Introduction to Dr. Manmohan Singh's Economic Reforms

- 31 Dec 2024

In News:

Dr. Manmohan Singh, a distinguished economist, played a crucial role in shaping India’s economic trajectory. His leadership, as Finance Minister (1991–96) and Prime Minister (2004–14), is particularly noted for the economic liberalization and reform policies that transformed India’s economy.

India’s Economic Crisis of 1991

- Economic Collapse: India faced a severe balance of payments crisis, with dwindling foreign reserves and rising inflation.

- Key Challenges: Fiscal deficit, industrial stagnation, and trade imbalances worsened by the collapse of the Soviet Union.

- Urgent Measures: Dr. Singh was appointed Finance Minister during this crisis and initiated bold reforms to stabilize and grow the economy.

Key Reforms in 1991

- Devaluation of the Rupee

- Aimed at making Indian exports competitive in global markets.

- Reduced import tariffs and liberalized foreign trade.

- Industrial Policy Reforms

- Abolition of Licence Raj: Deregulated the industrial sector, promoting private enterprises.

- Reduced state control and encouraged foreign investment, leading to industrial growth.

- Banking and Financial Reforms

- Reduced the statutory liquidity ratio (SLR) and cash reserve ratio (CRR).

- Allowed for more credit flow, fostering economic expansion and banking sector efficiency.

- Global Integration

- Introduced economic liberalization policies, integrating India with the global economy and attracting foreign investments.

Economic Growth and Social Welfare Initiatives

- Poverty Reduction: Reforms helped lift millions out of poverty by fostering job creation and industrial growth.

- Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA): Launched in 2005, providing 100 days of wage employment to rural households.

- Right to Information (RTI) and Right to Education (RTE)

- Empowered citizens by ensuring transparency and access to government information.

- RTE guaranteed free and compulsory education for children aged 6-14.

- Financial Inclusion: Aadhar project introduced to facilitate welfare delivery and financial inclusion.

Legacy of Economic Liberalization and Growth

- Economic Growth: Under his leadership, India’s GDP grew at an average rate of 8%, establishing India as one of the fastest-growing economies.

- Shift to a Market-Driven Economy: Reforms dismantled socialist controls, facilitating the rise of the private sector.

- Attracting Foreign Investment: Economic liberalization and policy reforms made India an attractive destination for foreign capital.

Leadership During Political and Economic Challenges

- Reluctant Prime Minister

- In 2004, Singh became Prime Minister despite initial reluctance, emerging as a unifying figure during coalition politics.

- His tenure saw India’s rise as a global economic power, particularly from 2004–2009.

- Challenges

- Singh’s second term was marred by allegations of corruption and policy paralysis, leading to criticism of his administration.

- However, his personal integrity remained intact, and he maintained focus on governance.

- Historic India-US Nuclear Deal (2008)

- The deal marked a significant shift in India’s foreign relations and energy policies, enabling civilian nuclear trade.

Conclusion

Dr. Manmohan Singh’s economic policies are central to India's modern economic framework. His vision transformed India from a closed, socialist economy to a vibrant, globalized economy, promoting inclusive growth and institutional reforms. Despite facing challenges and criticisms, his legacy remains a testament to strategic policymaking that continues to influence India’s economic landscape.

Sustainable Groundwater Management in India’s Agriculture

- 30 Dec 2024

Introduction: Groundwater Crisis and Agriculture

- India's Agricultural Dependence on Groundwater: India is a leading producer of water-intensive crops like rice, wheat, and pulses. The country’s agricultural sector heavily depends on groundwater for irrigation, especially for paddy cultivation.

- Over-exploitation of Groundwater: Groundwater extraction for irrigation is increasingly unsustainable, threatening agricultural sustainability in the long term.

Rising Groundwater Usage and Its Implications

- Population Growth and Groundwater Use: Between 2016 and 2024, global population grew from 7.56 billion to 8.2 billion, and India’s population rose from 1.29 billion to 1.45 billion. Concurrently, groundwater used for irrigation increased from 38% in 2016-17 to 52% in 2023-24, exacerbating the water crisis.

- Over-extraction in Major Paddy-Producing States: States like Rajasthan, Punjab, and Haryana have witnessed severe over-exploitation of groundwater for irrigation.

- Rajasthan: Highest groundwater salinisation (22%) despite receiving the highest average rainfall (608 mm) among these states.

- Punjab and Haryana: Lesser groundwater salinity due to canal irrigation and micro-irrigation systems.

Impact of Excessive Fertilizer Use on Groundwater Quality

- Soil Salinity and Groundwater Contamination: Excessive use of fertilizers, particularly for paddy cultivation, increases soil salinity and contributes to groundwater contamination.

- Toxic Chemicals in Groundwater: Nitrate contamination, caused by nitrogen-based fertilizers, and uranium contamination due to phosphate fertilizers are key concerns in states like Maharashtra, Telangana, Andhra Pradesh, and Tamil Nadu.

- Health Risks: Contaminated groundwater poses health risks such as thyroid disorders, cancer, and dental fluorosis, along with reduced agricultural productivity.

Projected Impact on Future Groundwater Availability

- Unsustainable Groundwater Levels: The Central Groundwater Board (CGWB) reports that if current practices continue, over half of the districts in Punjab could face groundwater depletion. Similarly, 21-23% of districts in Haryana and Rajasthan may experience a similar crisis.

- Population Growth and Water Scarcity: With India’s population expected to reach 1.52 billion by 2036, the need for sustainable groundwater management becomes even more critical.

Government Initiatives for Groundwater Management

- National Mission for Sustainable Agriculture (2014): Promotes sustainable practices like zero tillage, cover cropping, and micro-irrigation for efficient water and chemical use.

- Pradhan Mantri Krishi Sinchai Yojana (2015): Aims to boost irrigation efficiency through drip and sprinkler irrigation methods.

- Atal Bhujal Yojana (2019): Targets efficient groundwater management in water-stressed states like Gujarat, Haryana, Rajasthan, Maharashtra, and Uttar Pradesh.

- Success of Government Initiatives: CGWB data shows that the percentage of districts with unsustainable groundwater levels dropped from 23% in 2016-17 to 19% in 2023-24.

Role of State Governments in Groundwater Management

- State-Level Initiatives: States with unsustainable groundwater levels must take proactive measures to manage water resources efficiently.

- Example - Odisha: Odisha's Integrated Irrigation Project for Climate Resilient Agriculture emphasizes irrigation efficiency and climate-smart practices, supported by World Bank funding.

- Encouraging Resource-Efficient Agriculture: States with safe groundwater levels, like Chhattisgarh, Bihar, Jharkhand, Telangana, and Odisha, should adopt water-efficient practices to protect groundwater resources.

Conclusion: Ensuring Agricultural Sustainability and Water Security

- Need for Urgent Action: Scaling up efforts to improve irrigation practices and groundwater management is crucial to securing India’s agricultural future.

- Global Food Security: Protecting groundwater resources will not only ensure water security within India but also contribute to global food security amid climate challenges.

- Blueprint for Sustainable Agriculture: States like Odisha are providing a model for sustainable water management, which can be replicated across water-stressed regions in India.

Surge in E-Waste Generation in India

- 29 Dec 2024

In News:

India has seen a significant increase in electronic waste (e-waste) generation, rising by 72.54% from 1.01 million metric tonnes (MT) in 2019-20 to 1.751 million MT in 2023-24. The sharpest rise occurred between 2019-20 and 2020-21, driven by increased electronic consumption due to the COVID-19 pandemic's work-from-home and remote learning arrangements.

Environmental and Health Concerns

E-waste contains hazardous substances like arsenic, cadmium, lead, and mercury. If not properly managed, these materials can severely impact human health and the environment, contaminating soil and water sources.

Government Efforts: E-Waste Management Rules, 2022

- Introduction of Extended Producer Responsibility (EPR): The government introduced the E-Waste (Management) Rules, 2022, effective from April 1, 2023. These rules focus on making producers responsible for the recycling of e-waste. Producers are assigned recycling targets based on the quantity of e-waste generated or products sold and must purchase EPR certificates from authorized recyclers to meet these targets.

- Integration of Bulk Consumers: Public institutions and government offices, categorized as bulk consumers, are mandated to dispose of e-waste only through registered recyclers or refurbishers, ensuring proper treatment and recycling of the waste.

- Expansion of E-Waste Coverage: The updated rules expanded the scope to include 106 Electrical and Electronic Equipment (EEE) items from FY 2023-24, up from 21 items previously covered under the 2016 E-Waste Rules.

Challenges in E-Waste Recycling and Disposal

- Low Recycling Rates: Although the share of e-waste recycled in India has increased from 22% in 2019-20 to 43% in 2023-24, a significant 57% of e-waste remains unprocessed annually. Informal sector practices, which dominate e-waste handling, often lack the necessary environmental safeguards, leading to improper disposal and environmental contamination.

- Lack of Infrastructure and Awareness: India faces challenges in building adequate infrastructure for e-waste collection and recycling, resulting in improper disposal in landfills. Furthermore, a lack of public awareness regarding proper disposal methods exacerbates the problem.

Global Context and India’s Position

- India ranks as the third-largest e-waste generator globally, following China and the United States. With an increasing rate of e-waste generation, the country faces an urgent need to improve recycling efficiency and adopt sustainable disposal methods.

International and National Conventions on E-Waste

- India is a signatory to several international conventions that govern hazardous waste management, including the Basel Convention, which regulates the transboundary movement of hazardous wastes, and the Minamata Convention, which focuses on mercury. At the national level, India has established the E-Waste (Management) Rules, 2022, and other frameworks to manage and reduce e-waste effectively.

Strategic Recommendations for Effective E-Waste Management

- Harnessing the Informal Sector: India’s informal sector, which handles a significant portion of e-waste, must be integrated into the formal recycling systems. This can be achieved through training and financial support to ensure safe and environmentally responsible recycling practices.

- Technological Innovations: Encouraging research into advanced recycling technologies, such as AI and IoT-based solutions for efficient e-waste collection and tracking, will be crucial for improving the e-waste management system.

- Learning from Global Practices: Countries like the European Union (EU) and Japan have set strong examples. The EU’s Waste Electrical and Electronic Equipment (WEEE) Directive and Japan’s Home Appliance Recycling Law emphasize Extended Producer Responsibility (EPR) and provide models for India to adapt.

Conclusion

To address the growing e-waste challenge, India must improve its recycling infrastructure, integrate the informal sector, and adopt best practices from international models. With sustainable and effective strategies, India can mitigate the environmental and health risks posed by e-waste while promoting a circular economy.

Glass Ceiling Cracks: Women's Rising Role in the 2024 Lok Sabha Elections

- 28 Dec 2024

Introduction:

The 2024 Lok Sabha elections marked a significant step forward for women’s participation in Indian politics. With 800 women candidates contesting across 390 constituencies, this was the highest ever since the 1957 general elections. This surge in women candidates has been a positive reflection of the evolving role of women in India's democratic processes.

Increase in Women Candidates:

- A total of 800 women candidates participated in the 2024 elections, up from 726 in 2019.

- The number of constituencies with no female candidate dropped to a historic low of 152, from 171 in 2019.

- However, despite the rise in participation, only 74 women won, while 629 forfeited their deposits.

Regional Variations:

- The highest number of women candidates were from Maharashtra (111), followed by Uttar Pradesh (80) and Tamil Nadu (77).

- Some constituencies, like Baramati, Secunderabad, and Warangal, saw the highest participation of women, with eight candidates each.

Voter Turnout and Gender Dynamics:

- Women voters surpassed men in voter turnout for the second consecutive time, with 65.78% women casting their vote in 2024, compared to 65.55% of men.

- Assam’s Dhubri recorded the highest female voter turnout at 92.17%, reflecting increased female engagement in the electoral process.

Electoral Data and Gender Insights:

- In 2024, there were 47.63 crore female electors out of 97.97 crore total voters, making up 48.62% of the electorate, a slight increase from 2019.

- The number of female electors per 1,000 male voters reached 946, up from 926 in 2019, showing growing electoral inclusivity.

Challenges and Progress:

- Despite the gains in women’s representation, there remain several constituencies without any female candidates, notably in states like Uttar Pradesh (30 constituencies), Bihar (15), and Gujarat (14).

- Though women's participation has risen, the number of women who win remains disproportionately low, reflecting the challenges they face in a patriarchal political landscape.

Inclusion and Diversity:

- The 2024 elections also saw greater inclusivity, with a rise in third-gender electors, which increased by 23.5% to 48,272.

- Voter turnout among transgender voters nearly doubled, reaching 27.09% compared to 14.64% in 2019.

- Additionally, the number of persons with disabilities (PwD) electors increased to 90.28 lakh, showcasing broader electoral inclusivity.

Conclusion:

The 2024 Lok Sabha elections witnessed a remarkable increase in women’s participation, both as voters and candidates. While the journey toward full gender parity in politics continues, the trends from these elections indicate a growing shift toward more inclusive electoral processes. The data released by the Election Commission further underlines this progress, showing the increasing role of women in shaping India’s democratic future.

Free Movement Regime

- 27 Dec 2024

In News:

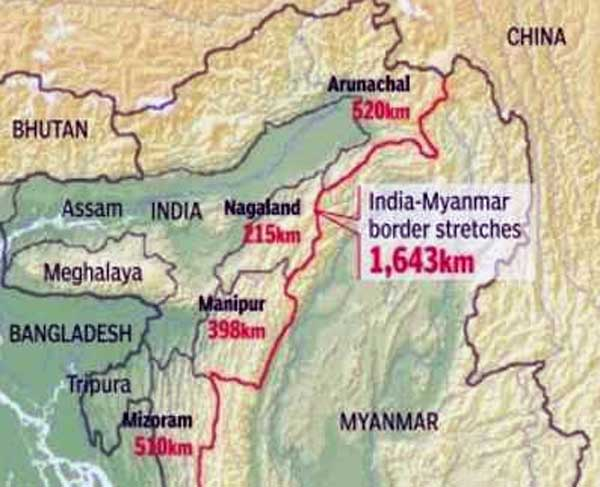

The Indian government, through the Ministry of Home Affairs (MHA), has recently issued new guidelines to regulate the movement of people between India and Myanmar, especially along the border regions. These guidelines come after the suspension of the Free Movement Regime (FMR), which had previously allowed residents within a specified range of the border to move freely. The new protocol aims to enhance internal security and address concerns related to demographic shifts in India's northeastern states.

Background of the Free Movement Regime (FMR)

What is FMR?

The Free Movement Regime (FMR) is a bilateral arrangement between India and Myanmar that permits residents living in border areas to cross the international boundary without a visa. This agreement was established in 1968 to facilitate familial, cultural, and economic exchanges between people living on either side of the border.

Territorial Limits and Evolution

Initially, the FMR allowed free movement within a 40 km radius from the border. However, in 2004, this limit was reduced to 16 km, and additional regulations were introduced in 2016. The most recent development sees the limit further reduced to 10 km, with stricter regulations implemented to regulate the movement.

Recent Developments and New Guidelines

Suspension of FMR

In February 2023, Union Home Minister Amit Shah announced the suspension of the FMR along the India-Myanmar border, citing concerns about internal security and demographic changes, particularly in India's northeastern states. This decision came in the context of growing ethnic violence and political pressures, especially from states like Manipur.

Despite the announcement, the formal scrapping of the FMR is yet to be officially notified by the Ministry of External Affairs (MEA). However, the MHA has issued new guidelines to regulate cross-border movement, focusing on enhancing security without completely discontinuing the regime.

Key Features of the New Guidelines

The updated protocols issued by the MHA include several measures aimed at improving the security and regulation of movement across the border:

- Reduced Movement Limit: The new guidelines reduce the free movement limit from 16 km to 10 km from the border on both sides.

- Border Pass System: Residents wishing to cross into Myanmar or return to India must obtain a "border pass" from the Assam Rifles. This pass allows a stay of up to seven days in the neighboring country.

- Document and Health Checks: Upon entry into India, individuals will undergo a document inspection by the Assam Rifles, followed by security and health checks conducted by state police and health authorities. Biometrics and photographs will be collected, and a QR code-enabled border pass will be issued for verification.

- Designated Entry Points: There will be 43 designated entry and exit points across the border, with biometric verification and health screening required at all points.

- Monitoring and Enforcement: The Assam Rifles will oversee the movement, ensuring that individuals comply with the new regulations. Violations of the movement protocol will result in legal action.

Infrastructure and Technology Implementation

The government plans to establish infrastructure, such as biometric machines and software for border pass issuance. Pilot entry and exit points will be operational soon, with a phased implementation for the remaining points.

Political Reactions and Opposition

Regional Concerns and Opposition

The suspension of the FMR has been a contentious issue in India's northeastern states. The governments of Nagaland and Mizoram have raised objections to the scrapping of the regime, citing the cultural and familial ties of border communities. The Nagaland Assembly passed a resolution opposing the government's decision, while political leaders in Manipur argued that the unregulated movement of people had contributed to ethnic violence in the region.

Specific Concerns in Manipur

The chief minister of Manipur, N. Biren Singh, attributed ongoing ethnic conflicts in the state to the unchecked movement of people across the border. This was particularly evident in the violent ethnic clashes that broke out in 2023. As a result, Singh urged the Home Ministry to cancel the FMR along the India-Myanmar border, and the new guidelines reflect the state's concerns.

Conclusion

The suspension of the Free Movement Regime along the India-Myanmar border, followed by the introduction of stricter guidelines, marks a significant shift in India's border management policy. While the formal scrapping of FMR is yet to occur, the new protocols aim to balance security concerns with the region's long-standing cultural ties. The implementation of biometric checks and designated entry points signifies the government’s focus on modernizing border control while addressing regional concerns. The outcome of this policy shift will have important implications for internal security, demographic dynamics, and bilateral relations between India and Myanmar.

Suposhit Gram Panchayat Abhiyan

- 26 Dec 2024

In News:

On December 26, 2024, Prime Minister Narendra Modi presided over the Veer Bal Diwas celebrations at the Bharat Mandap in New Delhi. This annual event commemorates the martyrdom of the sons of Sri Guru Gobind Singh Ji and highlights the importance of nurturing the next generation. During the occasion, PM Modi also launched the ‘Suposhit Gram Panchayat Abhiyan,’ an initiative aimed at improving nutrition and well-being in rural India.

Veer Bal Diwas: Commemorating Sacrifice and Courage

Veer Bal Diwas was declared on January 9, 2022, by PM Modi to honor the sacrifices made by the young sons of Guru Gobind Singh Ji — Sahibzada Baba Zorawar Singh and Baba Fateh Singh — who were martyred in 1704. During the Mughal-Sikh battles, these two brave boys were captured and offered safety if they converted to Islam, which they refused. Their refusal to abandon their faith led to their brutal martyrdom by being bricked alive in the walls of a fort in Sirhind (Punjab). This act of resilience and unwavering faith is a cornerstone of Sikh history and culture.

Veer Bal Diwas not only commemorates their sacrifice but also serves as a reminder of the strength, faith, and courage demonstrated by all four of Guru Gobind Singh Ji’s sons. It underscores the Sikh ideals of sacrifice, courage, and dedication to faith.

Suposhit Gram Panchayat Abhiyan: Addressing Malnutrition in Rural Areas

On the same day, PM Modi launched the 'Suposhit Gram Panchayat Abhiyan', a nationwide mission focused on improving nutritional outcomes in rural areas. The initiative aims to enhance nutrition-related infrastructure and promote active community participation in tackling malnutrition. By encouraging village-level involvement, the program seeks to ensure that nutrition becomes a community-driven effort.

Key Objectives

- Malnutrition Eradication: The initiative focuses on combating malnutrition in rural communities by improving access to better nutrition.

- Healthy Competition: Encourages competition among villages to adopt best practices for nutrition and overall health.

- Sustainable Development: Promotes long-term, sustainable health practices that align with India's broader goals, such as the Poshan Abhiyan and the Sustainable Development Goals (SDGs).

The program aims to make rural populations active participants in improving their own well-being, strengthening community-driven initiatives for better nutritional outcomes.

Engaging Children and Fostering Patriotism

In line with Veer Bal Diwas, various events were organized to engage young minds across the nation. These initiatives not only raised awareness about the significance of the day but also fostered a culture of courage, dedication, and patriotism.

- Online Competitions: Interactive quizzes were conducted through platforms like MyGov and MyBharat to encourage participation and understanding of Veer Bal Diwas.

- Creative Activities: Schools, Child Care Institutions, and Anganwadi centers organized storytelling, creative writing, and poster-making contests to engage children and promote nationalistic values.

Honoring Young Achievers: PMRBP Awardees

The event also saw the presence of the recipients of the Pradhan Mantri Rashtriya Bal Puraskar (PMRBP), which recognizes children who have demonstrated exceptional abilities in various fields. The awardees, 17 in total, were presented with medals, certificates, and citation booklets by President Droupadi Murmu. These young achievers served as a source of inspiration, reinforcing the theme of celebrating youth potential on Veer Bal Diwas.

Conclusion: Strengthening the Foundation of India’s Future

The celebrations of Veer Bal Diwas and the launch of the Suposhit Gram Panchayat Abhiyan highlight the government’s commitment to nurturing India’s future by investing in its children and rural communities. By honoring historical sacrifices and fostering community-driven health and nutrition initiatives, these efforts contribute to building a resilient, prosperous India that can meet global challenges head-on. The twin focus on children’s development and rural well-being underscores India’s vision of a healthier, more inclusive society, aligned with national and global development goals.

India-Kuwait Ties

- 24 Dec 2024

In News:

Prime Minister Narendra Modi's two-day visit to Kuwait marks a significant milestone in India-Kuwait relations, being the first visit by an Indian Prime Minister in over four decades. This visit, undertaken at the invitation of Emir Sheikh Meshal Al-Ahmad Al-Jaber Al-Sabah, aims to strengthen bilateral ties in key areas like trade, defense, energy, and cultural cooperation.

Strategic Partnership and Key Agreements

The visit elevated India-Kuwait relations to a 'Strategic Partnership,' with agreements covering diverse sectors. A Memorandum of Understanding (MoU) on defense cooperation was signed, focusing on joint military exercises, coastal defense, and training. Furthermore, the two countries signed a Cultural Exchange Programme for 2025-2029 and an Executive Programme on Sports Cooperation for 2025-2028, enhancing cultural and people-to-people ties.

The establishment of a Joint Commission on Cooperation (JCC) will monitor bilateral relations, and new Joint Working Groups (JWGs) have been set up in areas like education, trade, and counter-terrorism. Both nations also agreed to deepen collaboration in emerging sectors such as semiconductors, artificial intelligence, e-governance, and technology sharing.

Economic and Energy Cooperation

India and Kuwait share strong economic ties, with bilateral trade reaching USD 10.47 billion in 2023-24. Kuwait is India’s sixth-largest crude oil supplier, meeting 3% of India's energy needs. The countries have also agreed to transition from a buyer-seller relationship in energy to a more comprehensive partnership, with focus areas including oil, gas, refining, and renewable energy. Kuwait’s membership in the International Solar Alliance (ISA) was welcomed by India, reflecting their growing collaboration in the energy sector.

Indian Diaspora and Labour Cooperation

The Indian community, numbering over 1 million, forms the largest expatriate group in Kuwait and plays a pivotal role in the country’s economy. Their contribution spans various sectors, including healthcare, engineering, retail, and business. Kuwait’s Vision 2035, which seeks to diversify its economy beyond oil, presents significant opportunities for collaboration with India, particularly in infrastructure, renewable energy, and technology.

The skilled workforce from India also aligns with Kuwait's developmental goals, offering further opportunities for labor cooperation, especially in sectors like healthcare, technology, and infrastructure.

Geopolitical and Multilateral Cooperation

India-Kuwait relations hold regional significance, particularly in West Asia. Kuwait's role in the Gulf Cooperation Council (GCC) amplifies its geopolitical importance. India’s engagement with Kuwait helps maintain a balanced presence in the region, essential for its energy security and broader geopolitical interests. The GCC, which includes six Arab states, remains a key partner for India, contributing to significant trade and remittances. India also seeks to conclude a Free Trade Agreement with the GCC to enhance economic collaboration.

Cultural and Historical Ties

India and Kuwait’s relationship has deep historical roots, dating back to the pre-oil era when maritime trade was a cornerstone of Kuwait’s economy. Over the years, this relationship has grown, with India being a major trading partner and Kuwait contributing significantly to India's energy needs. The Indian Rupee was once the legal tender in Kuwait, underscoring the strength of their historical ties.

In conclusion, PM Modi's visit to Kuwait sets the stage for enhanced cooperation across several domains, reinforcing the strategic partnership between the two nations. It also highlights India's broader objectives in the West Asia region, balancing economic, geopolitical, and cultural interests.

Revitalization of India-China Relations: A Diplomatic Turning Point

- 23 Dec 2024

In News:

The 23rd meeting between India’s National Security Adviser (NSA) and China’s Foreign Minister, held as Special Representatives (SRs), marks a pivotal moment in the complex bilateral relationship between the two nations. This dialogue, which follows years of strain exacerbated by the 2020 Galwan Valley clash, signals a renewed commitment to restoring stability and fostering peace along the border.

Special Representatives Mechanism: A Foundation for Dialogue

The SR mechanism, established in the early 2000s, has long served as a key platform for addressing bilateral disputes, particularly the contentious boundary issue. Past rounds of discussions have facilitated troop disengagement and efforts to maintain peace along the Line of Actual Control (LAC). The recent meeting, following the 2023 BRICS summit discussions between Prime Minister Narendra Modi and Chinese President Xi Jinping, demonstrates a positive step towards de-escalation, with the resumption of talks providing hope for progress.

Key Outcomes of the 23rd SR Meeting

Several significant developments emerged from the meeting, focusing on cultural, economic, and strategic cooperation:

- Cultural and Economic Cooperation:

- Kailash-Mansarovar Yatra: The resumption of this religious pilgrimage represents a significant cultural exchange, fostering people-to-people ties.

- Border Trade Revival: Border trade in Sikkim has been reestablished, potentially revitalizing local economies and improving trade relations.

- Scientific and Environmental Cooperation:

- Trans-boundary River Data Sharing: China’s commitment to sharing crucial river data with India will aid in flood management, directly addressing India’s long-standing concerns over water security, particularly in light of China's upstream dam projects.

- Connectivity and Exchange Programs:

- Discussions on restarting direct flights and visa easements for students and businesses, along with enhanced journalist exchanges, signal a move toward greater normalization of relations.

- Commitment to Border Peace:

- Both sides have reiterated their intent to maintain peace along the border, a critical factor in reducing tensions. While China expressed a six-point consensus, India has cautiously framed the outcome as “positive directions,” reflecting a reserved optimism.

Challenges in India-China Relations

Despite the positive momentum, numerous challenges persist in the bilateral relationship:

- Boundary Dispute:

- The core irritant remains the unresolved border issue, with divergent perceptions of the LAC. While some disengagement has occurred, full de-escalation and demilitarization across the entire border have not yet been achieved.

- Trust Deficit:

- The 2020 Galwan clash has left a lasting scar on mutual trust. Additionally, China’s aggressive patrolling and policy shifts continue to raise concerns in India, necessitating vigilance in future negotiations.

- Economic Imbalances:

- India’s trade relationship with China remains lopsided, with a significant trade deficit. Moreover, China’s growing influence in India’s neighborhood, particularly in Pakistan, Nepal, and Sri Lanka, challenges India’s strategic interests.

- Global Power Dynamics:

- India’s evolving alliances, particularly with the U.S., QUAD, and I2U2 group, alongside China’s assertive stance in Taiwan and the South China Sea, complicate bilateral relations and influence global perceptions.

The Way Forward

To navigate the challenges and harness opportunities, India must adopt a balanced approach, combining diplomatic engagement, economic resilience, and strategic vigilance:

- Confidence-Building Measures:

- Continued disengagement and de-escalation at the LAC, coupled with increased transparency in military activities, will be critical to maintaining peace.

- Broadening Cooperation:

- Exploring areas of mutual interest, such as climate change, public health, and infrastructure development, could foster deeper cooperation and help transcend contentious issues.

- Economic Realignment:

- India must address its trade deficit by pushing for greater market access for Indian products in China. Additionally, diversifying supply chains and promoting joint ventures in renewable energy and technology can reduce dependency.

- Multilateral Engagement:

- Engaging through global forums like BRICS, SCO, and G20, and strengthening regional alliances, will help mitigate tensions and counterbalance China's regional influence.

- Strategic Vigilance:

- Strengthening ties with regional allies, particularly in the Indo-Pacific, and enhancing military preparedness will safeguard India’s strategic interests in the face of China’s assertiveness.

Conclusion

The recent meeting between India and China represents a cautious but constructive step toward stabilizing their fraught relationship. By focusing on diplomacy, strengthening economic ties, and maintaining strategic vigilance, India can navigate its complex relationship with China in a rapidly shifting global context. A careful balance of engagement and vigilance will be crucial for India’s future dealings with its powerful neighbor.

India-Sri Lanka Diplomatic Engagement

- 22 Dec 2024

In News:

The recent visit of Sri Lankan President Anura Kumara Dissanayake (AKD) to India marked a significant moment in bilateral relations, as it was his first foreign trip since assuming office. The visit underscored key diplomatic exchanges and collaborations between the two countries, showcasing both areas of agreement and divergence.

Key Takeaways from AKD's Visit

Assurance on Anti-India Activities: One of the primary concerns for India was the use of Sri Lankan territory for activities detrimental to its security, particularly the presence of Chinese “research vessels” at Sri Lankan ports. President AKD assured Prime Minister Narendra Modi that Sri Lanka would not allow its territory to be used in ways that threaten India’s interests. This assurance is crucial, as it signals Sri Lanka's stance on maintaining regional stability, despite AKD’s perceived pro-China inclinations.

Tamil Minority Issue: Divergent Views: A notable divergence in their discussions was the issue of the Tamil minority in Sri Lanka. India has long advocated for the full implementation of the 13th Amendment to Sri Lanka’s Constitution, which would grant greater autonomy to the Tamil minority. However, AKD resisted this, reaffirming his opposition to the amendment’s full implementation. While India emphasized the importance of reconciliation and holding provincial elections, AKD focused on unity, sustainable development, and social protection, sidestepping any definitive commitments on the Tamil issue.

Sri Lanka's Assertive Diplomatic Posture: AKD’s strong parliamentary mandate has allowed him to adopt a more assertive diplomatic stance. This is evident not only in his handling of the Tamil issue but also in his approach to dealing with major powers like India and China. His administration appears to be prioritizing a more independent foreign policy, signaling a shift from previous administrations.

Bilateral Cooperation and Development Initiatives

The visit saw significant agreements on bilateral cooperation, particularly in development and connectivity. Both nations acknowledged the positive impact of India’s assistance in Sri Lanka’s socio-economic growth. Key projects discussed include:

- Indian Housing Project: Phases III and IV.

- Hybrid Renewable Energy Projects across three islands.

- High-Impact Community Development Projects.

- Digital collaborations, such as the implementation of Aadhaar and UPI systems in Sri Lanka.

Additionally, discussions focused on enhancing energy cooperation, including the supply of LNG, development of offshore wind power in the Palk Strait, and the high-capacity power grid interconnection. The resumption of passenger ferry services between key Indian and Sri Lankan ports was also a priority.

Defence and Security Cooperation

The two leaders agreed to explore a Defence Cooperation Framework and intensify collaboration on maritime surveillance, cyber security, and counter-terrorism. This aligns with India’s strategic interests in the region, as it seeks to ensure stability in the Indian Ocean and strengthen its defense ties with Sri Lanka.

Strategic Continuity Amid Leadership Change

Despite a change in leadership, the core strategic interests between India and Sri Lanka remain aligned. India views Sri Lanka’s stability as crucial to regional security, and both countries are focused on a mutually beneficial partnership. AKD’s emphasis on economic recovery and tackling corruption within Sri Lanka, as seen in his actions against political figures like Speaker Asoka Ranwala, further signals his determination to build a strong foundation for his government’s future.

Conclusion

President AKD’s visit highlighted the evolving dynamics of Sri Lanka’s foreign policy, marked by a more confident and independent approach in engaging with India. While challenges remain, especially regarding the Tamil issue, both countries have reaffirmed their commitment to deepening bilateral ties, with a focus on development, connectivity, and strategic cooperation.

Bank Credit to Women Self-Help Groups (SHGs)

- 21 Dec 2024

Introduction

The Deendayal Antyodaya Yojana – National Rural Livelihoods Mission (DAY-NRLM) is a flagship program by the Ministry of Rural Development (MoRD) that aims to reduce poverty by empowering women, especially through Self-Help Groups (SHGs). These SHGs have been instrumental in improving financial inclusion, providing access to credit, and enhancing the economic and social status of women across India. The program has made significant strides in mobilizing women, improving their access to financial services, and facilitating entrepreneurial ventures in rural areas.

Key Features and Initiatives of DAY-NRLM

- Self-Help Groups (SHGs):

- Formation: DAY-NRLM supports the creation and strengthening of SHGs, primarily focusing on rural women from economically disadvantaged backgrounds.

- Mobilization: As of 2024, over 10.05 crore women have been mobilized into 90.87 lakh SHGs across India.

- Objective: The main goal is to reduce poverty through empowerment by providing access to financial services and sustainable livelihoods.

- Start-up Village Entrepreneurship Programme (SVEP):

- Support for Rural Enterprises: SVEP, a sub-scheme under DAY-NRLM, encourages SHG women and their families to set up small-scale businesses.

- Impact: As of October 2024, 3.13 lakh rural enterprises have been supported under this initiative.

- State-wise Distribution: The program has supported enterprises across various states, with notable contributions from Andhra Pradesh (27,651 enterprises), Kerala (34,569), and Uttar Pradesh (28,904).

- Banking Correspondent Sakhis:

- Role: Women in SHGs are trained as Banking Correspondent Sakhis to enhance access to banking services such as deposits, credit, remittances, pensions, and insurance in rural areas.

- Current Deployment: 1,35,127 Sakhis have been deployed under DAY-NRLM, empowering women to be financial intermediaries in their communities.

- Financial Support for SHGs:

- Revolving Fund: SHGs receive funds ranging from Rs. 20,000 to Rs. 30,000 to boost their operations and financial stability.

- Community Investment Fund: SHGs can avail of up to Rs. 2.50 lakh under the Community Investment Fund to strengthen their financial position.

- Interest Subvention: To make bank loans more affordable, DAY-NRLM provides interest subvention to SHGs, reducing their overall credit costs.

- Online Marketing Platform:

- www.esaras.in: This online platform allows SHGs to market their products, improving their access to broader markets and enhancing their income-generating potential.

Impact of DAY-NRLM and SHGs

- Financial Inclusion: SHGs play a vital role in financial inclusion by providing access to banking services, loans, and insurance to women, especially in rural and remote areas.

- Credit Mobilization: As of November 2024, SHGs have leveraged Rs. 9.71 lakh crore in bank credit, thanks to the capitalization support provided by DAY-NRLM, including Revolving Funds and Community Investment Funds.

- Empowerment of Women: SHGs have significantly contributed to the empowerment of women, providing them with financial independence, social support, and the ability to make decisions in their households and communities.

Challenges Faced by SHGs

- Beneficiary Identification: Ensuring that the most marginalized individuals are included in SHGs can be challenging.

- Training Gaps: There is a lack of quality training programs and expert trainers to build the capacity of SHG members.

- Financial Literacy: Many SHG members have limited knowledge of formal financial services, hindering effective financial management.

- Market Linkages: Poor integration with markets limits the growth potential of SHGs, especially in terms of product sales and business expansion.

- Community Support: Insufficient business environment support and value chain linkages pose challenges to SHG sustainability and growth.

Government Initiatives Supporting SHGs

- SHG-Bank Linkage Programme (SBLP): Launched by NABARD in 1992, this initiative aims to link SHGs with formal banking institutions, facilitating financial inclusion.

- Mission for Financial Inclusion (MFI): A broader initiative to ensure that rural populations have access to affordable financial services such as savings, credit, insurance, and pensions.

- Lakhpati Didi Initiative: Launched in 2023, this initiative empowers SHG women to adopt sustainable livelihood practices and aim for an annual household income exceeding Rs. 1 lakh.

Role of SHGs in Rural Development

- Women Empowerment: SHGs have emerged as a powerful tool for empowering women through financial independence, social security, and the ability to make informed decisions.

- Economic Growth: SHGs foster small-scale entrepreneurship, thereby creating local businesses that contribute to rural economic growth.

- Social Cohesion: By promoting collective action, SHGs provide a social support system that helps in addressing common issues faced by their members, such as health, education, and safety.

Future Prospects and Way Forward

- Technological Integration: SHGs should leverage advanced digital platforms for transaction management, record-keeping, and communication, enhancing efficiency and accessibility.

- Reducing Informal Borrowing: Linking SHGs with formal financial institutions will reduce reliance on informal lenders, promoting financial inclusion.

- Inclusive Approach: SHGs should adopt an inclusive model to ensure that members from diverse socio-economic backgrounds are fairly represented and benefit equally.

- Training and Capacity Building: There is a need for more Community Resource Persons (CRPs) who can guide SHGs in beneficiary identification, financial management, and scaling their activities.

Supreme Court Directs Policy for Sacred Groves Protection

- 20 Dec 2024

In News:

Recently, the Supreme Court of India issued a significant judgment directing the Union Government to formulate a comprehensive policy for the protection and management of sacred groves across the country. These natural spaces, traditionally safeguarded by local communities, play a crucial role in preserving both ecological diversity and cultural heritage.

What are Sacred Groves?

Sacred Groves are patches of virgin forests that are protected by local communities due to their religious and cultural significance. They represent remnants of what were once dominant ecosystems and serve as key habitats for flora and fauna. Typically, sacred groves are not just ecological reserves, but also form an integral part of local traditions, often protected due to spiritual beliefs.

Key Features of Sacred Groves:

- Ecological Value: Sacred groves contribute significantly to biodiversity conservation.

- Cultural Significance: These groves are revered in various religious practices and are central to local traditions.

- Geographical Presence: Sacred groves are found in regions like Tamil Nadu, Kerala, Karnataka, Maharashtra, and parts of Rajasthan.

Supreme Court's Directive

The court's judgment was based on a plea highlighting the decline of sacred groves in Rajasthan, particularly those being lost due to deforestation and illegal land-use changes. While the Wildlife (Protection) Act of 1972 empowers state governments to declare community lands as reserves, the court recognized the need for a unified national policy to protect sacred groves as cultural reserves.

Recommendations:

- Nationwide Survey: The Ministry of Environment, Forest, and Climate Change (MoEF&CC) was instructed to conduct a nationwide survey to map and assess sacred groves, identifying their size and extent.

- Legal Protection: Sacred groves should be recognized as community reserves and protected under the Wildlife (Protection) Act, 1972.

- State-Specific Measures: The Rajasthan government was specifically directed to carry out detailed mapping (both on-ground and satellite) of sacred groves within the state, ensuring that the groves are recognized for their ecological and cultural significance.

The Role of Sacred Groves in Conservation

Sacred groves play a pivotal role in the conservation of biodiversity. They serve as refuges for various plant and animal species, and the traditional practices associated with these groves, such as tree worship, discourage destructive activities like logging and hunting.

Ecological and Cultural Importance:

- Sacred groves often act as critical biodiversity hotspots, preserving rare and indigenous species.

- They help maintain clean water ecosystems and act as carbon sinks, contributing to climate mitigation.

- Practices of non-interference with these areas have allowed flora and fauna to thrive over centuries.

Cultural Significance Across India

The importance of sacred groves is deeply embedded in India's diverse cultural heritage. They are considered the abode of deities, and various regions have unique names and rituals associated with these groves.

Examples of Sacred Groves in India:

- Himachal Pradesh: Devban

- Karnataka: Devarakadu

- Kerala: Kavu

- Rajasthan: Oran

- Maharashtra: Devrai

Piplantri Village Model

A key example highlighted in the judgment was the Piplantri village in Rajasthan, where the community undertook a remarkable transformation of barren land into flourishing groves. The initiative, driven by local leadership, involves planting 111 trees for every girl child born, which has led to several environmental and social benefits.

Impact of Piplantri's Community Efforts:

- Over 40 lakh trees have been planted, which has recharged the water table by 800-900 feet and lowered the local climate by 3-4°C.

- The initiative has contributed to the reduction of female foeticide and empowered women's self-help groups.

- The village now enjoys economic growth, better education opportunities, and increased local income.

Legal and Statutory Framework

Sacred groves are already recognized under existing Indian laws, notably the Wildlife (Protection) Act, 1972, which allows states to declare sacred groves as community reserves. Additionally, the National Forest Policy of 1988 encourages the involvement of local communities in the conservation of forest areas, a principle supported by the Godavarman Case of 1996.

Key Legal Provisions:

- Wildlife (Protection) Act, 1972: Empowers state governments to declare sacred groves as community reserves.

- National Forest Policy, 1988: Encourages community involvement in the conservation and protection of forests, including sacred groves.

- Scheduled Tribes and Other Traditional Forest Dwellers (Recognition of Forest Rights) Act, 2006: Suggests empowering traditional communities as custodians of sacred groves.

Looking Ahead: The Need for Action

The Supreme Court has scheduled further hearings to assess the progress of the survey and mapping efforts by Rajasthan. The court also stressed the importance of empowering traditional communities to continue their role as custodians of sacred groves, ensuring their sustainable protection for future generations.

By recognizing the ecological and cultural significance of sacred groves and encouraging community-driven conservation efforts, the Supreme Court’s ruling sets a precedent for more inclusive environmental policies in India. This could also inspire similar initiatives in other parts of the world, promoting the protection of sacred natural spaces for their critical role in maintaining biodiversity and fostering sustainable communities.

The Costly Push for 100% Electrification of Indian Railways

- 19 Dec 2024

Introduction

RITES Ltd., the consultancy arm of the Indian Railways, has secured two contracts to repurpose six broad gauge diesel-electric locomotives for export to African railways. These locomotives, originally designed for India’s broad gauge of 1,676 mm, will be modified for use on railways with the narrower Cape Gauge of 1,067 mm. While this is a commendable re-engineering effort, it also highlights a larger issue within Indian Railways: the unnecessary redundancy of functional diesel locomotives, leading to significant wastage of resources.

The Growing Problem of Idle Diesel Locomotives

As of March 2023, there were 585 diesel locomotives idling across the Indian Railways network due to electrification. This number has now reportedly grown to 760 locomotives, many of which still have more than 15 years of serviceable life. The root cause of this redundancy lies in the government’s mission to electrify the entire broad gauge network at an accelerated pace. This electrification push has resulted in the premature retirement of locomotives that could still serve the network for years, raising questions about the economic and environmental logic behind this decision.

The Justification for Electrification: Foreign Exchange and Environmental Concerns

The Indian government’s electrification drive is often justified on two primary grounds: saving foreign exchange by reducing the import of crude oil and reducing environmental pollution. Additionally, electrification is framed as a step toward a “green railway” powered by renewable energy sources like solar and wind. However, the reality of these claims is more complicated.

Foreign Exchange Savings: A Small Impact on National Diesel Consumption

While electrification may reduce India’s diesel consumption, the impact on national fuel use is minimal. Railways account for just 2% of the country’s total diesel consumption. A report by AC Nielsen in 2014 indicated that the transport sector consumed 70% of the total diesel, with railways accounting for only 3.24%. Even with 100% electrification, the savings in foreign exchange would have little impact on the country’s overall diesel consumption, leaving other sectors like trucking and agriculture as the main contributors.

Environmental Concerns: Shifting Pollution, Not Reducing It

The environmental argument for electrification is also flawed. Electricity in India is still largely generated from coal-fired power plants, with nearly 50% of the country’s electricity coming from coal. Since the Indian Railways is heavily involved in transporting coal, switching from diesel to electric locomotives simply shifts pollution from the tracks to the power plants. This means that the transition to electric traction will not result in a cleaner environment unless the country significantly reduces its reliance on coal. Without a substantial increase in renewable energy generation, the push for a “green railway” remains unrealistic.

The Dilemma of Retaining Diesel Locomotives for Strategic Purposes

Despite the goal of 100% electrification, a significant number of diesel locomotives will remain in service. Reports indicate that 2,500 locomotives will be kept for “disaster management” and “strategic purposes,” although it is unclear why such a large fleet is necessary for these purposes. Additionally, about 1,000 locomotives will continue to operate for several more years to meet traffic commitments. This suggests that even with a fully electrified network, Indian Railways will continue to rely on thousands of diesel locomotives, many of which have substantial residual service life left.

Financial Sustainability and Coal Dependency

The financial sustainability of this transition remains a concern. Currently, the Indian Railways generates a significant portion of its freight revenue from transporting coal—40% of its total freight earnings in 2023-24. If the railways become fully electrified, it will need to find alternative revenue sources, as coal is a primary contributor. Until non-coal freight options can replace this income, the financial health of the railways may be at risk.

Conclusion: Wasted Resources and Unmet Goals

The mission to electrify the Indian Railways, while ambitious, is an example of how vanity projects can lead to colossal waste. Thousands of diesel locomotives are being discarded prematurely, despite their potential to continue serving the network. The environmental and financial justifications for 100% electrification, while appealing in theory, fail to account for the complexities of India’s energy landscape. As a result, the drive to create a “green railway” is likely to fall short, leaving behind a legacy of wasted taxpayer money and unfinished goals.

Arctic Tundra: From Carbon Sink to Carbon Source

- 18 Dec 2024

In News:

The Arctic tundra, a frozen, treeless biome, has historically been a vital carbon sink, absorbing vast amounts of carbon dioxide (CO?) and other greenhouse gases (GHGs). However, recent findings suggest that, for the first time in millennia, this ecosystem is emitting more carbon than it absorbs, a change that could have significant global consequences. This alarming shift was highlighted in the 2024 Arctic Report Card published by the National Oceanic and Atmospheric Administration (NOAA).

The Arctic Tundra’s Role as a Carbon Sink

The Arctic tundra plays a crucial role in regulating the Earth's climate. In typical ecosystems, plants absorb CO? through photosynthesis, and when they die, carbon is either consumed by decomposers or released back into the atmosphere. In contrast, the tundra’s cold environment significantly slows the decomposition process, trapping organic carbon in permafrost—the permanently frozen ground that underpins much of the region.

Over thousands of years, this accumulation of organic matter has resulted in the Arctic storing an estimated 1.6 trillion metric tonnes of carbon. This figure is roughly double the amount of carbon in the entire atmosphere. As such, the tundra has served as a critical carbon sink, helping to mitigate global warming by trapping vast quantities of CO?.

Shifting Dynamics: Emission of Greenhouse Gases

Recent reports indicate a dramatic shift in the Arctic tundra’s role in the carbon cycle. Rising temperatures and increasing wildfire activity have disrupted the tundra’s balance, leading it to transition from a carbon sink to a carbon source.

Impact of Rising Temperatures

The Arctic region is warming at a rate approximately four times faster than the global average. In 2024, Arctic surface air temperatures were recorded as the second-warmest on record since 1900. This rapid warming is causing permafrost to thaw, which in turn activates microbes that break down trapped organic material. As this decomposition accelerates, carbon in the form of CO? and methane (CH?)—a more potent greenhouse gas—are released into the atmosphere.

The experts, explained the process by comparing thawing permafrost to meat left out of the freezer. Similarly, thawing permafrost accelerates the breakdown of trapped carbon.

The Role of Wildfires

In addition to warming temperatures, the Arctic has experienced a surge in wildfires in recent years. 2024 marked the second-highest wildfire season on record in the region, releasing significant amounts of GHGs into the atmosphere. Wildfires exacerbate the thawing of permafrost, creating a feedback loop where increased carbon emissions contribute further to warming, which, in turn, leads to more emissions.

Between 2001 and 2020, these combined factors caused the Arctic tundra to release more carbon than it absorbed, likely for the first time in millennia.

The Global Consequences of Emission

The transition of the Arctic tundra from a carbon sink to a carbon source is alarming, as it represents a significant amplification of global climate change. The release of additional CO? and CH? into the atmosphere further accelerates the greenhouse effect, leading to higher global temperatures. This warming is already having visible consequences around the world, from extreme weather events to rising sea levels.

If the Arctic tundra continues to emit more carbon than it absorbs, it could significantly exacerbate the climate crisis. The report underscores the urgency of addressing global emissions, as reducing greenhouse gases remains the most effective way to prevent further destabilization of this sensitive ecosystem.

Mitigating the Impact: The Path Forward

Despite the alarming trends, the Arctic Report Card suggests that it is still possible to reverse this process. By reducing global GHG emissions, it may be possible to slow the thawing of permafrost and allow the Arctic tundra to regain its role as a carbon sink. Scientists emphasize that mitigating climate change on a global scale is essential to prevent further emissions from the Arctic ecosystem.

Scientists, stressed the importance of emission reductions, stating, “With lower levels of climate change, you get lower levels of emissions from permafrost… That should motivate us all to work towards more aggressive emissions reductions.”

However, current trends suggest that achieving this goal may be challenging. A recent report from the Global Carbon Project indicates that fossil fuel emissions are likely to rise in 2024, with total CO? emissions projected to reach 41.6 billion tonnes, up from 40.6 billion tonnes in 2023.

Commitment to Eradicating Naxalism in Chhattisgarh by 2026

- 17 Dec 2024

Overview

Union Home Minister Amit Shah has reiterated India's commitment to eliminate Naxalism in Chhattisgarh by March 31, 2026. He emphasized the progress made in the fight against Naxalism, highlighting key successes and outlining the strategy for the coming years.

Key Pointers

- Government Commitment: Amit Shah emphasized the joint commitment of the Government of India and the Chhattisgarh state leadership to rid the state of Naxalism by 2026.

- Security Forces’ Success: Over the past year, Chhattisgarh police neutralized 287 Naxalites, arrested around 1,000, and saw 837 surrenders.

- Top Naxal Cadres Neutralized: The state forces successfully neutralized 14 high-ranking Naxal cadres.

- President’s Police Colour Award: Chhattisgarh Police received the President's insignia within 25 years, a significant achievement for the state.

The Three-Pronged Strategy for Eliminating Maoist Insurgency

- Security Measures (Force)

Deployment of Security Forces

- Enhanced Presence: Increased deployment of Central and State police forces in Left-Wing Extremism (LWE) areas.

- Joint Operations: Coordinated operations between state and central forces, including CRPF and COBRA units.

- Upgraded Technology: Incorporation of UAVs, solar lights, and mobile towers to enhance operational efficiency.

Operation SAMADHAN

- Key Elements:

- Smart Leadership: Leading with innovative strategies.

- Aggressive Strategy: Swift, decisive action against insurgents.

- Motivation and Training: Strengthening the capabilities of forces.

- Actionable Intelligence: Real-time intelligence for effective operations.

- Harnessing Technology: Using modern tech for strategic advantage.

2. Development Initiatives

Focused Development Schemes

- PMGSY: Rural road connectivity under the Pradhan Mantri Gram Sadak Yojana.

- Aspirational Districts Program: Improving infrastructure in Naxal-affected areas.

- Skill Development: Targeted schemes in 47 LWE-affected districts to reduce unemployment.

Infrastructure Development

- Special Infrastructure Schemes: Building schools, roads, and bridges in remote areas to integrate them into the mainstream economy.

- Rehabilitation: Focus on providing rehabilitation for former Naxals through education and vocational training.

3. Empowerment (Winning Hearts and Minds)

Public Engagement

- Tribal Empowerment: Strengthening communication with tribal communities to reduce alienation and mistrust.

- Rehabilitation Policies: Surrender schemes offering incentives like education and financial aid to reintegrate former insurgents into society.

Maoism: Ideology and Background

What is Maoism?

- Origin: A form of communism developed by Mao Tse Tung, focusing on armed insurgency to capture state power.

- Core Beliefs: Maoists believe in violence and insurrection as legitimate means to overthrow the state and establish a People’s Democratic Republic.

- Indian Maoism: The Communist Party of India (Maoist), formed in 2004, leads the largest Maoist insurgency in India.

Recent Achievements in Combatting Maoist Insurgency

Key Successes in 2023

- Maoist-Free Villages: Villages in Dantewada declared "Maoist-free," a significant victory for the state.

- Reduction in Security Forces’ Casualties: 14 deaths in 2024, a dramatic decrease from 198 deaths in 2007.

- Infrastructure and Logistical Support: Enhanced use of helicopters and fortified police stations.

Government’s Commitment to Rebuilding

- Rehabilitation and Welfare: The government is implementing policies to improve the living standards of affected families, including 15,000 houses for Naxal-affected regions.

- Economic Development: Focus on building infrastructure and providing employment through skills training programs.

Challenges in Eliminating Naxalism

Socio-Economic Issues

- Exploitation of Tribals: Marginalization of tribals due to displacement for mining and forestry.

- Lack of Infrastructure: Basic amenities like roads, schools, and healthcare are absent in many areas.

- Centralized Naxal Command: The CPI (Maoist) retains a strong leadership, despite fragmentation of its forces.

Governance and Trust Issues

- Alienation of Local Populations: Ineffective governance and poor implementation of welfare schemes fuel local support for Naxal groups.

- Resource Conflict: The Naxals exploit rich mineral resources in the region to fund their insurgency.

Way Forward

Governance and Economic Reforms

- Tribal Empowerment: Form Tribal Advisory Councils as per the Fifth Schedule for better resource management.

- Land Redistribution: Enforce the Land Ceiling Act to reduce inequality.

- Livelihood Programs: Offer alternative livelihoods to reduce dependency on illegal activities.

Security Measures

- Paramilitary Deployment: Specialized forces to secure tribal areas and enable local governance.

- Resource Management: Ensure sustainable exploitation of natural resources, involving tribal communities in the decision-making process.

Peace Dialogues

- Inclusive Policies: Engage in dialogue with Naxals to facilitate their reintegration into mainstream society.

Conclusion

Naxalism in India, particularly in Chhattisgarh, is a complex issue rooted in socio-economic inequalities, lack of development, and historical alienation of tribal communities. The government's approach, encapsulated in the SAMADHAN strategy, combines security operations with developmental initiatives and a focus on empowerment to tackle the problem. With a clear commitment to eliminate Naxalism by 2026, the Indian government is making significant strides in reducing violence, improving governance, and integrating affected communities into the mainstream.

How would a carbon market function?

- 16 Dec 2024

In News:

COP29, the ongoing climate conference in Azerbaijan’s capital Baku, has given a fillip to the idea of using carbon markets to curb carbon emissions by approving standards that can help in the setting up of an international carbon market as soon as the coming year.

Introduction to Carbon Markets

- Carbon markets allow the buying and selling of the right to emit carbon dioxide (CO2) into the atmosphere.

- Governments issue certificates known as carbon credits, each representing the right to emit 1,000 kilograms of CO2.

- The total number of credits issued is capped to control carbon emissions. Companies and individuals who don’t have credits cannot emit CO2.

Trading of Carbon Credits

- Carbon Credit Trading: Companies holding more carbon credits than needed can sell them to others who need more, with the price determined by market forces.

- Carbon Offsets: Businesses can also purchase carbon offsets, often provided by environmental NGOs, which promise to reduce emissions (e.g., by planting trees). These offsets counterbalance the firm’s carbon emissions.

- The trading of both credits and offsets is designed to create financial incentives for companies to reduce their carbon footprint.

Advantages of Carbon Markets

- Addressing Externalities: Carbon emissions are a classic example of an economic externality, where the costs of pollution are not reflected in market prices.

- Market Efficiency: By allowing firms to buy and sell carbon credits, the system internalizes the cost of carbon emissions, encouraging businesses to reduce emissions to avoid higher costs.

- Incentive for Emission Reduction: Carbon markets aim to create a financial reason for companies to lower their emissions, thus helping mitigate climate change.

Voluntary vs. Government-Mandated Carbon Markets

- Voluntary Carbon Reporting: Many corporations prefer voluntary systems like the Carbon Disclosure Project (CDP) for reporting their emissions, fearing government-imposed restrictions.

- Market Flexibility: Corporations like ExxonMobil and General Motors argue that carbon markets with freely traded credits allocate carbon allowances more efficiently than government-imposed limits. This allows firms to purchase credits from others, optimizing resource allocation without restricting output.

- Corporate Resistance to Government Intervention: Firms are often reluctant to accept strict government budgets for carbon emissions, fearing increased operational costs and production limitations due to diverse supply chains.

Issues and Criticisms of Carbon Markets

- Government Manipulation of Credit Supply: Governments may increase the number of carbon credits issued, leading to lower prices and reduced incentives for emission reductions.

- Lack of Accountability in Carbon Offsets: Critics argue that some companies buy carbon offsets as a form of virtue signalling, without genuine concern for their environmental impact. This undermines the effectiveness of the offsets.

- Government Mismanagement: Political decision-making may lead to the over-restriction of carbon credits, potentially slowing economic growth by limiting available emissions allowances. The ability of governments to accurately determine the optimal supply of carbon credits is a contentious issue.

The Concept of Carbon Credits and Their History

- Introduction of Carbon Credits: Carbon credits were first introduced in the 1990s in the U.S., specifically through a cap-and-trade model designed to control sulfur dioxide emissions. This approach later expanded to include carbon emissions.

- Role of Carbon Markets: In essence, these markets aim to create a financial mechanism where firms can trade the right to pollute, ensuring a balance between economic growth and environmental protection.

Criticism of Carbon Offsets

- Effectiveness of Offsets: Experts are critical of carbon offsets, arguing that they do not always lead to meaningful reductions in emissions. For example, some companies may purchase offsets without ensuring that the projects are genuinely offsetting their emissions.

- Moral Hazard: Critics suggest that offset programs may lead to firms simply paying for the right to pollute, rather than actually reducing emissions in their operations.

Conclusion

- Carbon Markets as a Tool for Emission Reduction: Despite the criticisms, carbon markets remain a promising tool for mitigating climate change, provided they are carefully regulated and implemented.

- The Future of Carbon Trading: As discussions at COP29 evolve, the development of international standards for carbon trading could potentially enhance the effectiveness of these markets, offering a viable path to global emission reductions.

Agrarian Crisis in India

- 15 Dec 2024

Introduction

- Supreme Court Committee Report: A high-level committee, appointed by the Supreme Court in September 2024, submitted its interim report on November 21, 2024, highlighting the severe distress in India's agricultural sector.

- Key Focus Areas:

- Income crisis faced by farmers

- Rising debt burden

- Farmer suicides

- Stagnation in agricultural growth

- Impact of climate change

Key Findings of the Supreme Court Committee Report

Income Crisis in Indian Agriculture

- Daily Earnings: Farmers earn an average of just Rs 27 per day from agricultural activities, a meager income that makes it impossible to sustain a decent standard of living.

- Average Household Income: Agricultural households have an average monthly income of Rs 10,218, far below the basic threshold for a decent life.

Escalating Debt Burden

- Institutional Debt: In 2022-23, Punjab's institutional debt was Rs 73,673 crore, and Haryana's was Rs 76,630 crore.

- Non-Institutional Debt: This burden is further exacerbated by non-institutional debt, contributing 21.3% of total debt in Punjab and 32% in Haryana.

Farmer Suicides

- High Suicide Rates: Over 400,000 farmers and agricultural workers have committed suicide since 1995, primarily due to escalating debt and financial despair.

- Survey Findings: In Punjab, a survey found 16,606 suicides among farmers and farm workers between 2000 and 2015.

Stagnation in Agricultural Growth

- Growth Rates: Between 2014-15 to 2022-23, Punjab's agricultural growth was a mere 2% per year, and Haryana’s was 3.38%, far below the national average.

Disproportionate Employment

- Workforce Participation: 46% of India’s workforce is employed in agriculture, but it contributes only 15% to national income. Many farmers face disguised unemployment and underemployment.

Impact of Climate Change

- Environmental Degradation: Climate change, water depletion, erratic rainfall, and soil degradation are further destabilizing the agricultural sector and threatening food security.

Challenges Faced by the Agricultural Sector

1. Limited Access to Credit and Finance

- Small Farmers: 86% of Indian farmers are small and marginal, struggling to access institutional credit, which limits their ability to invest in modern agricultural inputs.

2. Fragmented Landholdings

- Small Landholdings: The average landholding is 1.08 hectares, insufficient for large-scale, efficient farming, limiting the adoption of modern agricultural techniques.

3. Outdated Farming Practices

- Traditional Methods: Many farmers continue using traditional, inefficient farming practices due to limited access to modern technology.

4. Water Scarcity and Irrigation Issues

- Dependence on Monsoons: 60% of cropped area is rainfed, and only 52% of gross sown area is irrigated, exacerbating vulnerability to droughts and erratic rainfall.

5. Soil Degradation and Erosion

- Degraded Land: 30% of India's agricultural land is affected by soil degradation, leading to lower productivity and reduced resilience to pests.

6. Inadequate Agricultural Infrastructure

- Post-Harvest Losses: Insufficient storage, cold chain, and rural infrastructure result in 15-20% post-harvest losses, further reducing farmers' income.

Government Schemes for Farmers' Welfare

- PM Kisan Samman Nidhi Yojana: Direct income support for farmers.

- PM Fasal Bima Yojana (PMFBY): Crop insurance scheme.

- PM Krishi Sinchai Yojana (PMKSY): Irrigation schemes to enhance water availability.

- e-NAM: National electronic market for better price realization.

- Agriculture Infrastructure Fund: Financial support for infrastructure development.

- Promotion of Farmer Producer Organizations (FPOs): Empowering farmers through collective marketing and production.

Recommendations for Addressing the Crisis

1. Loan Waivers and Debt Relief

- Debt Alleviation: Immediate measures to reduce the crushing debt burden through loan waivers, a key factor behind farmer suicides.

2. Legal Recognition of Minimum Support Price (MSP)

- MSP Protection: Granting legal backing to MSP to ensure farmers receive a fair price for their produce, reducing price volatility and income insecurity.

3. Promotion of Sustainable Farming

- Organic Farming: Encouraging organic farming and crop diversification to improve soil health and reduce dependency on a few staple crops.

- Climate-Resilient Agriculture: Adopting water-efficient practices, drought-resistant crops, and sustainable farming techniques.

4. Agricultural Marketing Reforms

- Market Efficiency: Improving the agricultural marketing system by establishing farmer-friendly markets and reducing intermediaries to ensure better price realization.

5. Rural Employment Generation

- Diversification: Creating non-agricultural employment opportunities in rural areas through skill development and promoting agro-based industries.

6. Climate Adaptation Measures

- Water Management: Enhancing water management systems and promoting rainwater harvesting.

- Resilience to Climate Change: Investing in climate-resilient infrastructure and farming technologies.

Implications of the Findings

Economic Impact

- Agricultural Decline: Continued neglect of the agricultural sector poses a risk to India's economy, potentially leading to long-term economic instability and increased rural-urban migration.

Food Security

- Threat to National Food Security: Declining agricultural productivity, exacerbated by climate change and inadequate reforms, threatens the country’s ability to meet food demands.

Social Stability

- Farmer Suicides and Unrest: The ongoing crisis, marked by widespread suicides and growing despair, risks social instability and unrest, particularly in rural regions.

Conclusion: Urgent Need for Reform

The committee’s report underscores the critical need for comprehensive reforms in India’s agricultural sector to alleviate the crisis. Immediate action is required to address the debt burden, improve incomes, and ensure sustainable agricultural practices. Legal reforms like MSP recognition and debt relief, along with investments in infrastructure and climate resilience, are key to securing a stable future for Indian agriculture.

Artificial Solar Eclipse: Why Are Satellites Trying to Block the Sun?

- 14 Dec 2024

Introduction

The European Space Agency (ESA) has launched Proba-3, a mission that will create an artificial solar eclipse to study the Sun's atmosphere, known as the corona. This mission aims to demonstrate new technology and address unresolved questions about the Sun's outer layers.

What is an Artificial Solar Eclipse?

- Definition: An artificial solar eclipse mimics the natural phenomenon where the moon blocks sunlight, allowing detailed observation of the Sun’s corona.

- Created By: The eclipse is created by two satellites, which align to block the Sun's light and generate a controlled shadow for scientific study.

- Purpose: The goal is to study the Sun’s corona, particularly to understand why it is significantly hotter than the Sun’s surface.

How Does the Proba-3 Create an Eclipse?

Launch and Spacecraft

Proba-3 was launched on December 5 from the Satish Dhawan Space Centre in India. The mission uses two satellites:

- Coronagraph Spacecraft (CSC): This spacecraft guides the other satellite.

- Occulter Spacecraft (OSC): This satellite has a disk that creates a controlled shadow onto the CSC.

Formation Flying

Using Precise Formation Flying (PFF) technology, the two spacecraft maintain a precise distance of 150 meters (492 feet) apart, aligning perfectly with the Sun. This alignment mimics the effect of a solar eclipse.

Precision Requirements