climate change and urbanization through innovation.

6. Expanding Global Reach

- International Collaborations: Partner with foreign accelerators and governments.

- Ease of Cross-Border Trade: Simplify export and import regulations for startups.

- Engaging the Indian Diaspora: Encourage successful overseas entrepreneurs to mentor and invest in Indian startups.

7. Advancing Sustainability Goals

- Green Tech Promotion: Support startups focusing on renewable energy and circular economy initiatives.

- Eco-Friendly Incentives: Offer financial support to ventures aligning with sustainability targets.

- Inclusive Growth Strategies: Expand agritech, edtech, and health-tech startups in rural areas, supporting platforms like the Women Entrepreneurship Platform (WEP) by NITI Aayog.

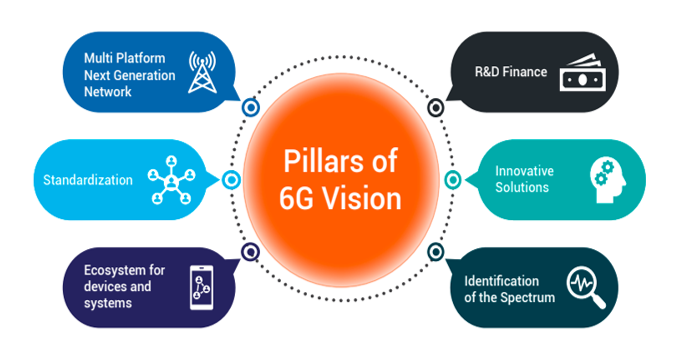

Building a Resilient Digital Economy

To fortify India's digital economy, startups should leverage existing infrastructure like UPI and Aadhaar while capitalizing on emerging technologies such as AI, 5G, and blockchain. A robust cybersecurity framework and data protection policies will be essential to ensure investor confidence.

Selection Process for Chief Election Commissioner (CEC)

- 12 Jan 2025

In News:

The Chief Election Commissioner and Other Election Commissioners (Appointment, Conditions of Service and Term of Office) Act, 2023 represents a significant shift in the process of selecting the Chief Election Commissioner (CEC) and other Election Commissioners (ECs) in India. Traditionally, the senior-most Election Commissioner automatically ascended to the position of CEC. However, the new law introduced in December 2023 widens the scope for selection, allowing for a more transparent process with an expanded pool of candidates.

Key Features of the Act:

- Election Commission Structure: The Election Commission of India is constituted by the Chief Election Commissioner (CEC) and two other Election Commissioners (ECs). The President of India appoints these members, with the number of ECs fixed periodically.

- Appointment Process: The Act mandates that the CEC and ECs are appointed by the President based on recommendations from a Selection Committee. This committee comprises:

- The Prime Minister (Chairperson),

- The Leader of the Opposition in the Lok Sabha (or leader of the largest opposition party),

- A Union Cabinet Minister appointed by the Prime Minister.

- Search Committee: A Search Committee, chaired by the Minister of Law and Justice, prepares a panel of five candidates. The Selection Committee may choose from this panel or opt for someone outside of it.

- Eligibility Criteria:

- Candidates must have integrity and experience in election management.

- They should be or have been Secretary-level officers or equivalent.

- Term and Reappointment:

- The term of CEC and ECs is six years or until they turn 65 years.

- They cannot be re-appointed after their term.

- Salary and Pension: The salary, allowances, and conditions of service of CEC and ECs are equivalent to those of a Cabinet Secretary.

- Removal Process:

- The CEC can be removed in the same manner as a Supreme Court Judge.

- ECs can be removed only on the recommendation of the CEC.

Departure from Tradition:

Traditionally, the next CEC was the senior-most Election Commissioner. However, the new law opens the process, allowing the Search Committee to consider candidates outside the current pool of Election Commissioners. This widens the net and may lead to a more transparent and inclusive selection.

Concerns and Criticisms: While the Act aims to improve the selection process, it has faced scrutiny and concerns, particularly about the independence of the Election Commission:

- Government Influence: The inclusion of the Leader of Opposition in the Selection Committee is a positive step, but critics argue that the final decision may still be influenced by the government. The government’s dominance in the Selection Committee could potentially affect the neutrality of the Commission.

- Exclusion of the Chief Justice of India (CJI): The Supreme Court's 2023 ruling had recommended including the CJI in the committee, but the new Act excludes the CJI. This has raised concerns about the balance of power and the credibility of the Election Commission.

- Risk of Partisanship: Former CEC O.P. Rawat expressed concerns that political changes might influence decisions, leading to a compromised credibility of the Election Commission.

Legal Challenges: Petitions challenging the exclusion of the CJI from the Selection Committee are currently pending before the Supreme Court, which is expected to address them in February 2025.

Historical Context and Legal Backdrop:

- Article 324 of the Indian Constitution provides for the appointment of CEC and ECs by the President, but this is subject to laws passed by Parliament.

- In 2023, the Supreme Court intervened in response to the growing concerns over the executive's unilateral control over these appointments. The Court's ruling in the Anoop Baranwal v. Union of India case led to the formation of a committee comprising the Prime Minister, Leader of Opposition, and CJI until Parliament could enact a law. This resulted in the Chief Election Commissioner and Other Election Commissioners Act, 2023, which was aligned with the Court's directions.

Implications and Way Forward:

- Potential Government Influence: While the law aims to reduce executive control, the dominant role of the Prime Minister and the Leader of the Opposition could still allow the government to influence appointments, especially in contentious times.

- Suggestions for Reform: The Law Commission had recommended a broader selection committee, including the CJI, to ensure a balanced and impartial selection process. The National Commission to Review the Working of the Constitution (NCRWC) also suggested a committee comprising key political figures, including the Leader of Opposition in the Rajya Sabha and the Speaker of Lok Sabha.

- Integrity of the Election Commission: The credibility and impartiality of the Election Commission are vital for ensuring free and fair elections. It is crucial to ensure that the appointment process not only appears fair but is also free from political interference.

Conclusion:

The Chief Election Commissioner and Other Election Commissioners (Appointment, Conditions of Service and Term of Office) Act, 2023 introduces a reformed approach to the selection of the Election Commission members. While the law aims for greater transparency, it also raises concerns regarding government influence and independence. The Supreme Court’s review of the exclusion of the CJI from the Selection Committee will be pivotal in determining the future trajectory of the Election Commission’s appointment process. The evolving legal and institutional dynamics will play a significant role in shaping the electoral reforms in India.

Unified District Information System for Education Plus (UDISE+) Report

- 10 Jan 2025

In News:

The Unified District Information System for Education Plus (UDISE+) report for 2023-24 reveals a significant decline in school enrolment across India, highlighting critical challenges in the education sector. The total enrolment in grades 1-12 fell by over 1.55 crore students, from 26.36 crore (2018-2022 average) to 24.8 crore in 2023-24. This represents a 6% drop, with the biggest declines occurring in government schools.

Key Findings:

- Enrolment Decline:

- In 2023-24, enrolment decreased from 25.17 crore in 2022-23 to 24.8 crore.

- The drop was not only in government schools (5.59%) but also in private schools (3.67%).

- States like Bihar, Uttar Pradesh, and Maharashtra saw the largest decreases.

- The decline in enrolment is despite an increase in the number of schools, from 14.66 lakh in 2022 to 14.72 lakh in 2023.

- Methodology Change:

- A significant change in the data collection methodology occurred in 2022-23, including linking enrolment to Aadhaar numbers, aimed at reducing data duplication.

- While this has improved data accuracy, it has also led to the removal of inflated figures, explaining part of the enrolment drop.

- Despite these changes, there has been a notable decline of 37 lakh students from 2022-23 to 2023-24, which remains unexplained in the report.

- Gender and Age Trends:

- Boys’ enrolment declined by 6.04%, and girls’ by 5.76%, reflecting a uniform drop across gender groups.

- The dropout rates increase as students progress through school, with the highest dropout at the secondary level.

- Infrastructure and Facilities:

- While most schools have basic facilities like electricity and gender-specific toilets, advanced infrastructure like functional computers (57%) and internet access (53%) is lacking in nearly half of schools.

- This technological gap exacerbates regional disparities and affects educational quality, particularly in rural areas.

- State-Specific Impact:

- Jammu and Kashmir, Assam, Uttar Pradesh, and Madhya Pradesh saw the highest reductions in the number of schools.

- Many school closures or mergers have led to increased distances for students, causing further dropouts during re-admission processes.

Socio-Economic Barriers:

- Economic hardships, migration, and inadequate facilities contribute to the enrolment decline.

- Low-income families and backward regions struggle to prioritize education, further affecting enrolment and retention.

Government Initiatives:

- Initiatives like the National Education Policy (NEP) 2020, Sarva Shiksha Abhiyan, and Right to Education Act (RTE) have made strides in primary education but face challenges in secondary education.

- Education spending has hovered around 4-4.6% of GDP, which is insufficient to meet the needs of the education system.

Moving Forward:

- Targeted Interventions: Focus on expanding vocational training, incentivizing school attendance, and improving digital infrastructure in schools.

- Address Regional Disparities: Conduct audits to address school shortages in densely populated areas and consolidate underutilized urban schools.

- Enhancing Teacher Quality: Invest in teacher training and encourage innovative teaching methods.

- Community Engagement: Promote local participation in school management to address specific educational needs.

Conclusion:

The UDISE+ 2023-24 report underscores the need for urgent reforms in India's education system, focusing on increasing enrolment, reducing dropout rates, and ensuring equitable access to quality education. By addressing these challenges with targeted policies, India can move closer to achieving its educational goals.

Implications of China’s Mega-Dam Project on the Brahmaputra River Basin

- 07 Jan 2025

Introduction:

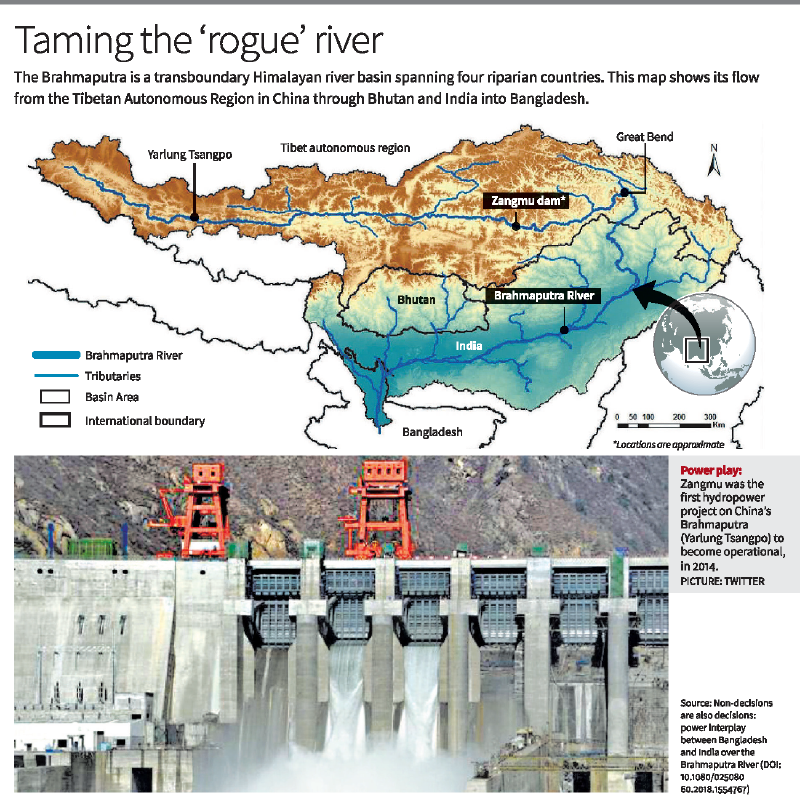

China has approved the construction of the Yarlung Tsangpo hydropower project, the world's largest hydropower project, with a capacity of 60,000 MW, on the Brahmaputra River in Tibet. This mega-dam, located at the Great Bend in Medog county, has significant geopolitical, environmental, and socio-economic implications for India, Bhutan, and Bangladesh, the downstream riparian countries.

Geographical and Geopolitical Context:

- The Brahmaputra is a transboundary river system flowing through China, India, Bhutan, and Bangladesh.

- China, located at the river’s source in Tibet, is the uppermost riparian nation, controlling water flow into India and Bangladesh.

- All riparian countries, including China, India, Bhutan, and Bangladesh, have proposed major water infrastructure projects in the river basin, which has become a site for geopolitical rivalry, with mega-dams symbolizing sovereignty.

China’s Hydropower Ambitions:

- The Yarlung Tsangpo project is part of China’s 14th Five-Year Plan (2021-2025) and aims to address the country's energy needs while moving towards net carbon neutrality by 2060.

- The river's steep descent from Tibet provides an ideal location for hydroelectricity generation.

- China’s previous mega-projects, like the Three Gorges Dam, highlight the scale of these ambitions but also raise concerns about environmental and social consequences, including ecosystem disruption, displacement, and seismic risks.

Impact on Downstream Communities:

- Water Flow and Agriculture: China’s mega-dam may significantly alter water flow to India, particularly affecting agriculture and water availability in the northeastern regions. India, reliant on the Brahmaputra for irrigation and drinking water, could face disruptions.

- Silt and Biodiversity: The blocking of silt essential for agriculture could degrade soil quality and damage biodiversity in the river basin.

- Seismic Risks: The region’s seismic activity, coupled with the construction of large dams, heightens the risk of catastrophic events such as landslides and Glacial Lake Outburst Floods (GLOFs), which have previously caused devastation in the Himalayas.

Hydropower Competition Between China and India:

- Both China and India are competing to harness the Brahmaputra's potential for hydropower, with India planning its own large project at Upper Siang.

- Bhutan has also proposed several medium-sized dams, raising concerns in downstream countries about cumulative impacts.

- No comprehensive bilateral treaty exists between India and China to regulate shared transboundary rivers, though they have mechanisms for data sharing and discussions on river issues.

Environmental and Regional Concerns:

- The Brahmaputra river basin is an ecologically sensitive region. The construction of large dams threatens the fragile ecosystem, including agro-pastoral communities, biodiversity, and wetlands.

- Tibet’s river systems are vital for the global cryosphere, affecting climate systems, including monsoon patterns. Disruption to these systems could have broader implications for regional and global climate stability.

Challenges in Bilateral Cooperation:

- India and China have struggled with effective coordination on river management. China has shown reluctance to share critical hydrological data, a concern amplified by the lack of a binding agreement.

- The ongoing geopolitical tensions between the two countries, particularly over the border dispute, further complicate cooperation on transboundary water issues.

Recommendations for India:

- Enhanced Cooperation: India should push for renewed agreements and mechanisms for real-time data exchange with China to prevent ecological and socio-economic damage.

- Public Challenges: India needs to challenge China’s claims that its hydropower projects will have minimal downstream impact, ensuring that India's concerns are addressed in international forums.

- Diplomatic Engagement: Water issues should be prioritized in India’s diplomatic engagement with China, emphasizing the importance of transparency and cooperation to ensure mutual benefit and regional stability.

Conclusion:

The Yarlung Tsangpo mega-dam project poses significant risks to the entire Brahmaputra river basin. A collaborative approach, involving transparent dialogue and cooperation among riparian countries, is essential to mitigate the potential adverse impacts on downstream communities and the fragile Himalayan ecosystem.

NITI Aayog Celebrates 10 Years

- 06 Jan 2025

In News:

- NITI Aayog, the National Institution for Transforming India, completed its 10th anniversary on January 1, 2025.

- Established to replace the Planning Commission, NITI Aayog was designed to address contemporary challenges such as sustainable development, innovation, and decentralization in a dynamic, market-driven economy.

About NITI Aayog

Establishment and Mandate

- Formation: Created through a Union Cabinet resolution in 2015.

- Primary Mandates:

- Overseeing the adoption and monitoring of the Sustainable Development Goals (SDGs).

- Promoting competitive and cooperative federalism between States and Union Territories.

Composition

- Chairperson: Prime Minister of India.

- Governing Council: Includes Chief Ministers (CMs) of all States and UTs, Lt. Governors, the Vice Chairperson, full-time members, and special invitees.

- CEO: Appointed by the PM for a fixed tenure.

Key Achievements

Policy Advisory and Decentralized Governance

- Shifted focus from financial allocation to policy advisory roles.

- Promoted decentralized governance through data-driven initiatives like the SDG India Index and the Composite Water Management Index.

Innovative Initiatives

- Aspirational Blocks Programme (2023): Focused on 500 underdeveloped blocks for 100% coverage of government schemes.

- Atal Innovation Mission (AIM): Trained over 1 crore students through Atal Tinkering Labs and incubation centres.

- Initiatives like e-Mobility, Green Hydrogen, and the Production-Linked Incentive (PLI) Scheme were conceptualized to drive innovation and sustainability.

Role and Functions of NITI Aayog

Strategic Advice and Federal Cooperation

- Provides policy formulation and strategic advice to both central and state governments.

- Fosters cooperative federalism by encouraging collaboration between the central and state governments.

Monitoring and Evaluation

- Plays a crucial role in monitoring and evaluating policies and programs to ensure alignment with long-term goals.

Promoting Innovation and SDGs

- NITI Aayog contributes to aligning national development programs with the Sustainable Development Goals (SDGs), focusing on innovation, research, and technology in critical sectors.

Key Differences Between Planning Commission and NITI Aayog

Aspect Planning Commission NITI Aayog

Purpose Centralized planning and resource allocation. Focus on cooperative federalism and policy research.

Structure Led by the PM, with Deputy Chairman and full-time members. Led by the PM, with Vice-Chairperson, CEO, and Governing Council.

Approach Top-down, centralized. Bottom-up, encouraging state participation.

Role in Governance Executive authority over policies. Advisory body without enforcement power.

Five-Year Plans Formulated and implemented. Focus on long-term development, no Five-Year Plans.

Challenges Faced by NITI Aayog

- Limited Executive Power: Lacks authority to enforce its recommendations, restricting its influence.

- Coordination Issues: Achieving effective collaboration between central and state governments remains challenging.

- Data Gaps: Inconsistent state-level data hampers accurate policymaking and evaluation.

- Resource Constraints: Limited resources hinder full implementation of initiatives.

- Resistance to Change: Some states resist NITI Aayog's initiatives due to concerns over autonomy and alignment with local needs.

Future Vision and Planning

- Agenda for 2030: Focus on achieving the Sustainable Development Goals (SDGs) in areas like poverty alleviation, education, healthcare, clean energy, and gender equality.

- Vision for 2035: NITI Aayog's 15-year vision document aims for sustainable, inclusive growth, with an emphasis on economic growth, social equity, and environmental sustainability.

- Innovation and Digitalization: Promotes digitalization and innovation through data-driven policymaking and regional focus on tribal and hilly areas.

Conclusion: Reflections on the First Decade

- Despite significant achievements, NITI Aayog’s influence remains limited by its advisory role and resource constraints.

- The shift away from centralized planning, evident since the dissolution of the Planning Commission, has sparked debate about the effectiveness of such a model in ensuring long-term development and inclusive growth.

Draft Digital Personal Data Protection Rules, 2025

- 05 Jan 2025

In News:

The Government of India has introduced the long-awaited draft Digital Personal Data Protection Rules, 2025 to operationalize the Digital Personal Data Protection Act, 2023. These rules contain several significant provisions, including the controversial reintroduction of data localisation requirements, provisions for children's data protection, and measures to strengthen data fiduciaries' responsibilities.

This development holds substantial implications for both Indian citizens' data privacy and global tech companies, especially with respect to compliance, security measures, and data processing.

Data Localisation Mandates

Key Provision: The draft rules propose that certain types of personal and traffic data must be stored within India. Specifically, "significant data fiduciaries", a category that will include large tech firms such as Meta, Google, Apple, Microsoft, and Amazon, will be restricted from transferring certain data outside India.

- Committee Oversight: A government-appointed committee will define which types of personal data cannot be transferred abroad, based on factors like national security, sovereignty, and public order.

- Localisation Re-entry: This provision brings back data localisation, a contentious issue previously removed from the 2023 Data Protection Act after heavy lobbying by tech companies.

- Impact on Big Tech: Companies like Meta and Google had previously voiced concerns that strict localisation rules could hinder their ability to offer services in India, with Google arguing for narrowly tailored data localisation norms.

Role and Responsibilities of Data Fiduciaries

Key Provision: The rules lay out a clear framework for data fiduciaries, defined as entities that collect and process personal data.

- Significant Data Fiduciaries (SDFs): This subcategory will include entities that process large volumes of sensitive data, such as health and financial data. These companies will be held to higher standards of compliance and security.

- Data Retention: Personal data can only be stored for as long as consent is valid; after which, it must be deleted.

- Security Measures: Data fiduciaries must implement stringent measures such as encryption, access control, unauthorized access monitoring, and data backups.

Parental Consent for Children's Data

Key Provision: The draft rules include provisions aimed at protecting children's data, including mechanisms to ensure verifiable parental consent before children under 18 can use online platforms.

- Verification Process: Platforms must verify the identity of parents or guardians using government-issued identification or digital locker services.

- Exceptions: Health, mental health institutions, educational establishments, and daycare centers will be exempted from needing parental consent.

Data Breach Reporting and Penalties

Key Provision: In the event of a data breach, data fiduciaries are required to notify affected individuals without delay, detailing the breach's nature, potential consequences, and mitigation measures. Failure to comply with breach safeguards can result in penalties.

- Penalties for Non-Compliance: Entities that fail to adequately protect data or prevent breaches could face fines of up to Rs 250 crore.

- Breach Notification: The rules mandate timely reporting of all breaches, whether minor or major, and an emphasis on transparency in the breach notification process.

Safeguards for Government Data Processing

Key Provision: The draft rules seek to ensure that the government and its agencies process citizen data in a lawful manner with adequate safeguards in place.

- Exemptions for National Security and Public Order: The rules also address concerns that the government may process data without adequate checks by stipulating lawful processing and protections when data is used for national security, foreign relations, or public order.

Compliance Challenges for Businesses

Key Challenges: The introduction of these rules will impose several challenges for businesses, particularly tech companies:

- Consent Management: Companies will need to implement robust systems to handle consent records, allowing users to withdraw consent at any time. This will require significant infrastructure changes.

- Data Infrastructure Overhaul: Organizations will need to invest in data collection, storage, and lifecycle management systems to ensure compliance.

- Security Standards: Experts have raised concerns about the vagueness of certain security standards, which could lead to inconsistent implementation across sectors.

Penalties and Enforcement

Key Provisions:

- Penalties for Non-Compliance: Entities failing to adhere to the rules may face significant financial penalties, including fines up to Rs 250 crore for serious breaches.

- Repeat Violations: Consent managers who repeatedly violate rules could have their registration suspended or cancelled.

Conclusion:

The Digital Personal Data Protection Rules, 2025 bring important changes to India’s data privacy framework, particularly the reintroduction of data localisation and more stringent requirements for data fiduciaries. These rules aim to strengthen citizen privacy and ensure greater accountability from businesses. However, the challenges in compliance, especially for global tech firms, and the potential impact on service delivery, will need to be closely monitored as the final rules take shape.

Unified District Information System for Education Plus (UDISE+) 2023-24 Report

- 04 Jan 2025

In News:

The UDISE+ report for 2023-24, released by the Ministry of Education, presents key insights into India’s school education system. UDISE+ serves as a comprehensive database, tracking student enrolment, school infrastructure, and other educational parameters, enabling efficient policy implementation and gap identification.

Key Findings:

- Decline in School Enrolment: Enrolment figures in Indian schools have witnessed a significant decline for the first time in recent years. The total enrolment dropped from 26.36 crore (2018-22 average) to 25.17 crore in 2022-23 and further to 24.8 crore in 2023-24, marking a fall of 1.55 crore students or nearly 6%. This drop is attributed to the improved data collection methods which helped eliminate duplicate entries, especially students enrolled in both government and private schools.

- Gender and School Type-wise Trends: The enrolment drop was observed across both government and private schools. Government schools saw a decline of 5.59%, whereas private schools experienced a 3.67% reduction. Gender-wise, the enrolment of boys decreased by 6.04%, while girls’ enrolment dropped by 5.76%, compared to the 2018-22 average.

- State-wise Data: The enrolment drop was not uniform across states. Bihar recorded the largest decline, with a loss of 35.65 lakh students, followed by Uttar Pradesh (28.26 lakh) and Maharashtra (18.55 lakh). In contrast, states like Andhra Pradesh, Delhi, Jammu & Kashmir, and Telangana saw an increase in enrolment during the same period.

- Level-wise Trends: The most significant declines were recorded at the primary (Classes 1-5), upper primary (Classes 6-8), and secondary (Classes 9-10) levels. However, enrolment in pre-primary and higher secondary (Classes 11-12) levels showed an increase in 2023-24 compared to the previous average.

- Impact of Data Refinement: The implementation of Aadhaar-linked student data collection has enhanced the accuracy of enrolment figures. The de-duplication process helped remove cases of students being enrolled in both government and private schools. This revision is expected to provide more accurate data for targeted educational schemes and improve the effectiveness of government programs like Samagra Shiksha and PM POSHAN.

Challenges in Education

Despite the improvements in data collection, several systemic issues persist:

- Access and Retention: High dropout rates, especially at the secondary level, remain a challenge for sustained student retention.

- Disparities among Marginalized Groups: Enrolment among SC, ST, OBC, and minority communities showed a notable decline, reflecting existing inequities in the education system.

- Infrastructure and Teacher Training: Uneven distribution of resources and insufficient teacher training continue to hamper educational outcomes, affecting quality and student engagement.

Way Forward

To address these challenges, the following steps are critical:

- Strengthening NEP 2020: The National Education Policy aims for universal Gross Enrolment Ratio (GER) by 2030, with a focus on skill-based learning and inclusive education.

- Teacher Capacity Building: There is a need for targeted interventions to improve teacher quality and address gaps in the student-teacher ratio.

- Infrastructure Optimization: Schools should optimize their resources based on enrolment trends to improve access and address disparities.

- Data-Driven Monitoring: Continuous monitoring using student-specific data will help identify dropouts and allocate resources efficiently.

Government Extends Special Subsidy on DAP

- 03 Jan 2025

In News:

The Indian government has decided to extend the special subsidy on Di-Ammonium Phosphate (DAP) fertilizer for another year, a decision aimed at stabilizing farmgate prices and addressing the challenges posed by the depreciation of the Indian rupee.

Key Government Decision

- Extension of Subsidy: The Centre has extended the Rs 3,500 per tonne special subsidy on DAP from January 1, 2025 to December 31, 2025.

- Objective: This extension aims to contain farmgate price surges of DAP, India’s second most-consumed fertilizer, which is being impacted by the fall in the rupee's value against the US dollar.

Fertilizer Price Dynamics and Impact

- MRP Caps on Fertilizers: Despite the decontrol of non-urea fertilizers, the government has frozen the maximum retail price (MRP) for these products.

- Current MRPs:

- DAP: Rs 1,350 per 50-kg bag

- Complex fertilizers: Rs 1,300 to Rs 1,600 per 50-kg bag depending on composition.

- Current MRPs:

- Subsidy on DAP: The subsidy includes Rs 21,911 per tonne on DAP, plus the Rs 3,500 one-time special package.

- Impact of Currency Depreciation:

- The rupee's depreciation has made imported fertilizers significantly more expensive.

- The landed price of DAP has increased from Rs 52,960 per tonne to Rs 54,160 due to the rupee falling from Rs 83.8 to Rs 85.7 against the dollar.

- Including additional costs (customs, port handling, insurance, etc.), the total cost of imported DAP is now Rs 65,000 per tonne, making imports unviable without further subsidy or MRP adjustments.

- The rupee's depreciation has made imported fertilizers significantly more expensive.

Industry Concerns and Viability Issues

- Import Viability:

- Fertilizer companies face significant cost pressures due to rising import prices and the current MRP caps.

- Without an increase in government subsidies or approval to revise MRPs upwards, imports will be unviable.

- Even with the extended subsidy, companies estimate a Rs 1,500 per tonne shortfall due to currency depreciation.

- Stock Levels and Supply Challenges:

- Current stock levels for DAP (9.2 lakh tonnes) and complex fertilizers (23.7 lakh tonnes) are below last year's levels.

- With inadequate imports, there are concerns about fertilizer supply for the upcoming kharif season (June-July 2025).

Government’s Strategy and Fiscal Implications

- Compensation for Imports:

- In September 2024, the government approved compensation for DAP imports above a benchmark price of $559.71 per tonne, based on an exchange rate of Rs 83.23 to the dollar.

- With the rupee falling below Rs 85.7, these previous compensation calculations have become outdated.

- Fiscal Impact:

- The extended subsidy will cost the government an additional Rs 6,475 crore. Despite this, political implications of raising the MRP are minimal, as only non-major agricultural states are facing elections in 2025.

Future Outlook and Priorities

- Immediate Priority: The government’s primary concern is securing adequate fertilizer stocks for the kharif season, focusing on ensuring sufficient imports of both finished fertilizers and raw materials.

- Balancing Factors: The government will need to navigate the complex balance of maintaining fertilizer affordability for farmers, ensuring the viability of fertilizer companies, and managing fiscal constraints.

As the subsidy extension is implemented, all eyes will be on the government's ability to ensure a stable supply of fertilizers while safeguarding both farmer interests and economic sustainability in the face of an increasingly challenging exchange rate environment.

Sustainable Groundwater Management in India’s Agriculture

- 30 Dec 2024

Introduction: Groundwater Crisis and Agriculture

- India's Agricultural Dependence on Groundwater: India is a leading producer of water-intensive crops like rice, wheat, and pulses. The country’s agricultural sector heavily depends on groundwater for irrigation, especially for paddy cultivation.

- Over-exploitation of Groundwater: Groundwater extraction for irrigation is increasingly unsustainable, threatening agricultural sustainability in the long term.

Rising Groundwater Usage and Its Implications

- Population Growth and Groundwater Use: Between 2016 and 2024, global population grew from 7.56 billion to 8.2 billion, and India’s population rose from 1.29 billion to 1.45 billion. Concurrently, groundwater used for irrigation increased from 38% in 2016-17 to 52% in 2023-24, exacerbating the water crisis.

- Over-extraction in Major Paddy-Producing States: States like Rajasthan, Punjab, and Haryana have witnessed severe over-exploitation of groundwater for irrigation.

- Rajasthan: Highest groundwater salinisation (22%) despite receiving the highest average rainfall (608 mm) among these states.

- Punjab and Haryana: Lesser groundwater salinity due to canal irrigation and micro-irrigation systems.

Impact of Excessive Fertilizer Use on Groundwater Quality

- Soil Salinity and Groundwater Contamination: Excessive use of fertilizers, particularly for paddy cultivation, increases soil salinity and contributes to groundwater contamination.

- Toxic Chemicals in Groundwater: Nitrate contamination, caused by nitrogen-based fertilizers, and uranium contamination due to phosphate fertilizers are key concerns in states like Maharashtra, Telangana, Andhra Pradesh, and Tamil Nadu.

- Health Risks: Contaminated groundwater poses health risks such as thyroid disorders, cancer, and dental fluorosis, along with reduced agricultural productivity.

Projected Impact on Future Groundwater Availability

- Unsustainable Groundwater Levels: The Central Groundwater Board (CGWB) reports that if current practices continue, over half of the districts in Punjab could face groundwater depletion. Similarly, 21-23% of districts in Haryana and Rajasthan may experience a similar crisis.

- Population Growth and Water Scarcity: With India’s population expected to reach 1.52 billion by 2036, the need for sustainable groundwater management becomes even more critical.

Government Initiatives for Groundwater Management

- National Mission for Sustainable Agriculture (2014): Promotes sustainable practices like zero tillage, cover cropping, and micro-irrigation for efficient water and chemical use.

- Pradhan Mantri Krishi Sinchai Yojana (2015): Aims to boost irrigation efficiency through drip and sprinkler irrigation methods.

- Atal Bhujal Yojana (2019): Targets efficient groundwater management in water-stressed states like Gujarat, Haryana, Rajasthan, Maharashtra, and Uttar Pradesh.

- Success of Government Initiatives: CGWB data shows that the percentage of districts with unsustainable groundwater levels dropped from 23% in 2016-17 to 19% in 2023-24.

Role of State Governments in Groundwater Management

- State-Level Initiatives: States with unsustainable groundwater levels must take proactive measures to manage water resources efficiently.

- Example - Odisha: Odisha's Integrated Irrigation Project for Climate Resilient Agriculture emphasizes irrigation efficiency and climate-smart practices, supported by World Bank funding.

- Encouraging Resource-Efficient Agriculture: States with safe groundwater levels, like Chhattisgarh, Bihar, Jharkhand, Telangana, and Odisha, should adopt water-efficient practices to protect groundwater resources.

Conclusion: Ensuring Agricultural Sustainability and Water Security

- Need for Urgent Action: Scaling up efforts to improve irrigation practices and groundwater management is crucial to securing India’s agricultural future.

- Global Food Security: Protecting groundwater resources will not only ensure water security within India but also contribute to global food security amid climate challenges.

- Blueprint for Sustainable Agriculture: States like Odisha are providing a model for sustainable water management, which can be replicated across water-stressed regions in India.

Glass Ceiling Cracks: Women's Rising Role in the 2024 Lok Sabha Elections

- 28 Dec 2024

Introduction:

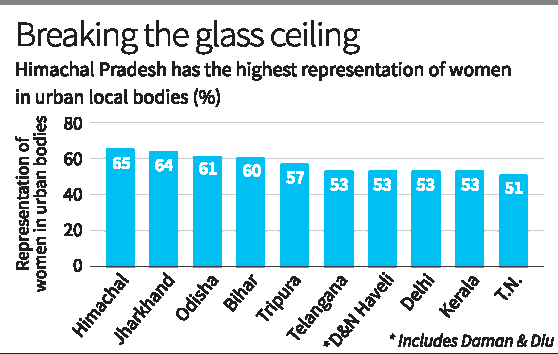

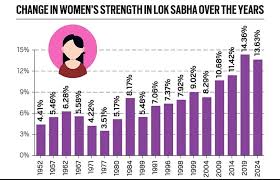

The 2024 Lok Sabha elections marked a significant step forward for women’s participation in Indian politics. With 800 women candidates contesting across 390 constituencies, this was the highest ever since the 1957 general elections. This surge in women candidates has been a positive reflection of the evolving role of women in India's democratic processes.

Increase in Women Candidates:

- A total of 800 women candidates participated in the 2024 elections, up from 726 in 2019.

- The number of constituencies with no female candidate dropped to a historic low of 152, from 171 in 2019.

- However, despite the rise in participation, only 74 women won, while 629 forfeited their deposits.

Regional Variations:

- The highest number of women candidates were from Maharashtra (111), followed by Uttar Pradesh (80) and Tamil Nadu (77).

- Some constituencies, like Baramati, Secunderabad, and Warangal, saw the highest participation of women, with eight candidates each.

Voter Turnout and Gender Dynamics:

- Women voters surpassed men in voter turnout for the second consecutive time, with 65.78% women casting their vote in 2024, compared to 65.55% of men.

- Assam’s Dhubri recorded the highest female voter turnout at 92.17%, reflecting increased female engagement in the electoral process.

Electoral Data and Gender Insights:

- In 2024, there were 47.63 crore female electors out of 97.97 crore total voters, making up 48.62% of the electorate, a slight increase from 2019.

- The number of female electors per 1,000 male voters reached 946, up from 926 in 2019, showing growing electoral inclusivity.

Challenges and Progress:

- Despite the gains in women’s representation, there remain several constituencies without any female candidates, notably in states like Uttar Pradesh (30 constituencies), Bihar (15), and Gujarat (14).

- Though women's participation has risen, the number of women who win remains disproportionately low, reflecting the challenges they face in a patriarchal political landscape.

Inclusion and Diversity:

- The 2024 elections also saw greater inclusivity, with a rise in third-gender electors, which increased by 23.5% to 48,272.

- Voter turnout among transgender voters nearly doubled, reaching 27.09% compared to 14.64% in 2019.

- Additionally, the number of persons with disabilities (PwD) electors increased to 90.28 lakh, showcasing broader electoral inclusivity.

Conclusion:

The 2024 Lok Sabha elections witnessed a remarkable increase in women’s participation, both as voters and candidates. While the journey toward full gender parity in politics continues, the trends from these elections indicate a growing shift toward more inclusive electoral processes. The data released by the Election Commission further underlines this progress, showing the increasing role of women in shaping India’s democratic future.

Suposhit Gram Panchayat Abhiyan

- 26 Dec 2024

In News:

On December 26, 2024, Prime Minister Narendra Modi presided over the Veer Bal Diwas celebrations at the Bharat Mandap in New Delhi. This annual event commemorates the martyrdom of the sons of Sri Guru Gobind Singh Ji and highlights the importance of nurturing the next generation. During the occasion, PM Modi also launched the ‘Suposhit Gram Panchayat Abhiyan,’ an initiative aimed at improving nutrition and well-being in rural India.

Veer Bal Diwas: Commemorating Sacrifice and Courage

Veer Bal Diwas was declared on January 9, 2022, by PM Modi to honor the sacrifices made by the young sons of Guru Gobind Singh Ji — Sahibzada Baba Zorawar Singh and Baba Fateh Singh — who were martyred in 1704. During the Mughal-Sikh battles, these two brave boys were captured and offered safety if they converted to Islam, which they refused. Their refusal to abandon their faith led to their brutal martyrdom by being bricked alive in the walls of a fort in Sirhind (Punjab). This act of resilience and unwavering faith is a cornerstone of Sikh history and culture.

Veer Bal Diwas not only commemorates their sacrifice but also serves as a reminder of the strength, faith, and courage demonstrated by all four of Guru Gobind Singh Ji’s sons. It underscores the Sikh ideals of sacrifice, courage, and dedication to faith.

Suposhit Gram Panchayat Abhiyan: Addressing Malnutrition in Rural Areas

On the same day, PM Modi launched the 'Suposhit Gram Panchayat Abhiyan', a nationwide mission focused on improving nutritional outcomes in rural areas. The initiative aims to enhance nutrition-related infrastructure and promote active community participation in tackling malnutrition. By encouraging village-level involvement, the program seeks to ensure that nutrition becomes a community-driven effort.

Key Objectives

- Malnutrition Eradication: The initiative focuses on combating malnutrition in rural communities by improving access to better nutrition.

- Healthy Competition: Encourages competition among villages to adopt best practices for nutrition and overall health.

- Sustainable Development: Promotes long-term, sustainable health practices that align with India's broader goals, such as the Poshan Abhiyan and the Sustainable Development Goals (SDGs).

The program aims to make rural populations active participants in improving their own well-being, strengthening community-driven initiatives for better nutritional outcomes.

Engaging Children and Fostering Patriotism

In line with Veer Bal Diwas, various events were organized to engage young minds across the nation. These initiatives not only raised awareness about the significance of the day but also fostered a culture of courage, dedication, and patriotism.

- Online Competitions: Interactive quizzes were conducted through platforms like MyGov and MyBharat to encourage participation and understanding of Veer Bal Diwas.

- Creative Activities: Schools, Child Care Institutions, and Anganwadi centers organized storytelling, creative writing, and poster-making contests to engage children and promote nationalistic values.

Honoring Young Achievers: PMRBP Awardees

The event also saw the presence of the recipients of the Pradhan Mantri Rashtriya Bal Puraskar (PMRBP), which recognizes children who have demonstrated exceptional abilities in various fields. The awardees, 17 in total, were presented with medals, certificates, and citation booklets by President Droupadi Murmu. These young achievers served as a source of inspiration, reinforcing the theme of celebrating youth potential on Veer Bal Diwas.

Conclusion: Strengthening the Foundation of India’s Future

The celebrations of Veer Bal Diwas and the launch of the Suposhit Gram Panchayat Abhiyan highlight the government’s commitment to nurturing India’s future by investing in its children and rural communities. By honoring historical sacrifices and fostering community-driven health and nutrition initiatives, these efforts contribute to building a resilient, prosperous India that can meet global challenges head-on. The twin focus on children’s development and rural well-being underscores India’s vision of a healthier, more inclusive society, aligned with national and global development goals.

Revitalization of India-China Relations: A Diplomatic Turning Point

- 23 Dec 2024

In News:

The 23rd meeting between India’s National Security Adviser (NSA) and China’s Foreign Minister, held as Special Representatives (SRs), marks a pivotal moment in the complex bilateral relationship between the two nations. This dialogue, which follows years of strain exacerbated by the 2020 Galwan Valley clash, signals a renewed commitment to restoring stability and fostering peace along the border.

Special Representatives Mechanism: A Foundation for Dialogue

The SR mechanism, established in the early 2000s, has long served as a key platform for addressing bilateral disputes, particularly the contentious boundary issue. Past rounds of discussions have facilitated troop disengagement and efforts to maintain peace along the Line of Actual Control (LAC). The recent meeting, following the 2023 BRICS summit discussions between Prime Minister Narendra Modi and Chinese President Xi Jinping, demonstrates a positive step towards de-escalation, with the resumption of talks providing hope for progress.

Key Outcomes of the 23rd SR Meeting

Several significant developments emerged from the meeting, focusing on cultural, economic, and strategic cooperation:

- Cultural and Economic Cooperation:

- Kailash-Mansarovar Yatra: The resumption of this religious pilgrimage represents a significant cultural exchange, fostering people-to-people ties.

- Border Trade Revival: Border trade in Sikkim has been reestablished, potentially revitalizing local economies and improving trade relations.

- Scientific and Environmental Cooperation:

- Trans-boundary River Data Sharing: China’s commitment to sharing crucial river data with India will aid in flood management, directly addressing India’s long-standing concerns over water security, particularly in light of China's upstream dam projects.

- Connectivity and Exchange Programs:

- Discussions on restarting direct flights and visa easements for students and businesses, along with enhanced journalist exchanges, signal a move toward greater normalization of relations.

- Commitment to Border Peace:

- Both sides have reiterated their intent to maintain peace along the border, a critical factor in reducing tensions. While China expressed a six-point consensus, India has cautiously framed the outcome as “positive directions,” reflecting a reserved optimism.

Challenges in India-China Relations

Despite the positive momentum, numerous challenges persist in the bilateral relationship:

- Boundary Dispute:

- The core irritant remains the unresolved border issue, with divergent perceptions of the LAC. While some disengagement has occurred, full de-escalation and demilitarization across the entire border have not yet been achieved.

- Trust Deficit:

- The 2020 Galwan clash has left a lasting scar on mutual trust. Additionally, China’s aggressive patrolling and policy shifts continue to raise concerns in India, necessitating vigilance in future negotiations.

- Economic Imbalances:

- India’s trade relationship with China remains lopsided, with a significant trade deficit. Moreover, China’s growing influence in India’s neighborhood, particularly in Pakistan, Nepal, and Sri Lanka, challenges India’s strategic interests.

- Global Power Dynamics:

- India’s evolving alliances, particularly with the U.S., QUAD, and I2U2 group, alongside China’s assertive stance in Taiwan and the South China Sea, complicate bilateral relations and influence global perceptions.

The Way Forward

To navigate the challenges and harness opportunities, India must adopt a balanced approach, combining diplomatic engagement, economic resilience, and strategic vigilance:

- Confidence-Building Measures:

- Continued disengagement and de-escalation at the LAC, coupled with increased transparency in military activities, will be critical to maintaining peace.

- Broadening Cooperation:

- Exploring areas of mutual interest, such as climate change, public health, and infrastructure development, could foster deeper cooperation and help transcend contentious issues.

- Economic Realignment:

- India must address its trade deficit by pushing for greater market access for Indian products in China. Additionally, diversifying supply chains and promoting joint ventures in renewable energy and technology can reduce dependency.

- Multilateral Engagement:

- Engaging through global forums like BRICS, SCO, and G20, and strengthening regional alliances, will help mitigate tensions and counterbalance China's regional influence.

- Strategic Vigilance:

- Strengthening ties with regional allies, particularly in the Indo-Pacific, and enhancing military preparedness will safeguard India’s strategic interests in the face of China’s assertiveness.

Conclusion

The recent meeting between India and China represents a cautious but constructive step toward stabilizing their fraught relationship. By focusing on diplomacy, strengthening economic ties, and maintaining strategic vigilance, India can navigate its complex relationship with China in a rapidly shifting global context. A careful balance of engagement and vigilance will be crucial for India’s future dealings with its powerful neighbor.

Supreme Court Directs Policy for Sacred Groves Protection

- 20 Dec 2024

In News:

Recently, the Supreme Court of India issued a significant judgment directing the Union Government to formulate a comprehensive policy for the protection and management of sacred groves across the country. These natural spaces, traditionally safeguarded by local communities, play a crucial role in preserving both ecological diversity and cultural heritage.

What are Sacred Groves?

Sacred Groves are patches of virgin forests that are protected by local communities due to their religious and cultural significance. They represent remnants of what were once dominant ecosystems and serve as key habitats for flora and fauna. Typically, sacred groves are not just ecological reserves, but also form an integral part of local traditions, often protected due to spiritual beliefs.

Key Features of Sacred Groves:

- Ecological Value: Sacred groves contribute significantly to biodiversity conservation.

- Cultural Significance: These groves are revered in various religious practices and are central to local traditions.

- Geographical Presence: Sacred groves are found in regions like Tamil Nadu, Kerala, Karnataka, Maharashtra, and parts of Rajasthan.

Supreme Court's Directive

The court's judgment was based on a plea highlighting the decline of sacred groves in Rajasthan, particularly those being lost due to deforestation and illegal land-use changes. While the Wildlife (Protection) Act of 1972 empowers state governments to declare community lands as reserves, the court recognized the need for a unified national policy to protect sacred groves as cultural reserves.

Recommendations:

- Nationwide Survey: The Ministry of Environment, Forest, and Climate Change (MoEF&CC) was instructed to conduct a nationwide survey to map and assess sacred groves, identifying their size and extent.

- Legal Protection: Sacred groves should be recognized as community reserves and protected under the Wildlife (Protection) Act, 1972.

- State-Specific Measures: The Rajasthan government was specifically directed to carry out detailed mapping (both on-ground and satellite) of sacred groves within the state, ensuring that the groves are recognized for their ecological and cultural significance.

The Role of Sacred Groves in Conservation

Sacred groves play a pivotal role in the conservation of biodiversity. They serve as refuges for various plant and animal species, and the traditional practices associated with these groves, such as tree worship, discourage destructive activities like logging and hunting.

Ecological and Cultural Importance:

- Sacred groves often act as critical biodiversity hotspots, preserving rare and indigenous species.

- They help maintain clean water ecosystems and act as carbon sinks, contributing to climate mitigation.

- Practices of non-interference with these areas have allowed flora and fauna to thrive over centuries.

Cultural Significance Across India

The importance of sacred groves is deeply embedded in India's diverse cultural heritage. They are considered the abode of deities, and various regions have unique names and rituals associated with these groves.

Examples of Sacred Groves in India:

- Himachal Pradesh: Devban

- Karnataka: Devarakadu

- Kerala: Kavu

- Rajasthan: Oran

- Maharashtra: Devrai

Piplantri Village Model

A key example highlighted in the judgment was the Piplantri village in Rajasthan, where the community undertook a remarkable transformation of barren land into flourishing groves. The initiative, driven by local leadership, involves planting 111 trees for every girl child born, which has led to several environmental and social benefits.

Impact of Piplantri's Community Efforts:

- Over 40 lakh trees have been planted, which has recharged the water table by 800-900 feet and lowered the local climate by 3-4°C.

- The initiative has contributed to the reduction of female foeticide and empowered women's self-help groups.

- The village now enjoys economic growth, better education opportunities, and increased local income.

Legal and Statutory Framework

Sacred groves are already recognized under existing Indian laws, notably the Wildlife (Protection) Act, 1972, which allows states to declare sacred groves as community reserves. Additionally, the National Forest Policy of 1988 encourages the involvement of local communities in the conservation of forest areas, a principle supported by the Godavarman Case of 1996.

Key Legal Provisions:

- Wildlife (Protection) Act, 1972: Empowers state governments to declare sacred groves as community reserves.

- National Forest Policy, 1988: Encourages community involvement in the conservation and protection of forests, including sacred groves.

- Scheduled Tribes and Other Traditional Forest Dwellers (Recognition of Forest Rights) Act, 2006: Suggests empowering traditional communities as custodians of sacred groves.

Looking Ahead: The Need for Action

The Supreme Court has scheduled further hearings to assess the progress of the survey and mapping efforts by Rajasthan. The court also stressed the importance of empowering traditional communities to continue their role as custodians of sacred groves, ensuring their sustainable protection for future generations.

By recognizing the ecological and cultural significance of sacred groves and encouraging community-driven conservation efforts, the Supreme Court’s ruling sets a precedent for more inclusive environmental policies in India. This could also inspire similar initiatives in other parts of the world, promoting the protection of sacred natural spaces for their critical role in maintaining biodiversity and fostering sustainable communities.

India-Bhutan Relations

- 13 Dec 2024

In News:

The December 2023 visit of Bhutan’s King and Queen to India highlights the enduring and strategic partnership between the two nations. Amidst growing Chinese influence and Bhutan’s domestic challenges, the visit holds significant geopolitical relevance, reinforcing India-Bhutan relations and underscoring Bhutan's critical role in India’s regional security.

Reaffirmation of India-Bhutan Relations

The visit reaffirmed the strong, time-tested partnership between India and Bhutan, rooted in mutual trust and cooperation. India reiterated its commitment to Bhutan's socio-economic development, increasing its financial aid for the 2024-2029 period from ?5,000 crore to ?10,000 crore. Notably, Bhutan’s flagship Gelephu Mindfulness City Project, championed by King Jigme Khesar, received strong Indian backing, reflecting India’s willingness to align with Bhutan’s developmental priorities.

Strategic Areas of Cooperation

Clean Energy and Hydropower

Bhutan remains central to India’s renewable energy strategy, particularly in hydropower, a vital part of Bhutan's economy. Bhutan exports the majority of its hydropower to India, reinforcing bilateral ties in the energy sector. This cooperation aligns with India’s regional energy security goals, with both nations seeking to strengthen clean energy initiatives.

Infrastructure Development

The visit also emphasized infrastructure projects, vital for enhancing Bhutan's connectivity. These projects are strategically significant, considering Bhutan's geostrategic importance in the Himalayas. Infrastructure development further strengthens the ties between the two nations, with a focus on mutual benefits and regional stability.

Geopolitical Context: China’s Growing Influence

China-Bhutan Border Disputes

The border issue with China has been ongoing since 1984. In 2023, Bhutan and China signed an agreement to expedite the settlement and demarcation of their borders. China’s push for resolution is part of its broader strategy to reduce India’s influence in Bhutan. The disputed areas, particularly those near India’s Siliguri Corridor, hold strategic importance for New Delhi. Any territorial adjustments could undermine India’s access to its Northeastern states.

Chinese Influence and Economic Engagement

China has been constructing villages along disputed border areas, altering ground realities and establishing civilian hubs that could serve as military outposts. Additionally, China is offering economic incentives to Bhutan, including promoting tourism and investing in Bhutan’s telecom sector, seeking to draw the country into closer economic and diplomatic alignment.

India’s Role in Bhutan’s Security and Sovereignty

Strategic Dependence on India

Bhutan's small military relies heavily on Indian support for training and defense. The 2017 Doklam standoff, where Indian forces intervened to prevent China from constructing a road in disputed territory, underscored India's crucial role in safeguarding Bhutan’s territorial integrity.

Friendship Treaty

The India-Bhutan Friendship Treaty is the cornerstone of their bilateral relations, ensuring Bhutan's sovereignty while reinforcing India's role in Bhutan’s foreign and defense policies. India's increased financial support aims to counter China’s economic influence in Bhutan.

Challenges for Bhutan

Balancing India and China

Bhutan is navigating a delicate balance between preserving its historical ties with India and engaging with China, which offers economic benefits. However, Bhutan’s sovereignty concerns limit its ability to make independent diplomatic decisions.

Domestic Issues

Bhutan faces challenges such as youth migration and limited economic diversification. Over-reliance on hydropower and a lack of industrial development make it vulnerable to external pressures, particularly from China.

The Strategic Importance of Bhutan to India

Geopolitical Buffer

Bhutan's location is vital for India’s security, especially in relation to the Siliguri Corridor, a narrow land link connecting India’s Northeast. Any Chinese presence in Bhutan’s disputed regions could disrupt access to this crucial corridor.

Hydropower Collaboration

Bhutan’s hydropower exports are central to India’s renewable energy strategy, and their cooperation in this area ensures mutual benefits.

Way Forward

India must continue to prioritize Bhutan’s development needs, ensuring robust financial and infrastructural support. Proactive engagement is necessary to address Bhutan’s concerns, particularly in light of China’s growing influence. Additionally, India should support Bhutan’s economic diversification to reduce reliance on external actors.

Impeachment of Judges

- 12 Dec 2024

In News:

The recent controversy surrounding remarks made by Justice Shekhar Kumar Yadav of the Allahabad High Court has prompted calls for his impeachment. During an event organized by the Vishwa Hindu Parishad (VHP), Justice Yadav made statements that were perceived as communal, leading to concerns over judicial impartiality. This incident has reignited discussions about the impeachment process for judges in India, highlighting the delicate balance between judicial independence and accountability.

Impeachment Process for Judges in India

In India, the impeachment process for judges, although not explicitly mentioned in the Constitution, serves as a mechanism to ensure judicial accountability while safeguarding judicial independence. The process is outlined under Articles 124 and 218 of the Indian Constitution, which govern the removal of Supreme Court and High Court judges, respectively.

Grounds for Impeachment

Judges in India can be removed on two grounds:

- Proved Misbehavior: Conduct that breaches the ethical standards of the judiciary.

- Incapacity: A judge’s inability to perform judicial duties due to physical or mental infirmity.

These grounds are clearly specified to prevent arbitrary removal, ensuring that the process remains fair and just.

Steps in the Impeachment Process

- Initiation of Motion: The process begins when a motion for impeachment is introduced in Parliament, either in the Lok Sabha or Rajya Sabha. The motion must be supported by at least 100 members of the Lok Sabha or 50 members of the Rajya Sabha. This ensures significant parliamentary backing before the motion proceeds.

- Formation of an Inquiry Committee: If the motion is admitted, a three-member inquiry committee is constituted. This includes a Supreme Court judge, the Chief Justice of a High Court, and a distinguished jurist. The committee conducts a thorough investigation into the allegations.

- Committee Report and Parliamentary Debate: Following the investigation, the committee submits its findings. If the judge is found guilty, the report is debated in Parliament. Both Houses must approve the motion by a special majority, which requires a two-thirds majority of members present and voting, as well as a majority of the total membership.

- Final Removal by the President: Once the motion is passed in both Houses, it is presented to the President, who issues the removal order.

Safeguards Against Misuse

The impeachment process includes several safeguards to prevent misuse:

- High Threshold for Initiation: The requirement for significant support from Parliament ensures that the process cannot be initiated frivolously.

- Objective Inquiry: The inquiry committee, comprising legal experts, guarantees an impartial investigation.

- Parliamentary Scrutiny: Both Houses of Parliament are involved, ensuring that the process undergoes democratic scrutiny.

Challenges and Precedents

Despite the rigorous process, no Supreme Court judge has been successfully impeached to date. Past attempts, such as those against Justice V. Ramaswami (1993) and Chief Justice Dipak Misra (2018), were unsuccessful. These instances demonstrate the complexities involved in the impeachment process.

Guidelines for Judges’ Public Statements

Judges in India are entitled to freedom of speech, but they are expected to exercise caution in public statements to maintain the dignity of their office. The Bangalore Principles of Judicial Conduct (2002) and the Restatement of Values of Judicial Life (1997) outline key principles for judicial conduct, including:

- Non-Interference in Political Matters: Judges should refrain from commenting on political issues to avoid any perception of bias.

- Impartiality: Judges must avoid statements that could prejudice ongoing cases or align them with specific ideologies.

Upholding Judicial Impartiality in a Diverse Society

To maintain impartiality, judges must interpret laws based on constitutional values of justice, equality, and secularism. Furthermore, the judiciary must ensure representation from diverse backgrounds to foster inclusivity and reduce systemic biases. Training programs focused on cultural competence and social diversity are essential to ensure that judges are sensitive to the needs of marginalized communities.

Conclusion

The impeachment process, while stringent, plays a critical role in maintaining judicial accountability in India. As seen in the case of Justice Yadav, judicial conduct, particularly public statements, must be carefully scrutinized to preserve the integrity of the judiciary. Upholding impartiality and adhering to constitutional values are paramount in ensuring that the judiciary continues to function as a neutral arbiter in India’s democracy.

Analysis of Female Labour Force Participation Rate (LFPR) Trends in India: 2017-2023

- 11 Dec 2024

In News:

The Economic Advisory Council to the Prime Minister (EAC-PM) recently released a working paper revealing critical insights into the trends of female Labour Force Participation Rate (LFPR) in India from 2017-18 to 2022-23. The report highlights an overall increase in female LFPR, with rural areas experiencing more significant growth compared to urban areas. This article delves into the key findings, regional disparities, influencing factors, and government initiatives aimed at promoting female workforce participation.

Key Findings on Female LFPR

The period between 2017-18 and 2022-23 witnessed a notable rise in female LFPR, both in rural and urban regions, though rural areas saw higher gains.

Rural female LFPR surged by approximately 69%, from 24.6% to 41.5%, while urban female LFPR increased from 20.4% to 25.4%. This consistent growth was observed even after excluding unpaid family workers or household helpers, reinforcing the long-term trend of increased female workforce participation across India.